Press release

Professional Indemnity Insurance Market Expects to See Significant Growth During 2023-2030 | IMR

Market Overview:The Global Professional Indemnity Insurance Market Is Expected to Grow at A Significant Growth Rate, And the Forecast Period Is 2023-2030, Considering the Base Year As 2022.

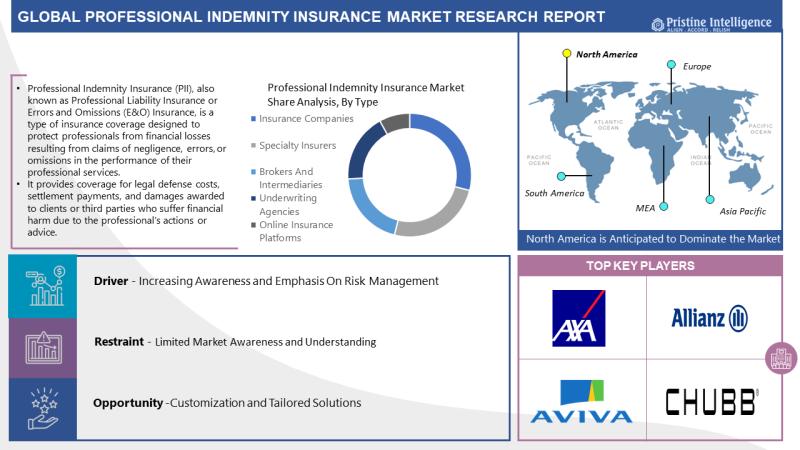

The Professional Indemnity Insurance Market involves the provision of insurance coverage designed to protect professionals and businesses from financial losses arising due to professional errors, negligence, or omissions. It is also known as professional liability insurance or errors and omissions insurance. This type of insurance is crucial for individuals and companies in various industries, including legal, medical, engineering, architecture, financial services, and consulting, where professional advice or services are provided.

The global Professional Indemnity Insurance Market has experienced significant growth in recent years, driven by the increasing awareness of litigation risks, the need for financial protection against professional liabilities, and regulatory requirements in many industries.

Get Free PDF Sample Report + All Related Tables and Graphs at: 👉

https://pristineintelligence.com/request-sample/global-professional-indemnity-insurance-market-44

Top Key Players Covered in The Global Professional Indemnity Insurance Market

American International Group (AIG) (US), Allianz Global (Germany), Chubb European (Switzerland), AXA SA (France), Aviva (UK), Hiscox Ltd. (Bermuda), Liberty Mutual Insurance Group (US), Manchester Underwriting (UK), Markel International (US), Royal and Sun Alliance (UK), Tokyo Marine HCC (US), Travelers Insurance (US), Zurich Insurance Group (Switzerland), Berkshire Hathaway Specialty Insurance (US), Beazley plc (UK), Generali Group (Italy), Arch Capital Group Ltd. (Bermuda), QBE Insurance Group Limited (Australia), The Hartford Financial Services Group Inc. (US), CNA Financial Corporation (US) and Other Major Players.

Market Dynamics:

Driver:

Legal and Regulatory Requirements: Many industries have regulatory mandates or contractual obligations that necessitate professionals to carry professional indemnity insurance. This legal and regulatory framework drives the demand for such insurance coverage to comply with industry standards and safeguard against potential legal claims. The rise in litigation cases and professional liabilities has put individuals and businesses at higher risk of facing costly lawsuits. Professional indemnity insurance provides a safety net to mitigate financial risks arising from legal claims and disputes.

Opportunities:

Emerging Markets and Increasing Professional Services: As emerging economies experience growth in professional services, there is an opportunity for insurance providers to expand their offerings in these markets. As more professionals and businesses seek insurance coverage, there is potential for market expansion in these regions. The complexity of professional services and industries demands customized insurance coverage that accurately addresses specific risks. Insurance providers can seize opportunities by offering tailored policies and conducting thorough risk assessments to cater to unique professional liabilities. In conclusion, the Professional Indemnity Insurance Market is driven by legal and regulatory requirements, growing litigation risks, and increasing awareness of financial protection. Insurance providers can capitalize on opportunities in emerging markets, offer customized coverage, address technology-related risks, and expand their presence among small and medium-sized enterprises to foster growth and success in the professional indemnity insurance industry.

Any Doubt or Need Customization Report @👉

https://pristineintelligence.com/inquiry/global-professional-indemnity-insurance-market-44

Segmentation Analysis of The Global Professional Indemnity Insurance Market

The segment of insurance companies dominates the Global Professional Indemnity Insurance Market due to several factors. Insurance companies, ranging from large multinational insurers to regional players, have a significant presence and influence in the market.

Insurance companies possess the expertise and resources required to underwrite and manage the risks associated with professional indemnity insurance. They have actuarial teams, risk assessment capabilities, and extensive knowledge of insurance products and coverage. This enables them to assess the risks involved in various professions, set appropriate premiums, and provide comprehensive coverage.

Moreover, insurance companies have the financial strength to handle claims and pay out settlements or judgments. Professional indemnity insurance policies often involve substantial coverage limits to protect against significant losses. Insurance companies financial stability and ability to meet their obligations provide reassurance to professionals seeking coverage, making them a preferred choice in the market.

Furthermore, insurance companies have established networks and distribution channels, allowing them to reach a wide range of professionals and industries. They have relationships with brokers, intermediaries, and agents who facilitate the placement of professional indemnity insurance policies. Insurance companies can leverage their distribution capabilities to effectively market and sell their products to potential clients.

By Type

• Insurance Companies

• Specialty Insurers

• Brokers And Intermediaries

• Underwriting Agencies

• Online Insurance Platforms

By Application

• Legal

• Accounting

• Healthcare

• Engineering

• IT

• Others

Business Size

• Small-Size Enterprises

• Medium-Sized Enterprises

• Large-Size Enterprises

Risk Profile

• High-Risk

• Low-Risk

Customize Your Report:

https://pristineintelligence.com/request-customization/global-professional-indemnity-insurance-market-44

Regional Analysis of The Global Professional Indemnity Insurance Market

North America is Expected to Dominate the Market Over the Forecast Period.

North America, particularly the United States, has one of the largest and most developed economies globally. The region's economic strength translates into a robust demand for professional services across various industries, which in turn drives the need for professional indemnity insurance. North America is home to a wide range of industries, including finance, healthcare, legal services, technology, and consulting, among others. These industries often require professional services and expertise, leading to a higher demand for professional indemnity insurance to protect against potential liabilities arising from errors, negligence, or omissions.

North America has a well-defined and rigorous regulatory environment that emphasizes risk management and professional accountability. Regulatory bodies and professional associations impose stringent standards and guidelines for professional conduct, often mandating the need for professional indemnity insurance. This regulatory push further drives the demand for coverage in the region. North America has a comparatively litigious culture, where individuals and businesses are more inclined to pursue legal action to seek compensation for alleged professional errors or omissions. This propensity for lawsuits contributes to a greater awareness of potential risks and the need for comprehensive insurance coverage.

The North American insurance market is highly competitive, with numerous established insurers and specialized providers operating in the region. This competition drives innovation, product development, and customization of insurance solutions, including professional indemnity insurance, to meet the specific needs of professionals and industries.

• North America (U.S., Canada, Mexico)

• Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

• Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

• Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

• Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

• South America (Brazil, Argentina, Rest of SA)

Scope of this Report:

👉 This report segments the global Professional Indemnity Insurance market comprehensively and provides the closest approximations of the revenues for the overall market and the sub-segments across different verticals and regions.

👉 The report helps stakeholders understand the pulse of the Professional Indemnity Insurance market and provides them with information on key market drivers, restraints, challenges, and opportunities.

👉 This report will help stakeholders to understand competitors better and gain more insights to better their position in their businesses. The competitive landscape section includes the competitor ecosystem, new product development, agreement, and acquisitions.

Key questions answered in this report:

1. What will the market size be in 2030 and what will the growth rate be?

2. What are the key market trends?

3. What is driving this market?

4. What are the challenges to market growth?

5. Who are the key vendors in this market space?

6. What are the market opportunities and threats faced by the key vendors?

7. What are the strengths and weaknesses of the key vendors? And more...

Buy Now the Professional Indemnity Insurance Market Report Avail 25% Discount:

https://pristineintelligence.com/reports/global-professional-indemnity-insurance-market

Contact Us:

Office No 101, Saudamini Commercial Complex,

Right Bhusari Colony, Kothrud,

Pune, Maharashtra,

India - 411038

(+1) 773 382 1049

+91 - 81800 - 96367

Email: sales@pristineintelligence.com

About Us:

We are technocratic market research and consulting company that provides comprehensive and data-driven market insights. We hold the expertise in demand analysis and estimation of multidomain industries with encyclopedic competitive and landscape analysis. Also, our in-depth macro-economic analysis gives a bird's eye view of a market to our esteemed client.

Our team at Pristine Intelligence focuses on result-oriented methodologies which are based on historic and present data to produce authentic foretelling about the industry. Pristine Intelligence's extensive studies help our clients to make righteous decisions that make a positive impact on their business. Our customer-oriented business model firmly follows satisfactory service through which our brand name is recognized in the market.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Professional Indemnity Insurance Market Expects to See Significant Growth During 2023-2030 | IMR here

News-ID: 3156547 • Views: …

More Releases from Pristine Intelligence

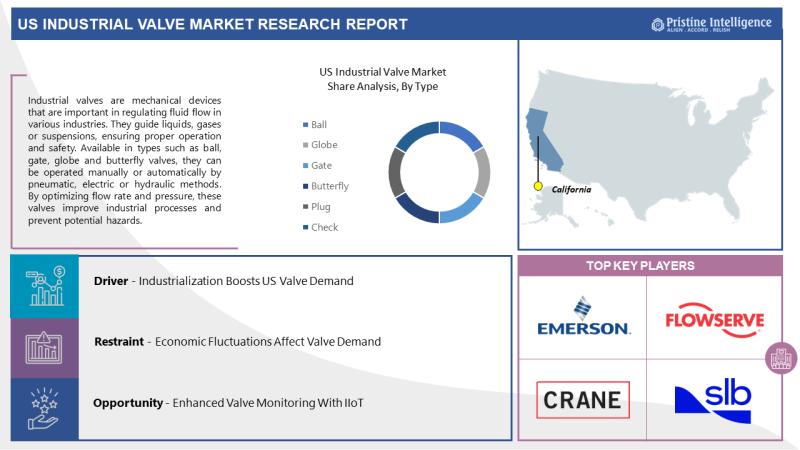

US Industrial Valve Market Share, Size, Growth, Worth, Trends, Scope, Impact & F …

Market Overview:

The US Industrial Valve Market is Expected to Grow at a Significant Growth Rate, and the Forecast Period is 2023-2030, Considering the Base Year as 2022.

The US Industrial Valve Market is a pivotal segment of the industrial machinery and equipment sector, encompassing the production, distribution, and utilization of a diverse range of valves used in various industries. Industrial valves are crucial components that control the flow of liquids, gases,…

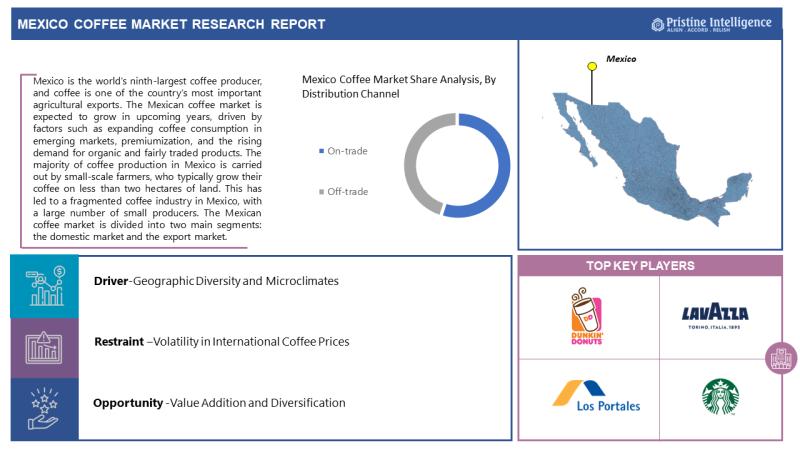

Mexico Coffee Market Forecast To 2030 - Covid-19 Impact And Global Analysis - By …

𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The Mexico Coffee Market is Expected to Grow at a Significant Growth Rate, and the Forecast Period is 2023-2030, Considering the Base Year as 2022.

The Mexico Coffee Market is a vibrant and integral part of the country's economy, culture, and global trade. Mexico is renowned for its rich coffee heritage, producing a variety of high-quality coffee beans known for their distinct flavors and profiles. Coffee has deep cultural significance…

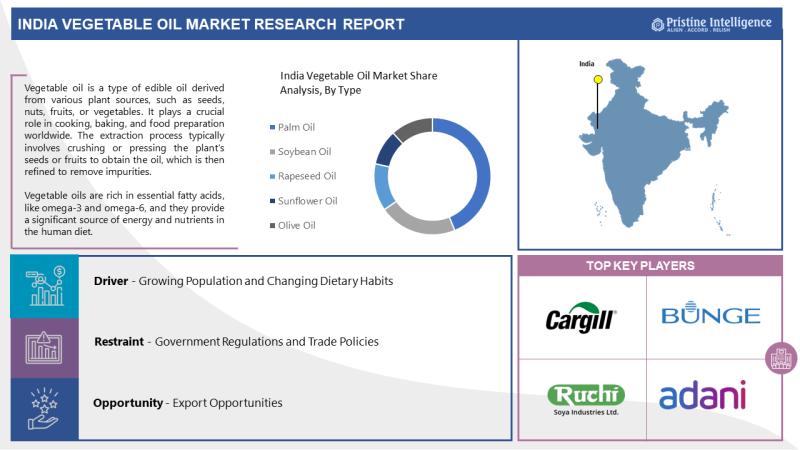

Recent Analysis Report On India Vegetable Oil Market 2023-2030

Market Overview:

The India Vegetable Oil Market is Expected to Grow at a Significant Growth Rate, and the Forecast Period is 2023-2030, Considering the Base Year as 2022.

The India Vegetable Oil Market encompasses the production, distribution, and consumption of various edible vegetable oils used in cooking, food processing, and industrial applications. Vegetable oils are derived from plant sources such as seeds, fruits, and nuts, and they play a crucial role in…

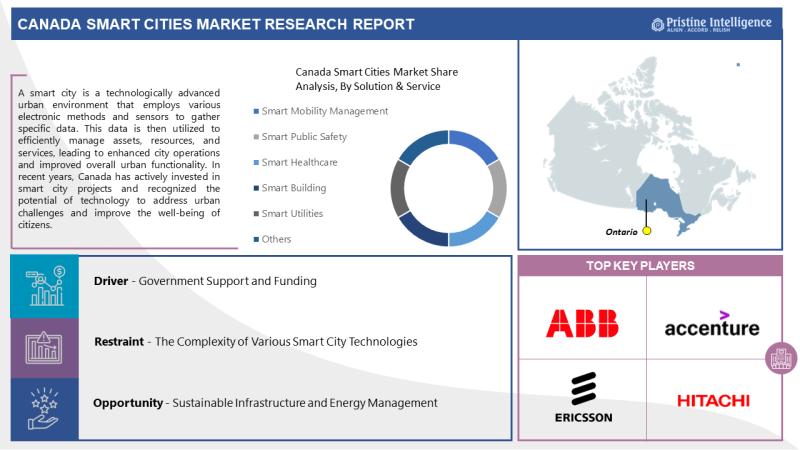

Canada Smart Cities Market Booming Worldwide with Latest Trend and Future Scope …

Market Overview:

The Canada Smart Cities Market is Expected to Grow at a Significant Growth Rate, and the Forecast Period is 2023-2030, Considering the Base Year as 2022.

The Canada Smart Cities Market is a dynamic landscape focused on the implementation of innovative technologies and solutions to enhance the efficiency, sustainability, and quality of life in urban areas across the country. Smart cities leverage data, connectivity, and digital infrastructure to improve various…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…