Press release

P2P Lending Market | Market Stats, Trends, Dynamics & Key Players

P2P Lending Market Size in 2021 was USD 82.3 Billion, and is set to garner a market size of USD 804.2 Billion by 2030 growing at a CAGR of 29.1% from 2022 to 2030.P2P Lending Market Overview

P2P, or Peer-to-peer lending is a type of loan that is made through an online platform that connects borrowers with lenders directly, eliminating the need for traditional financial intermediaries, including banks, to act as the middleman in the lending process.

On a P2P lending platform, borrowers submit loan applications and post their credit profiles and loan requirements. Lenders can then review the loan applications and choose to lend money to the borrowers they find to be the most creditworthy. P2P lending platforms charge a low fee, which can be a percentage of the loan amount, making P2P loans more affordable for borrowers.

The peer-to-peer (P2P) lending market has been witnessing excellent growth and shall continue to grow at a high CAGR due to various factors. The P2P lending market began to gain traction in the early 2000s, with the launch of platforms such as Lending Club and Prosper. These loans include student loans, personal loans, as well as mortgage loans.

Request For Free Sample Report @ https://www.acumenresearchandconsulting.com/request-sample/3113

P2P Lending Market Research Report Highlights and Statistics

• The global P2P lending market size was valued at USD 82,300 million in 2021, and is expected to touch USD 804,200 million by 2030, growing at a 29.1% CAGR.

• Consumer lending is the largest segment which accounted for 80% of the total p2p lending market size.

• Rising adoption of digital platforms, rising demand for alternative lending options, and increasing disposable income are the growth-fueling factors.

• North America and Europe have the largest P2P lending market share, with the Asia-Pacific region noted as the fastest-growing market for P2P lending.

• Some of the key players in the P2P lending market include Lending Club, Prosper, Funding Circle, and Zopa.

• The COVID-19 pandemic has had a significant impact on the P2P lending market. Many borrowers have been unable to repay loans, and some platforms have had to halt their lending activities.

Trends in the P2P Lending Market

• Technology has played a significant role in p2p lending by facilitating platforms so lenders and borrowers can meet.

• The P2P lending sector in India has undergone a significant transformation as a result of digital lending, with paperless transactions and loans for customers with no credit history becoming more common.

• Fintech companies are encouraging paperless lending, which has opened up new opportunities and accessibility in the p2p lending market.

P2P Lending Market Dynamics

• Low-interest rates and more flexible repayment options: With interest rates at historic lows, investors are looking for higher returns on their money, and P2P lending can offer higher returns than traditional savings accounts or bonds.

• Increased trust in online marketplaces: With the rise of e-commerce and online marketplaces, people have become more comfortable making financial transactions online. This has helped to increase trust in P2P lending platforms.

• Easier access to credit: P2P lending platforms can make it easier for borrowers to access credit, particularly those who may not qualify for a loan from a traditional bank.

• Technological advancements: Advancements in technology have made it easier for borrowers and lenders to connect and transact with each other online, which has helped to fuel the growth of the P2P lending market.

• Risk diversification: P2P lending can provide a way for investors to diversify their portfolios by spreading their investments across multiple borrowers, thereby reducing their risk.

• Government regulations & Tax benefits: Depending on the country some Governments have favorable regulations and tax benefits to encourage P2P Lending.

P2P Lending Market Growth Hampering Factors

P2p lending comes with a lot of risks including

• Regulation challenges: P2P lending platforms are subject to a wide range of regulations, which can vary by country and region. Some governments have put in place strict regulations that make it difficult for P2P lending platforms to operate, which can hamper the growth of the market.

• Credit risk: One of the main risks associated with P2P lending is the risk of default by borrowers. This can be especially challenging for P2P lending platforms, as they may not have the same information level about borrowers as traditional banks.

• Lack of Transparency: Some P2P lending platforms may not be as transparent as they should be making it difficult for investors to assess the risk of a loan.

• Lack of trust and Awareness: Due to the relative newness of the industry, some people may not have enough trust and knowledge about P2P lending which may discourage them from participating.

• Platform Risk: If a P2P lending platform fails or goes out of business, it can create significant problems for borrowers and investors, who may not be able to access their money or have their loans repaid.

• Competition: P2P lending platforms face competition from other online lending platforms, such as crowd funding platforms and traditional banks.

• Market downturn: In the event of a market downturn, P2P lending platforms may face increased difficulty in attracting borrowers and investors, as many people may be more risk-averse during such times.

Check the detailed table of contents of the report @

https://www.acumenresearchandconsulting.com/table-of-content/p2p-lending-market

Market Segmentation

The P2P lending market can be segmented based on:

• Lending Type: Consumer lending, business lending, and real estate lending.

• Platform Type: Online platforms and offline platforms.

• Loan Type: Unsecured loans, secured loans, and lines of credit.

• Borrower Type: Individuals, small and medium-sized enterprises (SMEs), and large corporations.

• Credit Risk: Low-risk borrowers, medium-risk borrowers, and high-risk borrowers.

• Industry: P2P lending for specific industries such as education, healthcare, agriculture, and others.

• Investment Type: Retail investors, institutional investors, and crowdfunding investors.

• Segmenting the market helps companies better understand the target audience for enhanced products and services that meet specific needs.

P2P Lending Market Overview by Region

• In North America, the P2P lending market share is the largest in terms of revenue and has grown rapidly in recent years, with the United States being the largest market in the region. The growth of the market has been driven by the emergence of several successful platforms, such as Lending Club and Prosper, which have attracted large numbers of borrowers and investors. In addition, the growing adoption of mobile and digital technologies has made it easier for consumers to access and use P2P lending platforms.

• In Europe, the P2P lending market is also growing rapidly, but it is still relatively small compared to the North American market. The United Kingdom has the largest market in Europe, followed by Germany. The growth of the market in Europe has been driven by the same factors as in North America, as well as by a lack of access to traditional credit for some segments of the population.

• In Asia-Pacific, the P2P lending market is in the early stages of development, but it is the fastest growing market amongst all other regions. China has the largest P2P lending market in the region, and it has grown rapidly in recent years. Other countries in the region with rapidly growing markets include India, Japan and South Korea.

P2P Lending Market Key Players

• Lending Club

• Prosper

• Zopa

• Funding Circle

• Upstart

• Peerform

• LendingHome

• Bondora

• Mintos

• RateSetter

• Yirendai

• Lufax

• LCX

• Sebon

Buy this premium research report -

https://www.acumenresearchandconsulting.com/buy-now/0/3113

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release P2P Lending Market | Market Stats, Trends, Dynamics & Key Players here

News-ID: 3123200 • Views: …

More Releases from Acumen Research and Consulting

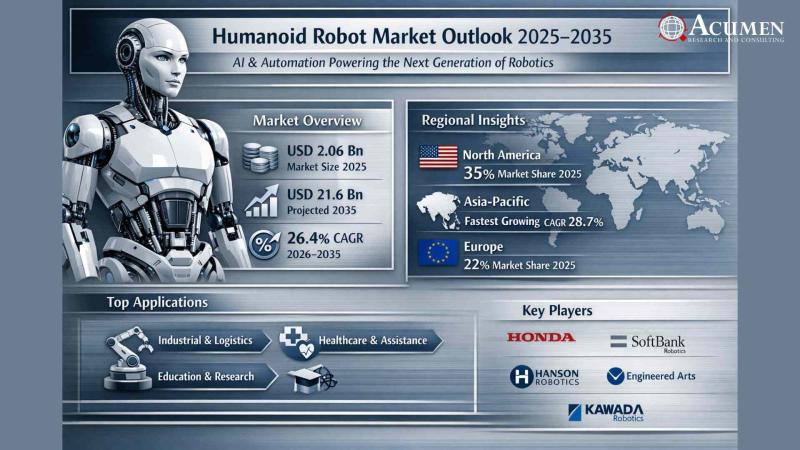

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

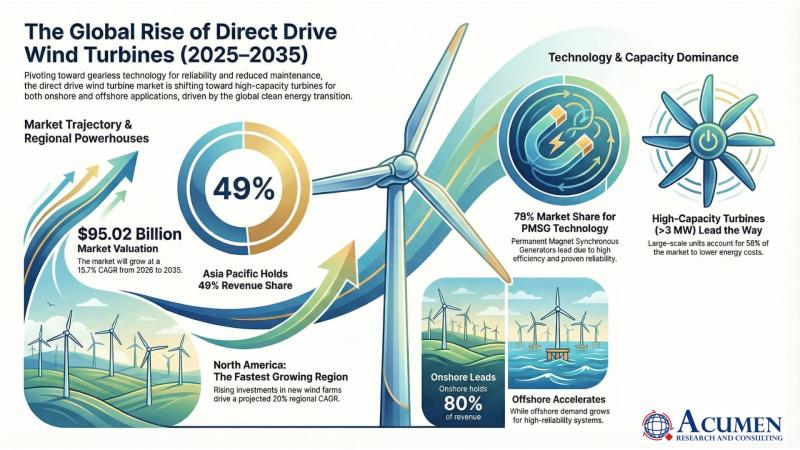

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for P2P

Millennials fuel P2P investment surge

According to the latest research, Robocash's core audience consists of millennial men with an average investment of up to €5,000. At the same time, the platform is becoming more appealing to a broader demographic, as well as geographically.

Robocash analysts studied how the profile of the platform's investors has changed over the past year.

Currently, the majority of investors on Robocash are aged 29-44. However, since 2024, the share…

P2P Content Delivery Network (P2P CDN) Market to Witness Growth by 2024-2031

The P2P Content Delivery Network (P2P CDN) market has emerged as a transformative force in the digital content distribution landscape. P2P CDNs leverage peer-to-peer technology to distribute content efficiently, reducing the strain on centralized servers and enhancing delivery speeds. This market has experienced substantial growth due to the increasing demand for high-quality video streaming, online gaming, and other content-rich applications. P2P CDNs enable more scalable and cost-effective content delivery, making…

P2P Content Delivery Network (P2P CDN) Market is Touching New Development Level …

The latest independent research document on P2P Content Delivery Network (P2P CDN) examines investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore their potential to become major business disrupters. The P2P Content Delivery Network (P2P CDN) study eludes very useful reviews & strategic assessments including the generic market trends, emerging technologies, industry drivers, challenges, and regulatory policies that propel the market growth,…

Revving Up Indonesia's P2P Lending Market: 3 Catalyst Driving the Indonesia's P2 …

Indonesia has witnessed a rapid increase in internet and smartphone usage, leading to greater accessibility and creating a conducive environment for P2P lending platforms to reach a large customer base.

Introduction

The peer-to-peer (P2P) lending market in Indonesia has experienced significant growth in recent years, driven by various factors. P2P lending platforms, also known as financial technology (FinTech) platforms, provide an alternative financing option for individuals and businesses, particularly those who are…

P2P Content Delivery Network (P2P CDN) Market to See Huge Demand by 2030: Alibab …

2022-2030 World P2P Content Delivery Network (P2P CDN) Market Report Professional Analysis 2022 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the P2P Content Delivery Network (P2P CDN) Market. Some of the key players profiled…

P2P Content Delivery Network (P2P CDN) Market to see Booming Worldwide | Major G …

A Qualitative Research Study accomplished by HTF MI Titled on Global P2P Content Delivery Network (P2P CDN) Industry Market Report-Development Trends, Threats, Opportunities and Competitive Landscape in 2020 with detailed information of Product Types [Video & Non-video], Applications [Media and Entertainment, Gaming, Retail and eCommerce, Education, Healthcare & Others] & Key Players Such as Streamroot, Alibaba Group, Viblast, Globecast, Edgemesh, Peer5, Akamai, Qumu Corporation & CDNvideo etc. The Study provides…