Press release

Indian Credit Card Market Outlook to 2027: Ken Research

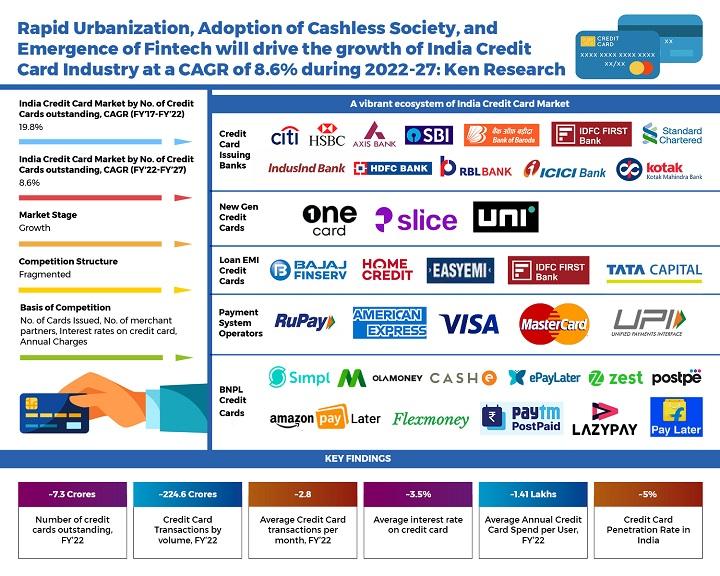

Competitive Landscape Of Indian Credit Card Industry, 2022Traditionally, Indian Credit Card Industry has been dominated by banks such as HDFC, SBI, ICICI and Axis. However, FinTechs such as Slice, OneCard, Uni Cards, PostPe, LazyPay are disrupting the banking space by changing the whole ecosystem of how banks traditionally work and bringing in a digital change across all segments. In the last few years, the credit space has seen some of the most popular offerings globally by neobanks. New players are entering the credit space in India and have started providing credit cards and digital lending via BNPL, EMI and other services. These FinTech start-ups are also partnering with traditional banks to launch new products and services in the untapped market. These Credit Card issuing Platforms in India compete on the basis of user-friendly interface, easy and quick KYC norms, advertisement, wide range of investment options they offer, EMI/loans, NIP and low transaction fees. One of the major competition parameters is facilitation of secure transactions, rewards and cashbacks provided for traction of users, hassle free payments without waiting for OTPs, transparency and service diversification such as wallet options, using virtual credit cards as mode of payment for buying goods/services instead of fiat currency being provided by the credit card issuing platforms to their users. Credit card companies often offer 0% APR on purchases and/or balance transfers for a limited period of time with better promotional incentives in case of personal cards which has led to higher issuance of these cards when compared to credit cards issued for commercial purposes. However, in coming years, the international credit card issuing platforms are eyeing a piece of the Indian credit card, either through independent operations or co-branding partnerships. In essence, the credit card industry has a lot more potential to flourish across the country if its pain points can be resolved fast, paving the path for a robust penetration of Credit cards

Apart from covering comparison dynamics between major credit card issuing platforms in India, the report also provides comprehensive insights on the company profiles of leading fintech's and bank in the ecosystem. The profiles of fintech's cover various parameters such as Company Overview, About the Company, Revenue Model, Funding and Investors, Key Features, Fee Structure, Product Offered, Strengths, Recent Developments, Key Takeaways and Financials and profiles of banks incorporates Bank Overview, About the Company, Business Model, Product Offered, Key Features, Strengths, Recent Developments and Key Takeaways.

To learn more about this report Download a Free Sample Report: https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2Mzcw

Future Outlook and Projections of Indian Credit Card Industry, 2023-2027E

Indian credit card industry is expected to expand with a CAGR of XX% in between FY'22 and FY'27 on the basis of revenue generated. It is anticipated that credit card industry will grow at a substantial rate owing to factors such as due to wider acceptability at shops and better product offerings in a competitive landscape in the coming years. India has been culturally conservative towards credit and it is always seen as a debt trap instrument. But new-age start-ups are very focused on changing this mentality by creating awareness about how credit cards and BNPL can be used for daily expenditure. Many new FinTechs will be entering the Indian credit card space by offering credit cards to individuals and corporates. All FinTechs in this space are trying to attract customers through their digital offerings and will witness significant growth in new credit card customers in the coming years. FinTechs are also focusing on bringing out co-branded cards with features and rewards dedicated to a segment. Co-branding has enabled banks to acquire customers fast and at a lower cost. There are co-branded credit cards in the market which are specifically designed for market players. Banks are also exploring partnerships with FinTech players to acquire new customers to their platforms. Banks are actively participating to provide open APIs to the FinTechs to leverage their ecosystem and on-board new credit card customers. Banks should focus on bringing these FinTechs on board with co-branded partnerships in the credit card space. The focus should be on introducing more propositions in the high-spend categories. This will help banks to not only provide better offerings to their existing customer base and acquire new customers but also earn higher interchange.

Some global players are providing best-in-class credit solutions with the latest mobile application features such as digital onboarding, enhanced UX/UI, single click payment, QR, token-based payments, dispute resolution, in-app support and spend analysis. Traditional players need to take a cue from these players to enhance their offerings in the coming future. The credit EMI market has traditionally been dominated by offline retail. However, due to advent of COVID-19, online buying is gaining traction among the customers. Players in this sector need to focus more on building the Omni channel ecosystem to cater to both the offline and online market.

Visit this Link: - Request for custom report: https://www.kenresearch.com/ask-customization.php?Frmdetails=NTk2Mzcw

Key Segments Covered in Indian Credit Card Industry

Indian Credit Card Market

By Purpose of Usage

Shopping/ Non-ATM Purpose

ATM Withdrawals

By Payment System Operator

Regular VISA

Peer to Peer Mastercard

Rupay

America Express

Others

By Type of Credit Card

Personal Credit Card

Commercial Credit Card

By Average Ticket Size of Loan Disbursement

Less than Rs. 25,000

Between Rs 25,000- Rs. 50,000

Between Rs. 50,000- Rs. 100,000

More than Rs. 100,000

Business Model Analysis of NewGen Cards

Business Model Analysis of BNPL Cards

Business Model Analysis of Loan EMI Cards

Overview of India Credit Card Industry

Comparison of Indian Credit Card Industry with Other Countries

Value Chain Analysis of Credit Cards

Scope for the Credit card in Semi-Urban and Rural India

Key Target Audience

Credit Card Issuing Banks

New Gen Credit Cards Players

Traders Loan EMI Credit Cards Players

Banking Institutions Payment System Operators

Regulatory Bodies BNPL Credit Cards Players

FinTechs

Various International Digital Lending Platforms and Players

New Entrants in Credit Card Space

Potential Credit Card Users

Time Period Captured in the Report:

Historical Period: FY'2017-FY'2022

Forecast Period: FY'2022-FY'2027F

Indian Credit Card Industry Players/Ecosystem

Credit Card Issuing Banks

HDFC Bank

SBI

ICICI

Axis Bank

IDFC Bank

RBL

IndusInd Bank

Citibank

Bank of Baroda

Standard Chartered Bank

Kotak Bank

South Indian Bank

Request free 30 minutes analyst call: https://www.kenresearch.com/book-a-discovery-call.php?Frmdetails=NTk2Mzcw

New Gen Credit Cards

Slice

OneCard

UniPay Card

Loan EMI Credit Cards

Bajaj Finserv

Tata Capital

HDFC EasyEMI

Home Credit India

Cards BNPL Credit Cards

Simpl

ZestMoney

LazyPay

CASHe

PostPe

Amazon Pay Later

Flipkart Pay Later

Ola Postpaid

Paytm Postpaid

Flexmoney

ICICI PayLater

Payment System Operators

Visa

Mastercard

American Express

Rupay

UPI

Key Topics Covered in the Report

Overview and Genesis of Indian Credit Card Market

India Credit Card Industry Cycle

Overview of Credit Card Services/ Products

Consumption Expenditure and Borrowing Trends

Emerging business models- Loan against Credit Cards

Socio-Demographic Outlook of India

Economic Outlook of India

Bank Loan Rates

Financing Options in India

Overview of India's Banking Industry

Digital Payment Growth v/s Cash Payment Growth

India Credit Card Industry Introduction

Comparison of Indian Credit Card Industry with Other Countries

Ecosystem of Entities in the Indian Credit Card Industry

Value Chain Analysis of Credit Cards

India Credit Card Market Sizing on the basis of number of credit cards outstanding, Number of Credit Cards Issued by Issuer Bank. Credit Card Transaction by Volume & Value and Annual Credit Card Spend and Monthly Transactions

India Credit Card Market Segmentation (By Purpose of Usage, By Payment System Operator, By Type of Credit Card, By Average Ticket Size of Loan Disbursement).

Business Model Analysis of NewGen Cards

Cross Comparison of Major Players in the NewGen Cards Segment

Business Model Analysis of BNPL Cards

Cross Comparison of Major Players in the BNPL Cards Segment

Business Model Analysis of Loan EMI Cards

Cross Comparison of Major Players in the Loan EMI Cards Segment

Trends and Developments

Growth Drivers of the Indian Credit Card Industry

Restraints and Challenges

Alternative Assessment for NIP (No-Income-Proof) Customers for Credit Card Offerings

Collection risks associated with credit card

Key Metrics of Credit Card Issuers in India

Government Initiatives in the Indian Credit Card Industry

Pradhan Mantri Jan Dhan Yojana (PMJDY)

Pradhan Mantri Jan Dhan Awas Yojana (PMAY)

Initiatives to Promote Access to Data & Innovation

Regulatory Sandbox

Launch of India Stack

Recognising P2P Lenders

Increase in number of Fintech start-ups

Growth of Digital Lending,

Credit Growth in Rural India

Evaluation of KYC Norms

Company profile of major Bank players operating in the ecosystem (Bank Overview, About the Company, Business Model, Product Offered, Key Features, Strengths, Recent Developments and Key Takeaways)

Company profile of major FinTechs players operating in the ecosystem (Company Overview, About the Company, Revenue Model, Funding and Investors, Key Features, Fee Structure, Product Offered, Strengths, Recent Developments, Key Takeaways and Financials)

Analyst Recommendations

Industry Speaks

For More Insights On Market Intelligence, Refer To The Link Below: -

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/indian-credit-card-industry/596370-93.html

Related Reports by ken Research: -

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/india-buy-now-pay-later-market-outlook-to-2026/515064-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/asia-credit-cards-market-outlook/289128-93.html

India

Ken Research is a Market Research and Consulting Firm, based out of India, Indonesia and UAE. Since 2011, we have been assisting clients globally with our Syndicate and Bespoke Market Research and Advisory Services.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Indian Credit Card Market Outlook to 2027: Ken Research here

News-ID: 3082917 • Views: …

More Releases from Ken Research Pvt .Ltd

Ken Research Stated KSA Generative AI Market to Reach USD 230 million

Comprehensive market analysis maps exponential growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the Kingdom's rapidly evolving Generative AI ecosystem.

Delhi, India - January 14, 2026 - Ken Research released its strategic market analysis titled "KSA Generative AI Market Outlook to 2030," revealing that the current market size is valued at USD 230 million, based on a five-year historical analysis. The detailed study outlines how the market is…

India Cement Market - Ken Research Stated the Sector Valued at ~USD 430 million …

Comprehensive market analysis maps growth trajectory, investment opportunities, and strategic imperatives for industry leaders in India's rapidly expanding cement industry.

Delhi, India - January 16, 2026 - Ken Research released its strategic market analysis titled "India Cement Market," revealing that the current market size is valued at USD 430 million tonnes, based on a five-year historical analysis. The detailed study outlines how the market is poised for significant expansion, driven by…

Ken Research Stated Saudi Arabia's Long Term Care Private Insurance Market to Re …

Comprehensive market analysis maps exponential growth trajectory, investment opportunities, and strategic imperatives for industry leaders in Saudi Arabia's long-term care private insurance ecosystem.

Delhi, India - January 14, 2026 - Ken Research released its strategic market analysis titled "Saudi Arabia Long Term Care Private Insurance Market Outlook to 2030", revealing that the current market size is valued at USD 1.4 billion, based on a five-year historical analysis. The detailed study outlines…

Europe Textile Market - Ken Research Stated the Sector Valued at ~USD 180 billio …

Comprehensive market analysis maps exponential growth trajectory, investment opportunities, and strategic imperatives for industry leaders in Europe's rapidly evolving textile ecosystem.

Delhi, India - January 14, 2026 - Ken Research released its strategic market analysis titled "Europe Textile Market Outlook to 2030," revealing that the current market size is valued at USD 180 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised to expand,…

More Releases for Card

Gift Card and Incentive Card Market Set for Explosive Growth | National Gift Car …

A new business intelligence report released by AMA with title "Gift Card and Incentive Card Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Gift Card and Incentive Card Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through…

IC Card/Smart Card Market 2022 | Detailed Report

The IC Card/Smart Card research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the IC Card/Smart Card research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Download FREE Sample Report…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future.

A new report published by Allied Market Research, titled, Prepaid Card Market…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future

Prepaid Card Market is projected to grow at a CAGR of 22.7%…

Card Intelligent Lock Market Report 2018: Segmentation by Type (Magnetic card Lo …

Global Card Intelligent Lock market research report provides company profile for Tri-circle, Dessmann, Royalwand, Bangpai, ZKTeco, Schlage, KEYLOCK, Yale, Tenon, KAADAS, BE-TECH and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also…

Prepaid Card Market Report 2018: Segmentation by Card Type (Single-purpose prepa …

Global Prepaid Card market research report provides company profile for Green Dot Corporation, NetSpend Holdings, Inc., H&R Block Inc., American Express Company, JPMorgan Chase & Co., PayPal Holdings, Inc., BBVA Compass Bancshares, Inc. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…