Press release

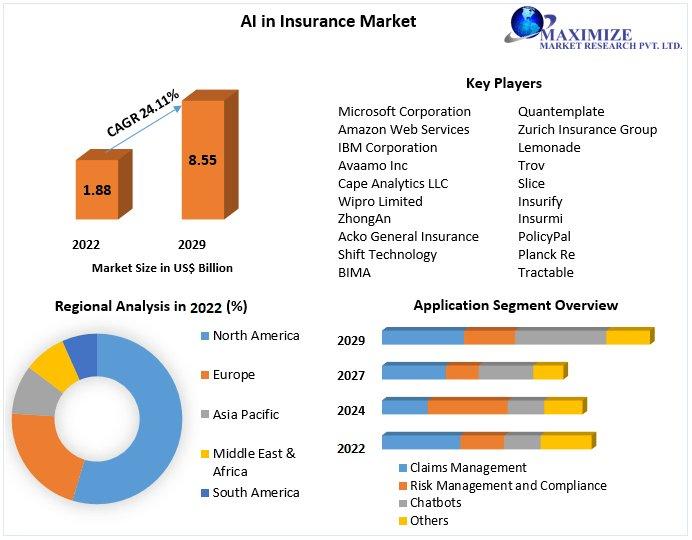

AI in Insurance Market, valued at USD 1.88 billion in 2022, is projected to exhibit a robust growth rate of 24.11% from 2022 to 2029

AI in Insurance Market, valued at USD 1.88 billion in 2022, is projected to exhibit a robust growth rate of 24.11% from 2022 to 2029, reaching an estimated market value of nearly USD 8.55 billion.AI in Insurance Market Report Scope and Research Methodology:

The AI in Insurance Market Research Report provides an in-depth analysis of this evolving industry. The report delves into segmentations based on Component, Technology, Deployment, Application, and Sector. It aims to equip industry stakeholders with comprehensive insights to navigate the market landscape effectively.

Maximize Market Research Pvt Ltd employed a robust research methodology to curate this report, combining primary and secondary research sources. The report presents complex data in a simplified manner, catering to decision-makers seeking informed business strategies.

For detail insights on this market, request for methodology here @ https://www.maximizemarketresearch.com/request-sample/62986

AI in Insurance Market Dynamics:

Artificial Intelligence is poised to revolutionize the insurance industry, with 75% of insurance executives acknowledging its potential. From back-office automation to front-line virtual assistance, AI is becoming the digital face of insurance brands. AI solutions can optimize policy administration, underwriting, billing, and customer relations, while also enhancing insurers' internal operations. The market is driven by factors such as the need for personalized insurance services, automation of operational processes, and the increasing adoption of IoT technologies.

Despite its promising outlook, the AI in Insurance Market faces challenges related to the lack of technical expertise in complex AI algorithms and concerns about cybersecurity. These factors could potentially limit the market's growth in the forecast period.

Request Free Sample Copy (To Understand the Complete Structure of this Report [Summary + TOC]) @ https://www.maximizemarketresearch.com/request-sample/62986

AI in Insurance Market Segmentation:

by Component

Hardware

Services

Software

by Technology

Machine Learning and Deep Learning

Natural Language Processing (NLP)

Machine Vision

Robotic Automation

Machine Learning and Deep Learning held a market share of 37.98% in terms of technology in 2022, and it is anticipated that it will continue to dominate during the projected period. Before, only data scientists could utilize machine learning; now, business users can create data models and quickly forecast the future with accuracy. Actuaries, claims managers, and underwriters are already subject-matter experts for insurers, and with the proper training and resources, they can contribute to machine learning projects. To fully automate the workflow, insurers are investigating machine learning for their organizations.

by Deployment

On-Premise

On-Demand

by Application

Claims Management

Risk Management and Compliance

Chatbots

Others

By application, claims management has a xx% market share worldwide over the predicted period. Artificial intelligence (AI) is utilized for underwriting, claims, new business, retention, marketing, to boost operational efficiencies, and to enhance the customer experience. Machine learning is being used by insurers to increase operational effectiveness across the claims process, from filing to resolving. Additionally, predictive modeling and machine learning can give insurers a better understanding of claims expenses. Through proactive management, quick settlement, focused investigations, and improved case management, these insights can help a carrier save millions of dollars in claim costs.

by Sector

Life Insurance

Health Insurance

Title Insurance

Auto Insurance

Others

For any Queries Linked with the Report, Ask an Analyst @ https://www.maximizemarketresearch.com/request-sample/62986

AI in Insurance Market Key Players:

Microsoft Corporation (US)

Amazon Web Services Inc. (US)

3. IBM Corporation (US)

4. Avaamo Inc (US)

5. Cape Analytics LLC (US)

6. Wipro Limited (India)

7. ZhongAn (China)

8. Acko General Insurance (India)

9. Shift Technology (France)

10.BIMA (UK)

11.Quantemplate (US)

12.Zurich Insurance Group (Switzerland)

13.Lemonade (US)

14.Trov (Japan)

15.Slice (US)

16.Insurify (US)

17.Insurmi

18.PolicyPal

19.Planck Re

20.Tractable

Please connect with our representative, who will ensure you to get a report sample here @ https://www.maximizemarketresearch.com/request-customization/62986

Table of content for the AI in Insurance Market includes:

Global AI in Insurance Market: Research Methodology

Global AI in Insurance Market: Executive Summary

Market Overview and Definitions

Introduction to the Global Market

Summary

Key Findings

Recommendations for Investors

Recommendations for Market Leaders

Recommendations for New Market Entry

Global AI in Insurance Market: Competitive Analysis

MMR Competition Matrix

Market Structure by region

Competitive Benchmarking of Key Players

Consolidation in the Market

M&A by region

Key Developments by Companies

Market Drivers

Market Restraints

Market Opportunities

Market Challenges

Market Dynamics

PORTERS Five Forces Analysis

PESTLE

Regulatory Landscape by region

North America

Europe

Asia Pacific

Middle East and Africa

South America

COVID-19 Impact

Global AI in Insurance Market Segmentation

Global AI in Insurance Market, by Component (2021-2029)

Global AI in Insurance Market, by Technology (2021-2029)

Global AI in Insurance Market, by Deployment (2021-2029)

Global AI in Insurance Market, by Application (2021-2029)

Global AI in Insurance Market, by Sector (2021-2029)

Regional AI in Insurance Market (2021-2029)

Regional AI in Insurance Market, by Component (2021-2029)

Regional AI in Insurance Market, by Technology (2021-2029)

Regional AI in Insurance Market, by Deployment (2021-2029)

Regional AI in Insurance Market, by Application (2021-2029)

Regional AI in Insurance Market, by Sector (2021-2029)

Regional AI in Insurance Market, by Country (2021-2029)

Company Profile: Key players

Company Overview

Financial Overview

Global Presence

Capacity Portfolio

Business Strategy

Recent Developments

Get More Details: https://www.maximizemarketresearch.com/market-report/global-ai-in-insurance-market/62986/

Regional Insights:

Asia Pacific dominates the AI in Insurance market, holding the largest market share in 2022, attributed to the rising demand for AI in Insurance extract in the dairy industry and growing consumer base in emerging nations like China and India. North America and Europe also play significant roles in the market due to extensive usage in the food and beverage industry and the expanding confectionery and baked goods sectors.

Key Offerings:

Past Market Size and Competitive Landscape (2018 to 2021)

Past Pricing and price curve by region (2018 to 2021)

Market Size, Share, Size & Forecast by different segment | 2022-2029

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Related Report:

Off-site Construction Market

https://www.maximizemarketresearch.com/market-report/off-site-construction-market/169386/

Global Allergy Immunotherapy Market

https://www.maximizemarketresearch.com/market-report/global-allergy-immunotherapy-market/37109/

T-cell Therapy Market

https://www.maximizemarketresearch.com/market-report/t-cell-therapy-market/124121/

Solar Street Lighting Market

https://www.maximizemarketresearch.com/market-report/solar-street-lighting-market/11744/

Autologous Cell Therapy Market

https://www.maximizemarketresearch.com/market-report/autologous-cell-therapy-market/171125/

Global Graph Analytics Market

https://www.maximizemarketresearch.com/market-report/global-graph-analytics-market/83587/

India Accounting Software Market

https://www.maximizemarketresearch.com/market-report/india-accounting-software-market/44134/

Global Protein Drugs Market

https://www.maximizemarketresearch.com/market-report/global-protein-drugs-market/82226/

Biscuits Market

https://www.maximizemarketresearch.com/market-report/global-biscuits-market/26465/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

✆ +1 800 507 4489

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI in Insurance Market, valued at USD 1.88 billion in 2022, is projected to exhibit a robust growth rate of 24.11% from 2022 to 2029 here

News-ID: 3160969 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…