Press release

Insurance Fraud Detection Software Market to Eyewitness Huge Growth by 2030 | Fraud.net, ClearSale, Oracle, Riskified

Advance Market Analytics published a new research publication on "Insurance Fraud Detection Software Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Insurance Fraud Detection Software market was mainly driven by the increasing R&D spending across the world.Get Free Exclusive PDF Sample Copy of This Research @ https://www.advancemarketanalytics.com/sample-report/128741-global-insurance-fraud-detection-software-market#utm_source=OpenPRKavita

Some of the key players profiled in the study are: Fraud.net (United States), ClearSale (Brazil), Crawford & Company (United States), Oracle Corporation (United States), Riskified (Israel), NICE Actimize (United States), Kount, Inc. (United States), Scout Case Management Software (United States), IBM (United States), FRISS Inc. (United States), Agnovi Corporation (Canada).

Scope of the Report of Insurance Fraud Detection Software

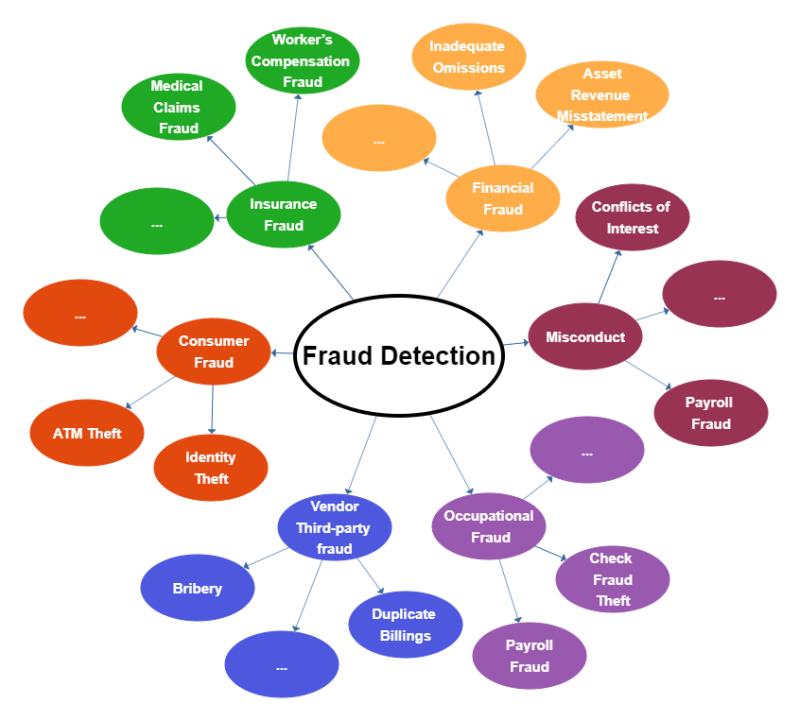

Insurance fraud detection software provides an end-to-end solution for detecting, preventing, and managing both opportunistic and organized claims. It uses multiple techniques (automated business rules, embedded AI and machine learning methods, text mining, anomaly detection, and network link analysis) to automatically score millions of claims records in real-time or in batch. Growing fraud-related activities in the insurance sector are the major factor driving the market growth. North America holds the largest market share of the global insurance fraud detection software market.

The titled segments and sub-section of the market are illuminated below: by Type (Fraud Analytics, Authentication, Other), Application (Life Insurance, Health Care Insurance, Automobile Insurance, Property Insurance, Others), Technology (Artificial Intelligence (AI), Internet Of Things (IoT), Blockchain, Anomaly Detection And Network Link Analysis, Others), End-User (Insurance Providers, Agents & Brokers, Insurance Intermediaries, Others), Deployment (On-premise, Cloud-based), Component (Solution, Service)

On 8th December 2021, Crawford & Company launches the Crawford Intelligent Fraud Detection solution. This new solution combines human expertise and forensic analysis, utilizing DXC Luxoft's Financial Crimes Intelligence technology with IBM to further enhance how it detects and manages fraudulent claims for its clients.

Market Drivers:

Growing Demand for Cybersecurity

The Increasing Number of Fraudulent Auto Claims

Market Trends:

Growing Demand Integration of Technologies Such As AI, Mining Text, Machine Learning

An Upsurge of Technology and Rising Digitization

Opportunities:

Adoption of Automation in the Insurance Industry

Growing Complexity in Individual or Organized Crime Is a Major Concern for Many Insurance Companies

Have Any Questions Regarding Global Insurance Fraud Detection Software Market Report, Ask Our Experts@ https://www.advancemarketanalytics.com/enquiry-before-buy/128741-global-insurance-fraud-detection-software-market#utm_source=OpenPRKavita

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Strategic Points Covered in Table of Content of Global Insurance Fraud Detection Software Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Insurance Fraud Detection Software market

Chapter 2: Exclusive Summary - the basic information of the Insurance Fraud Detection Software Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Insurance Fraud Detection Software

Chapter 4: Presenting the Insurance Fraud Detection Software Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2018-2022

Chapter 6: Evaluating the leading manufacturers of the Insurance Fraud Detection Software market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2023-2028)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

finally, Insurance Fraud Detection Software Market is a valuable source of guidance for individuals and companies.

Read Detailed Index of full Research Study at @ https://www.advancemarketanalytics.com/reports/128741-global-insurance-fraud-detection-software-market#utm_source=OpenPRKavita

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA - 08837

Phone: +1(201) 7937323, +1(201) 7937193

sales@advancemarketanalytics.com

About Author:

Advance Market Analytics is Global leaders of Market Research Industry provides the quantified B2B research to Fortune 500 companies on high growth emerging opportunities which will impact more than 80% of worldwide companies' revenues.

Our Analyst is tracking high growth study with detailed statistical and in-depth analysis of market trends & dynamics that provide a complete overview of the industry. We follow an extensive research methodology coupled with critical insights related industry factors and market forces to generate the best value for our clients. We Provides reliable primary and secondary data sources, our analysts and consultants derive informative and usable data suited for our clients business needs. The research study enable clients to meet varied market objectives a from global footprint expansion to supply chain optimization and from competitor profiling to M&As.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Fraud Detection Software Market to Eyewitness Huge Growth by 2030 | Fraud.net, ClearSale, Oracle, Riskified here

News-ID: 3136965 • Views: …

More Releases from AMA Research & Media LLP

Property Insurance in the Oil and Gas Sector Market Detailed Strategies, Competi …

Advance Market Analytics published a new research publication on "Property Insurance in the Oil and Gas Sector Market Insights, to 2033" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Property Insurance in the Oil and Gas Sector market was mainly driven by the…

Textile Reinforced Concrete Market Charting Growth Trajectories: Analysis and Fo …

Advance Market Analytics published a new research publication on "Textile Reinforced Concrete Market Insights, to 2033" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Textile Reinforced Concrete market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample…

Online TV Streaming Service Market Detailed Strategies, Competitive Landscaping …

Advance Market Analytics published a new research publication on "Online TV Streaming Service Market Insights, to 2033" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Online TV Streaming Service market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive…

Potato Vodka Market Unidentified Segments - The Biggest Opportunity Of 2025

Advance Market Analytics published a new research publication on "Potato Vodka Market Insights, to 2033" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Potato Vodka market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…