Press release

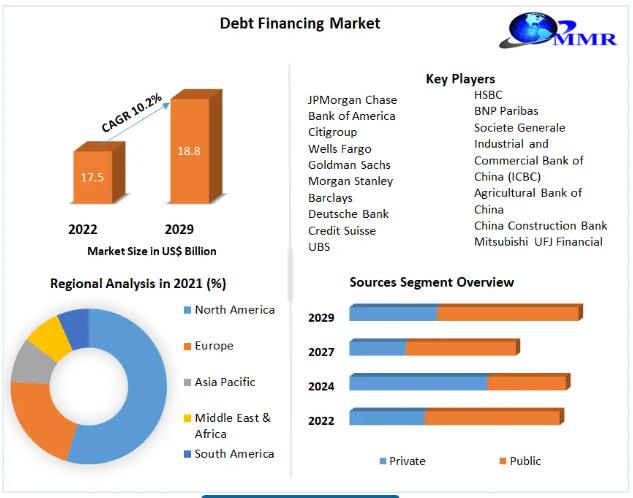

Debt Financing Market to Reach USD 18.8 Bn by 2029, with 10.2% CAGR - Maximize Market Research

Debt Financing Market Report Scope and Research MethodologyThe Debt Financing Market report provides a comprehensive analysis of the global market, including market size, growth rate, and revenue projections. The report covers various aspects of the market, including market drivers, restraints, regional insights, and market segmentation.

To gather the necessary data and insights, our research methodology involved a combination of primary and secondary research. In the primary research phase, we conducted interviews and discussions with industry experts, key market players, and stakeholders to gain a deeper understanding of the market dynamics and trends.

Get to Know More About This Market Study:https://www.maximizemarketresearch.com/market-report/debt-financing-market/199016/

Secondary research was conducted by analyzing relevant industry publications, company reports, government sources, and other available data sources to gather information on market size, historical data, and industry trends. This data was then analyzed and validated using advanced analytical tools and techniques.

The scope of the report encompasses a detailed analysis of the Debt Financing Market, including its overview, market drivers, restraints, market opportunities, and regional insights. The report provides valuable insights to businesses, investors, and stakeholders to make informed decisions and capitalize on the growth opportunities in the market.

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/199016

What are Debt Financing Market Dynamics:

The debt financing market dynamics refer to the factors and trends that influence the borrowing and lending of funds through debt instruments. These dynamics are driven by various economic, financial, and regulatory factors and play a significant role in shaping the availability, cost, and terms of debt financing for individuals, corporations, and governments.

One of the key dynamics in the debt financing market is interest rates. Interest rates set by central banks and influenced by monetary policies have a direct impact on the cost of borrowing. When interest rates are low, it becomes more attractive for borrowers to seek debt financing as the cost of borrowing is relatively cheaper. Conversely, when interest rates rise, borrowing costs increase, leading to a potential slowdown in debt financing activity.

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/199016

Credit conditions also play a crucial role in the debt financing market dynamics. Lenders' willingness to extend credit and the criteria they use to evaluate borrowers can affect the availability of debt financing. During periods of economic expansion and confidence, lenders may be more willing to lend and offer favorable terms, leading to increased debt financing activity. However, during economic downturns or periods of increased credit risk, lenders may tighten their lending standards, making it more challenging for borrowers to access debt financing.

Request For Free Sample Report:https://www.maximizemarketresearch.com/request-sample/199016

Debt Financing Market Market Regional Insights:

In developed economies such as North America and Europe, the debt financing market is well-established and highly liquid. These regions have robust financial systems, deep capital markets, and a diverse range of debt instruments available. The regulatory frameworks in these regions provide a stable and transparent environment for debt financing activities. Investors in these markets have a higher risk tolerance and are often willing to invest in a variety of debt instruments, including corporate bonds, government bonds, and structured debt products.

In emerging markets, the debt financing market dynamics differ due to unique economic and regulatory characteristics. These regions may have less developed financial systems, limited access to capital markets, and varying degrees of investor protection. As a result, debt financing in emerging markets may be more challenging, with higher borrowing costs and a narrower range of available debt instruments. However, these markets also present opportunities for growth and higher yields, attracting investors seeking higher returns despite the increased risk.

What is Debt Financing Market Segmentation:

by Sources

Private

Public

by Type

Bank loans

Bonds

Debenture

Bearer bond

Others

by Duration

Short-Term

Long-Term

Purchase Report:https://www.maximizemarketresearch.com/market-report/debt-financing-market/199016/

Who are Debt Financing Market Key Players:

1. JPMorgan Chase

2. Bank of America

3. Citigroup

4. Wells Fargo

5. Goldman Sachs

6. Morgan Stanley

7. Barclays

8. Deutsche Bank

9. Credit Suisse

10. UBS

11. HSBC

12. BNP Paribas

13. Societe Generale

14. Industrial and Commercial Bank of China (ICBC)

15. Agricultural Bank of China

16. China Construction Bank

17. Mitsubishi UFJ Financial Group (MUFG)

18. Sumitomo Mitsui Financial Group (SMFG)

19. Mizuho Financial Group

20. Nomura Holdings

Table of content for the Debt Financing Market includes:

1. Global Debt Financing Market: Research Methodology

1. Global Debt Financing Market: Executive Summary

• Market Overview and Definitions

• Introduction to the Global Market

• Summary

• Key Findings

• Recommendations for Investors

• Recommendations for Market Leaders

• Recommendations for New Market Entry

3. Global Debt Financing Market: Competitive Analysis

• MMR Competition Matrix

• Market Structure by region

• Competitive Benchmarking of Key Players

• Consolidation in the Market

• M&A by region

• Key Developments by Companies

• Market Drivers

• Market Restraints

• Market Opportunities

• Market Challenges

• Market Dynamics

• PORTERS Five Forces Analysis

• PESTLE

• Regulatory Landscape by region

• North America

• Europe

• Asia Pacific

• Middle East and Africa

• South America

• COVID-19 Impact

4. Global Debt Financing Market Market Segmentation

• Global Market, by Sources (2022-2029)

• Global Market, by Type (2022-2029)

• Global Market, by Duration (2022-2029)

5. Regional Debt Financing Market Market (2021-2029)

• Regional Market, by Sources (2022-2029)

• Regional Market, by Type (2022-2029)

• Regional Market, by Duration (2022-2029)

• Regional Market, by Country (2022-2029)

6. Company Profile: Key players

• Company Overview

• Financial Overview

• Global Presence

• Capacity Portfolio

• Business Strategy

• Recent Developments

Key Offerings:

• Past Market Size and Competitive Landscape (2018 to 2021)

• Past Pricing and price curve by region (2018 to 2021)

• Market Size, Share, Size & Forecast by different segment | 2022-2029

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Market Segmentation - A detailed analysis by Product

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

• Competitive landscape - Market Leaders, Market Followers, Regional player

• Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

Global Maltodextrin Market https://www.maximizemarketresearch.com/market-report/maltodextrin-market/124413/

Home Fitness equipment Market https://www.maximizemarketresearch.com/market-report/global-home-fitness-equipment-market/103369/

Global Smart Display Market for Automotive https://www.maximizemarketresearch.com/market-report/smart-display-market/2924/

Global Aircraft Engines Market https://www.maximizemarketresearch.com/market-report/global-aircraft-engines-market/31471/

Instant Coffee Market https://www.maximizemarketresearch.com/market-report/global-instant-coffee-market/100678/

Global Vegan Cheese Market https://www.maximizemarketresearch.com/market-report/global-vegan-cheese-market/104025/

Water Softener Market https://www.maximizemarketresearch.com/market-report/global-water-softener-market/27116/

Zinc Oxide Market https://www.maximizemarketresearch.com/market-report/global-zinc-oxide-market/22594/

Window Film Market https://www.maximizemarketresearch.com/market-report/global-window-film-market/80767/

Global Continuous Basalt Fiber Market https://www.maximizemarketresearch.com/market-report/global-continuous-basalt-fiber-market/55000/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Debt Financing Market to Reach USD 18.8 Bn by 2029, with 10.2% CAGR - Maximize Market Research here

News-ID: 3118580 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ashwagandha Extract Market Poised for Robust Growth, Driven by Rising Demand for …

The global Ashwagandha Extract Market is gaining strong momentum as consumers, healthcare providers, and nutraceutical companies increasingly turn toward plant-based, time-tested remedies to address modern lifestyle challenges. Valued at USD 59.59 million in 2024, the market is projected to grow at a compound annual growth rate (CAGR) of 11.5% from 2025 to 2032, reaching nearly USD 142.37 million by 2032. This growth trajectory highlights the expanding acceptance of Ashwagandha extract…

Racing Drone Market Poised for Rapid Expansion, Expected to Reach USD 5,428.54 M …

Driven by esports convergence, technological innovation, and rising youth engagement, the Racing Drone Market accelerates at a CAGR of 22.1% from 2025 to 2032

Market Overview

The global Racing Drone Market is entering a high-growth phase, fueled by the convergence of advanced drone technology, esports culture, and immersive digital entertainment. Valued at USD 1,098.9 million in 2024, the market is projected to grow at a robust CAGR of 22.1% between 2025 and…

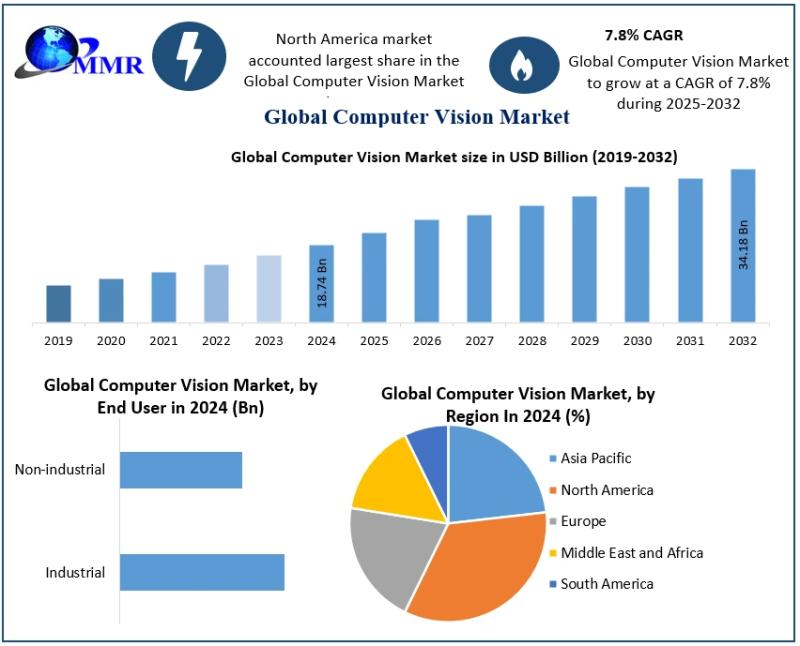

Computer Vision Market to Reach USD 34.18 Billion by 2032 at a CAGR of 7.8% - Ma …

The Computer Vision Market was valued at USD 18.74 Billion in 2024 and is projected to reach approximately USD 34.18 Billion by 2032, growing at a CAGR of around 7.8% during 2025-2032.

Market Overview

The Computer Vision Market represents a rapidly expanding segment of artificial intelligence (AI) that enables machines and systems to interpret, analyze, and understand visual data from the world-much like human vision but powered by algorithms, cameras, and deep…

Corporate Wellness Market Poised for Robust Growth, Projected to Reach USD 120.2 …

The Global Corporate Wellness Market, valued at USD 69.45 Billion in 2024, is witnessing a significant transformation as organizations worldwide increasingly prioritize employee health, well-being, and productivity. According to the latest industry analysis, the market is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2025 to 2032, reaching nearly USD 120.23 Billion by 2032. This sustained growth reflects a fundamental shift in corporate culture, where…

More Releases for Debt

Debt Settlement Solution Market Impressive Growth 2021-2028 | National Debt Reli …

The Insight Partners announces the research on Global Debt Settlement Solution Market [Report Page Link as it covers the key boundaries Required for your Research Need. This Global Debt Settlement Solution Market Report covers worldwide, local, and nation level market size, pieces of the overall industry, ongoing pattern, the effect of covid19 on worldwide

Market Research Report Investigations Research Methodology review comprises of Secondary Research, Primary Research, Company Share Analysis,…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market 2019 By Freedom Debt Relief National Debt Relief Rescue O …

This report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in which the debtor and creditor agree on a reduced balance that will be regarded as payment in full.

Request a Sample of this Report @ https://www.orbisresearch.com/contacts/request-sample/2575396 …

Debt Settlement Market 2018-National Debt Relief, Freedom Debt Relief, New Era D …

The report on Debt Settlement, documents a detailed study of different aspects of the ‘Debt Settlement’ market. It shows the steady growth in market in spite of the fluctuations and changing market trends. In the past four years the ‘Debt Settlement’ market has grown to a booming value of $xxx million and is expected to grow more.

Request a Sample of this Report@ http://www.orbisresearch.com/contacts/request-sample/2335800

Every market intelligence report is based on certain…

Debt Settlement Market 2018 | Global Demand, Top Companies Analysis- National De …

Global Debt Settlement Market Research Report 2018 is a professional and in-depth study on the current state of the global Debt Settlement industry with a focus on the regional market, analysis of industry share, growth factors, development trends, size, majors manufacturers and 2025 forecast. The report also analyze innovative business strategies, value added factors and business opportunities. The Debt Settlement report introduces market revenue, product & services, latest developments and…