Press release

Global Loan Origination Software Market Size | Industry Analysis, Share, Trends, Growth, Opportunities and Latest Research Report, 2028

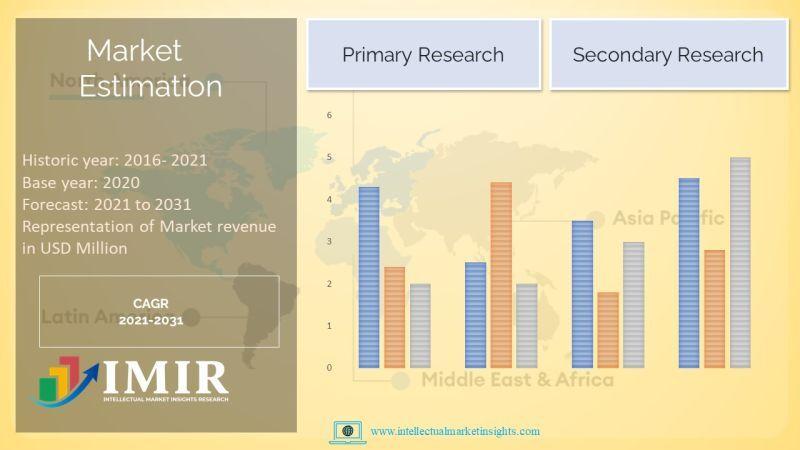

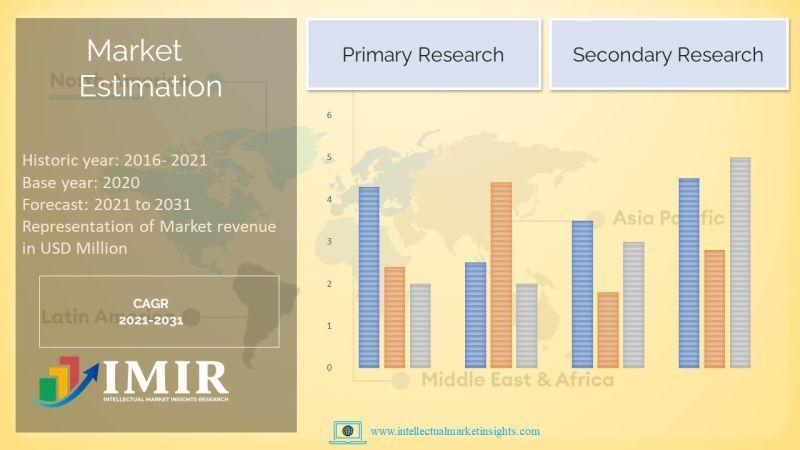

Loan Origination Software Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (On-Premise, Cloud), By Enterprise Size (Large Enterprise, Small & Medium Enterprises), COVID-19 Impact Analysis, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2022 - 2028Global Loan Origination Software Market size was valued at USD 4.18 Million in 2021 and is projected to reach USD 7.52 Million by 2028, growing at a CAGR of 12.96% from 2021 to 2028 according to a new report by Intellectual Market Insights Research.

The Loan Origination Software market research report comprises a thorough examination of the current and future scenario of this industry vertical. The research highlights major trends and opportunities, as well as challenges, for various segments and sub-segments, while broadening the company horizon. The study report also includes extensive information based on past and present patterns across several industry verticals to help find various expansion prospects.

Get Sample Copy of this Premium Market Research Report @ https://www.intellectualmarketinsights.com/download-sample/IMI-000441

Scope of Loan Origination Software Market Report:

This report examines all the key factors influencing growth of global Loan Origination Software market, including demand-supply scenario, pricing structure, profit margins, production and value chain analysis. Regional assessment of global Loan Origination Software market unlocks a plethora of untapped opportunities in regional and domestic market places. Detailed company profiling enables users to evaluate company shares analysis, emerging product lines, pricing strategies, innovation possibilities and much more.

Points Covered in the Report

The points that are discussed within the report are the major market players that are involved in the market such as market players, raw material suppliers, equipment suppliers, end users, traders, distributors and etc.

The complete profile of the companies is mentioned. And the capacity, production, price, revenue, cost, gross, gross margin, sales volume, sales revenue, consumption, growth rate, import, export, supply, future strategies, and the technological developments that they are making are also included within the report. This report analysed 12 years data history and forecast.

The growth factors of the market are discussed in detail wherein the different end users of the market are explained in detail.

Data and information by market player, by region, by type, by application and etc., and custom research can be added according to specific requirements.

The report contains the SWOT analysis of the market. Finally, the report contains the conclusion part where the opinions of the industrial experts are included.

Get Access of this Research Report @ https://www.intellectualmarketinsights.com/report/loan-origination-software-market-size/imi-000441

𝐒𝐨𝐦𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐤𝐞𝐲 𝐪𝐮𝐞𝐬𝐭𝐢𝐨𝐧𝐬 𝐬𝐜𝐫𝐮𝐭𝐢𝐧𝐢𝐳𝐞𝐝 𝐢𝐧 𝐭𝐡𝐞 𝐬𝐭𝐮𝐝𝐲 𝐚𝐫𝐞:

• What are some of the recent brand building activities of key players undertaken to create customer value in the Loan Origination Software market?

• Which companies are expanding litany of products with the aim to diversify product portfolio?

• Which companies have drifted away from their core competencies and how have those impacted the strategic landscape of the Loan Origination Software market?

• Which companies have expanded their horizons by engaging in long-term societal considerations?

• Which firms have bucked the pandemic trend and what frameworks they adopted to stay resilient?

• What are the marketing programs for some of the recent product launches?

About US:

IMIR® Market Research Pvt Ltd.

Intellectual Market Insights Research is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including, Semiconductor, aerospace, Automation, Agriculture, Food & Beverages, Automotive, Chemicals and Materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports.

IMIR has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Follow Us: LinkedIn

Mr. Smit Patel

Phone: +1 412-730-2889

Email: Smit@intellectualmarketinsights.com

Corporate Sales: Sales@intellectualmarketinsights.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Loan Origination Software Market Size | Industry Analysis, Share, Trends, Growth, Opportunities and Latest Research Report, 2028 here

News-ID: 3125953 • Views: …

More Releases from IMIR Market Research

A Breakthrough Innovation with New High-Growth Sectors in the Spinal Fusion Devi …

Global Spinal Fusion Devices Market size was valued at USD 7.26 Billion in 2021 and is projected to reach USD 8.72 Billion by 2028, growing at a CAGR of 3.5% from 2021 to 2028 according to a new report by Intellectual Market Insights Research.

Spinal Fusion Devices Market Players Analysis: Johnson & Johnson, Medtronic Plc, Zimmer Biomet Holdings, Inc., Alphatec Holdings Inc, B. Braun Melsungen AG, Orthofix International N.V., Stryker Corporation,…

Interventional Oncology Devices Market Size, Information Technology Overview: Tr …

Global Interventional Oncology Devices Market size was valued at USD 2.25 Billion in 2021 and is projected to reach USD 3.59 Billion by 2028, growing at a CAGR of 6.6% from 2021 to 2028 according to a new report by Intellectual Market Insights Research.

Interventional Oncology Devices Market Players Analysis: Medtronic, Boston Scientific, BD, Terumo, Merit Medical, Cook Medical, HealthTronics, MedWaves, Sanarus, AngioDynamics, J&J, Teleflex, IMBiotechnologies, Trod Medical, IceCure Medical, Mermaid…

The Spinal Implants And Surgery Devices Market is Set to Experience Considerable …

Global Spinal Implants And Surgery Devices Market size was valued at USD 11.45 Billion in 2021 and is projected to reach USD 15.68 Billion by 2028, growing at a CAGR of 4.6% from 2021 to 2028 according to a new report by Intellectual Market Insights Research.

Spinal Implants And Surgery Devices Market Players Analysis: Zimmer, Synthes, Pioneer Surgical, Globus Medical, DePuy Spine, Medtronic, Stryker Corporation, NuVasive, Orthovita, Exactech, Integra Lifesciences, Amedica,…

2022 Occlusion Devices Market: Leading Players Developments, Innovations, and Ad …

Global Occlusion Devices Market size was valued at USD 2953.24 Million in 2021 and is projected to reach USD 4379.63 Million by 2028, growing at a CAGR of 5.1% from 2021 to 2028 according to a new report by Intellectual Market Insights Research.

Occlusion Devices Market Players Analysis: Boston Scientific Corporation, Boston Scientific, Medtronic, KYOTO MEDICAL, Meril Life Sciences Pvt. Ltd, DePuy Synthes, Abbott, Acrostak Int. Distr. Sàrl, Stryker Corporation, Terumo,…

More Releases for Loan

Travel Loan Personal Loan Guide To Finance Domestic And International Trips Easi …

Image: https://www.abnewswire.com/upload/2026/02/71bfa2bd36a80322c40217cb0777143c.jpg

Travel opens up new worlds, fresh perspectives, and unforgettable memories. Whether it is a peaceful beach escape, a mountain adventure, or an international holiday, planning the perfect trip often requires careful budgeting. This is where a travel loan can help you turn your plans into reality without financial stress. As a type of personal loan, it offers flexible funding, easy repayment, and quick access to money, making travel planning…

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…