Press release

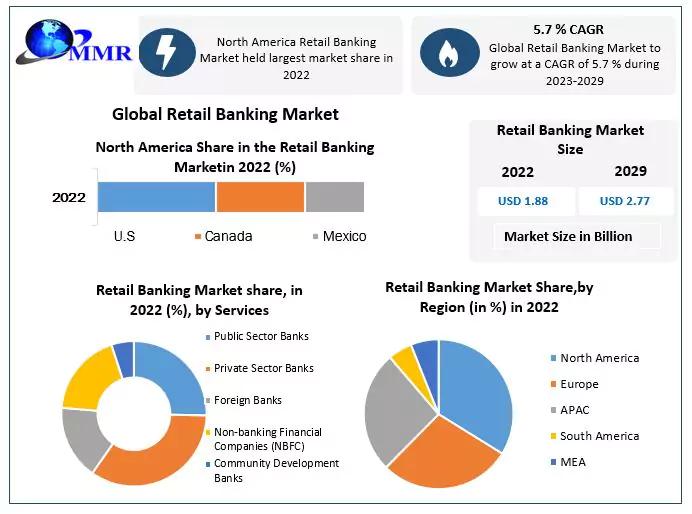

The Global Retail Banking Market was valued at USD 1.88 Bn in 2022 and is projected to reach USD 2.77 Bn by 2029, growing at a CAGR of 5.7 Percent during the forecast period.

Retail Banking Market Report Scope and Research Methodology:The Retail Banking Market report provides comprehensive insights into the industry, analyzing the market dynamics, drivers, restraints, growth trends, and key regions, including North America, Asia Pacific, South America, the Middle East and Africa, and Europe. The report leverages a combination of primary and secondary research methodologies to gather qualitative and quantitative data to present a detailed and accurate analysis.

The market encompasses various financial services provided to individual customers and small businesses, including checking and savings accounts, credit and debit cards, mortgages, personal loans, investment products, insurance, and wealth management services. Traditional banks such as JPMorgan Chase, Bank of America, and HSBC, along with fintech disruptors like PayPal, Square, and Revolut, are shaping the retail banking landscape, offering user-friendly interfaces, convenient access, and personalized services.

Get to Know More About This Market Study: https://www.maximizemarketresearch.com/market-report/retail-banking-market/195573/

What are Retail Banking Market Dynamics:

The evolution of digital technology has revolutionized the retail banking sector, leading to increased smartphone usage, internet connectivity, and user-friendly banking apps. Customers now expect seamless and convenient digital banking experiences, encouraging banks to invest in digital infrastructure, offering mobile banking, online transactions, and 24/7 customer support. The integration of AI and ML technologies enables personalized financial products, recommendations, and automated customer service, enhancing the overall customer experience. The pursuit of financial inclusion in emerging markets has driven the growth of retail banking, providing previously excluded individuals access to basic financial products through mobile banking and digital platforms. Affordable and accessible banking solutions, mobile payment apps, contactless payments, and digital wallets have significantly impacted the retail banking market.

The market growth may face challenges due to stringent regulatory guidelines and compliance measures. While crucial for maintaining trust and integrity in the industry, these regulations often require significant resources and investments from banks for compliance measures, impacting the overall market growth. Additionally, increased competition from non-bank financial institutions, cybersecurity risks, and changing customer expectations pose challenges for the market during the forecast period.

Request a Free Sample Copy or View Report Summary: https://www.maximizemarketresearch.com/request-sample/195573

Retail Banking Market Regional Insights:

North America dominated the retail banking market in 2022, driven by well-established banking systems, technological innovation, and high digital adoption rates. The region's advanced infrastructure, high smartphone penetration, and growing population are expected to drive the growth of digital banking services.

In the Asia Pacific region, retail savings and investment growth boost the market as population growth, increasing disposable income, and technology penetration drive regional market growth. The proliferation of digital wallets, online banking, and peer-to-peer lending platforms, along with technological advancements like AI, blockchain, and biometric authentication, contributes to the region's growth.

Request For Free Sample Report: https://www.maximizemarketresearch.com/request-sample/195573

What is Retail Banking Market Segmentation:

By Type:

Public Sector Banks

Private Sector Banks

Foreign Banks

Community Development Banks

Non-banking Financial Companies (NBFC)

By Services:

Saving and Checking Account

Transactional Account

Personal Loan

Home Loan

Mortgages

Debit and Credit Cards

ATM Cards

Certificates of Deposits

Request For Free Inquiry Report: https://www.maximizemarketresearch.com/inquiry-before-buying/195573

Who are Retail Banking Market Key Players:

1. Wells Fargo

2. Mitsubishi UFJ Financial Group

3. Bank of America

4. Barclays

5. ICBC

6. China Construction Bank Deutsche Bank

7. HSBC

8. JPMorgan Chase

9. Citigroup

10. NP Paribas

11. BNP Paribas

12. Banco Santander, S.A.

13. The Royal Bank of Scotland Group plc (RBS)

14. Société Générale S.A.

15. ING Groep N.V.

16. BBVA (Banco Bilbao Vizcaya Argentaria)

17. UBS Group AG

18. Standard Chartered PLC

Purchase Report: https://www.maximizemarketresearch.com/market-report/retail-banking-market/195573/

Table of content for the Retail Banking Market includes:

1. Global Retail Banking: Research Methodology

2. Global Retail Banking Market: Executive Summary

• Market Overview and Definitions

• Introduction to the Global Market

• Summary

• Key Findings

• Recommendations for Investors

• Recommendations for Market Leaders

• Recommendations for New Market Entry

1. Global Retail Banking Market: Competitive Analysis

• MMR Competition Matrix

• Market Structure by region

• Competitive Benchmarking of Key Players

• Consolidation in the Market

• M&A by region

• Key Developments by Companies

• Market Drivers

• Market Restraints

• Market Opportunities

• Market Challenges

• Market Dynamics

• PORTERS Five Forces Analysis

• PESTLE

• Regulatory Landscape by region

• North America

• Europe

• Asia Pacific

• Middle East and Africa

• South America

• COVID-19 Impact

1. Global Retail Banking Market Segmentation

• Global Market, by Type (2022-2029)

• Global Market, by Services (2022-2029)

1. Regional Retail Banking Market (2022-2029)

• Regional Market, by Type (2022-2029)

• Regional Market, by Services (2022-2029)

• Regional Market, by Country (2022-2029)

1. Company Profile: Key players

• Company Overview

• Financial Overview

• Global Presence

• Capacity Portfolio

• Business Strategy

• Recent Developments

Key Offerings:

• Past Market Size and Competitive Landscape (2018 to 2021)

• Past Pricing and price curve by region (2018 to 2021)

• Market Size, Share, Size & Forecast by different segment | 2022-2029

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Market Segmentation - A detailed analysis by Type and Services

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

• Competitive landscape - Market Leaders, Market Followers, Regional player

• Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

Professional Service Robots Market https://www.maximizemarketresearch.com/market-report/professional-service-robots-market/188073/

Cocoa Liquor Market https://www.maximizemarketresearch.com/market-report/cocoa-liquor-market/188078/

Transparent Solar Cells Market https://www.maximizemarketresearch.com/market-report/transparent-solar-cells-market/188181/

Healthcare Security Systems Market https://www.maximizemarketresearch.com/market-report/healthcare-security-systems-market/188190/

Retort Machine Market https://www.maximizemarketresearch.com/market-report/retort-machine-market/188203/

Natural Graphite Market https://www.maximizemarketresearch.com/market-report/natural-graphite-market/188206/

Sleep Apnea Implants Market https://www.maximizemarketresearch.com/market-report/sleep-apnea-implants-market/188223/

Polymer Bearing Market https://www.maximizemarketresearch.com/market-report/polymer-bearing-market/188234/

Dysmenorrhea Treatment Market https://www.maximizemarketresearch.com/market-report/dysmenorrhea-treatment-market/188244/

Soft Tissue Sarcoma Market https://www.maximizemarketresearch.com/market-report/soft-tissue-sarcoma-market/188261/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Global Retail Banking Market was valued at USD 1.88 Bn in 2022 and is projected to reach USD 2.77 Bn by 2029, growing at a CAGR of 5.7 Percent during the forecast period. here

News-ID: 3113633 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

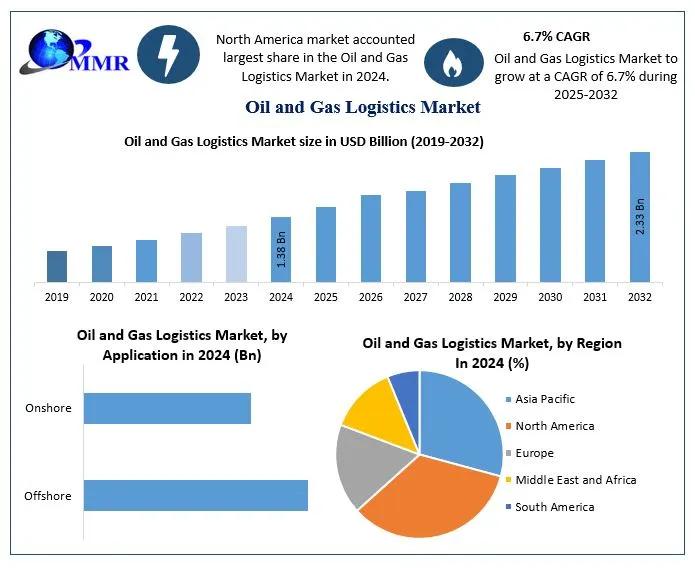

Oil and Gas Logistics Market to Reach USD 2.33 Billion by 2032 | Growth, Trends, …

The Oil and Gas Logistics Market was valued at USD 1.38 Billion in 2024 and is forecasted to grow to USD 2.33 Billion by 2032, exhibiting a CAGR of 6.7% during 2025 to 2032, driven by rising global energy demand, technological innovation, and expanding upstream and downstream supply chain activities.

Market Overview

The oil and gas logistics market encompasses the transportation, storage, handling, and distribution of crude oil, refined products, natural gas,…

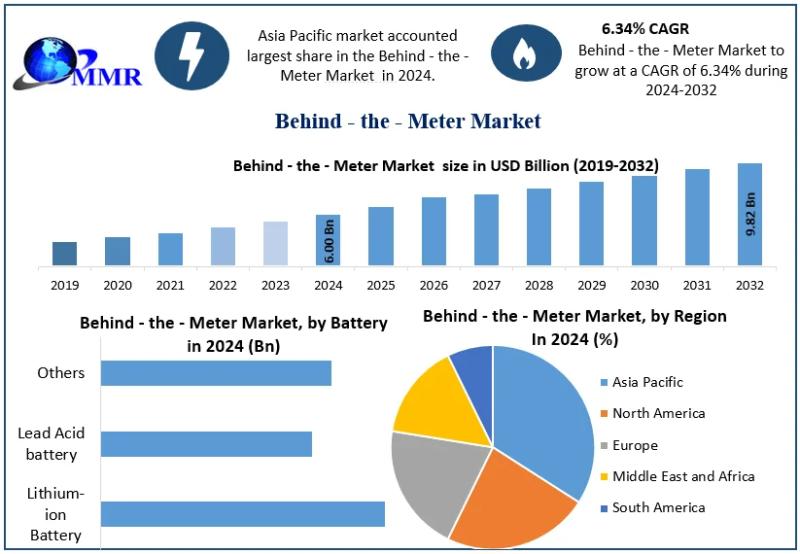

Behind the Meter Market to Surge to USD 9.82 Billion by 2032 - Unmatched Growth …

According to Maximize Market Research, the Global Behind the Meter Market was valued at USD 6.00 Billion in 2024 and is projected to reach USD 9.82 Billion by 2032 at a 6.34 % CAGR, driven by growth in residential, commercial, and industrial energy storage adoption.

Market Overview

The Behind the Meter Market consists of energy storage systems installed on the consumer side of the utility meter. These systems store electricity generated from…

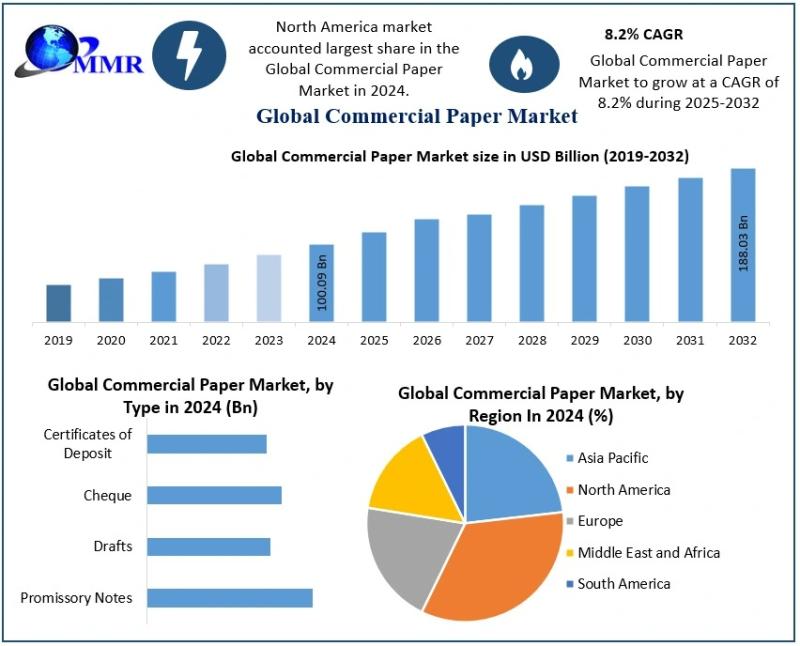

Commercial Paper Market Expected to Witness Steady Growth Driven by Short-Term C …

The Commercial Paper Market size was valued at USD 100.09 Billion in 2024 and the total Commercial Paper revenue is expected to grow at a CAGR of 8.2% from 2025 to 2032, reaching nearly USD 188.03 Billion.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/199690/

The Commercial Paper Market is gaining strong momentum as corporations, financial institutions, and large enterprises increasingly rely on short-term unsecured debt instruments…

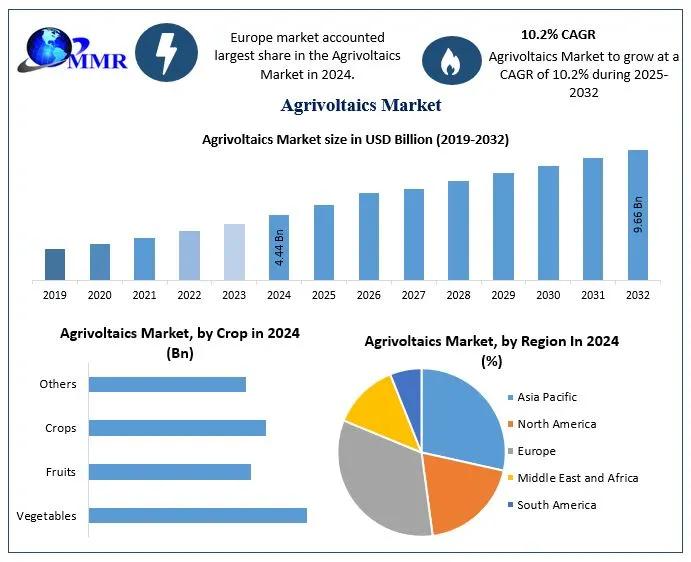

Agrivoltaics Market to Reach USD 9.66 Billion by 2032: Unlocking Dual-Use Land f …

The Global Agrivoltaics Market size was valued at USD 4.44 Billion in 2024 and is anticipated to reach nearly USD 9.66 Billion by 2032, growing at a CAGR of 10.2 % from 2025 to 2032, driven by rising demand for renewable energy solutions and sustainable agriculture practices.

Market Overview

Agrivoltaics - also called "dual-use farming" - integrates photovoltaic (PV) solar power systems with agricultural land, enabling simultaneous cultivation and energy generation on…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…