Press release

Family Floater Health Insurance Market : Opportunity Analysis and Industry Forecast, 2023-2032 | Care Health Insurance, HDFC ERGO, Now Health International

Family Floater Health Insurance Market by Coverage (In-Patient Hospitalization, Pre and Post Hospitalization Cost, Day Care Treatments, Others), by Distribution Channel (Insurance Companies, Banks, Agents and Brokers, Others), by Plan Type (Immediate Family Plan, Extended Family Plan): Global Opportunity Analysis and Industry Forecast, 2021-2031Buy Now: https://www.alliedmarketresearch.com/checkout-final/1a7f5c4ee8f613db33c55226c52db452?utm_source=AMR&utm_medium=research&utm_campaign=P19623

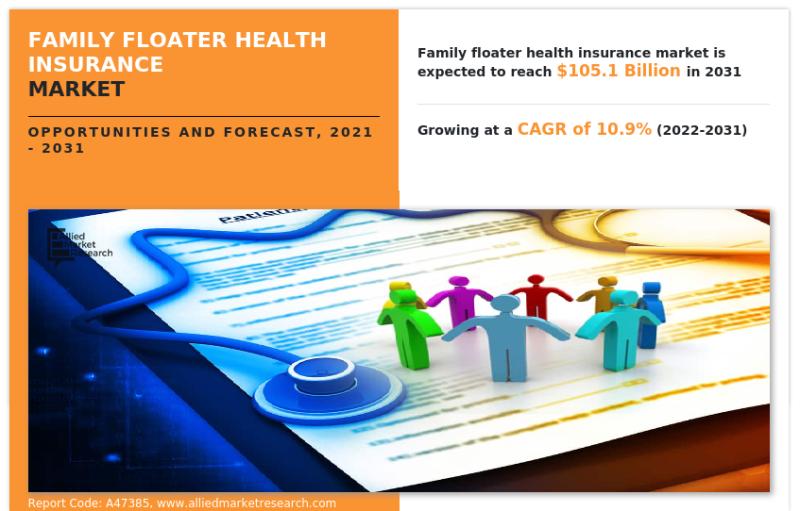

According to a new report published by Allied Market Research, titled, "Family Floater Health Insurance Market," The family floater health insurance market was valued at $38.6 billion in 2021, and is estimated to reach $105.1 billion by 2031, growing at a CAGR of 10.9% from 2022 to 2031.

A family floater health insurance is an insurance wherein the individual and its family members share one plan. This means both health insurance premium and sum insured would be shared amongst all members in the plan. Moreover, family floater health insurance is one of the good options because, when it comes to safeguarding the health of loved ones. Since it is single policy offering family benefit, it relives the person from the task of maintaining and keeping track of several health insurance policies & offers affordability also.

Furthermore, major market players have undertaken various strategies to increase the competition and offer enhanced services to their customers. For instance, in January 2023, Niva Bupa Health Insurance Company Limited (formerly known as Max Bupa Health Insurance Company Limited) has signed a corporate agency agreement with Sundaram Finance Limited to offer Niva Bupa's select range of indemnity family health insurance plans to its growing range of existing and past customers. Therefore, such strategy helps to grow the family floater health insurance market size.

Get a free sample copy: https://www.alliedmarketresearch.com/request-sample/47859

In addition, some general trends that may affect the market include an increasing focus on preventative care, the use of technology to improve the claims process and customer experience, and the incorporation of wellness and lifestyle management programs. Additionally, with the ongoing global pandemic, there may be an increased demand for health insurance in general, as well as greater awareness of the importance of having insurance coverage. There are a few additional family floater health insurance market trends that may be affecting the market, as technology advances, more and more insurance providers are offering telemedicine services, which allows customers to consult with doctors remotely. This can make it more convenient for customers to access medical care, and may also help reduce costs for insurance providers. Furthermore, some insurance providers are beginning to offer more personalized insurance plans that are tailored to the specific needs of individual customers. For example, a family floater plan may include options for additional coverage for specific conditions or treatments. In addition, insurance providers are increasingly using data analytics to better understand their customers and to develop more effective insurance products. For example, data analytics can be used to identify trends in customer claims and to develop targeted marketing campaigns.

On the basis of distribution channels, the agents and brokers segment is the highest growing segment. This is attributed to the fact that the agents and brokers provide services for another company (or that company's customers). Moreover, insurance agents/brokers are authorized with registered license to sell insurance policies for customers. In addition, it acts as an intermediary between insurers and customers by comparing best deals, and offer best health insurance policy from several insurers available in the market.

By region, Asia Pacific attained the highest growth in 2021. This is attributed to the fact that family floater health insurance market is rapidly growing in the Asia-Pacific region, driven by a growing demand from customers expecting fast, seamless trading as well as customized user experiences. Moreover, the second-largest market share in the health insurance is held by the Asia-Pacific region owing to increasing expenditure on health facilities which generates more demand for the family floater health insurance market in the global market.

Request Customization

https://www.alliedmarketresearch.com/request-for-customization/47859

Key findings of the study

By coverage, the in-patient hospitalization segment led the family floater health insurance market growth in terms of revenue in 2021.

By plan type, the immediate family segment accounted for the highest family floater health insurance market share in 2021.

By region, North America generated the highest revenue in 2021.

The key players profiled in the family floater health insurance market analysis are Aetna Inc., Aviva, Care Health Insurance, Cigna, eHealthinsurance Services, Inc., Future Generali India Insurance Company Ltd., HDFC ERGO, IFFCO-Tokio General Insurance Company Limited, Niva Bupa Health Insurance, and Now Health International. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

More Reports:

U.S. Personal Finance Software Market : https://www.alliedmarketresearch.com/us-personal-finance-software-market

Takaful Insurance Market : https://www.alliedmarketresearch.com/takaful-insurance-market-A11835

Canada Extended Warranty Market : https://www.alliedmarketresearch.com/canada-extended-warranty-market-A24713

Fintech Cloud Market : https://www.alliedmarketresearch.com/fintech-cloud-market-A31616

WealthTech Solutions Market : https://www.alliedmarketresearch.com/wealthtech-solutions-market-A31614

Currency Management Market : https://www.alliedmarketresearch.com/currency-management-market-A31435

Business Liquidation Services Market : https://www.alliedmarketresearch.com/business-liquidation-services-market-A06702

Financial Leasing Services Market : https://www.alliedmarketresearch.com/financial-leasing-services-market-A06707

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Family Floater Health Insurance Market : Opportunity Analysis and Industry Forecast, 2023-2032 | Care Health Insurance, HDFC ERGO, Now Health International here

News-ID: 3089377 • Views: …

More Releases from www.alliedmarketresearch.com

Pet Insurance Market Soars: Projected to Hit $38.3 Billion by 2033 as Demand for …

According to a new report published by Allied Market Research, titled, "Pet Insurance Market, By Policy Coverage (Accident Only, Accident and Illness, and Others), By Animal Type (Dogs, Cats, and Others), and By Sales Channel (Agency, Broker, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". The pet insurance market was valued at $10.10 billion in 2023, and is estimated to reach $38.3 billion by 2033, growing at a CAGR…

Manual Spray Guns Market to Hit $2.6 Billion by 2032 | Key Growth Drivers & Oppo …

Prime determinants of growth

The demand for manual spray guns, which are mostly used for painting consumer durables, has increased because of this need, particularly in developing nations like India, China, and Vietnam. Additionally, there is a greater need for manual spray guns from car manufacturers due to the rising demand for automobiles around the world, particularly in industrialized nations like Europe and North America.

Download PDF Sample Report: www.alliedmarketresearch.com/request…ple/111362

Due to…

Hygienic Cladding Market Poised for Growth: Global Trends & Opportunities 2023-2 …

According to the report, the global hygienic cladding market generated $2.8 billion in 2022, and is anticipated to generate $6 billion by 2032, rising at a CAGR of 8.3% from 2023 to 2032.

Prime Determinants of Growth

The increased awareness & demand for health-related products, the increasing need for safe & healthy environments in healthcare facilities, and hygienic wall cladding's affordability & durability than traditional tiling methods are the factors expected to…

AI in Insurance Market Poised to Reach $45.74 Bn Globally by 2031, Soaring at a …

Global Opportunity Analysis and Industry Forecast, 2021-2031". According to the report, the global AI in insurance industry generated $2.74 billion in 2021, and is anticipated to generate $45.74 billion by 2031, witnessing a CAGR of 32.5% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11615

Higher deployment cost of AI, advanced machine learning, and lack of skilled labor hamper the market growth. On the contrary, surge in government initiatives…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…