Press release

Global Trade Finance Market Size, Share, Research Report 2023

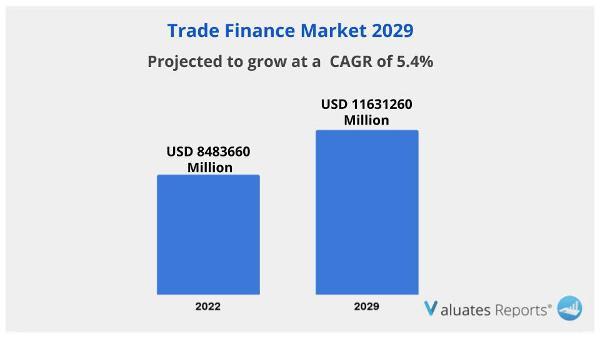

For many businesses, trade finance is an essential subject because it helps them manage risk and is a crucial component of company continuity. Certain projects would be put on hold without trade financing instruments because the risk of conducting business would be too great. Trade finance nowadays is influenced by a variety of circumstances, therefore it's critical for businesses to stay current on these issues in order to streamline the relevant procedures.The global Trade Finance market was valued at US$ 8483660 million in 2022 and

is anticipated to reach US$ 11631260 million by 2029, witnessing a CAGR of 5.4%

during the forecast period 2023-2029.

Shipping delays and a lack of some goods have an impact on supply chains. As expenses grow and the supply of goods is delayed or canceled, the risk of conducting business therefore increases. This may have an impact on certain manufacturing lines and income generation in particular businesses, making trade financing even more crucial.

Processes must be thoroughly monitored since there are so many potential problems along the supply chain, but ideally without adding to the workload of the finance and treasury staff. Working together with other departments and managing the workload, trade finance must be able to manage supply chain risk from the beginning of the supply chain to the end.

The fight for talent is partly to blame for the current difficulties in trade financing.

Many businesses are understaffed and overburdened with handling all trade finance activities because they can't find enough qualified candidates for their treasury or trade finance departments. However, we've also seen that it varies by company; some companies, by virtue of their nature, must place a strong emphasis on trade finance, and they devote a lot of resources therein; in contrast, other companies lack an appointed individual in charge of it and view it as a task for the treasury or finance team.

As a result, trade finance experts frequently begin to think about implementing specialized solutions to address the problem of understaffed teams and the potential for process improvement.

Companies are becoming more aware of how crucial it is to handle financial risk in trade financing. To assess where trade finance is required and how it affects the organization, trade finance specialists must now engage effectively with other departments. Trade finance specialists increasingly need great communication skills to interact with a variety of stakeholders, according to recruitment experts.

Many businesses are unaware of how time-consuming trade finance is since it involves handling hundreds of instruments together with all relevant parties. especially when there is a lack of automation, digitization, and efficient procedures. Relying on treasurers to complete this can be equivalent to adding a second full-time job to an already taxing position. Modern equipment or software can lighten the burden, but organizations that use a lot of equipment must assign specialized personnel to the task.

The businesses that do see the value of trade finance are often those that are highly exposed to supply chain disruptions and counterparty dependence and are aware of how crucial it is to maintain operational continuity.

View Full Report

https://reports.valuates.com/market-reports/QYRE-Auto-6X849/global-trade-finance

Similar Reports

https://reports.valuates.com/market-reports/QYRE-Othe-4N372/global-trade-credit-insurance

https://reports.valuates.com/market-reports/QYRE-Othe-3A258/non-bank-trade-finance

https://reports.valuates.com/market-reports/QYRE-Othe-3B386/saudi-arabia-trade-finance

https://reports.valuates.com/market-reports/QYRE-Othe-0P392/trade-management-software

https://reports.valuates.com/market-reports/ALLI-Manu-2V67/canada-financial-guarantee

Valuates Reports

sales@valuates.com

For U.S. Toll-Free Call 1-(315)-215-3225

For IST Call +91-8040957137

WhatsApp: +91-9945648335

Website: https://reports.valuates.com

Twitter - https://twitter.com/valuatesreports

Valuates offers in-depth market insights into various industries. Our extensive report repository is constantly updated to meet your changing industry analysis needs.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Trade Finance Market Size, Share, Research Report 2023 here

News-ID: 3099516 • Views: …

More Releases from Valuates Reports

Global Wafer Bonder and Debonder Market Expands as Advanced Packaging and MEMS A …

Wafer Bonder and Debonder Market Size

The global market for Wafer Bonder and Debonder was valued at US$ 321 million in the year 2024 and is projected to reach a revised size of US$ 449 million by 2031, growing at a CAGR of 5.0% during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-9G8597/Global_Wafer_Bonder_and_Debonder_Market_Insights_Forecast_to_2028

By Type

• Fully Automatic

• Semi Automatic

By Application

• MEMS

• Advanced Packaging

• CIS

Key Companies

EV Group, SUSS MicroTec, Tokyo Electron, Applied Microengineering, Nidec Machine Tool, Ayumi Industry, Bondtech, Aimechatec,…

Global Wafer Bonding and Debonding Equipment Market Expands with Rising Demand f …

Wafer Bonding and Debonding Equipment Market Size

The global market for Wafer Bonding and Debonding Equipment was valued at US$ 321 million in the year 2024 and is projected to reach a revised size of US$ 449 million by 2031, growing at a CAGR of 5.0% during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-7D16601/Global_Wafer_Bonding_and_Debonding_Equipment_Market_Research_Report_2024

By Type

• Fully Automatic

• Semi Automatic

By Application

• MEMS

• Advanced Packaging

• CIS

Key Companies

EV Group, SUSS MicroTec, Tokyo Electron, Applied Microengineering, Nidec Machine Tool, Ayumi Industry,…

Global GaN HEMT Epitaxial Wafer Market Accelerates as RF and Power Device Innova …

GaN HEMT Epitaxial Wafer Market Size

The global GaN HEMT Epitaxial Wafer revenue was US$ 175.9 million in 2022 and is forecast to a readjusted size of US$ 608.6 million by 2029 with a CAGR of 19.5% during the forecast period (2023-2029).

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-26C15937/Global_and_India_GaN_HEMT_Epitaxial_Wafer_Market_Report_Forecast_2023_2029

By Type

• GaN-on-SiC

• GaN-on-Si

• GaN-on-Sapphire

• GaN on GaN Others

By Application

• GaN HEMT RF Devices

• GaN HEMT Power Devices

Key Companies

Wolfspeed, Inc, IQE, Soitec (EpiGaN), Transphorm Inc., Sumitomo Chemical (SCIOCS), NTT Advanced Technology (NTT-AT), DOWA…

Global 300 mm Wafer Shippers and Carriers Market Advances as Semiconductor Capac …

300 mm Wafer Shippers and Carriers Market Size

The global market for 300 mm Wafer Shippers and Carriers was valued at US$ 521 million in the year 2024 and is projected to reach a revised size of US$ 759 million by 2031, growing at a CAGR of 5.6% during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-8C10284/Global_300mm_Wafer_Shippers_and_Carriers_Market_Insights_Forecast_to_2028

By Type

• FOUP

• FOSB

By Application

• Foundry

• IDM

Key Companies

Entegris, Shin-Etsu Polymer, Miraial, Chuang King Enterprise, Gudeng Precision, 3S Korea, Dainichi Shoji

Major Trends

The…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…