Press release

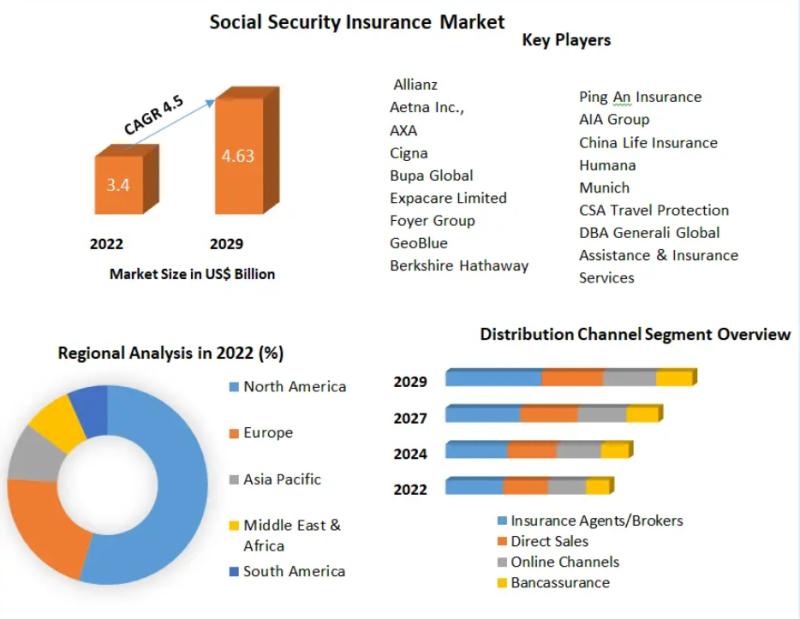

The Global Social Security Insurance Market size was valued at USD 3.4 Bn in 2022 and is expected to reach USD 4.63 Bn by 2029, with a CAGR of 4.5 Percent.

Social Security Insurance Market Report Scope and Research MethodologyThe Global Social Security Insurance Market report provides a comprehensive analysis of the market, covering various aspects such as insurance types, end users, and regional insights. The research methodology involves a bottom-up approach to estimate market size using primary and secondary data collection methods. The report focuses on drivers, challenges, and major restraints affecting the Social Security Insurance industry, providing valuable insights for stakeholders. The goal is to assist decision-makers in making informed choices and understanding the market dynamics.

Get to Know More About This Market Study: https://www.maximizemarketresearch.com/market-report/social-security-insurance-market/199752/

Technology has streamlined administrative processes and automated tasks in managing Social Security insurance programs, resulting in increased efficiency. Faster claims processing, reduced paperwork, and more accurate benefit calculations are possible with technology. Advances in data analytics and machine learning algorithms help identify potential fraud or abuse, protecting the integrity of social security programs. Digitization enables individuals to access and manage their social security benefits online through user-friendly interfaces, improving accessibility and enhancing the user experience.

Request a Free Sample Copy or View Report Summary: https://www.maximizemarketresearch.com/request-sample/199752

What are Social Security Insurance Market Dynamics:

As the population ages, a larger number of individuals approach or enter retirement, creating a demand for retirement planning and financial security during the post-employment phase. Social Security Insurance products, including annuities and retirement income policies, offer additional income streams to supplement Social Security benefits, ensuring a more comfortable retirement for individuals. Additionally, the aging population is more likely to require long-term care services, and Social Security Insurance products such as long-term care insurance provide coverage for these specific needs, easing financial burdens on individuals and families.

Request For Free Inquiry Report: https://www.maximizemarketresearch.com/inquiry-before-buying/199752

Governments around the world recognize the importance of retirement planning and the need for individuals to save for their future. They implement various initiatives, such as tax incentives, employer-sponsored retirement plans, and public awareness campaigns, to encourage citizens to take an active role in planning for retirement. These initiatives create a favorable environment for the growth of Social Security Insurance products, complementing current social security programs. Governments aim to reduce the strain on public social security systems by promoting private insurance solutions, ensuring the long-term sustainability of social security programs while enhancing individuals' financial security.

Request For Free Sample Report: https://www.maximizemarketresearch.com/request-sample/199752

Social Security Insurance Market Regional Insights:

Changing demographics, particularly the aging population, contribute to financial sustainability concerns. As life expectancies increase, there is a higher demand for retirement benefits and healthcare services, straining social security insurance systems. In many countries, declining birth rates reduce future contributors to the system, creating funding gaps that need to be addressed to ensure the long-term viability of social security insurance programs. Economic fluctuations, inadequate contribution rates, and future economic uncertainty also hamper market growth.

What is Social Security Insurance Market Segmentation:

By Insurance Type:

Retirement Insurance

Disability Insurance

Survivor Insurance

Healthcare Insurance

Unemployment Insurance

By End User:

Individuals

Employers

Government Employees

Self-employed/Independent Workers

By Distribution Channel:

Insurance Agents/Brokers

Direct Sales

Online Channels

Bancassurance

Purchase Report: https://www.maximizemarketresearch.com/market-report/social-security-insurance-market/199752/

Who are Social Security Insurance Market Key Players:

1. Allianz

2. Aetna Inc.,

3. AXA

4. Cigna

5. Bupa Global

6. Expacare Limited

7. Foyer Group

8. GeoBlue

9. Berkshire Hathaway

10. Ping An Insurance

11. AIA Group

12. China Life Insurance

13. Humana

14. Munich

15. CSA Travel Protection DBA Generali Global Assistance & Insurance Services

Table of content for the Social Security Insurance Market includes:

Global Social Security Insurance Market: Research Methodology

Global Social Security Insurance Market: Executive Summary

Market Overview and Definitions

Introduction to the Global Market

Summary

Key Findings

Recommendations for Investors

Recommendations for Market Leaders

Recommendations for New Market Entry

Global Social Security Insurance Market: Competitive Analysis

MMR Competition Matrix

Market Structure by region

Competitive Benchmarking of Key Players

Consolidation in the Market

M&A by region

Key Developments by Companies

Market Drivers

Market Restraints

Market Opportunities

Market Challenges

Market Dynamics

PORTERS Five Forces Analysis

PESTLE

Regulatory Landscape by region

North America

Europe

Asia Pacific

Middle East and Africa

South America

COVID-19 Impact

Global Social Security Insurance Market Segmentation

Global Market, by Insurance Type (2022-2029)

Global Market, by End User (2022-2029)

Global Market, by Distribution Channel (2022-2029)

Regional Social Security Insurance Market (2021-2029)

Regional Market, by Insurance Type (2022-2029)

Regional Market, by End User (2022-2029)

Regional Market, by Distribution Channel (2022-2029)

Regional Market, by Country (2022-2029)

Company Profile: Key players

Company Overview

Financial Overview

Global Presence

Capacity Portfolio

Business Strategy

Recent Developments

Key Offerings:

Past Market Size and Competitive Landscape (2018 to 2021)

Past Pricing and price curve by region (2018 to 2021)

Market Size, Share, Size & Forecast by different segment | 2022-2029

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Market Segmentation - A detailed analysis by Insurance Type, End User and Distribution Channel

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Global Cars-as-a-Service (CaaS)Market https://www.maximizemarketresearch.com/market-report/global-cars-as-a-service-caasmarket/66515/

Global Industrial Motor Management and Control Device Market https://www.maximizemarketresearch.com/market-report/global-industrial-motor-management-and-control-device-market/80964/

Global High-performance Tires Market https://www.maximizemarketresearch.com/market-report/global-high-performance-tires-market/120926/

Vehicle for Disabled Market https://www.maximizemarketresearch.com/market-report/vehicles-for-disabled-market/122545/

Automotive Electronic Logging Device (ELD/E-Log) Market https://www.maximizemarketresearch.com/market-report/automotive-electronic-logging-device-eld-e-log-market/71125/

Global Electric Recliner Market https://www.maximizemarketresearch.com/market-report/global-electric-recliner-market/72020/

Global Automotive Purge Pump Market https://www.maximizemarketresearch.com/market-report/global-automotive-active-purge-pump-market/120994/

Global Electric Scooter Lift and Carrier Market https://www.maximizemarketresearch.com/market-report/global-electric-scooter-lift-and-carrier-market/114078/

Global Automotive Center Console Market https://www.maximizemarketresearch.com/market-report/global-automotive-center-console-market/101608/

global semi automatic truck market https://www.maximizemarketresearch.com/market-report/global-semi-automatic-truck-market/68646/

Automotive Road Roller Market https://www.maximizemarketresearch.com/market-report/global-automotive-road-roller-market/69376/

Global Hand Brake Market https://www.maximizemarketresearch.com/market-report/global-hand-brake-market/73356/

Global Manifold Absolute Pressure Sensor Market https://www.maximizemarketresearch.com/market-report/global-manifold-absolute-pressure-sensor-market/69400/

Global Air Deflector Market https://www.maximizemarketresearch.com/market-report/air-deflector-market/12682/

Global Pitman Arm Market https://www.maximizemarketresearch.com/market-report/global-pitman-arms-market/96360/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Global Social Security Insurance Market size was valued at USD 3.4 Bn in 2022 and is expected to reach USD 4.63 Bn by 2029, with a CAGR of 4.5 Percent. here

News-ID: 3139573 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

Indonesia Electric Vehicle Market Poised for Rapid Growth Driven by Government S …

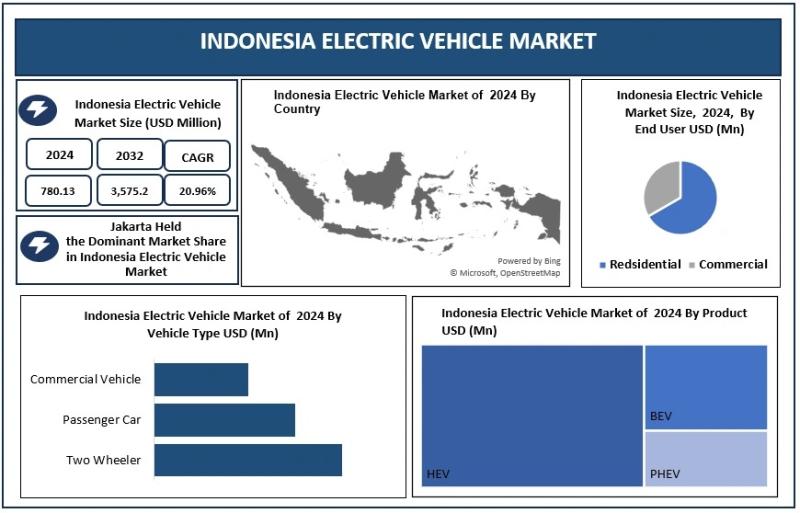

The Indonesia Electric Vehicle Market was valued at USD 780.13 Mn. in 2024. Indonesia Electric Vehicle Market size is estimated to grow at a CAGR of 20.96%. The market is expected to reach a value of USD 3,575.24 Mn. in 2032.

Indonesia Electric Vehicle Market Overview:

The Indonesia Electric Vehicle Market is gaining strong attention as the country moves toward cleaner mobility and long-term energy security. Indonesia's rapid urbanization, rising fuel costs,…

India Sports Apparel Market Shows Strong Momentum Driven by Lifestyle Shifts and …

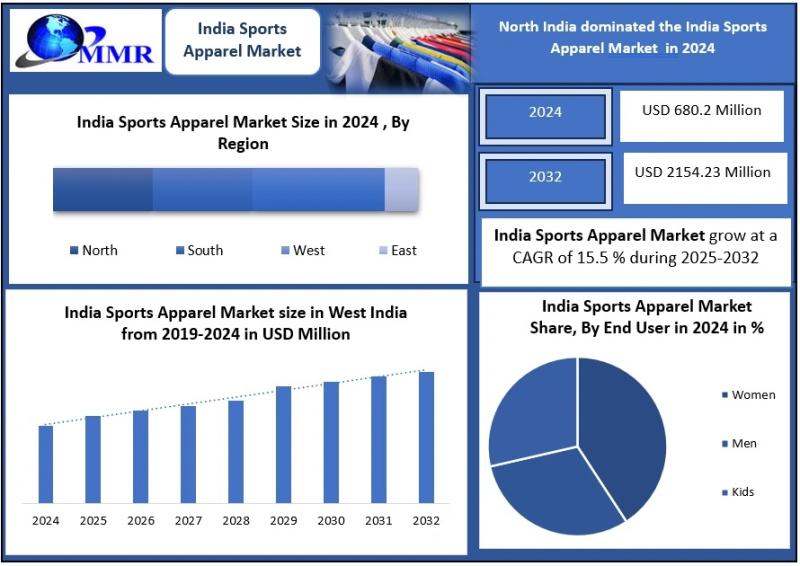

The India Sports Apparel Market was valued at USD 680.2 Million in 2024 and is projected to reach USD 2154.23 Million by 2032, growing at a robust CAGR of 15.5 %.

India Sports Apparel Market Overview:

The India Sports Apparel Market is shaped by changing consumer behavior and an expanding sports culture across the country. Increasing participation in activities such as running, yoga, gym training, and team sports has boosted the demand…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…