Press release

Trade Finance Market Size to Hit US$ 70.0 Billion by 2028 | IMARC Group

According to IMARC Group's new report, titled "Trade Finance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028.' the global trade finance market size reached US$ 48.2 Billion in 2022. Looking forward, IMARC Group expects the market to reach US$ 70.0 Billion by 2028, exhibiting a growth rate (CAGR) of 6.2% during 2023-2028.Trade finance is a financial assistance offered to enterprises to help facilitate international trade and commerce. It involves the use of various products and financial instruments, which enables them to access working capital, thereby achieving liquidity to make investments, pay salaries, and pay suppliers. Unlike general finance, the functional wing of trade finance involves the introduction of a third party, such as banks, insurance companies, exporters, importers, trade finance firms, and credit agencies, to manage the transaction between the buyer and seller. Apart from this, trade finance aids in controlling the goods, monitoring the trade cycle through the transaction, providing security over the receivables, and mitigating the risks involved in international trade transactions.

Request to Get the Free Sample Report: https://www.imarcgroup.com/trade-finance-market/requestsample

Trade Finance Market Trends:

The increasing global trade activities due to rapid urbanization and industrialization, particularly in emerging economies, is facilitating the demand for safe and secure financial instruments, such as trade finance. This represents the key factor driving the market growth. In line with this, digitization of trade financing operations has enabled enterprises to automate large volumes of financial and transactional information, which is acting as another growth-inducing factor. Additionally, the increasing utilization of developing technologies, such as optical character recognition (OCR), radio frequency identification (RFID), and quick response (QR) codes, to identify and track shipments and enhance the digital conversion of trading documents are further catalyzing the market growth. Besides this, the rising integration of trade finance with blockchain, artificial intelligence (AI), machine learning (ML), and the internet of things (IoT) technologies have enabled organizations to recognize market patterns, predict future issues, resolve concerns, anticipate demand, and take appropriate measures. This, in turn, is accelerating the flow of transactions, thereby creating a positive outlook for the market. Other factors responsible for the market growth include increasing investments in the banking, financial services, and insurance (BFSI) sector, the implementation of favorable government policies, and improving supply chain capabilities.

Trade Finance Market 2023-2028 Competitive Analysis and Segmentation:

Competitive Landscape With Key Players:

The competitive landscape of the trade finance market has been studied in the report with the detailed profiles of the key players operating in the market.

Some of these Key Players Include:

Asian Development Bank

Banco Santander SA

Bank of America Corp.

BNP Paribas SA

Citigroup Inc.

Crédit Agricole Group

Euler Hermes

Goldman Sachs Group Inc.

HSBC Holdings Plc

JPMorgan Chase & Co.

Mitsubishi Ufj Financial Group Inc.

Morgan Stanley

Royal Bank of Scotland

Standard Chartered Bank

Wells Fargo & Co.

Key Market Segmentation:

The report has segmented the global trade finance market on the basis of finance type, offering, service provider and end-user.

Breakup by Finance Type:

Structured Trade Finance

Supply Chain Finance

Traditional Trade Finance

Breakup by Offering:

Letters of Credit

Bill of Lading

Export Factoring

Insurance

Others

Breakup by Service Provider:

Banks

Trade Finance Houses

Breakup by End-User:

Small and Medium Sized Enterprises (SMEs)

Large Enterprises

Breakup by Region:

North America (United States, Canada)

Europe (Germany, France, United Kingdom, Italy, Spain, Others)

Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Others)

Explore full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=2031&flag=E

Key Highlights of the Report:

Market Performance (2017-2022)

Market Outlook (2023-2028)

Market Trends

Market Drivers and Success Factors

Impact of COVID-19

Value Chain Analysis

Comprehensive mapping of the competitive landscape

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: https://www.imarcgroup.com/

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Market Size to Hit US$ 70.0 Billion by 2028 | IMARC Group here

News-ID: 3116955 • Views: …

More Releases from IMARC Group

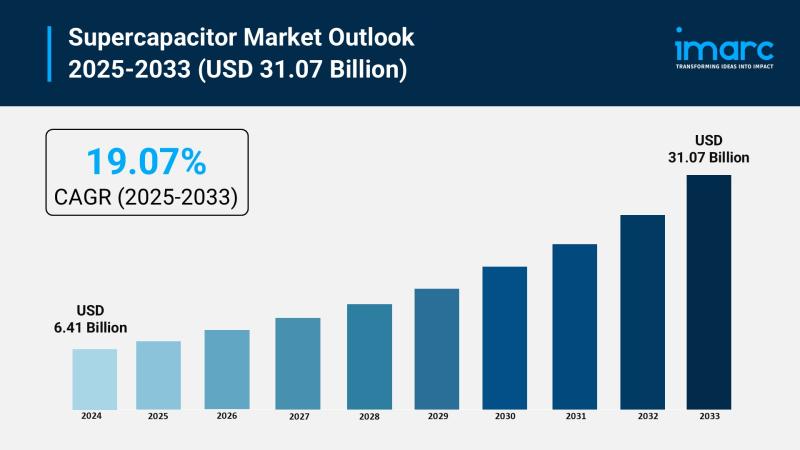

Supercapacitor Market Size to Reach $31.07B by 2033: Trends & Opportunities

Market Overview:

The supercapacitor market is experiencing rapid growth, driven by electrification of automotive systems, renewable energy and grid stabilization, and expansion of industrial automation and robotics. According to IMARC Group's latest research publication, "Supercapacitor Market Size, Share, Trends and Forecast by Product Type, Module Type, Material Type, End Use Industry, and Region, 2025-2033", the global supercapacitor market size was valued at USD 6.41 Billion in 2024. Looking forward, IMARC Group…

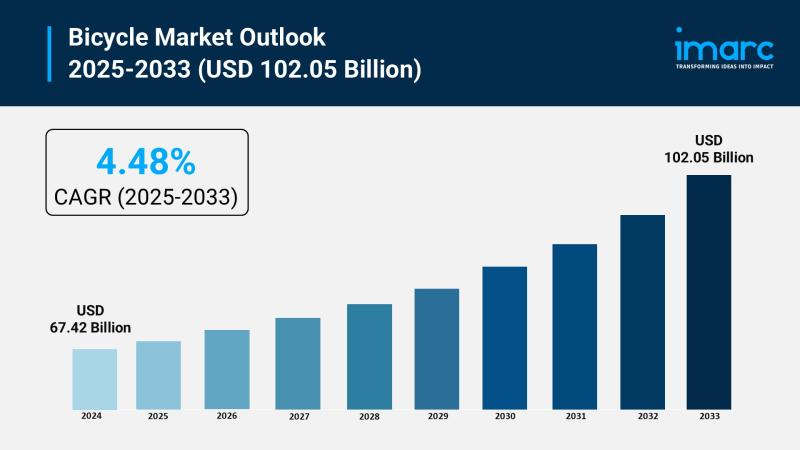

Bicycle Market Size to Surpass $102.05B by 2033: Growth & Insights

Market Overview:

The bicycle market is experiencing rapid growth, driven by global expansion of cycling infrastructure, rising health consciousness and preventative wellness, and technological advancements in e-bike propulsion. According to IMARC Group's latest research publication, "Bicycle Market Size, Share, Trends and Forecast by Type, Technology, Price, Distribution Channel, End User, and Region, 2025-2033", The global bicycle market size was valued at USD 67.42 Billion in 2024. Looking forward, IMARC Group estimates…

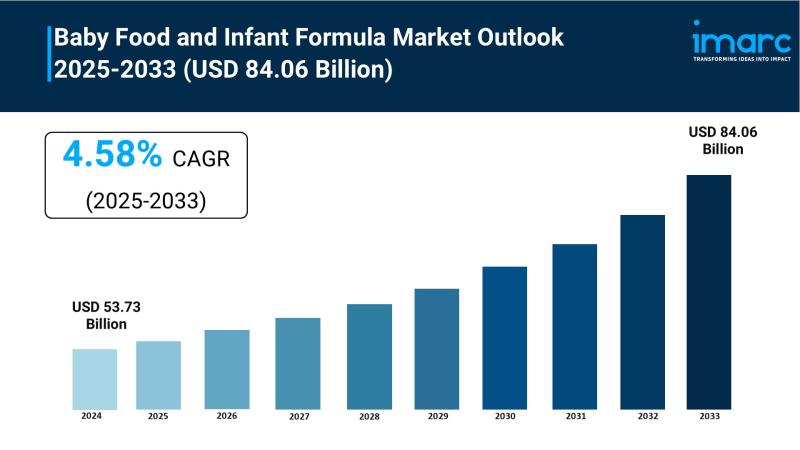

Baby Food and Infant Formula Market to Reach USD 84.06 Billion by 2033, Growing …

Market Overview:

The Baby Food and Infant Formula Market is experiencing steady expansion, driven by Increasing Awareness of Nutritional Needs for Infants, Rising Number of Working Women, and Technological Advancements and Product Innovation. According to IMARC Group's latest research publication, "Baby Food and Infant Formula Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global baby food and infant formula market size reached USD 53.73 Billion in 2024.…

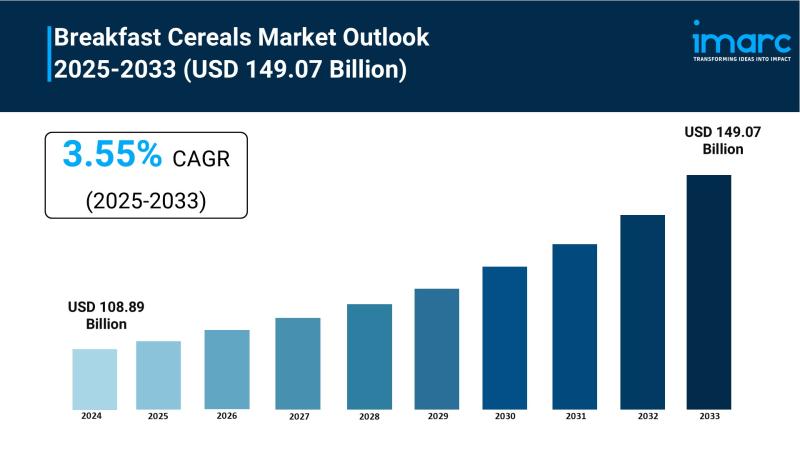

Breakfast Cereals Market to Reach USD 149.07 Billion by 2033, Growing at a CAGR …

Market Overview:

The Breakfast Cereals Market is experiencing rapid growth, driven by Health and Wellness Awareness, Busy Lifestyles and On-the-Go Demand and Rising Disposable Incomes and Global Market Expansion . According to IMARC Group's latest research publication, "Breakfast Cereals Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global breakfast cereals market size was valued at USD 108.89 Billion in 2024. Looking forward, IMARC Group estimates…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…