Press release

Digital Banking Platforms Market Size Will Reach USD 131.65 Billion by 2032, at Expected CAGR of 19.9%: Polaris Market Research

Digital Banking Platform Market: By Size, Latest Trends, Share, Huge Growth, Segments, Analysis and Forecast, 2030Polaris Market Research has recently published an insightful research study titled Digital Banking Platform Market: By Size, Latest Trends, Share, Huge Growth, Segments, Analysis and Forecast, 2030, providing a comprehensive analysis of the market structure based on usage and type. The report evaluates the Digital Banking Platform Market size and share by conducting a thorough examination within a specific timeframe. With a focus on the market, the study delves into consumption patterns, emerging trends, and sales performance in key countries. To begin with, the report establishes the market's concept and scope, encompassing product classifications, application areas, and the geographic coverage of the entire study.

Get Sample PDF with Report Insight @ https://www.polarismarketresearch.com/industry-analysis/digital-banking-platforms-market/request-for-sample

The report features the recent and upcoming growth trends of this business and explains the regional spectrum of the market. The dynamics, such as drivers, restraints, and opportunities, have been presented with their corresponding impact analysis. The research report presents a comprehensive segmentation analysis, examining all significant segments in terms of Digital Banking Platform Market growth, share, growth rate, and other essential factors. Additionally, it includes an attractiveness index for each segment, enabling market players to identify the most profitable revenue opportunities within the market. This analysis provides valuable insights for businesses aiming to establish a strong market presence.

Competitive Landscape Analysis:

The report shifts its attention to the present competitive landscape within the market. It furnishes fundamental details, data, product introductions, and more pertaining to Digital Banking Platform Market key players. The comprehensive examination of the market's competitive scenario will aid players in formulating innovative strategies to maintain their position in the industry. Furthermore, the report encompasses recent collaborations, mergers, acquisitions, and partnerships, along with an assessment of regulatory frameworks across various regions that influence the trajectory of the Digital Banking Platform Market.

Top Key Players:

Alkami

Apiture

Appway

Backbase

BNY Mellon

CR2

EdgeVerve

ebankIT

Finastra

Fiserv

Intellect Design Arena

Mambu

MuleSoft

nCino

NCR

NETinfo

Oracle

SAP

Sopra Banking Software

TCS

Technisys

Temenos

TPS

Velmie and Worldline.

Latest Market Developments:

This report provides an analytical overview of the market, including its current trends and future projections

The trade scenarios of the products and services in particular segments are detailed in the report

It offers insights into the key drivers, restraints, and opportunities, along with a comprehensive analysis of significant Digital Banking Platform Market trends

Porter's five forces analysis highlights the bargaining power of buyers and suppliers within the market. The report provides a detailed analysis, focusing on the level of competitive intensity.

It includes information on market opportunities, allowing for the identification of potential regions and countries to explore.

It offers comprehensive details regarding new products, unexplored geographical markets, recent developments, and investment activities

Inquire your Questions If any Before Purchasing this Report @ https://www.polarismarketresearch.com/industry-analysis/digital-banking-platforms-market/inquire-before-buying

Regional Analysis:

Moreover, the research offers insightful forecasts for consumption, production, sales, and other key aspects of the market. It encompasses a comprehensive analysis of major regions and countries, enabling industry players to explore untapped regional markets and formulate targeted strategies accordingly. This section also provides estimations of Digital Banking Platform Market share and growth rate for each region, country, and sub-region during the predicted period.

Key Regions Covered in This Report Are:

North America (United States, Canada, and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and the Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and the rest of South America)

The Middle East and Africa (Saudi Arabia, United Arab Emirates, Egypt, South Africa, and the Rest of the Middle East and Africa)

Additionally, the report covers other crucial aspects of the market, including product definition, various applications, revenue and demand analysis, as well as supply statistics. The report's analysts have thoroughly examined investments in research and development, the influence of changing economies, and consumer behaviors to determine the factors that will drive the overall Digital Banking Platform Market growth. Readers of the report will also have access to a comprehensive study on market positioning, which includes factors such as target clients, brand strategy, and price strategy.

Browse Additional Details on Digital Banking Platform Market @ https://www.polarismarketresearch.com/industry-analysis/digital-banking-platforms-market

Key Questions Answered in The Report:

Which are the top players in the market?

How will the market change in the next years?

What are the drivers and restraints of the market?

Which regional market will show the highest growth?

What will be the CAGR and size of the market throughout the forecast period?

How have the players or the leading market firms addressed the challenges faced during the pandemic?

What growth opportunities does the market offer?

Contact Us:

Polaris Market Research

Email: sales@polarismarketresearch.com

Ph: +1-929 297-9727

About Us

Polaris Market Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Polaris Market Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We at Polaris are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semiconductors, chemicals, automotive, and aerospace & defense, among different ventures, present globally.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Platforms Market Size Will Reach USD 131.65 Billion by 2032, at Expected CAGR of 19.9%: Polaris Market Research here

News-ID: 3079490 • Views: …

More Releases from Polaris Market Research & Consulting

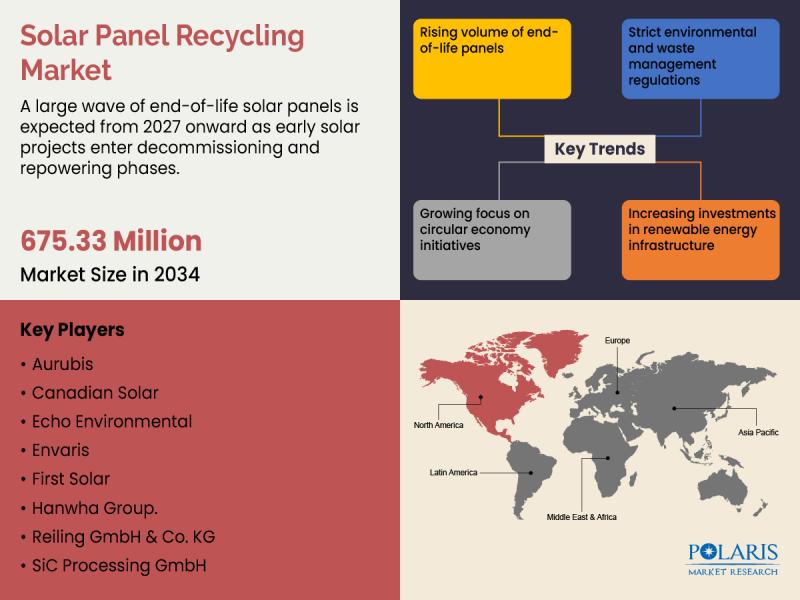

Outlook for the Solar Panel Recycling Market Through 2034: Key Trends, Investmen …

Market Size and Share:

Global Solar Panel Recycling Market is currently valued at USD 353.88 million in 2025 and is anticipated to generate an estimated revenue of USD 675.33 million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 7.5% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2026 - 2034

Polaris Market Research has introduced the latest market…

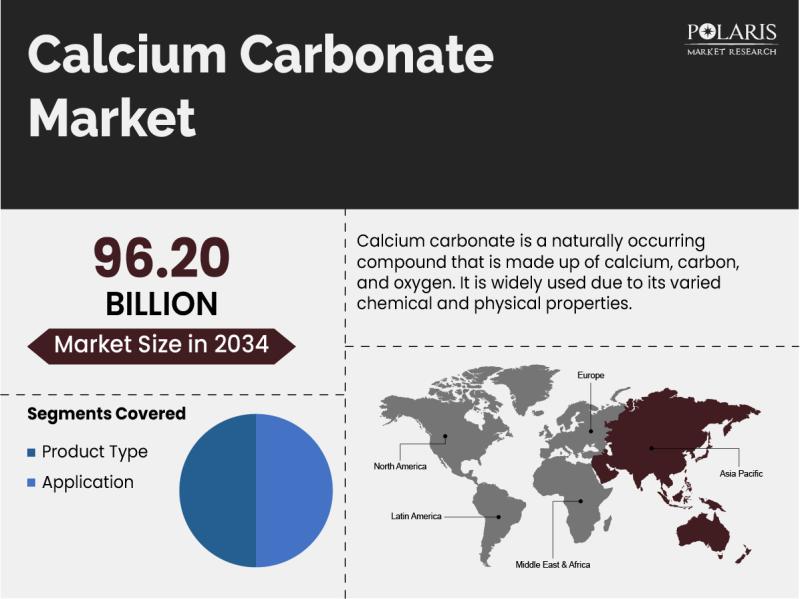

Calcium Carbonate Market Projected to Reach USD 96.20 Billion by 2034, Growing a …

The quantitative market research report published by Polaris Market Research on Calcium Carbonate Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Calcium Carbonate Market size, financial data, and projected future growth. All the information presented…

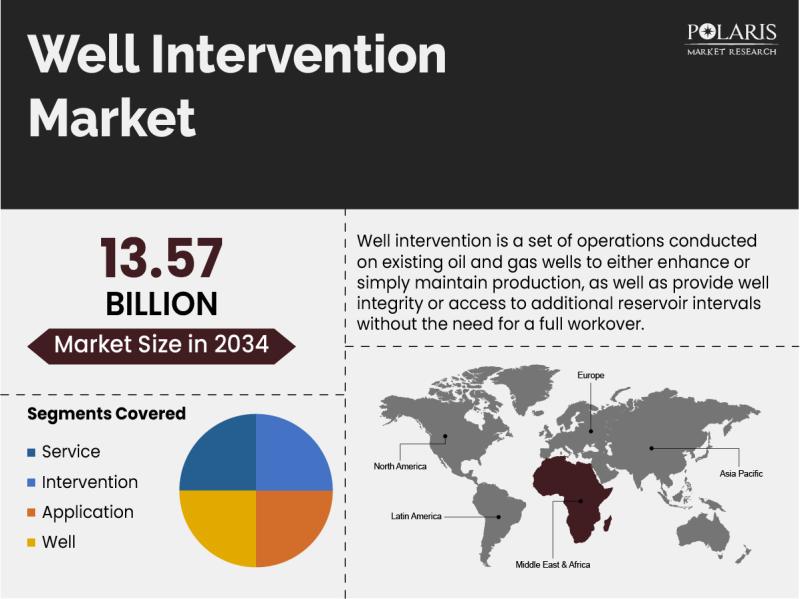

Well Intervention Market Size And Booming Worldwide From 2026-2034 | Archer Limi …

Market Size and Share:

Global Well Intervention Market is currently valued at USD 9.95 billion in 2025 and is anticipated to generate an estimated revenue of USD 13.57 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 3.5% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2026 - 2034

Polaris Market Research has introduced the latest market research…

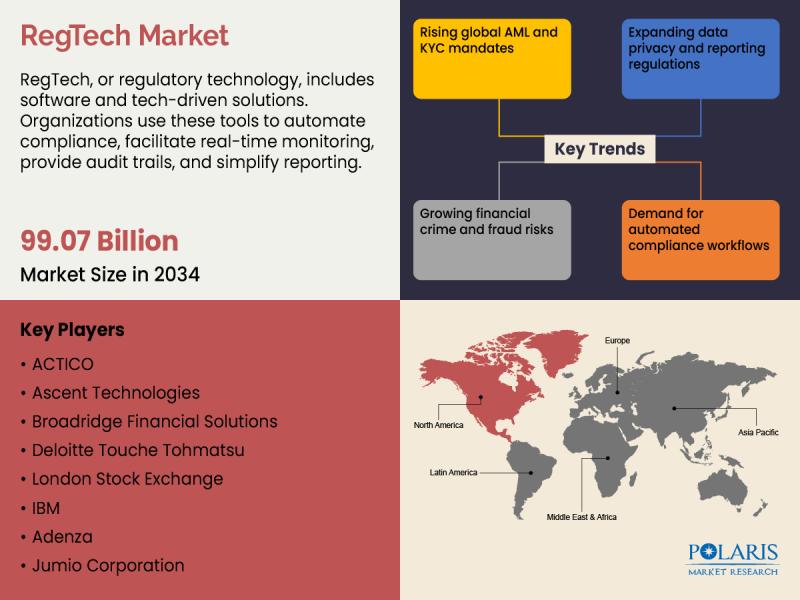

RegTech Market to Reach USD 99.07 Billion by 2034, Expanding at a 21.5% CAGR Ami …

The quantitative market research report published by Polaris Market Research on RegTech Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, RegTech Market size, financial data, and projected future growth. All the information presented in the…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…