Press release

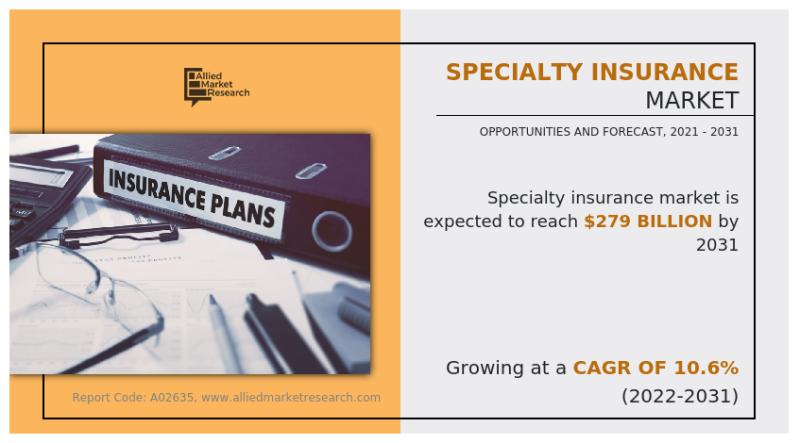

Specialty Insurance Market Report -2031 | Industry Trends, Market Share, Size, Growth and Opportunities

Decline in asset values, lower investment returns, and low interest rates requiring insurers to adjust premiums & accelerate flexible cash flows are the major specialty insurance market trends. Moreover, increasing incorporation of technologies in the specialty insurance product offering is expected to boost the growth of the market.Download Free Sample Report: https://www.alliedmarketresearch.com/request-sample/2973

The specialty insurance market was valued at $104.7 billion in 2021, and is estimated to reach $279 billion by 2031, growing at a CAGR of 10.6% from 2022 to 2031.

Businesses involved in a high-risk holding prefer specialty insurance plans, which help with an unusual coverage that are not covered under standard policies. Moreover, unusual characteristics such as diamond necklace, exotic insurance, title insurance, body part insurance, and jet ski insurance are covered in the specialty insurance. Factors such as surge in demand for specialized expertise, technological advancements, and numerous benefits provided by specialty insurance along with covering unique needs & preferences propel the global specialty insurance market growth. In addition, incorporation of technologies in specialty insurance product lines and untapped potential of emerging economies are expected to provide lucrative opportunities for the specialty insurance solution providers in the coming years.

Furthermore, major market players have undertaken various strategies to increase the competition and offer enhanced services to their customers. For instance, in March 2023, Falvey Insurance Group has expanded its product offering with the launch of inland marine coverage to further its growth in specialty markets. This product introduction of an inland marine coverage product is seen as a continuation of this development as well as an expansion in the specialty market, given the success of the company in the maritime transportation industries. Along with being a logical complement to the current portfolio of Falvey, it brought on a whole team of experts to launch its inland marine product.

Buy Now: https://www.alliedmarketresearch.com/checkout-final/144e14141723d78cf4421b091eec1752

Furthermore, increase in collaboration among the key players in the market is expected to propel the growth of the market. For instance, in January 2023, specialty insurer Relm Insurance Ltd. announced an expansion of its strategic fronting partnership with Trisura Specialty Insurance Company ("Trisura"), enabling the Bermuda-domiciled carrier to provide capacity in support of AM-Best rated paper for U.S. digital asset risks. Relm will be able to offer a variety of Financial and Professional Lines and specialized coverage options (including D&O, Cyber, Tech E&O, Crime, and more) on AM Best rated paper owing to the full-fronting arrangement with Trisura, which will cover the book of Relm. The reinsurance broker is projected to be Howden Broking Group.

Moreover, a collaboration in the surplus lines insurance market has been announced by Trean Insurance Group, Inc., a top supplier of goods and services to the specialty insurance market, and Beat Capital Partners Americas, a long-term investor with expertise in the insurance sector. Trean, via its recently formed subsidiary Benchmark Specialty Insurance Company, is expected to offer E&S products through its exclusive relationship with Beat, giving Trean its first partnership in the large non-admitted insurance underwriting market.

Further, in January 2023, Starfish Specialty Insurance announced that it has launched a new program designed for Community Associations. The "CAProtect" program offers D&O, crime, and excess liability coverages for non-profit planned unit projects, condominiums, businesses, and homeowner's organizations. As a result, surge in demand for specialize expertise among businesses and other end users is propelling the demand for specialty insurance, globally.

For Purchase Enquiry: https://www.alliedmarketresearch.com/purchase-enquiry/2973

On the basis of type, the marine, aviation, & transport (MAT) insurance segment acquired the highest specialty insurance market share in 2021. This is attributed to the fact that marine insurance protects ship owners from financial loss occurring through damaged or lost cargo. In addition, it covers the amount for loss incurred to the freight and events such as natural disasters, vehicle accidents, cargo abandonment, customs rejection, acts of war, and piracy.

On the basis of region, the specialty insurance market size was dominated by Europe in 2021. This is attributed to increased trade-related political risk such as counterparty non-payment, non-delivery for pre-paid goods, embargo, and license cancellation. However, Asia-Pacific is expected to grow at the fastest CAGR during the forecast period, due to increased flow of imports and rise in number of small & medium enterprises.

The COVID-19 pandemic has a negative impact on the specialty insurance industry. Sectors such as aviation, marine, and construction have been affected by halt in global travel, trade, and new builds during the crisis. Therefore, use of underlying assets has rapidly reduced, and losses occurred in these sectors have led to decline in specialty insurance coverages. This, in turn, has declined the demand for specialty insurance products during the global health crisis.

Connect to Analyst: https://www.alliedmarketresearch.com/connect-to-analyst/2973

Key findings of the study

By end user, the business segment led the specialty insurance market trends in terms of revenue in 2021.

By distribution channel, the brokers segment accounted for the highest specialty insurance market share in 2021.

By region, Europe generated the highest revenue of specialty insurance market in 2021.

The key players profiled in the specialty insurance market analysis are AXA, American International Group, Inc., Allianz, ASSICURAZIONI GENERALI S.P.A., Berkshire Hathaway Inc., Chubb, Munich Re, PICC, Tokio Marine HCC, and Zurich. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Specialty Insurance Market Report -2031 | Industry Trends, Market Share, Size, Growth and Opportunities here

News-ID: 3074911 • Views: …

More Releases from Allied Market Research

Autonomous Aircraft Radars & Transponders Market Overview, Size, Share, Top Comp …

The global autonomous aircraft radars & transponders market is experiencing a significant growth due to increasing procurement of autonomous UAVs globally. Autonomous aircraft is a fully automated manned or unmanned aircraft that require minimum or no human intervention in its operations. Autonomous aircrafts radars & transponders are equipped with technology to provide situational awareness, cooperative surveillance, extended squitter message, and autonomous navigation, among others. However, installation of such system on…

Autonomous Aircraft Radars & Transponders Market Overview, Size, Share, Top Comp …

The global autonomous aircraft radars & transponders market is experiencing a significant growth due to increasing procurement of autonomous UAVs globally. Autonomous aircraft is a fully automated manned or unmanned aircraft that require minimum or no human intervention in its operations. Autonomous aircrafts radars & transponders are equipped with technology to provide situational awareness, cooperative surveillance, extended squitter message, and autonomous navigation, among others. However, installation of such system on…

Indoor Farming Equipment Market Outlook, Top Key Players Analysis, Current Trend …

The report highlights numerous factors that influence the growth of the global Indoor farming equipment market such as market demand & forecast and qualitative and quantitative information. The qualitative data of market report includes pricing analysis, key regulations, macroeconomic factors, microeconomic factors, key impacting factors, company share analysis, market dynamics & challenges, strategic growth initiatives, and competition intelligence. The study cracks market demand in 15+ high-growth markets in the…

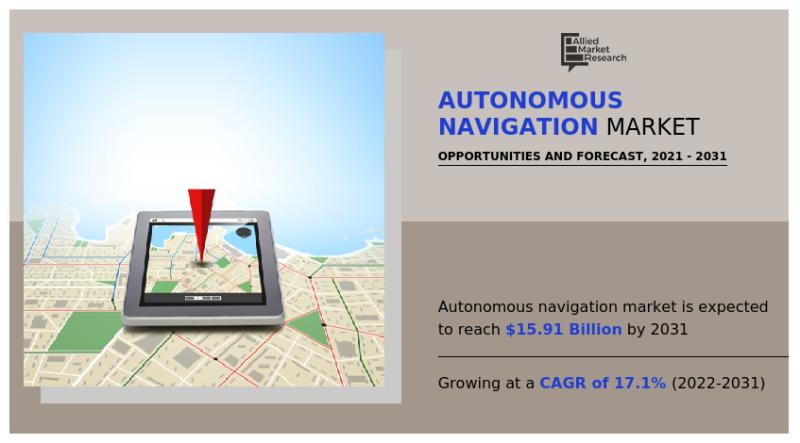

Autonomous Navigation Market Analysis and Forecast with a CAGR of 17.1% (2022-20 …

The global autonomous navigation market garnered $3.27 billion in 2021, and is estimated to generate $15.91 billion by 2031, manifesting a CAGR of 17.1% from 2022 to 2031.

Increase in demand for sense & avoid systems in autonomous system, rise in adoption of autonomous robot in commercial & military applications, and surge in demand for real-time data in military applications drive the growth of the global autonomous navigation market. During…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…