Press release

Premium Finance Market Will Hit Big Revenues In Future By 2032 | Size, Share, Trends And Analysis

Premium finance loans are often provided by a third-party finance entity known as a premium financing company; however, insurance companies and insurance brokerages occasionally provide premium financing services through premium finance platforms. Premium financing is mainly devoted to financing life insurance which differs from property and casualty insurance. However, insurance companies and insurance brokerages also provide premium financing services through premium finance platforms. In addition, premium financing is primarily used to finance life insurance, as opposed to property and casualty insurance. Furthermore, the individual or company requesting insurance must sign a premium finance agreement with the life insurance premium finance company to finance a premium. The loan period can range from one year to the life of the policy. So, to provide easy availability of funds for premium demand, the premium finance market is expected to grow faster in the forecasted period. Premium financing is the lending of funds to a person or company to cover the cost of an insurance premium.Download Sample Report: https://www.alliedmarketresearch.com/request-toc-and-sample/15727

The global premium finance market is segmented on the basis of type, interest rate, and region. Based on type, the market is divided into Recourse Premium Finance, Non-Recourse Premium Finance, Hybrid Premium Finance. In terms of interest rate, the market is categorized into Fixed Interest Rate, Floating Interest Rates. Geographically, the market is analyzed across several regions such as North America, Europe, Asia-Pacific, and Latin America, Middle East & Africa (LAMEA).

COVID-19 Scenario Analysis

In the COVID-19 pandemic, the demand for insurance products has increased, as consumers became more aware of the importance of insurance to protect people from financial losses during the time of emergency. Therefore, the increase in sales of insurance led to a rise in the demand for premium financing since consumers purchased insurance because of the rising awareness. However, to pay the premium amount, consumers adopted premium financing, which led to a growth of the market. Thus, COVID-19 positively impacted the premium finance market forecast.

Top Impacting Factors: Market Scenario Analysis, Trends, Drivers, and Impact Analysis

Increasing premium rates of insurance and customer satisfaction of the business are driving the growth of the market. However, the loan application process and risk of default in premium payment are expected to hamper the market growth. Contrarily, the rise in adoption of internet-of-things and the usage of artificial intelligence (AI) insurance platforms can be seen as an opportunity for the market.

Buy This Report: https://www.alliedmarketresearch.com/checkout-final/17d2e28b0f0feea85f944c9e8dbc6715

The Premium Finance Market Trends Are as Follows:

Increasing Premium Rates of Insurance Policies:

Due to the rising demand for insurance products and services, insurance companies are increasing the premium rates to increase profitability. Consumers have no other choice but to agree on the high price of the premium for the insurance. Therefore, premium finance offers customers to cover the cost of these high premiums, so that customers can afford to have insurance. Therefore, this is a major factor for the propelling growth of the premium finance market.

Risk of Default in Premium Payment:

The risk of default refers to a situation in which a borrower is unable to meet their premium payment obligations. Almost every type of insurance includes a default risk provision. Sometimes, insurance premiums are not paid back on time and therefore, secured assets are used to pay off the payment amount. Moreover, while a premium payment has defaulted, the company attempts to sue the defaulter in court for due payment. However, in light of the current pandemic situation, the financial position of firms has deteriorated dramatically, turning businesses into default and hampering the growth of the premium finance market, as these firms have to face huge losses because of the defaulters. Hence, this is a major factor hampering the growth of the premium finance market.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/15727

Key Benefits of the Report:

This study presents an analytical depiction of the market along with the current trends and future estimations to determine the imminent investment pockets.

The report presents information related to key drivers, restraints, and opportunities along with a detailed analysis of the premium finance market share.

The current market is quantitatively analyzed to highlight the premium finance market growth scenario.

Porter's five forces analysis illustrates the potency of buyers & suppliers in the market.

The report provides a detailed premium finance market analysis depending on the present and future competitive intensity of the market.

Key Market Players:

Royal Bank of Canada, Citigroup Inc., Bank of America Corporation, Goldman Sachs, Julius Baer Group, UBS, Morgan Stanley, JPMorgan Chase & Co, Charles Schwab & Co, CREDIT SUISSE GROUP.

Access Full Summary: https://www.alliedmarketresearch.com/premium-finance-market-A15358

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Premium Finance Market Will Hit Big Revenues In Future By 2032 | Size, Share, Trends And Analysis here

News-ID: 3135771 • Views: …

More Releases from Allied Market Research

Mortar Ammunition Market Demand, Growth Opportunities, Analysis by Top Key Playe …

Mortar ammunitions are stealth, robust and modern devices that can launch to a counter at short and low nearing activities. Modern-age mortars are light in weight and portable in nature. These ammunitions generally come in two types: fin-stabilized and spin-stabilized. Fin-Stabilized projectiles obtain stability through use of fins located at the aft of projectile. Spin-stabilized projectile technology has been used for aerodynamic stabilization. Glided path is auto-tracked and spinning creates…

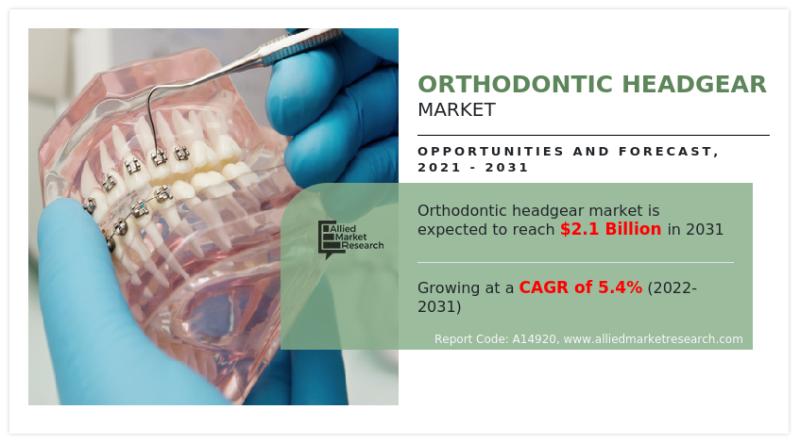

Orthodontic Headgear Market is Projected to Reach $2,094.00 Million by 2031, Gro …

The Orthodontic Headgear Market is a dynamic and integral segment of the orthodontic industry, playing a pivotal role in the correction of malocclusions and the alignment of teeth. Orthodontic headgear is a crucial orthodontic appliance used to address a wide range of dental and skeletal irregularities, such as overbites, underbites, and spacing issues. This market is witnessing substantial growth as orthodontic treatments become increasingly popular for both functional and cosmetic…

Olive Oil Market Analysis, Size, Growth, Trends, Segmentation, Opportunity and F …

The global olive oil industry was valued at $18,552.6 million in 2022, and is projected to reach $30,196.4 million by 2032, registering a CAGR of 5.2% from 2023 to 2032.

The olive oil market has experienced significant growth driven by several prime determinants. The increase in awareness and adoption of healthier lifestyles have led consumers to seek alternatives to traditional cooking oils, with olive oil being recognized for its numerous health…

Hotel Toiletries Market Revenue is expected to Surpass $50.5 billion by 2031

The hotel toiletries market was valued at $17.9 billion in 2021, and is estimated to reach $50.5 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/75060

There is a greater demand for hotel toiletries with the growth of the tourism industry and the rise in international travel. Improved transportation, economic growth, globalization, technology advancements, and other initiatives have…

More Releases for Premium

Premium Dedicated Proxy - Unmatched Exclusivity with Oculus Premium Dedicated Pr …

In today's increasingly data-centric world, enterprises are pushing the boundaries of automation, web intelligence, and digital security. Central to these evolving needs is the demand for fast, private, and reliable internet access. For companies that rely on uninterrupted, large-scale data extraction and secure browsing, shared IP infrastructures are simply no longer viable. This has led to a rise in the adoption of premium proxy solutions-particularly exclusive IP resources that deliver…

Premium Pets, Premium Nutrition: Inside the USD 332M Freeze-Dried Pet Food Surge

The home freeze-dried pet food industry represents one of the fastest growing segments within the global pet nutrition market due to increasing pet ownership worldwide, rising humanization of companion animals, and expanding demand for premium, nutritionally superior food products. Freeze drying, also known as lyophilization, preserves pet food by removing moisture under low temperature and pressure, enabling longer shelf life, superior nutrient retention, and convenient storage features that align strongly…

Introducing Premium Bail Bonds

Bartow, FL - 8/20/2023 - Premium Bail Bonds, a dynamic and dedicated player in the bail bond industry, is excited to announce its official launch in Bartow, FL. With a steadfast commitment to serving the local community, Premium Bail Bonds aims to redefine the standards of professionalism, reliability, and unwavering support.

Boasting a team of seasoned experts with extensive knowledge of the legal landscape, Premium Bail Bonds is poised to be…

Mighty Travels Premium

Haven't you wondered why online travel search always started with the same input that a few travel websites first started with in 1996? Two airport codes and two dates and a big search button - where has the innovation been since?

What if we could search by price instead and find trips that are inspiring and sometimes luxurious where we would like to go? The world has changed and flexible schedules…

Sydney Premium Detailing

Operating for more than 12 years, Sydney Premium Detailing provides services such as Paint Protection, Paint Protection Film (Clear Bra), Paint Correction and Interior & Wheel Protection.

Operating for more than 12 years, Sydney Premium Detailing provides services such as Paint Protection, Paint Protection Film (Clear Bra), Paint Correction and Interior & Wheel Protection.

Sydney Premium Detailing

7/3 Salisbury Rd, Castle Hill, NSW 2154…

Paint Colors & Trim Market Growth and Analysis by Major Top Vendors are BEHR Pre …

ResearchReportsInc.com adds a new 2018-2023 Global Paint Colors & Trim Market Report focuses on the major drivers and restraints for the global key players providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market. The Paint Colors & Trim Market report aims to provide a 360-degree view of the market in terms of cutting-edge technology, key developments, drivers, restraints and future trends with impact analysis…