Press release

Auto Finance Market : The Emergence of Online Automotive Finance Applications

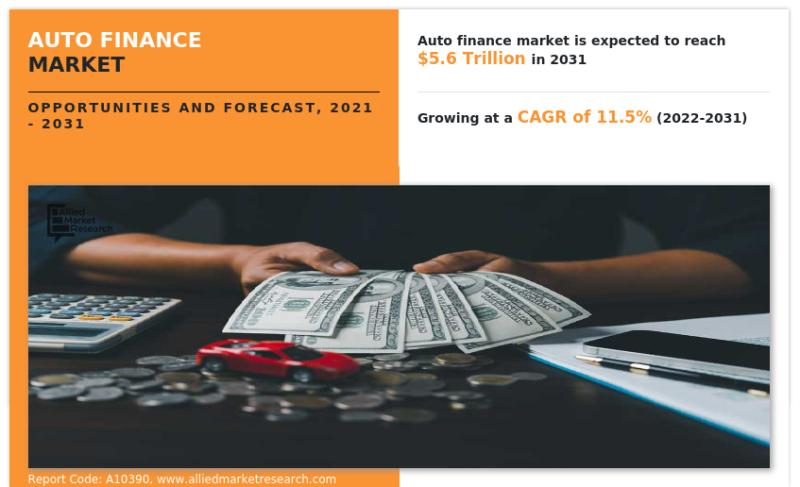

According to the report published by Allied Market Research, the global Auto Finance market was estimated at $1.9 Trillion in 2021 and is expected to hit $5.6 Trillion by 2031, registering a CAGR of 11.5% from 2022 to 2031. The report provides a detailed analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive landscape, and evolving market trends. The market study is a helpful source of information for the frontrunners, new entrants, investors, and shareholders in crafting strategies for the future and heightening their position in the market.Download Sample Report @ https://www.alliedmarketresearch.com/request-sample/10755

The key market players analyzed in the global Auto Finance market report include Ally Financials Inc., Bank of America, Capital One Financial Corporation, Chase Auto Finance, Ford Motor Company, General Motors Financial Company, Inc., Mercedes-Benz Mobility, Novuna, Toyota Financial Services and Volkswagen Finance Private Limited. These market players have embraced several strategies including partnership, expansion, collaboration, joint ventures, and others to highlight their prowess in the industry. The report is helpful in formulating the business performance and developments by the top players.

The global Auto Finance market is analyzed across type, loan provider, purpose, vehicle type, and region. The report takes in an exhaustive analysis of the segments and their sub-segments with the help of tabular and graphical representation. Investors and market players can benefit from the breakdown and devise stratagems based on the highest revenue-generating and fastest-growing segments stated in the report.

By vehicle type, the passenger vehicles segment held the largest share in 2021, garnering more than two-fifths of the global Auto Finance market revenue, and is projected to maintain its dominance by 2031. The commercial vehicles segment, on the other hand, would showcase the fastest CAGR of 13.8% during the forecast period.

By vehicle age, the new vehicle segment contributed to nearly one-fifth of the global Auto Finance market share in 2021 and is projected to rule the roost by 2031. The used vehicles segment, on the other hand, it would display the fastest CAGR of 12.5% throughout the forecast period.

Connect Analyst

https://www.alliedmarketresearch.com/connect-to-analyst/10755

By purpose, the loan segment accounted for the highest share in 2021, generating around half of the global Auto Finance market revenue. The leasing segment, simultaneously, would portray the fastest CAGR of 16.2% during the forecast period. The Banks, OEMs, Credit Unions segments are also analyzed through the report.

By region, Asia-Pacific held the major share in 2021, garnering more than two-thirds of the global Auto Finance market revenue. The LAMEA region would also showcase the fastest CAGR of 14.7% from 2022 to 2031. The other provinces assessed through the report include North America, Europe, and LAMEA.

KEY BENEFITS FOR STAKEHOLDERS

The study provides an in-depth analysis of the global auto finance market forecast along with current & future trends to explain the imminent investment pockets.

Information about key drivers, restraints, & opportunities and their impact analysis on global auto finance market trends is provided in the report.

The Porter's five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

The auto finance market analysis from 2022 to 2031 is provided to determine the market potential.

By Vehicle Age

New Vehicles

Used Vehicles

By Vehicle Type

Passenger Vehicles

Commercial Vehicles

By Purpose

Loan

Leasing

By Loan Provider

Banks

OEMs

Credit Unions

Others

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Spain, Italy, Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Australia, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Key Market Players :

Toyota Financial Services, Novuna, General Motors Financial Company, Inc., JPMorgan Chase & Co., Mercedes-Benz Mobility, Bank of America Corporation, Volkswagen Finance Private Limited, Ford Motor Company, Capital One Financial Corporation, Ally Financials Inc.

Request Customization

https://www.alliedmarketresearch.com/request-for-customization/10755

More Reports:

Telecommunication Insurance Market : https://www.alliedmarketresearch.com/telecommunication-insurance-market-A14997

B2B Payments Market : https://www.alliedmarketresearch.com/b2b-payments-market-A08183

Threat Intelligence in BFSI Market : https://www.alliedmarketresearch.com/threat-intelligence-in-bfsi-market-A14676

Disability Insurance Market : https://www.alliedmarketresearch.com/disability-insurance-market-A07393

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Auto Finance Market : The Emergence of Online Automotive Finance Applications here

News-ID: 3136075 • Views: …

More Releases from www.alliedmarketresearch.com

Pet Insurance Market Soars: Projected to Hit $38.3 Billion by 2033 as Demand for …

According to a new report published by Allied Market Research, titled, "Pet Insurance Market, By Policy Coverage (Accident Only, Accident and Illness, and Others), By Animal Type (Dogs, Cats, and Others), and By Sales Channel (Agency, Broker, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". The pet insurance market was valued at $10.10 billion in 2023, and is estimated to reach $38.3 billion by 2033, growing at a CAGR…

Manual Spray Guns Market to Hit $2.6 Billion by 2032 | Key Growth Drivers & Oppo …

Prime determinants of growth

The demand for manual spray guns, which are mostly used for painting consumer durables, has increased because of this need, particularly in developing nations like India, China, and Vietnam. Additionally, there is a greater need for manual spray guns from car manufacturers due to the rising demand for automobiles around the world, particularly in industrialized nations like Europe and North America.

Download PDF Sample Report: www.alliedmarketresearch.com/request…ple/111362

Due to…

Hygienic Cladding Market Poised for Growth: Global Trends & Opportunities 2023-2 …

According to the report, the global hygienic cladding market generated $2.8 billion in 2022, and is anticipated to generate $6 billion by 2032, rising at a CAGR of 8.3% from 2023 to 2032.

Prime Determinants of Growth

The increased awareness & demand for health-related products, the increasing need for safe & healthy environments in healthcare facilities, and hygienic wall cladding's affordability & durability than traditional tiling methods are the factors expected to…

AI in Insurance Market Poised to Reach $45.74 Bn Globally by 2031, Soaring at a …

Global Opportunity Analysis and Industry Forecast, 2021-2031". According to the report, the global AI in insurance industry generated $2.74 billion in 2021, and is anticipated to generate $45.74 billion by 2031, witnessing a CAGR of 32.5% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11615

Higher deployment cost of AI, advanced machine learning, and lack of skilled labor hamper the market growth. On the contrary, surge in government initiatives…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…