Press release

Tech-Enabled Managed Services Improving Financial Crime Compliance

CENTRAL, Hong Kong - Aug. 5, 2023 - Businesses are reducing compliance costs by as much as 50% through the use of regulatory technology.RegTech startup AML360 has ambitious plans to expand across Asia Pacific, pushing its third-party tech-enabled managed solutions as one of its key services.

As an anti-money laundering (AML) solutions provider, AML360 (aml360.com) is the latest of a string of RegTech businesses expanding in the Asia Pacific region.

And it is clear why as Southeast Asia is experiencing increasing regulatory obligations for combatting money laundering, terrorism financing and other types of financial crimes.

AML360 is tapping into the Asia Pacific market by providing its tech-enabled solutions to financial institutions operating in Hong Kong, Singapore, Malaysia and Vietnam. The CEO of AML360 has provided a clear message to compliance officers with responsibilities to financial crime regulations. At a recent RegTech forum for AML/CFT compliance officers, CEO Kerry Grass highlighted, "Governments across the globe are increasing their expectations of participants in the financial services industry. The risk-based approach requires client risk profiling which means more than identity verification and screening. It includes understanding the nature and purpose of the client's business relationship. This information is minimum expectation in order to monitor and manage client risks. If businesses are not operating at these minimum standards, they are by default low hanging fruit for regulatory action."

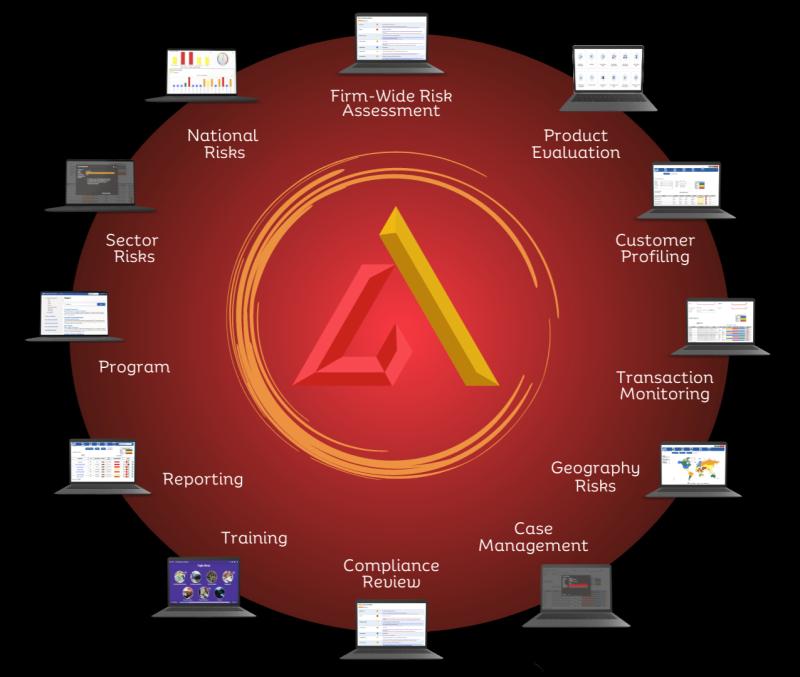

AML360 empowers business owners and compliance officers to self-manage customer and client onboarding, client risk profiling, transaction monitoring, inhouse compliance reviews and case management.

The RegTech company will also focus on developing affiliations with large advisory businesses that are seeking to expand in the AML compliance advisory space.

Tech-enabled managed services holds immense potential to revolutionise AML/CFT compliance in the Asia Pacific region. By enhancing risk-based decision making, facilitating regulatory obligations and preventing fraud, AML360's tech-enabled services can significantly improve the efficiency and quality of AML/CFT compliance frameworks. To assist businesses to fully realise the benefits of regulatory technology, AML360 is providing a free risk assessment for Proliferation Financing - a new threat that jurisdictions are coming to grips with.

As the Asia Pacific region continues to embrace digital transformation, AML360 aims to be play a pivotal role in shaping the future of the financial crime ecosystem.

Get more info: https://aml360software.com

AML360

Level 39, Marina Bay Financial Centre

10 Marina Blvd, Tower 2

Singapore 018983

media@aml360.com

Recognised as a leading vendor in the global anti-money laundering software marketplace, AML360 provides an anti-money laundering compliance dashboard to meet end-to-end and increasingly complex regulatory obligations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tech-Enabled Managed Services Improving Financial Crime Compliance here

News-ID: 3155960 • Views: …

More Releases for AML

Xepeng Emphasizes AML Screening in Platform Security

Platform details AML measures, including counterparty checks, to support secure conversions for merchants.

Denpasar, Bali, Indonesia, 30th Dec 2025 -- As digital value conversion systems evolve, enterprises like Xepeng recognize that robust anti-money laundering (AML) practices are essential to maintaining trust, safeguarding merchants, and aligning with regulatory expectations. AML encompasses a set of policies and practices intended to prevent, detect, and respond to financial activity that may be linked to illicit…

Top Trends Transforming the Hemato Oncology Testing Market Landscape in 2025: Ne …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the Hemato Oncology Testing Industry Market Size Be by 2025?

There has been a swift expansion in the hemato oncology testing market in the past few years. The market, which was valued at $3.5 billion in 2024, is predicted to surge to $3.96 billion in 2025, reflecting…

AML BitCoin Founder Asks President Trump to release their AML BITCOIN Classified …

The DOJ and the FBI should practice tough love while also providing financial incentives for government employees that uphold the constitution and obey the law. AG Bondi and Director Patel should ask President Trump for access to some of the billions of dollars that DOGE has saved us and utilize it for pay raises. Their employees need to be taken care of financially, or their hardships will make them the…

Anti-Money Laundering (AML) Software Market Is Booming So Rapidly with Thomson R …

The Latest published market study on Global Anti-Money Laundering (AML) Software Market provides an overview of the current market dynamics in the Anti-Money Laundering (AML) Software space, as well as what our survey respondents all outsourcing decision-makers predict the market will look like in 2032. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and…

Global Anti Money Laundering (AML) Software Market Size, Share and Forecast By K …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the Market Research Intellect, the global Anti Money Laundering (AML) Software market is projected to grow at a robust compound annual growth rate (CAGR) of 14.78% from 2024 to 2031. Starting with a valuation of 7.83 Billion in 2024, the market is expected to reach approximately 17.9 Billion by 2031, driven by factors such as Anti Money Laundering (AML) Software and Anti Money Laundering (AML)…

What is AML Verification? A Detailed Guide

With the rise of cryptocurrencies and the increasing adoption of digital assets, regulatory frameworks have become a critical component for ensuring that the cryptocurrency space remains secure and compliant. One of the most important elements in this regulatory framework is AML verification, which stands for Anti-Money Laundering.

Image: https://revbit.net/wp-content/uploads/2024/10/aml-in-crypto-3-1024x640.png

What is AML Verification?

AML (Anti-Money Laundering) verification [https://revbit.net/] refers to a set of procedures and regulations designed to prevent illegal activities such as…