Press release

Natural Disaster Insurance Market May See Big Move | Selective Insurance, Sompo Holdings, Amcat Adjusting Services

The Global Natural Disaster Insurance Market was valued at USD 2.84 Billion in 2023 and is expected to reach USD 4.1 Billion by 2029, growing at a CAGR of 6.1% during 2023-2029. The Latest research study released by HTF MI "Global Natural Disaster Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying the importance of different factors that aid market growth. Some of the Major Companies covered in this Research are Selective Insurance (US), Pilot Catastrophe Services (US), Amcat Adjusting Services (US), MS&AD Insurance Group Holdings, Inc (Japan), Tokio Marine & Nichido Fire Insurance Co., Ltd. (Japan), Sompo Holdings Inc. (Japan), Rakuten General Insurance Co., Ltd. (Japan), Nisshin Fire & Marine Insurance Co., Ltd. (Japan), China Life Property & Casualty Insurance (China), China United Property & Casualty Insurance (China), HDFC (India) etc.Click here for sample + related graphs of the report @: https://www.htfmarketintelligence.com/sample-report/global-natural-disaster-insurance-market

Browse market information, tables, and figures extent in-depth TOC on Natural Disaster Insurance Market by Application (Commercial, Residential), by Product Type (Home Insurance, Disaster insurance, Flood Insurance, Earthquake insurance, Region-specific insurance, Additional coverage), Business scope, Manufacturing, and Outlook - Estimate to 2029.

for more information or any query mail at sales@htfmarketintelligence.com

Finally, all parts of the Global Natural Disaster Insurance market are also quantitatively evaluated in order to think about the global market alike. This market study contains fundamental data and true figures about the market, which contains a deep analysis of this market based on market trends, market drivers, restrictions, and future prospects. The report delivers the global money request with the help of Porters' five forces and SWOT analysis.

If you have any Enquiry please click here: https://www.htfmarketintelligence.com/enquiry-before-buy/global-natural-disaster-insurance-market

On the basis of the report- titled segments and sub-segment of the market are highlighted below:

Global Natural Disaster Insurance Market By Application/End-User (Value and Volume from 2023E to 2029: Commercial, Residential

Natural Disaster Insurance Market By Type (Value and Volume from 2023 to 2029): Home Insurance, Disaster insurance, Flood Insurance, Earthquake insurance, Region-specific insurance, Additional coverage

Global Natural Disaster Insurance Market by Key Players: Selective Insurance (US), Pilot Catastrophe Services (US), Amcat Adjusting Services (US), MS&AD Insurance Group Holdings, Inc (Japan), Tokio Marine & Nichido Fire Insurance Co., Ltd. (Japan), Sompo Holdings Inc. (Japan), Rakuten General Insurance Co., Ltd. (Japan), Nisshin Fire & Marine Insurance Co., Ltd. (Japan), China Life Property & Casualty Insurance (China), China United Property & Casualty Insurance (China), HDFC (India)

On the basis of the report- titled segments and sub-segment of the market are highlighted below:

Global Natural Disaster Insurance Market Study Global Natural Disaster Insurance Market Breakdown by Application (Commercial, Residential) by Type (Home Insurance, Disaster insurance, Flood Insurance, Earthquake insurance, Region-specific insurance, Additional coverage) and by Geography (North America, South America, Europe, Asia Pacific, MEA)

Market Drivers:

• The rising economic losses caused by natural disasters have highlighted the need for individuals and businesses to protect themselves financially. This drives the demand for natural disaster insurance coverage.

• In some regions, government regulations or mortgage lenders may require property owners to obtain natural disaster insurance as a condition for obtaining loans or building permits. Such requirements drive the demand for natural disaster insurance.

Market Trend:

• The rise in the frequency and intensity of natural disasters worldwide is driving the demand for natural disaster insurance coverage, prompting insurance companies to expand their offerings in this market segment.

• The use of advanced technologies such as satellite imagery, remote sensing, and predictive modelling is improving risk assessment and underwriting processes in the natural disaster insurance market, enabling more accurate pricing and coverage customization

Opportunities:

• Growing awareness about climate change and its impact on natural disasters are creating opportunities for insurance providers to offer specialized coverage and risk management solutions tailored to the changing climate-related risks.

• Governments around the world are emphasizing the importance of disaster risk reduction and encouraging individuals and businesses to obtain natural disaster insurance coverage. This creates opportunities for insurers to collaborate with governments and participate in public-private partnerships.

Challenges:

• The cost of natural disaster insurance can be a challenge, especially for individuals or businesses in high-risk areas. Some may find it difficult to afford comprehensive coverage, leading to an affordability gap.

• The availability and accuracy of data related to natural disaster risks can pose challenges for insurers in accurately assessing and pricing policies. Limited data or outdated information can impact the underwriting process and risk estimation.

To get this report buy a full copy @: https://www.htfmarketintelligence.com/buy-now?format=1&report=1970

Customization of the Report: The report can be customized as per your needs for added data from up to 3 businesses or countries.

Global Natural Disaster Insurance Market by Key Players: Selective Insurance (US), Pilot Catastrophe Services (US), Amcat Adjusting Services (US), MS&AD Insurance Group Holdings, Inc (Japan), Tokio Marine & Nichido Fire Insurance Co., Ltd. (Japan), Sompo Holdings Inc. (Japan), Rakuten General Insurance Co., Ltd. (Japan), Nisshin Fire & Marine Insurance Co., Ltd. (Japan), China Life Property & Casualty Insurance (China), China United Property & Casualty Insurance (China), HDFC (India)

Geographically, this report is segmented into some key Regions, with manufacture, depletion, revenue (million USD), and market share and growth rate of Natural Disaster Insurance in these regions, from 2018 to 2028 (forecast), covering China, USA, Europe, Japan, Korea, India, Southeast Asia & South America and its Share (%) and CAGR for the forecasted period 2023 to 2028

Some of the important questions for stakeholders and business professionals for expanding their position in the Global Natural Disaster Insurance Market:

Q 1. Which Region offers the most rewarding open doors for the market Ahead of 2022?

Q 2. What are the business threats and Impacts of the latest scenario over the market Growth and Estimation?

Q 3. What are probably the most encouraging, high-development scenarios for the Natural Disaster Insurance movement showcased by applications, types, and regions?

Q 4. What segments grab the most noteworthy attention in Natural Disaster Insurance Market in 2020 and beyond?

Q 5. Who are the significant players confronting and developing in Natural Disaster Insurance Market?

For More Information Read the Table of Content: https://www.htfmarketintelligence.com/report/global-natural-disaster-insurance-market

Key poles of the TOC:

Chapter 1 Global Natural Disaster Insurance Market Business Overview

Chapter 2 Major Breakdown by Type [Home Insurance, Disaster insurance, Flood Insurance, Earthquake insurance, Region-specific insurance, Additional coverage]

Chapter 3 Major Application Wise Breakdown (Revenue & Volume)

Chapter 4 Manufacture Market Breakdown

Chapter 5 Sales & Estimates Market Study

Chapter 6 Key Manufacturers Production and Sales Market Comparison Breakdown

...........

Chapter 8 Manufacturers, Deals and Closings Market Evaluation & Aggressiveness

Chapter 9 Key Companies Breakdown by Overall Market Size & Revenue by Type

Chapter 10 Business / Industry Chain (Value & Supply Chain Analysis)

Chapter 11 Conclusions & Appendix

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like APAC, North America, LATAM, Europe, or Southeast Asia.

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +1 434 322 0091

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Natural Disaster Insurance Market May See Big Move | Selective Insurance, Sompo Holdings, Amcat Adjusting Services here

News-ID: 3104754 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Online Travel Booking Platform Market: Growth Factors, Emerging Trends & Key Pla …

The Online Travel Booking Platform Market is entering a transformative phase as digitalization, AI-driven personalization, and mobile-first travel planning redefine the global tourism landscape. Today's travelers demand speed, transparency, and seamless booking experiences, pushing travel-tech companies to innovate with automation, virtual assistance, smart itinerary planning, and multi-service integration. As global tourism recovers strongly and digital adoption accelerates, online travel booking solutions are witnessing exponential growth across leisure, corporate, and last-minute…

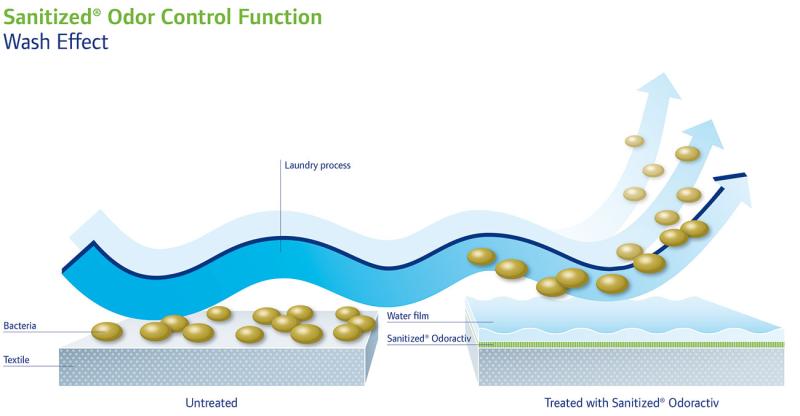

Odour Control Textiles Market Growth Outlook: Trends, Opportunities & Competitiv …

The Odour Control Textiles Market is entering a high-growth phase as global consumer and industrial sectors increasingly demand freshness-enhancing, hygiene-focused, and performance-driven textile solutions. From sportswear and athleisure to healthcare fabrics, military gear, and home furnishings, odour-neutralizing technologies are transforming product design and functionality. As brands move toward sustainability, antimicrobial performance, and premium comfort, odour control textiles have become a core component in next-generation material engineering.

Get a Sample Copy of…

Pet Shampoo Market Overview & Growth Rate Forecast for the Next 5 Years

The latest study released on the Global Pet Shampoo Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Pet Shampoo study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

E-Passport and E-Visa Market: Pioneering Secure, Digital Travel Authentication

The E-Passport and E-Visa Market is at the intersection of travel security, digital identity management, and global mobility. As international travel continues to rebound and migrate toward contactless experiences, governments and border authorities are embracing electronic solutions that streamline entry processes, enhance security, and reduce fraud. E-passports and e-visas have emerged as cornerstones of modern travel infrastructure, enabling faster processing, greater convenience, and stronger identity assurance for travelers and authorities…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…