Press release

Global Digital Mortgage Software Market Analysis and Forecast, 2023-2028

The global digital mortgage software market was estimated at a market value of US$ 5.8 billion in 2022 and is expected to grow at a significant CAGR of over 18% over the forecast period of 2023-2028.There is more competition among lenders in the mortgage sector. Lenders are implementing digital solutions to differentiate themselves, draw in tech-savvy borrowers, and streamline processes to stay competitive. For lenders to stay relevant in the rapidly changing market environment, the mortgage business must be modernized through digital transformation.

In light of these aspects, the global market for digital mortgage software is anticipated to expand as more lenders become aware of the advantages of digitization and work to improve their operational effectiveness, customer experience, and market competitiveness.

Market Scope and Report Overview

According to a deep-dive market assessment by RationalStat, the global digital mortgage software market has been analyzed on the basis of market segments, including type, application and geography/regions (incl. North America, Latin America, Western Europe, Eastern Europe, Middle East & Africa, and Asia Pacific). The report also offers global and regional market sizing for the historical period of 2019-2022 and the forecast period of 2023-2028.

Market intelligence for the global digital mortgage software market covers market sizes on the basis of market value (US$/EUR Million) and volume ('000 units/tons/liters) by various products/services/ equipment, demand assessment across the key regions, customer sentiments, price points, cost structures, margin analysis across the value chain, financial assessments, historical and forecast data, key developments across the industry, import-export data, trade overview, components market by leading companies, etc.

In addition, the long-term sector and products/services 10-year outlook and its implications on the global digital mortgage software market. It also includes the industry's current state - Production Levels, Capacity Utilization, Tech quotient, etc. Key information will be manufacturing capacity by country, installed base, import volumes, market size, key players, market size, dynamics, market data, insights, etc.

Period Covered include data for 2019-2028 along with year-wise demand estimations

The digital mortgage software market report analyzes the market on the basis of global economic situations, regional geopolitics, import-export scenarios, trade duties, market developments, organic and inorganic strategies, mergers and acquisitions, product launches, government policies, new capacity addition, technological advancements, R&D investments, and new market entry, replacement rates, penetration rates, installed base/fleet size, global and regional production capacity, among others.

RationalStat offers market analysis and consulting studies on the basis of dedicated and robust desk/secondary research supported by a strong in-house data repository. In addition, the research leverages data based on the real-time insights gathered from primary interviews. Market estimations and insights are based on primary research (covering more than 240 entities) and secondary research by leveraging international benchmarking.

The global digital mortgage software market report also covers value chain and supply chain analysis that provides in-depth information about the value chain margins and the role of various stakeholders across the value chain. Market dynamics provided in the market study include market drivers, restraints/challenges, trends, and their impact on the market throughout the analysis period.

In the competition analysis section, the global digital mortgage software market provides a detailed competition benchmarking analysis based on the market share of the leading companies/brands/ producers/suppliers, a market structure overview with detailed company profiles of more than 25 players with their financials, product/service offerings, major developments, business models, etc. This enables, clients and report buyers to make strong, precise, and timely decisions.

Explore more about this report - Request for Sample and Scope of the Study

https://store.rationalstat.com/store/global-digital-mortgage-software-market/#tab-ux_global_tab

Macroeconomic Scenario and the Impact of COVID-19 on Regional Economic Sentiment

In the latest RationalStat analysis, geopolitical conflicts and inflation are the cited economic risks, while concerns about the volatility across energy sectors prevail in Europe and other parts of the world. Some of the potential risks to the economic growth in the leading regions, including Asia Pacific, Europe, North America, the Middle East & Africa, and other developing regions, are inflation, volatile energy prices, supply chain disruptions, geopolitical instability, labor shortages, rising interest rates, and COVID-19 pandemic.

The global economy experienced heavy headwinds, throughout 2019-2021, as some countries witnessed subdued growth, while other countries continued to grapple with economic slowdowns. The COVID-19 pandemic has levied undue pressure across the majority of industries globally and has caused a major economic crisis in the US, India, Italy, the UK, Germany, India, Japan, South Korea, the UK, and many others. Besides, the exit of the UK from the European Union earlier in 2020 and the Russo-Ukraine war in 2022 exacerbated the ever-heightened global uncertainty.

In addition to this, the global economic growth slowed in 2022 to 3.3%, weaker than expected at the end of 2021, mainly weighed down by Russia's war in Ukraine and the associated cost-of-living crisis in many countries. However, improvement in economic activities during the forecast period is expected. Growth is projected to remain at lower rates in 2023 and 2024, at 2.6% and 2.9% respectively.

Competition Analysis and Market Structure

Some of the prominent players that contribute significantly to the global digital mortgage software market growth include ICE Mortgage Technology Inc., Roostif, HW Media LLC, SimpleNexus, StreamLoan, Blue Sage Solutions, Cloudvirga, Salesforce Inc., and Maxwell Lender Solutions Inc., among others.

RationalStat has segmented the global digital mortgage software market based on type, application and region

• Global Digital Mortgage Software Market Value (US$ Million), Volume ('000 units/tons), and Market Share (2023-2028) Analysis by Type

o Conventional Mortages

o Adjustable-Rate Mortages

o Fixed-Rate Mortages

o Government-Insured Mortages

o Government- Insured Mortages

• Global Digital Mortgage Software Market Value (US$ Million), Volume ('000 units/tons), and Market Share (2023-2028) Analysis by Application

o Individual

o Corporate

• Global Digital Mortgage Software Market Value (US$ Million), Volume ('000 units/tons), and Market Share (2023-2028) Analysis by Region

o North America Digital Mortgage Software Market

US

Canada

o Latin America Digital Mortgage Software Market

Brazil

Mexico

Rest of Latin America

o Western Europe Digital Mortgage Software Market

Germany

UK

France

Spain

Italy

Benelux

Nordic

Rest of Western Europe

o Eastern Europe Digital Mortgage Software Market

Russia

Poland

Hungary

Other CIS Countries

Rest of Eastern Europe

o Asia Pacific Digital Mortgage Software Market

China

Japan

India

South Korea

Australia

ASEAN

• Indonesia

• Thailand

• Philippines

• Vietnam

• Malaysia

• Rest of ASEAN

Rest of Asia Pacific

o Middle East & Africa Digital Mortgage Software Market

GCC

• Saudi Arabia (KSA)

• United Arab Emirates (UAE)

• Rest of the GCC

South Africa

Nigeria

Turkey

Rest of the Middle East & Africa

• Leading Companies and Market Players

o ICE Mortgage Technology Inc.

o Roostify

o HW Media LLC

o SimpleNexus

o StreamLoan

o Blue Sage Solutions

o Cloudvirga

o Salesforce Inc.

o Maxwell Lender Solutions Inc.

For more information about this https://store.rationalstat.com/store/global-digital-mortgage-software-market/

Key Questions Answered in the Digital Mortgage Software Report:

• What will be the market value of the global digital mortgage software market by 2028?

• What is the market size of the global digital mortgage software market?

• What are the market drivers of the global digital mortgage software market?

• What are the key trends in the global digital mortgage software market?

• Which is the leading region in the global digital mortgage software market?

• What are the major companies operating in the global digital mortgage software market?

• What are the market shares by key segments in the global digital mortgage software market?

Kimberly Shaw,

Content and Press Manager

RationalStat LLC

sales@rationalstat.com

Phone: +1 302 803 5429

RationalStat is an end-to-end global market intelligence and consulting company that provides comprehensive market research reports, customized strategy, and consulting studies. The company has sales offices in India, Mexico, and the US to support global and diversified businesses. The company has over 80 consultants and industry experts, developing more than 850 market research and industry reports for its report store annually.

RationalStat has strategic partnerships with leading data analytics and consumer research companies to cater to the client's needs. Additional services offered by the company include consumer research, country reports, risk reports, valuations and advisory, financial research, due diligence, procurement and supply chain research, data analytics, and analytical dashboards.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Digital Mortgage Software Market Analysis and Forecast, 2023-2028 here

News-ID: 3086828 • Views: …

More Releases from RationalStat LLC

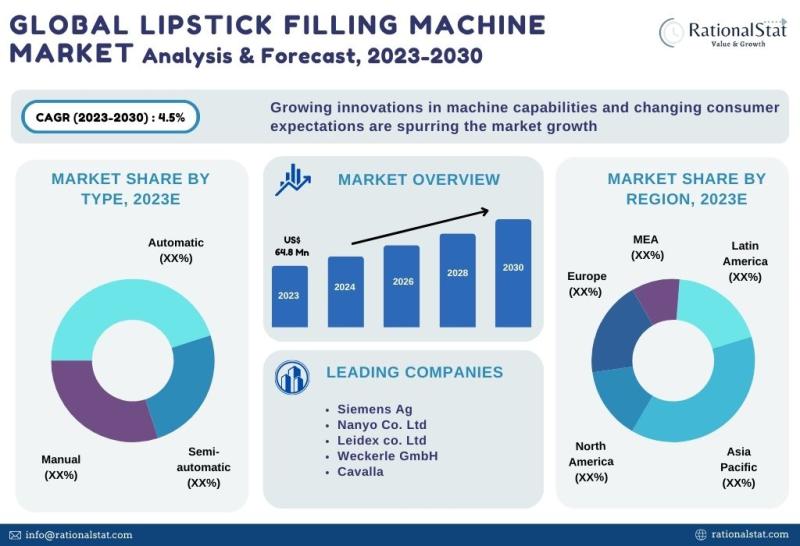

Latest Market Study | Global Lipstick Filling Machine Market Size, Share, & Fore …

The global lipstick filling machine market is expected to reach US$ 88.2 million by 2030, with an annual growth rate of more than 4.5%.

According to RationalStat's recent industry analysis, the Global Lipstick Filling Machine Market value is estimated at US$ 64.8 million in 2023 and is expected to rise at a strong CAGR of over 4.5% over the forecast period of 2023-2030.

Market Definition, Market Scope, and Report Overview

A lipstick…

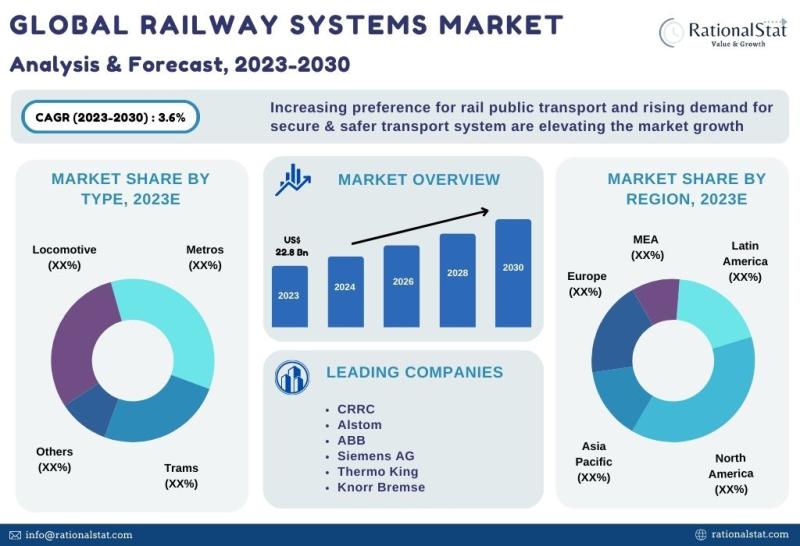

Published Market Report | Global Railway Systems Market Size, Share, & Forecast …

The global railway systems market is expected to reach US$ 29.2 billion by 2030, with an annual growth rate of more than 3.6%.

According to RationalStat's recent industry analysis, the Global Railway Systems Market value is estimated at US$ 22.8 billion in 2023 and is expected to rise at a strong CAGR of over 3.6% over the forecast period of 2023-2030.

Market Definition, Market Scope, and Report Overview

Railway systems, also known…

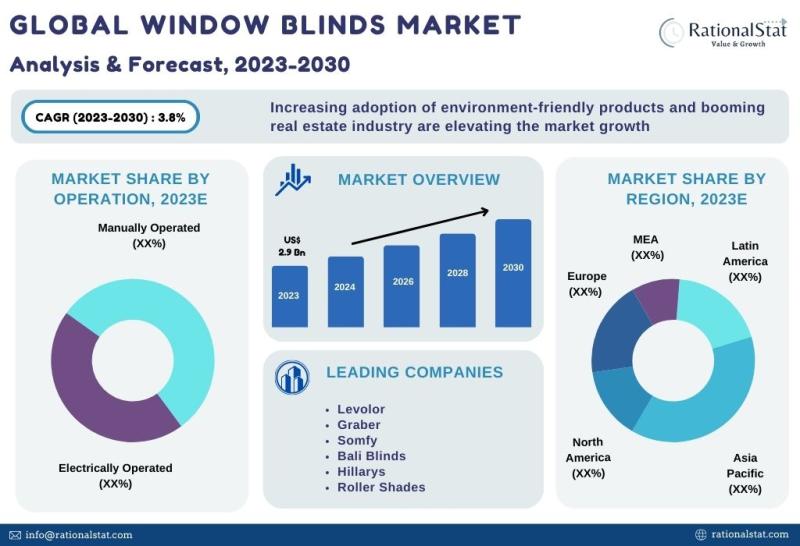

Published Market Report | Global Window Blinds Market Size, Share, & Forecast 20 …

The global window blinds market is expected to reach US$ 3.7 billion by 2030, with an annual growth rate of more than 3.8%.

According to RationalStat's most recent industry analysis, the Global Window Blinds Market value is estimated at US$ 2.9 billion in 2023 and is expected to rise at a strong CAGR of over 3.8% over the forecast period of 2023-2030.

Market Definition, Market Scope, and Report Overview

Window blinds are…

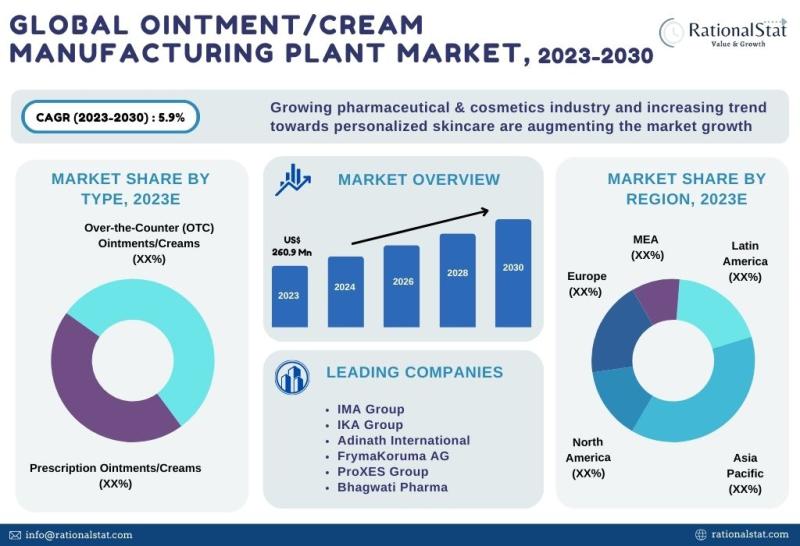

Ointment and Cream Manufacturing Plant Market Report 2023 | Ointment and Cream M …

The global ointment and cream manufacturing plant market is expected to approach US$ 388.7 million by 2030, with an annual growth rate of more than 5.9%

Global Ointment and Cream Manufacturing Plant Market is valued at US$ 260.9 million in 2023 and is expected to grow at a significant CAGR of over 5.9% over the forecast period of 2023-2030, according to the published market report by RationalStat

Market Definition, Market…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…