Press release

Insurtech Market: Growing Demand for Effective Treatment Options

The Global Insurtech Market Size valued for USD 8.8 Billion in 2021 and is projected to occupy a market size of USD 166.4 Billion by 2030 growing at a CAGR of 39.1% from 2022 to 2030.Insurance companies are developing new products to meet the changing needs of their customers, resulting in greater transparency. As a result, with the help of insurtech platforms, proper data and risk management can be achieved, thereby improving underwriting accuracy and loss prediction. This enables insurance companies to increase operational efficiency, lowering the costs of insurance products via insurtech platforms. This will assist insurance companies in earning higher profits throughout the forecasted years. Many insurance companies are skeptical of the rising competition, but insurtech start-ups will play a critical role in the broader ecosystem, which includes venture capital investors, consultants, accelerators, and corporations, over the next eight years.

Request For Free Sample Report @ https://www.acumenresearchandconsulting.com/request-sample/3100

Insurtech Market Dynamics

The growing digitization of business is the primary driver of the global insurtech market. Furthermore, the rapidly growing insurance service providers, combined with the increase in insurance service seekers, are increasing the value of the insurtech market. The rapidly increasing number of smartphone users, as well as the growing technologically aware population, has heavily favored digital business models, propelling the insurance technology industry forward.

Insurtech not only creates, manages, and distributes insurance products and services, but it also provides ultra-customized policies, social insurance, and uses new data streams from internet-enabled devices to proactively price premiums. This factor dramatically expands the usage of insurtech solutions. The increased implementation of AI, big data analytics, ML, and cloud computing significantly assist in saving the claims. As a result of the rapid adoption of these technologies, insurtech players may discover ways to reduce additional value-added service charges.

Furthermore, with increased availability of transactional data, insurtech players can easily handle massive amounts of data while lowering costs, increasing profits, and providing better customer service. However, data security and privacy concerns, as well as a changing regulatory framework, are expected to limit market growth.

Insurtech Market Statistics:

Global insurtech market revenue valued at USD 8.8 Billion in 2021, with a 39.1% CAGR from 2022 to 2030

According the CDC data, 31.6 million people of all ages were uninsured in 2020

North America insurtech market share occupied over 36% in 2021

Asia-Pacific insurtech market growth is estimated to attain a noteworthy CAGR from 2022 to 2030

By technology, the cloud computing sub-segment seized USD 2.5 billion in market revenue in 2021

Based on end-use, the BFSI sub-segment gathered US$ 21 billion income in 2021

The growing adoption of cloud computing and AI is a key trend in the insurtech industry

Check the detailed table of contents of the report @

https://www.acumenresearchandconsulting.com/table-of-content/insurtech-market

Insurtech Market Segmentation

The global market has been split into insurance type, technology, services, end-use, and region.

The insurance type segment is further categorized into auto, business, health, home, specialty, travel, and others. Based on technology, the industry is split into artificial intelligence, big data and analytics, blockchain, cloud computing, IoT, machine learning, and others. Consulting, support & maintenance, and managed services are the splits of the services segment. By end-use, the segmentation includes BFSI, automotive, government, healthcare, retail, manufacturing, transportation, and others. Furthermore, the regional categorization is comprised of North America, Europe, Latin America, Asia-Pacific, and the Middle East & Africa.

Insurtech Market Share

According to our insurtech industry research, the health insurance type sub-segment will account for a sizable market share in 2021. In contrast, the home sub-segment is projected to expand significantly between 2022 and 2030. The cloud computing technology segment is predicted to gain a substantial market share by 2030, according to our insurtech market forecast. Managed services generated the most revenue among service segments in 2021 and are expected to do so in the future. Furthermore, demand for insurtech platforms has increased in the BFSI industry, and the healthcare industry is anticipated to expand in popularity in the coming years.

Insurtech Market Regional Outlook

According to our regional analysis, the North America region collected the most income in 2021 and is expected to maintain its dominance throughout the forecast timeframe. The early adoption of technologies, the presence of banking, insurance, IT, and healthcare behemoths, and the long-term implementation of AI, big data analytics, and cloud computing are all factors supporting the North American insurtech market.

The Asia-Pacific region, on the other hand, is expected to grow at a rapid pace during the forecasted years of 2022 to 2030. The Asia-Pacific insurtech industry will benefit from the rapid digitization of business, the increasing massive amount of data from various sectors, and the growing penetration of smartphone and online platforms for banking and insurance services.

Insurtech Market Players

Some prominent insurtech companies covered in the industry are Damco Group, InsuerTech Nova, DXC Technology Company, Insurance Technology Services, KFin Technologies, Oscar Insurance, Majesco, Quantemplatem, Trov, Inc., Wipro Limited, Shift Technology, and ZhongAn Insurance.

Buy this premium research report -

https://www.acumenresearchandconsulting.com/buy-now/0/3100

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurtech Market: Growing Demand for Effective Treatment Options here

News-ID: 3139211 • Views: …

More Releases from Acumen Research and Consulting

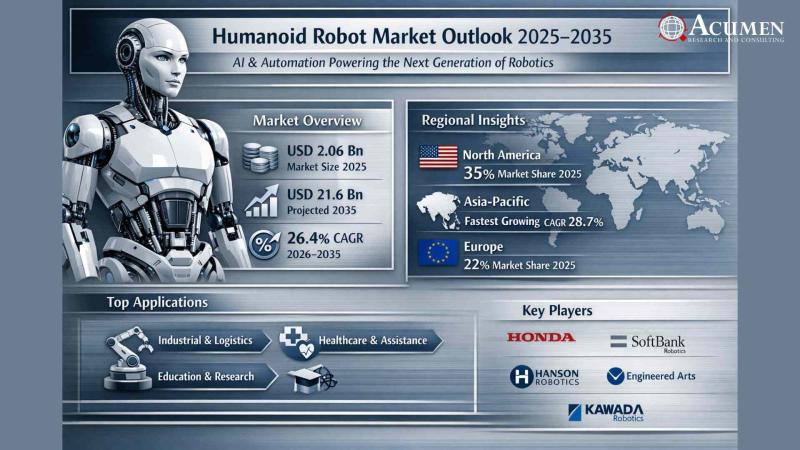

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

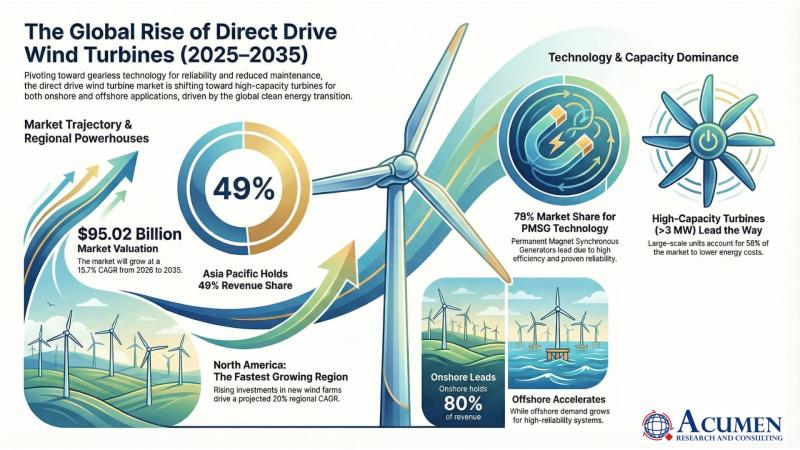

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for Insurtech

Insurtech Accelerators Market Hits New High | Major Giants Plug and Play, Startu …

HTF MI just released the Global Insurtech Accelerators Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Insurtech Accelerators Market are: Plug and Play,…

Insurtech Market: A Comprehensive Overview

The global insurtech market was valued at approximately USD 10.3 billion in 2024 and is projected to reach around USD 152.9 billion by 2033, growing at a compound annual growth rate (CAGR) of about 31.5% from 2025 to 2033.

Insurtech Market Overview

The global Insurtech market is undergoing explosive growth, fueled by the insurance industry's rapid digitization and rising customer demand for seamless, personalized digital experiences. Advanced technologies like artificial intelligence (AI),…

Top Trends Transforming the InsurTech (Insurance Technology) Market Landscape in …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the InsurTech (Insurance Technology) Industry Market Size Be by 2025?

The volume of the insurtech (insurance technology) market has expanded significantly in the past few years. The market, currently valued at $19.23 billion in 2024, is projected to reach $25.95 billion in 2025, demonstrating a compound annual…

Emerging Trends Influencing The Growth Of The Insurtech Market: Innovative AI-Po …

The Insurtech Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Insurtech Market Size Expected to Be by 2034?

In recent times, the insurtech market has seen substantial expansion. The projected growth indicates an increase from $17.08 billion in 2024 to $22.08 billion…

Top Factor Driving Insurtech Market Growth in 2025: Rising Tide Of Insurance Cla …

How Are the key drivers contributing to the expansion of the insurtech market?

The expected surge in insurance claims is projected to directly contribute to the expanded growth of the insurtech market. Insurtech plays a critical role in claim management, risk assessment, contract processing, and policy underwriting. The increase in hospitalizations during the COVID-19 pandemic has resulted in a steep rise in insurance claims. An illustrative example of this could be…

Insurtech, Market Dynamics, Global Opportunities, Forecast 2024

The Business Research Company recently released a comprehensive report on the Global Insurtech Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…