Press release

Energy Trade Finance Market to Witness Major Growth by 2028 | Citi Bank, Tradeteq, Santander

The latest published Energy Trade Finance market study has assessed the future growth potential of the global and regional Energy Trade Finance market, providing information and useful statistics on market structure and size. The report aims to provide market information and strategic insights to help decision makers make informed investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyzes changing dynamics and emerging trends along with major drivers, challenges, opportunities and restraints in the Energy Trade Finance market. The study includes market share analysis and profiles of players such as Citi Bank (United States), Tradeteq (United Kingdom), Santander (United States), ANZ (Australia), ING Wholesale Banking (Netherlands), Standard Bank (South Africa), Marco Polo (Germany), Commerzbank (Germany), Rand Merchant Bank (South Africa), Asian Development Bank (Philippines).If you are a Energy Trade Finance manufacturer and want to review or understand the proposed policies and regulations, draft clear explanations of the stakes, potential winners and losers, and opportunities for improvement, this article will help you understand the pattern with impacting tendencies. Click To get SAMPLE PDF (Including Full TOC, Table & Figures) https://www.htfmarketreport.com/sample-report/3715086-global-energy-trade-finance-market

Trade finance refers to the representation of financial instruments and products that are used by companies to initialize international trade and commerce. Due to trade finance, it is easier for importers and exporters to transact business through trade. As with many other commodities, pricing volatility drives commercial strategy for the firms engaged in the commercial trade of petrol, gas, electricity, and other types of energy commodities. Trade-in petrol and gas requires huge amounts of capital to invest in exploration, extraction, and transportation along with high-tech, physical and digital infrastructure. As a result, companies engaged in the trade of petrol and gas have a need for energy trade finance. With the increasing demand for energy, the demand for trade finance is also increasing.

Major Highlights of the Energy Trade Finance Market report released by HTF MI

Energy Trade Finance Market Study by Type (Trade Credit, Cash Advances, Purchase Order Finance, Term Loan, Others), Commodity (Oil, Natural Gas, Electricity, Others)

Market Drivers

• Increasing Energy Consumption All Over the Globe

• Huge Capital Requirements in Energy Trade

Market Trend

• Increasing Preference for Renewable Energy Finance

• Rising Demand for Portfolio Management Team

Opportunities

• Increasing Demand from Developing Nation with Increasing Energy Needs

Challenges

• Exposure to Currency Risk

• Complex Structure of Energy Trade Finance

"In Jan 2021, Tradeteq, a trade finance firm that also provides energy trade finance, raised the US $9.4 Mn funding in a Series A funding round which it aims to use to incorporate both bank-to-bank and credit insurance distribution in its trade finance products into standardizing investments which could be bought and sold through private distribution networks. Tradeteq will use its funding to increase its geographical reach."

Revenue and Sales Estimates - Historical revenue and sales volumes are displayed and additional data is triangulated in a top down and bottom up approach to predict overall market size and forecast figures for the key regions covered in the report along with classified and well estimate - known reports. Species and end-use industries.

Have Any Query? Ask Our Expert @: https://www.htfmarketreport.com/enquiry-before-buy/3715086-global-energy-trade-finance-market

FIVE FORCES & PESTLE ANALYSIS:

To better understand the market conditions, a five forces analysis is conducted which includes bargaining power of buyers, bargaining power of suppliers, and threat of new entrants, threat of substitutes and threat of competition.

- Politics (political policy and stability, trade, fiscal and tax policy)

- Economics (interest rate, employment or unemployment rate, raw material costs, exchange rate)

- Society (changes in family demographics, educational levels, cultural trends, changes in attitudes and lifestyles)

- Technology (digital or mobile technology change, automation, research and development)

- Legal (labour law, consumer law, health and safety, international and trade regulations and restrictions)

- Environment (climate, recycling processes, carbon footprint, waste treatment and sustainability)

Book Latest Edition of Global Energy Trade Finance Market Study @ https://www.htfmarketreport.com/buy-now?format=1&report=3715086

Heat map Analysis, 3-Year Financial and Detailed Company Profiles of Key & Emerging Players: Citi Bank (United States), Tradeteq (United Kingdom), Santander (United States), ANZ (Australia), ING Wholesale Banking (Netherlands), Standard Bank (South Africa), Marco Polo (Germany), Commerzbank (Germany), Rand Merchant Bank (South Africa), Asian Development Bank (Philippines).

Geographically, the following regions are fully explored along with the listed national/local markets:

- APAC (Japan, China, South Korea, Australia, India, and Rest of APAC; Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka)

- Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania)

- North America (U.S., Canada, and Mexico)

- South America (Brazil, Chile, Argentina, Rest of South America)

- MEA (Saudi Arabia, UAE, South Africa)

Some Extracts from Global Energy Trade Finance Market Study Table of Content

Global Energy Trade Finance Sales and Growth Rate (2018-2028)

Energy Trade Finance Competition by Players/Suppliers, Region, Type, and Application

Energy Trade Finance (Volume, Value, and Sales Price) table defined for each geographic region defined.

Supply Chain, Sourcing Strategy and Downstream Buyers, Industrial Chain Analysis

……..and view more in complete table of Contents

Check out the Full Details in the Report @ https://www.htfmarketreport.com/reports/3715086-global-energy-trade-finance-market

Thank you for reading this article; HTF MI also offers custom research services that provide focused, comprehensive and customized research according to clients' goals. Thank you for reading this article; You can also get individual chapter wise sections or regional reports like Balkans, China, North America, Europe or Southeast Asia.

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +1 434 322 0091

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence consulting is uniquely positioned empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist in decision making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Energy Trade Finance Market to Witness Major Growth by 2028 | Citi Bank, Tradeteq, Santander here

News-ID: 3072292 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Heating Coil for Heat Treatment Market to See Revolutionary Growth: Watlow, Chro …

HTF MI just released the Global Heating Coil for Heat Treatment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2026-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered: Watlow, Chromalox, NIBE Induction,…

CAD-CAM Dental Systems Market to Witness Phenomenal Growth |Medit, 3Shape, Planm …

HTF MI just released the Global CAD-CAM Dental Systems Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2026-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered: Dentsply Sirona, Straumann, 3Shape, Ivoclar Vivadent,…

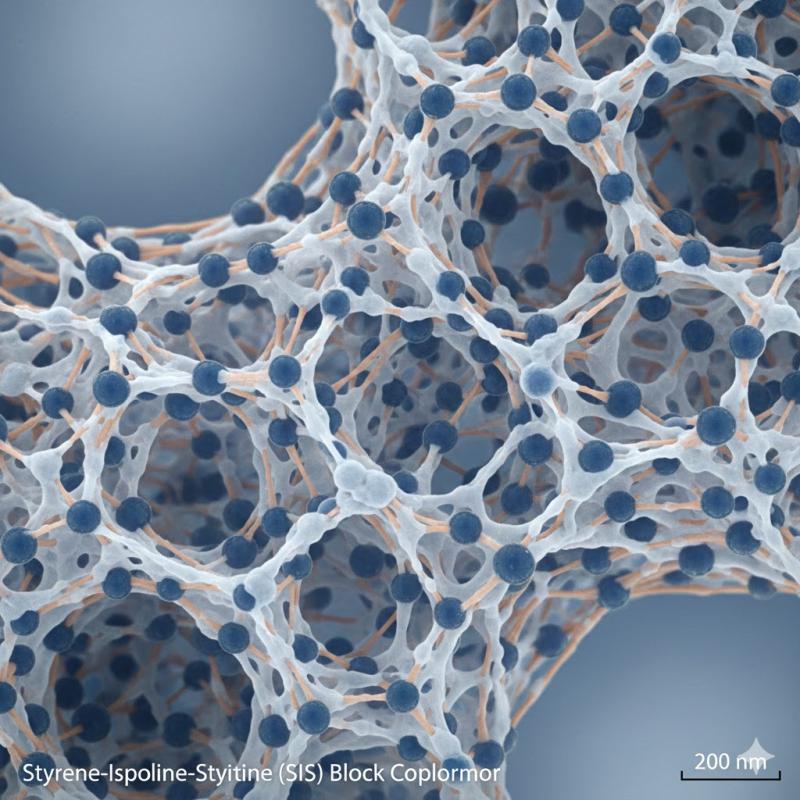

Styrene-Isoprene-Styrene (SIS) Market is Booming Worldwide | Major Giants Arlanx …

HTF MI just released the Global Styrene-Isoprene-Styrene (SIS) Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2026-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered: Kraton Polymers, Sinopec, LCY Chemical, TSRC, Zeon…

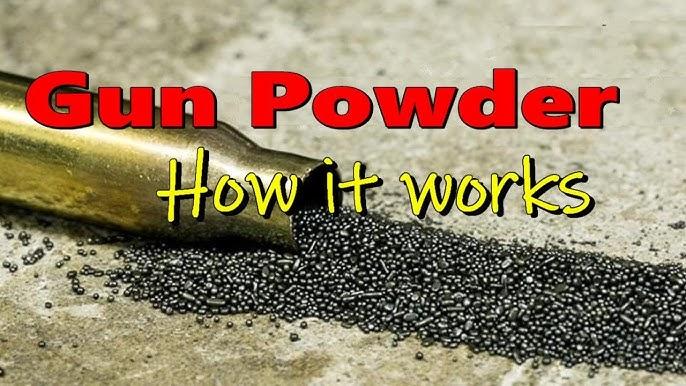

Smokeless Gunpowder Market Is Going to Boom | Major Giants Hodgdon, Alliant Powd …

HTF MI just released the Global Smokeless Gunpowder Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Smokeless Gunpowder Market are:

Hodgdon, Alliant Powder, IMR…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…