Press release

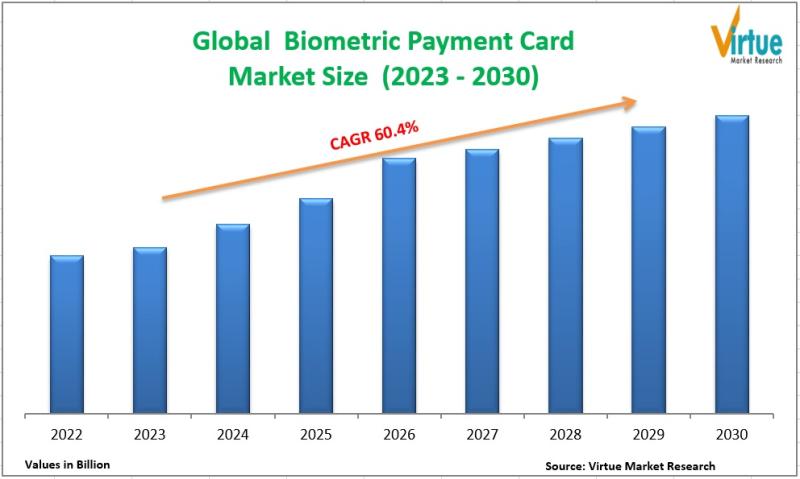

Global Biometric Payment Card Market is projected to reach the value of $5,292Million by 2030

According to the report published by Virtue Market Research , In 2022, the Global Biometric Payment Card Market was valued at $120.78 Million, and is projected to reach a market size of $5,292 Million by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 60.4%.In recent years, the Biometric Payment Card Industry has witnessed remarkable growth and innovation, driven by the increasing demand for secure and convenient payment methods.

A key long-term market driver propelling the growth of biometric payment cards is the increasing concern among consumers and businesses alike about the security of financial transactions. As traditional payment methods such as magnetic stripe cards and chip cards became susceptible to fraud, the need for a more secure solution became apparent.

Read More @ https://virtuemarketresearch.com/report/biometric-payment-card-market

COVID-19, while presenting unprecedented challenges across various industries, also served as a catalyst for the adoption of biometric payment cards. The pandemic raised hygiene and safety concerns over the use of traditional payment methods that require physical contact, like PIN entry and signing. Biometric payment cards, with their touchless authentication capabilities, offered a compelling alternative, minimizing the risk of virus transmission and bolstering consumer confidence.

In the short term, the ongoing transition towards a cashless society has emerged as a prominent market driver for biometric payment cards. As consumers increasingly prefer digital transactions for their speed and convenience, the demand for secure, contactless payment methods has surged. Biometric payment cards, with their seamless and robust authentication process, have risen to the occasion and are poised to shape the future of digital payments.

Amidst this evolving landscape, an exciting opportunity presents itself for biometric payment card providers to collaborate with financial institutions and merchants. By forging strategic partnerships, these companies can leverage each other's expertise to create an integrated ecosystem that caters to the diverse needs of consumers and businesses. This collaboration would facilitate the widespread adoption of biometric payment cards and further boost market growth.

One notable trend observed in the industry is the integration of advanced biometric technologies. In addition to fingerprint authentication, card manufacturers are exploring other biometric modalities like iris and palm vein recognition to enhance security and offer more options to consumers. This diversification of biometric authentication methods aims to provide greater flexibility and customization, accommodating the preferences of a wide range of users.

Segmentation Analysis:

The global Biometric Payment Card Market segmentation includes:

By Card Type: Debit Card, Credit Card

Among the different card types in the Biometric Payment Card Market, the largest segment is occupied by Biometric Debit Cards. These cards are linked directly to a user's bank account, enabling them to make payments using their available funds. Biometric Debit Cards provide a level of convenience that resonates with consumers, as they eliminate the need to carry cash and allow for swift and hassle-free transactions.

With biometric technology integrated into Debit Cards, users can authenticate their identity through fingerprint recognition. This advanced security measure ensures that only authorized users can access and use the card, minimizing the risk of fraudulent activities.

Furthermore, Biometric Debit Cards have witnessed substantial growth during the forecast period. As more consumers seek secure and touchless payment options, the demand for these cards has skyrocketed, making them the fastest-growing segment in the Biometric Payment Card Market.

The second significant card type in the Biometric Payment Card Market is Biometric Credit Cards. Unlike Debit Cards, which use available funds from the user's bank account, Credit Cards allow users to borrow money from the issuing financial institution to make purchases.

Biometric Credit Cards incorporate the same fingerprint authentication technology found in Debit Cards, ensuring a secure and personalized payment experience. By adding an extra layer of security, these cards offer peace of mind to users, knowing that their transactions are protected against unauthorized use.

While Biometric Credit Cards have gained popularity among consumers, they do not claim the largest share in the market segment. Nevertheless, their steady growth and potential for wider adoption make them an essential component of the Biometric Payment Card Market.

By End-User: Hospitality, Transportation, Electronics, Hospitality, Government, and Others One of the prominent end-user segments in the Biometric Payment Card Market is the hospitality industry. Biometric payment cards have gained traction in hotels, resorts, and restaurants due to their ability to streamline payment processes for guests and customers.

In the hospitality sector, biometric payment cards enable travelers and diners to make secure and touchless payments, enhancing their overall experience. By incorporating fingerprint recognition technology, these cards provide a swift and secure way to settle bills and transactions, eliminating the need for cash or physical cards. With its seamless integration into hospitality services, the segment of Biometric Payment Cards in the hospitality industry emerges as the largest category within the market.

Another significant end-user segment in the Biometric Payment Card Market is the transportation sector. Public transportation systems, airports, and ride-sharing services have adopted biometric payment cards to facilitate easy and secure fare payments.

Transportation services are embracing the convenience and security offered by biometric payment cards, where passengers can pay their fares with a simple touch of their fingerprint. This touchless payment method has become increasingly popular, especially in the context of growing concerns about hygiene and safety during travel.

The segment of Biometric Payment Cards in the transportation sector is poised for rapid growth during the forecast period, making it the fastest-growing category in the Biometric Payment Card Market.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/biometric-payment-card-market/request-sample

Regional Analysis:

The Biometric Payment Card Market has transcended borders, garnering interest and adoption across different regions worldwide. As biometric technology continues to revolutionize the payment landscape, various regions have embraced the convenience and security offered by biometric payment cards.

North America emerges as a dominant player in the Biometric Payment Card Market. The region's robust technological infrastructure and forward-thinking approach to payment innovations have driven the widespread adoption of biometric payment cards.

With the integration of fingerprint recognition technology, biometric payment cards have become a preferred choice for consumers in North America. The seamless and secure payment experience these cards offer has accelerated their acceptance in the region.

Due to these factors, North America claims the title of the largest segment in the Biometric Payment Card Market.

Europe's increasing awareness of the benefits of biometric payment cards has led to significant growth during the forecast period.

In Europe, the adoption of biometric payment cards has been driven by a growing demand for contactless and secure payment methods. As consumers seek convenient ways to make transactions without compromising on security, biometric payment cards have emerged as an ideal solution.

Europe's robust growth in biometric payment card adoption positions the region as the fastest-growing segment within the Biometric Payment Card Market.

The Asia-Pacific region presents vast opportunities for the Biometric Payment Card Market. With a large and diverse population, the region's adoption of biometric payment cards is steadily increasing.

In countries like China, India, and Japan, biometric payment cards are gaining popularity due to their convenience and enhanced security. As the region continues to advance technologically, the integration of biometric authentication in payment cards aligns with the trend towards a cashless society.

The Asia-Pacific region's growing interest and potential in adopting biometric payment cards make it a promising market segment to watch during the forecast period.

South America is gradually embracing the adoption of biometric payment cards. The region's diverse economies and cultural factors influence the pace of adoption in different countries.

While the growth rate may not be as rapid as in other regions, South America's gradual acceptance of biometric payment cards indicates a growing interest in the technology. As consumers become more familiar with the benefits of biometric authentication, the region is likely to witness an upward trajectory in adoption.

The Middle East & Africa region is in the exploration phase of biometric payment solutions. As the technology gains prominence globally, countries in this region are beginning to assess its potential benefits.

Factors such as increasing smartphone penetration, government initiatives, and rising digitalization efforts are likely to influence the adoption of biometric payment cards in the Middle East & Africa. While the region is still in the early stages of adoption, it holds promise for future growth.

Latest Industry Developments:

• Companies in the Biometric Payment Card Market are investing heavily in research and development to introduce innovative biometric technologies. By incorporating advanced modalities such as iris recognition and palm vein authentication, they aim to offer a wider range of secure and user-friendly options to consumers. These novel technologies not only enhance security but also cater to the evolving preferences of tech-savvy users, positioning companies at the forefront of the market.

• To expand their market share and reach, companies are forming strategic partnerships and alliances with key stakeholders in the payment ecosystem. By collaborating with financial institutions, payment processors, and merchants, biometric payment card providers can offer integrated and seamless payment solutions. These partnerships enable companies to tap into existing customer bases and access new markets, creating mutually beneficial opportunities for growth.

• As the adoption of biometric payment cards gains momentum worldwide, companies are increasingly focusing on global expansion. By identifying emerging markets and tailoring their offerings to suit regional preferences and regulatory requirements, companies can capture untapped opportunities in various regions. This global outlook allows companies to diversify their revenue streams, mitigate risks associated with regional economic fluctuations, and solidify their position as industry leaders in the Biometric Payment Card Market.

Customize the Full Report Based on Your Requirements @ https://virtuemarketresearch.com/report/biometric-payment-card-market/customization

Virtue Market Research

Kumar Plaza, #103, SRPF Rd, Ramtekadi, Pune, Maharashtra 411013, India

E-mail: megha@virtuemarketresearch.com

Phone: +1-917 436 1025

Virtue Market Research is a strategic management firm helping companies to tackle most of their strategic issues and make informed decisions for their future growth. We offer syndicated reports and consulting services. Our reports are designed to provide insights on the constant flux in the global demand-supply gap of markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Biometric Payment Card Market is projected to reach the value of $5,292Million by 2030 here

News-ID: 3144656 • Views: …

More Releases from Virtue Market Research

The Global Vodka Seltzer Market is projected to reach a market size of USD 16.22 …

The Vodka Seltzer Market was valued at USD 9.4 billion in 2024 and is projected to reach a market size of USD 16.21 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.1%.

Request Sample @ https://virtuemarketresearch.com/report/vodka-seltzer-market/request-sample

The vodka seltzer market has grown from a niche beverage choice into a mainstream favorite, supported by shifting consumer lifestyles and evolving…

The Global Telehealth Services Market and is projected to reach a market size of …

The Global Telehealth Services Market was valued at USD 126.1 billion and is projected to reach a market size of USD 302.49 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.7%.

Request Sample @ https://virtuemarketresearch.com/report/telehealth-services-market/request-sample

The perennial shift towards patient-centric healthcare has been a pivotal long-term market driver for telehealth services. Over the years, the industry has witnessed…

The Subscription Box/Subscription E-Commerce Market is projected to reach a mark …

The Subscription Box/Subscription E-Commerce Market is valued at USD 47.19 billion in 2024 and is projected to reach a market size of USD 97.73 billion by the end of 2030. Over the outlook period of 2025-2030, the market is anticipated to grow at a CAGR of 12.9%.

Request Sample @ https://virtuemarketresearch.com/report/subscription-e-commerce-market/request-sample

The subscription e-commerce market has grown into one of the most dynamic parts of the digital economy. It began as a…

The Global Aramid Fibre Reinforced Polymer Composites Market is projected to rea …

According to the report published by Virtue Market Research in Aramid Fibre Reinforced Polymer Composites Market was valued at USD 5.55 billion and is projected to reach a market size of USD 8.57 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.5%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/aramid-fibre-reinforced-polymer-composites-market/request-sample

The Aramid Fibre Reinforced Polymer Composites…

More Releases for Card

Gift Card and Incentive Card Market Set for Explosive Growth | National Gift Car …

A new business intelligence report released by AMA with title "Gift Card and Incentive Card Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Gift Card and Incentive Card Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through…

IC Card/Smart Card Market 2022 | Detailed Report

The IC Card/Smart Card research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the IC Card/Smart Card research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Download FREE Sample Report…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future.

A new report published by Allied Market Research, titled, Prepaid Card Market…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future

Prepaid Card Market is projected to grow at a CAGR of 22.7%…

Card Intelligent Lock Market Report 2018: Segmentation by Type (Magnetic card Lo …

Global Card Intelligent Lock market research report provides company profile for Tri-circle, Dessmann, Royalwand, Bangpai, ZKTeco, Schlage, KEYLOCK, Yale, Tenon, KAADAS, BE-TECH and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also…

Prepaid Card Market Report 2018: Segmentation by Card Type (Single-purpose prepa …

Global Prepaid Card market research report provides company profile for Green Dot Corporation, NetSpend Holdings, Inc., H&R Block Inc., American Express Company, JPMorgan Chase & Co., PayPal Holdings, Inc., BBVA Compass Bancshares, Inc. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…