Press release

Payment Processing Solutions Market Size, Opportunity, Manufacturers, Growth Factors Analysis

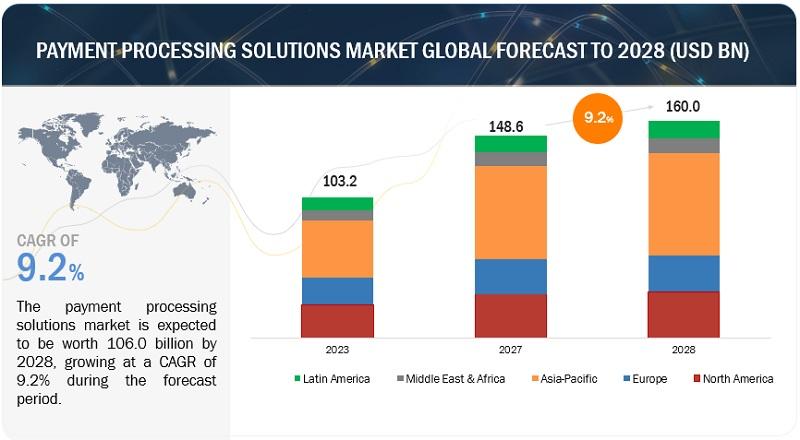

The payment processing solutions market is projected to grow from USD 103.2 billion in 2023 to USD 160.0 billion by 2028, at a CAGR of 9.2% during the forecast period. The increasing prevalence of smartphones and mobile applications has led to a growing trend of consumers utilizing mobile devices for making payments. Mobile payment solutions, such as digital wallets and mobile banking apps, heavily depend on payment processing services to facilitate smooth transactions, driving the payment processing solutions market.Download Report Brochure @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=751866

Based on payment method, the credit card method to hold the largest market during the forecast period.

A credit card is a payment card issued by banks or financial institutions to individuals, allowing them to make purchases from merchants and incur agreed-upon charges. It provides a revolving line of credit, enabling cardholders to borrow money for payments or cash advances. Credit cards offer convenience and flexibility, eliminating the need for cash or checks. Cardholders have the option to carry a balance from month to month, subject to interest charges. Different types of credit cards, such as business, secured, prepaid, and digital cards, cater to various needs and preferences. While credit cards provide benefits like rewards programs and enhanced purchasing power, responsible credit management is crucial to avoid excessive debt and interest accumulation.

Based on region, Asia Pacific is expected to hold the largest market size during the forecast

Asia Pacific consumers in the region prefer seamless and secure digital payment transactions, driving the demand for advanced payment processing solutions. With a growing retail market in Asia Pacific, global payment processing solution providers increasingly focus on this region to offer sophisticated solutions. Countries like China, India, Indonesia, and Malaysia witness a high volume of daily mobile transactions, prompting respective governments to prioritize convenient payment methods. The GSMA's "The Mobile Economy 2021" report highlights that Asia Pacific has a 42% mobile internet penetration rate, with 1.2 billion people connected to mobile internet by the end of 2020, marking an addition of 200 million new subscribers compared to the previous year.

Get More Info - https://www.marketsandmarkets.com/Market-Reports/payment-processing-solutions-market-751866.html

Market Players

The major vendors covered in the payment processing solutions market include PayPal (US), Fiserv (US), FIS (US), Global Payments (US), ACI Worldwide (US), Square (US), Mastercard (US), Visa (US), Adyen (Netherland), Stripe (US), PayU (Netherland), Jack Henry & Associates (US), Paysafe (UK), PhonePe (India), Razorpay (India), Secure Payment Systems (US), Worldline (France), Spreedly (US), Fattmerchant (US), North American Bancard (US), Dwolla (US), CCBill (US), Authorize.Net (US), Alipay (China), PayProTec (US), SignaPay (US), Klik & Pay (Switzerland), Finix Payments (US), Due (US), Pineapple Payments (US), Modulr (UK), MuchBetter (UK), Paykickstart (US), AeroPay (US), and Sila (US).

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: sales@marketsandmarkets.com

Visit Our Website: https://www.marketsandmarkets.com

About MarketsandMarkets™

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are moulded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit MarketsandMarkets™ or follow us on Twitter, LinkedIn and Facebook.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Processing Solutions Market Size, Opportunity, Manufacturers, Growth Factors Analysis here

News-ID: 3150034 • Views: …

More Releases from Markets and Markets

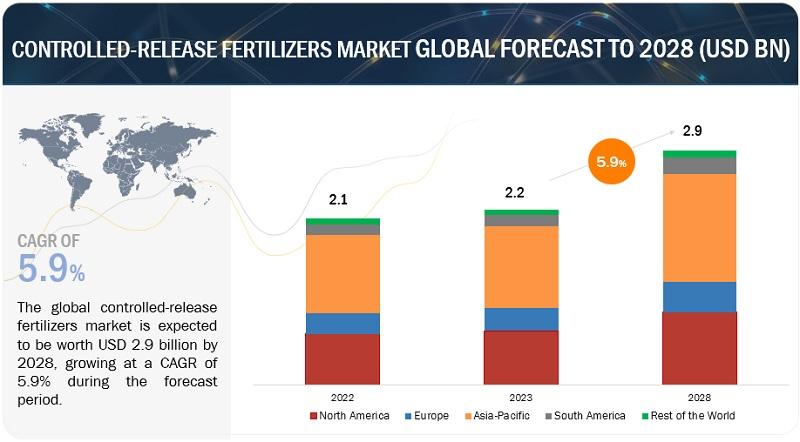

Controlled-release Fertilizers Market Latest Trends, Demands, Overview and Analy …

The controlled-release fertilizers market is experiencing notable growth, estimated at USD 2.2 billion in 2023 and projected to reach USD 2.9 billion by 2028. This reflects a compound annual growth rate (CAGR) of 5.9% during the forecast period. The demand for controlled-release fertilizers is increasing due to their benefits in enhancing nutrient efficiency, reducing environmental impact, and supporting sustainable agricultural practices.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

These fertilizers are prized for their ability…

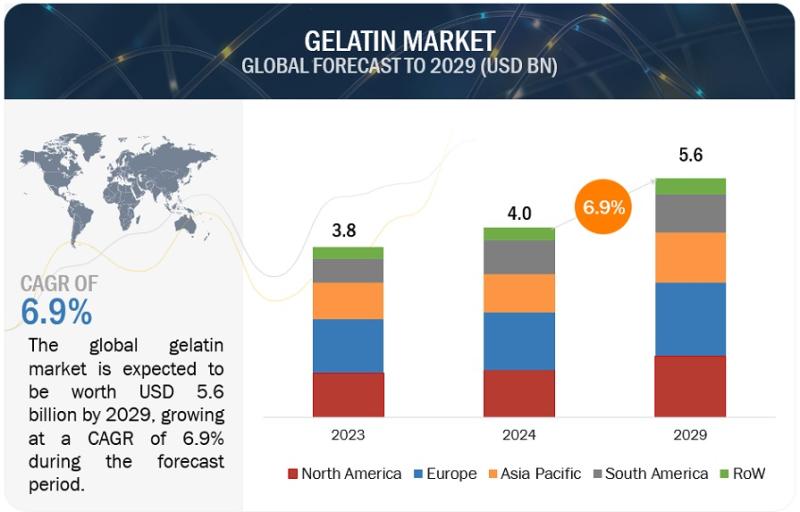

Gelatin Market is Projected to Reach $5.6 billion by 2029, at a CAGR of 6.9% fro …

According to a research report titled "Gelatin Market by Source (Animal, Plants), By Applications (Food & Beverages, Pharmaceuticals, Health & Nutrition, Cosmetics, Personal Care, Animal Feed), Type (Type A, Type B), Function (Thickener, Stabilizer, Gelling Agent) - Global Forecast to 2029," published by MarketsandMarkets, the gelatin market is poised for significant growth. The market, valued at USD 4.0 billion in 2024, is projected to reach USD 5.6 billion by 2029,…

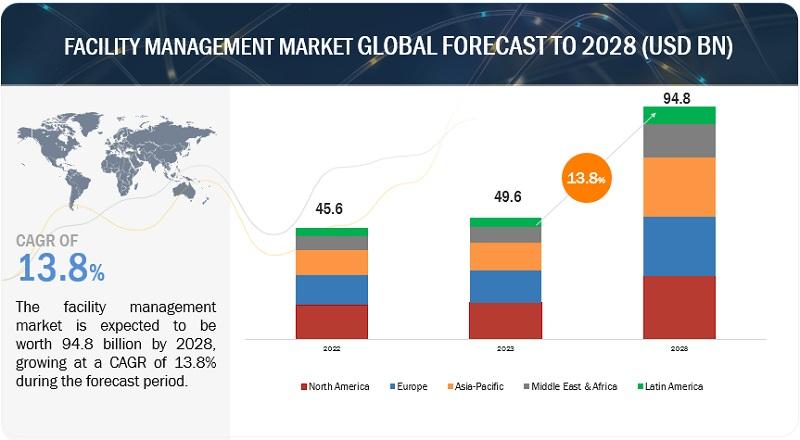

Facility Management Market Status, Revenue, Growth Rate, Services and Solutions

According to a research report "Facility Management Market by Offering (Solutions (IWMS, BIM, Facility Operations & Security Management) and Services), Vertical (BFSI, Retail, Construction & Real Estate, Healthcare & Life sciences) and Region - Global Forecast to 2028" published by MarketsandMarkets, the facility management market is estimated at USD 49.6 billion in 2023 to USD 94.8 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 13.8%.

Download PDF Brochure:…

Endpoint Security Market Size, Revenue, Growth Rate Analysis and Forecast 2024

According to a research report "Endpoint Security Market by Solution (Endpoint Protection Platform and Endpoint Detection and Response), Service, Deployment Mode, Organization Size, Vertical (Healthcare, Retail and eCommerce, and Government), and Region - Global Forecast to 2024", published by MarketsandMarkets, the global endpoint security market size is expected to grow from USD 12.8 billion in 2019 to USD 18.4 billion by 2024, at a Compound Annual Growth Rate (CAGR) of…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…