Press release

Video Banking Service Market Demand, Scope, Size, and Growth by 2031

The video banking service market was valued at $71.4 billion in 2021, and is estimated to reach $247.9 billion by 2031, growing at a CAGR of 13.6% from 2022 to 2031.Download Sample Report: https://www.alliedmarketresearch.com/request-sample/32101

The phrase "video banking" refers to carrying out financial operations or receiving expert financial advice through a remote video connection. A bank staff and a customer can communicate via video conferencing technology through video for financial services. In addition, consumers may use a laptop, tablet, or smartphone to speak with their bank via service of virtual banking while at home. It uses live video technology to link a client with a banker or financial advisor. Therefore, these are the major video banking service market trends.

Furthermore, major market players are undertaking various strategies to increase the competition and offer enhanced services to their customers. For instance, In May 2021, One Touch Video Banking announced a new partnership with NuSource Financial. This partnership helps companies for cutting-edge video banking technology to NuSource's customer base to deepen their relationships with banks and credit unions. One Touch Video Banking allows financial institutions that thrive on face-to-face relationships to connect with customers who thrive on convenience. With the help of this partnership the companies delivered more personal approach to video banking that build customer and bank relationship. Which provided a strategic advantage to the company and video banking service market size.

On the basis of application, the banks segment is the highest growing segment. This is attributed to the fact that banking institutions provide video banking services which generally involves advice and execution of transactions on behalf of affluent clients. Moreover, banks also help with financial planning, manage client portfolios, and performs a variety of other financial services in relation to a client's private financing choices with the help of video banking services.

Buy This Report: https://www.alliedmarketresearch.com/checkout-final/42e06d0a21f2d17f76bed40cf31db94b

Region wise, North America attained the highest growth in 2021. This is attributed to growing need for video communication, virtual workforce management, and cloud-based collaboration platform are some of the major factors that impact the video banking service market growth. In addition, banks and corporations are adopting video collaboration solutions with the aim to make faster decisions and avoid high costs associated with traveling.

COVID-19 had a positive impact on the video banking service market. Rapid adoption of digitalization in the banking sector during the pandemic helped to grow the video banking market. Moreover, to improve the security features in the banking platform, many banks adopted machine learning to predict fraud even before it happens. In addition, AI in video banking solutions possesses extreme capabilities to reduce account opening time and operational costs. Furthermore, in the approaching years, it is anticipated that this aspect will present the video banking service industry with numerous, very lucrative prospects.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/32101

Key findings of the study

By component, the solution segment led the video banking service market in terms of revenue in 2021.

By deployment mode, the on-premise segment accounted for the highest video banking service market share in 2021.

By region, North America accounted for the highest video banking service market share in 2021.

The report analyzes the profiles of key players operating in the video banking service market analysis such as AU Small Finance Bank Limited, Barclays, Glia Technologies, Inc., Guaranty Trust Bank Limited, NatWest International, Royal Bank of Scotland plc, Star Financial, StonehamBank, U.S. Bank and Ulster Bank. These players have adopted various strategies to increase their market penetration and strengthen their position in the video banking service market.

Access Full Summary: https://www.alliedmarketresearch.com/video-banking-service-market-A31651

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Video Banking Service Market Demand, Scope, Size, and Growth by 2031 here

News-ID: 3141219 • Views: …

More Releases from Allied Market Research

Renal Denervation Market to Exceed USD $4.5 Billion by 2030 | Allied Market Rese …

Renal denervation is a medical procedure that uses radiofrequency ablation or other methods to disrupt the activity of nerves that surround the kidneys. These nerves are part of the sympathetic nervous system, which controls various bodily functions, including blood pressure regulation. During renal denervation, upper chamber and lower chamber of the heart beat irregularly, chaotically, and out of sync, which can cause shortness of breath, chest pain, weakness, lightheadedness, or…

The Booming Surgical Equipment Market Is Projected to Reach $59 Billion by 2032

Allied Market Research recently said the surgical equipment industry has been growing steadily in recent years, driven by advances in technology, increasing demand for minimally invasive surgeries, and rising healthcare expenditures. The global surgical equipment market size was valued at $35.6 billion in 2022, and is projected to reach $59 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032. Surgical equipment refers to the various tools,…

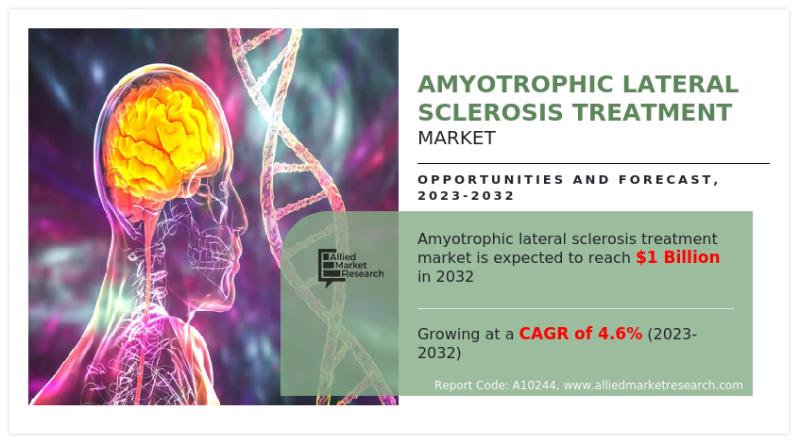

ALS Treatment Market to Reach US$ 1.04 Billion by 2032, Growing at 4.6% CAGR

The global amyotrophic lateral sclerosis (ALS) treatment market is entering a critical phase of growth as unmet therapeutic needs and research momentum converge. Current figures indicate a market value of US$ 662.3 million in 2022, with a projected increase to US$ 1,038.94 million by 2032, which equates to a CAGR of 4.6% from 2023 to 2032. ALS is a severe neurodegenerative disease affecting nerve cells in the brain and spinal…

Aircraft Engine Forging Market to Garner $5 Billion, Globally, By 2032 At 6.9% C …

Aircraft engine forging industry size was valued at $2.6 billion in 2022, and is estimated to garner $5 billion by 2032, growing at a CAGR of 6.9% from 2023 to 2032.

The demand for lightweight materials, such as titanium, aluminum, and advanced alloys, aimed at improving fuel efficiency and overall performance of aircraft engines. Moreover, there is surge in air travel demand that led airlines to expand their fleets, necessitating the…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…