Press release

Global Automotive Finance Market Analysis, Key Trends, Growth Opportunities, Challenges And Key Players By 2029

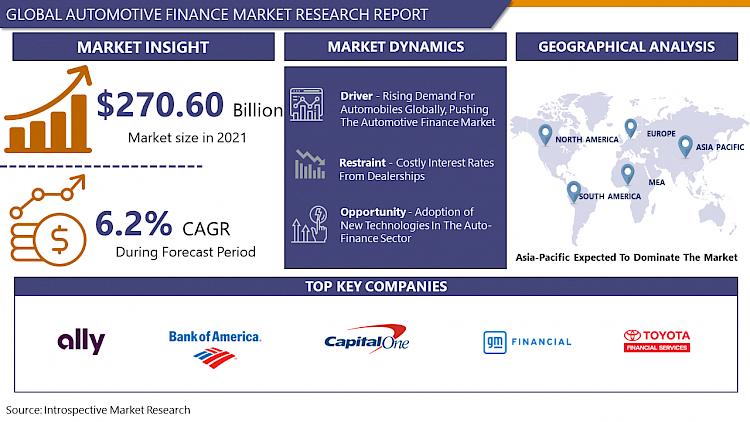

Market Overview:Global Automotive Finance Market Size Was Valued At USD 270.60 Billion In 2021 And Is Projected To Reach USD 412.29 Billion By 2028, Growing At A CAGR Of 6.2% From 2022 To 2028.

Car financing is provided by financing firms or specialized automobile manufacturers, offering a range of financial solutions such as loans and leases that enable buyers to purchase vehicles. The distribution of vehicle loan products and services is primarily carried out by original equipment manufacturers (OEMs), banks, credit unions, brokers, and other financial organizations. Auto financing is a service that allows borrowers to acquire vehicles without the need to make full upfront payments. Instead, they can opt for financing options that suit their financial situation. Automotive financing companies are leveraging loan structuring and automated decision-making to swiftly approve or decline online applications within minutes. The incorporation of machine learning and artificial intelligence tools enables these companies to efficiently manage both new and used auto loans.

Read More: https://introspectivemarketresearch.com/reports/automotive-finance-market/

Market Dynamics:

Driver:

As incomes rise and living standards improve in many regions, more individuals have the financial means to purchase vehicles. This increased affordability drives the demand for automotive finance as consumers seek financing options to acquire their desired vehicles. Rapid urbanization and the resulting increase in population density contribute to greater transportation needs. As more people reside in urban areas, the demand for personal vehicles, such as cars and motorcycles, rises. Automotive finance enables individuals to access the necessary funds for vehicle ownership, supporting the growth of the automotive market.

Opportunities:

The integration of digital technologies and online platforms in the auto-finance sector offers opportunities for streamlining processes and enhancing customer experience. Online platforms can provide efficient loan application and approval processes, automated document verification, and convenient payment options, making it easier for customers to access and manage their auto financing. The increasing use of mobile devices opens avenues for the development of mobile apps and fintech solutions in the auto-finance sector.

Key Chapter Will Be Provided In The Report

• Patent Analysis

• Regulatory Framework

• Technology Roadmap

• BCG Matrix

• Heat Map Analysis

• Price Trend Analysis

• Investment Analysis

• Company Profiling and Competitive Positioning

• Industry Value Chain Analysis

• Market Dynamics and Factors

• Porter's Five Forces Analysis

• Pestle Analysis

Make confident decisions using our insights and analysis | Request a PDF Sample Report:

https://introspectivemarketresearch.com/request/16254

Key Prominent Players In The Automotive Finance Market:

• Ally Financial

• Bank of America

• Capital One

• Chase Auto Finance

• Daimler Financial Services

• Ford Motor Credit Company

• GM Financial Inc.

• Hitachi Capital

• Toyota Financial Services

• Volkswagen Financial Services and other major players.

Segmentation of the Automotive Finance Market:

The report will help the Automotive Finance manufacturers, new entrants, and industry chain related companies in this market with information on the revenues, production, and average price for the overall market and the sub-segments across the different segments, Provider Type Finance Type, Vehicle Condition, and regions.

By Provider Type

• Banks

• OEMs

• Others

By Finance Type

• Loan

• Leasing

By Vehicle Condition

• New

• Used

Regional Analysis of Automotive Finance Market

The Asia Pacific is dominating the Automotive Finance Market. The expanding number of favorable government measures in nations like India, Japan, and China to stimulate automobile sector expansion while preserving customer interest is likely to generate growth prospects for regional markets. The region is seeing an increase in the selling of vehicles to meet people's needs. As a result, the rise of the regional market is predicted. Asia Pacific's fast-growing economies, where car finance is still a relatively new notion. Banks must become accustomed to structuring lending terms, while captives must adjust to high entrance costs and the necessity for extensive market education. Asia-Pacific leads the automotive financing market, followed by North America and Europe. Due to growing demand from Asia-Pacific, the loan market for used cars is likely to rise at a higher rate.

• North America (U.S., Canada, Mexico)

• Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

• Western Europe (Germany, U.K., France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

• Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

• Middle East & Africa (Turkey, Saudi Arabia, Bahrain, Kuwait, Qatar, UAE, Israel, South Africa)

• South America (Brazil, Argentina, Rest of SA)

Enquire For Customization in The Report @

https://introspectivemarketresearch.com/custom-research/16254

COVID-19 Impact Analysis on Automotive Finance Market

The coronavirus pandemic is wreaking havoc on the global economy, with plant closures, supply chain disruptions, and lockdowns reducing demand, making it impossible for financing businesses to stay afloat throughout the outbreak. However, organizations are delivering streamlined and straightforward online financing environments to their clients, therefore the market is likely to increase significantly during the forecast period. Due to the current economic instability, automobile buyers have been compelled to postpone the purchase of a new or used car. Despite the slowing of automobile sales, auto lenders will have to prepare for an increase in servicing activity, such as refinancing and extension requests. To speed up remote service processes, auto lenders are turning to digital solutions.

Table of Content:

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2: Executive Summary

Chapter 3: Growth Opportunities By Segment

3.1 By Provider Type

3.2 By Finance Type

3.3 By Vehicle Condition

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Automotive Finance Market by Provider Type

5.1 Automotive Finance Market Overview Snapshot and Growth Engine

5.2 Automotive Finance Market Overview

5.3 Banks

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Banks: Geographic Segmentation

Chapter 6: Automotive Finance Market by Finance Type

Chapter 7: Automotive Finance Market by Vehicle Condition

Chapter 8: Company Profiles and Competitive Analysis

Chapter 9: Global Automotive Finance Market Analysis, Insights and Forecast, 2016-2028

Chapter 10: North America Automotive Finance Market Analysis, Insights and Forecast, 2016-2028

Continue.

Buy the Latest Version of this Report @

https://introspectivemarketresearch.com/checkout/?user=1&_sid=16254

Read More Related Report: -

https://introspectivemarketresearch.com/reports/dtg-printing-machine-market/

https://introspectivemarketresearch.com/reports/algae-market/

https://introspectivemarketresearch.com/reports/outdoor-fire-pits-market/

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1 773 382 1049

About Us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assist our clients grow and have a successful impact on the market. Our team at IMR is ready to assist our clients flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, specialized in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyse extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Automotive Finance Market Analysis, Key Trends, Growth Opportunities, Challenges And Key Players By 2029 here

News-ID: 3073272 • Views: …

More Releases from Introspective Market Research

Absorbed Glass Mat (AGM) Separator Batteries Market To Reach USD 38.55 Billion b …

Absorbed Glass Mat (AGM) Separator Batteries Market was valued at USD 23.81 Billion in 2023 and is expected to reach USD 38.55 Billion by the year 2032.

Absorbed Glass Mat (AGM) batteries are advanced lead-acid batteries designed for higher electrical output, making them ideal for start-stop vehicle systems and increasingly popular in electric vehicles. Unlike conventional batteries, AGM batteries are sealed, maintenance-free, non-spillable, and highly resistant to vibrations, with improved…

Automotive Fuel Injection Systems Market: Business Research Analysis By 2032

Automotive Fuel Injection Systems are crucial for optimizing engine performance, fuel efficiency, and reducing emissions in modern vehicles. These systems, which include fuel injectors, a fuel pump, a pressure regulator, and an ECU, precisely control fuel delivery either through Direct Fuel Injection or Port Fuel Injection. With growing demand for fuel-efficient, environmentally-friendly vehicles, advanced technologies like Gasoline Direct Injection (GDI) and Common Rail Diesel Injection (CRDI) are driving market growth…

North America Coal to Liquid Market to Reach 3.02 Mn at CAGR 8.1% | DKRW Energy, …

North America Coal to Liquid Market Size Was Valued at USD 1.50 Billion in 2023, and is Projected to Reach USD 3.02 Billion by 2032, Growing at a CAGR of 8.1% From 2024-2032.

The North America Coal to Liquid (CTL) market is a niche but evolving segment within the broader energy and fuel industry. CTL technology involves converting coal into liquid hydrocarbons, such as diesel, gasoline, and other petroleum products, through…

India Green Hydrogen Market Next Big Thing | Adani Green Energy, JSW Energy, NTP …

IMR posted new studies guide on India Green Hydrogen Market Insights with self-defined Tables and charts in presentable format. In the Study you may locate new evolving Trends, Drivers, Restraints, Opportunities generated via targeting market related stakeholders. The boom of the India Green Hydrogen marketplace became specifically driven with the aid of the growing R&D spending internationally.

India Green Hydrogen Market Size Was Valued at USD 2.51 Billion in 2023, and…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…