Press release

Debt Underwriting Services Market to Witness Steady Growth with a Promising CAGR (2023-2032)

Debt underwriters buy debt securities from issuer to market debt securities on a benefit basis, in financial terms it is defined as underwriting spread. In addition, underwriters can either resell debt securities to capital markets or merchants disbursing securities to other purchasers. Debt underwriting for companies is mostly performed by big financial institutions such as investment banks, insurance companies, and merchant banks. Debt underwriting allows businesses to raise money and is beneficial for selling securities business expansion. The global debt underwriting services market has experienced tremendous growth, and is expected to maintain its dominance during the forecast period.Download Research Sample Report: https://www.alliedmarketresearch.com/request-toc-and-sample/7763

The global debt underwriting services market is segmented on the basis of service, end user, and region. Based on service, the market is categorized into debt capital underwriting, mergers & acquisitions advisory, equity capital markets underwriting, syndicated loans, and others. On the basis of end user, the market is divided into individual, corporate institutions, and others. Geographically, the market is analyzed across several regions such as North America, Europe, Asia-Pacific, and Latin America, Middle East & Africa (LAMEA).

Key players operating in the global debt underwriting services industry include UBS Group, Bank of America Corporation, JPMorgan Chase & Co., Goldman Sachs Group Inc., Credit Suisse Group, Deutsche Bank AG, Morgan Stanley, Citigroup Inc., Wells Fargo & Company, DBS Bank, and Axis Capital. These companies have adopted several strategies such as product launches, partnerships, collaborations, mergers & acquisitions, and joint ventures to strengthen their foothold in the global debt underwriting services market.

Buy This Report: https://www.alliedmarketresearch.com/checkout-final/f86d608590dea4290431ea74b918b7f7

Top Impacting Factors

Increase in demand for corporate banks, owing to their higher yield levels and corporate companies seeking for business expansions by approaching loan debt underwriting and issuing debt instruments in the market boost the market growth. However, higher competition and stringent government regulations are some of the factors that hamper the debt underwriting services market growth.

Rise in economical and corporate activities in emerging countries such as India, Malaysia, China, and other Asian countries are expected to provide lucrative opportunities to the market in the upcoming years.

Fintech Applications For Effective Debt Securities Issuance

Investment banks have implemented several technologies such as distributed ledger systems, artificial intelligence, machine learning, large data analytics, and cloud storage with considerable potential to transform the life cycle of debt. In addition, blockchain technology, with its higher efficiency in assessing consumer data through large databases, helps debt underwriters effectively issue and sell bonds in the market. For instance, in August 2019, the International Bank for Reconstruction and Development (IBRD), an international financial institution of the World Bank, has generated surplus revenue with nearly $35 million for its Kangaroo bond leveraging distributed ledger (blockchain) technology.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/7763

Rise in Commission Fees in Lower Market Regions

For instance, in India, investment banking fees from debt markets underwriting hit a record high of $251.7 million in 2019, in comparison to 70.1% in 2018. Regulated environment and lower market activity in the area urged underwriters to come up with valuable solutions for their operations. Moreover, owing to their lower potential in market for raising funds, debt issuers have increased fees as companies & governments sought to sell and issue debt securities in the market.

Key Benefits of the Report

This study presents analytical depiction of the global debt underwriting services market size along with the current trends and future estimations to determine the imminent investment pockets.

The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the global debt underwriting services market share.

The current market is quantitatively analyzed to highlight the market growth scenario.

Porter's five forces analysis illustrates the potency of buyers & suppliers in the market.

The report provides a detailed debt underwriting services market analysis based on the present and future competitive intensity of the market.

COVID-19 Scenario Analysis

COVID-19 has created severe business disruptions in the corporate sector and has left many obstacles for underwriting institutions. New deals have been postponed and delays on security issuer's side are mainly due to disrupted value chains and stoppages.

Moreover, business continuity is taking place virtually, owing to health care regulations. The impact of COVID-19 has severely impacted debt securities leading to negative returns due to poor economic activities and market illiquidity.

Owing to the pandemic, the Securities and Exchange Commission of U.S. and regulatory bodies across globe issued new guidelines to underwriting firms to facilitate great benefit for issuer companies.

Trending Reports:

Debt Financing Market: https://www.alliedmarketresearch.com/debt-financing-market-A06292

Investment Banking Market: https://www.alliedmarketresearch.com/investment-banking-market-A06710

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Debt Underwriting Services Market to Witness Steady Growth with a Promising CAGR (2023-2032) here

News-ID: 3137489 • Views: …

More Releases from Allied Market Research

Mobile Application Security Market Growing at 26.3% CAGR Reach USD 37.1 Billion …

Allied Market Research published a new report, titled, "Mobile Application Security Market Growing at 26.3% CAGR Reach USD 37.1 Billion by 2032." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

MarTech Market Witnessing CAGR of 18.5% Hit USD 1.7 Trillion by 2032

The global marketing technology market is experiencing growth due to several factors, including the increasing digital transformation, the surge in demand for personalized experience, and the proliferation of automation and efficiency. However, data privacy and compliance, and the high cost of implementation are expected to hamper market growth. Furthermore, the growing integration of AI and ML technologies and the increase in demand for real-time marketing are anticipated to provide lucrative…

Feedback Management Software Market Growing with CAGR of 12.9% Reach USD 28.7 Bi …

Allied Market Research published a new report, titled, "Feedback Management Software Market Growing with CAGR of 12.9% Reach USD 28.7 Billion by 2031 ." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segment, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain thorough understanding of the industry and…

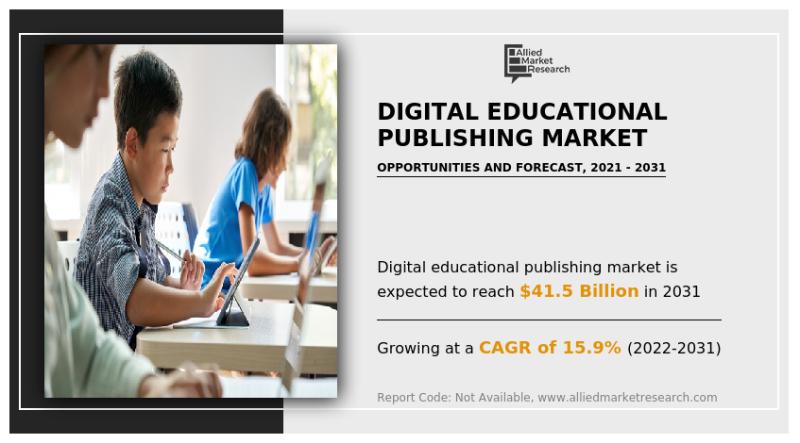

Digital Educational Publishing Market Growing at 15.9% CAGR Reach USD 41.5 Billi …

The Market report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers a valuable guidance to leading players, investors, shareholders, and startups in devising strategies for the sustainable growth and gaining competitive edge in the market.

The global Digital Educational Publishing Market was valued at $9.9 billion in 2021, and is projected to reach $41.5 billion by 2031, growing at…

More Releases for Debt

Debt Settlement Solution Market Impressive Growth 2021-2028 | National Debt Reli …

The Insight Partners announces the research on Global Debt Settlement Solution Market [Report Page Link as it covers the key boundaries Required for your Research Need. This Global Debt Settlement Solution Market Report covers worldwide, local, and nation level market size, pieces of the overall industry, ongoing pattern, the effect of covid19 on worldwide

Market Research Report Investigations Research Methodology review comprises of Secondary Research, Primary Research, Company Share Analysis,…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market 2019 By Freedom Debt Relief National Debt Relief Rescue O …

This report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in which the debtor and creditor agree on a reduced balance that will be regarded as payment in full.

Request a Sample of this Report @ https://www.orbisresearch.com/contacts/request-sample/2575396 …

Debt Settlement Market 2018-National Debt Relief, Freedom Debt Relief, New Era D …

The report on Debt Settlement, documents a detailed study of different aspects of the ‘Debt Settlement’ market. It shows the steady growth in market in spite of the fluctuations and changing market trends. In the past four years the ‘Debt Settlement’ market has grown to a booming value of $xxx million and is expected to grow more.

Request a Sample of this Report@ http://www.orbisresearch.com/contacts/request-sample/2335800

Every market intelligence report is based on certain…

Debt Settlement Market 2018 | Global Demand, Top Companies Analysis- National De …

Global Debt Settlement Market Research Report 2018 is a professional and in-depth study on the current state of the global Debt Settlement industry with a focus on the regional market, analysis of industry share, growth factors, development trends, size, majors manufacturers and 2025 forecast. The report also analyze innovative business strategies, value added factors and business opportunities. The Debt Settlement report introduces market revenue, product & services, latest developments and…