Press release

Neo and Challenger Bank Market Size, Industry Scope, Revenue Analysis, & Forecast By 2029

Global Neo and Challenger Bank Market was valued at USD 6.41 billion in 2021 and is expected to reach USD 1326.41 billion by 2029, registering a CAGR of 47.80% during the forecast period of 2022-2029. "Mobile Banking" is expected to witness high growth owing to the rapid digitization and adoption of smartphones globally.The market type, organization size, availability on-premises, end-users' organization type, and the availability in areas such as North America, South America, Europe, Asia-Pacific and Middle East & Africa are kept at the centre while building a worldwide Neo and Challenger Bank market report. This document identifies and analyses the up-and-coming trends along with major drivers, challenges and opportunities in the ICT industry. The report has been provided with the comprehensive market insights and analysis that offers advanced perspective of the market place. A number of business challenges can be conquered with an excellent Neo and Challenger Bank market research report.

Neo and Challenger Bank report is a careful investigation of current scenario of the market and future estimations which spans several market dynamics. This marketing document states that the global market is anticipated to expand significantly and is projected to reach million US$ by 2029, at a CAGR during the forecast period. The report has been prepared by using primary and secondary research methodologies. Competitor strategies such as new product launches, expansions, agreements, joint ventures, partnerships, and acquisitions can be utilized well by the ICT industry to take better steps for selling goods and services. Neo and Challenger Bank market report is an amazing report that makes it possible to the ICT industry to take strategic decisions and achieve growth objectives.

Neo and Challenger Bank Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

• Need for Advanced Features in Banking

The emergence of neo and challenger banks the banking industry incorporating advance features, client-centric products and services, and real-time services acts as one of the major factors driving the neo and challenger bank market.

• Increase in Popularity of Challenger Banks

The increase in the popularity of challenger banks owing to its services such as investments and savings accounts, mobile banking, lending, checking and merchant accounts, among others accelerate the market growth. These banks are also considered beneficial for buying and selling of cryptocurrency, insurance products and retirement savings.

• Higher Interest Rates

The increase in adoption of these banks due to their higher interest rates over traditional banks further influence the market. Also, the increase in government and regulatory supports toward banking operations has a positive impact on the market growth.

Additionally, rapid urbanization, change in lifestyle, surge in investments and increased consumer spending positively impact the neo and challenger bank market.

Get full access of report https://www.databridgemarketresearch.com/reports/global-neo-and-challenger-bank-market

Neo and Challenger Bank Market Regional Analysis/Insights

The neo and challenger bank market is analysed and market size insights and trends are provided by country, type, services provided, and application as referred above.

The countries covered in the neo and challenger bank market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Some of the key questions answered in this report:

· How has the Global Neo and Challenger Bank Market performed so far and how will it perform in the coming years?

· What has been the impact of COVID-19 on the Neo and Challenger Bank Market?

· What are the key regional markets?

· What is the breakup of the market based on the procedure?

· What is the breakup of the market based on the injury location?

· What is the breakup of the market based on the end user?

· What are the various stages in the value chain of the industry?

· What are the key driving factors and challenges in the industry?

· What is the structure of the Neo and Challenger Bank and who are the key players?

· What is the degree of competition in the industry?

Key Pointers Covered in Neo and Challenger Bank Market Industry Trends and Forecast

· Market Size

· Market New Sales Volumes

· Market Replacement Sales Volumes

· Market By Brands

· Market Procedure Volumes

· Market Product Price Analysis

· Market Regulatory Framework and Changes

· Market Shares in Different Regions

· Recent Developments for Market Competitors

· Market Upcoming Applications

· Market Innovators Study

Competitive Landscape and Neo and Challenger Bank Market

The neo and challenger bank market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to neo and challenger bank market.

Major Key Player Neo and Challenger Bank Market

Some of the major players operating in neo and challenger bank market are

• Atom bank (UK)

• Fidor Solutions AG (Germany)

• Monzo Bank Limited (UK)

• Moven Enterprise (US)

• N26 GmbH (Germany)

• Tandem Bank Limited (UK)

• Pockit LTD (UK)

• UBank (Australia)

• PRETA S.A.S. (France)

• WeBank (China)

• Starling Bank (UK)

• DBS Bank India Limited (India)

MAJOR TOC OF THE REPORT

• Chapter One: Introduction

• Chapter Two: Market Scope

• Chapter Three: Regional Analysis

• Chapter Four: Market Share Analysis

BROWSE RELATED REPORTS

https://indexing35.blogspot.com/2023/05/neo-and-challenger-bank-market-size.html

https://indexing35.blogspot.com/2023/05/laser-ablation-systems-market-growth.html

Contact Us:-

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email:- corporatesales@databridgemarketresearch.com

About Data Bridge Market Research:

An absolute way to forecast what future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavours to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Data Bridge Market Research has over 500 analysts working in different industries. We have catered more than 40% of the fortune 500 companies globally and have a network of more than 5000+ clientele around the globe. Data Bridge adepts in creating satisfied clients who reckon upon our services and rely on our hard work with certitude. We are content with our glorious 99.9 % client satisfying rate.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neo and Challenger Bank Market Size, Industry Scope, Revenue Analysis, & Forecast By 2029 here

News-ID: 3070191 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

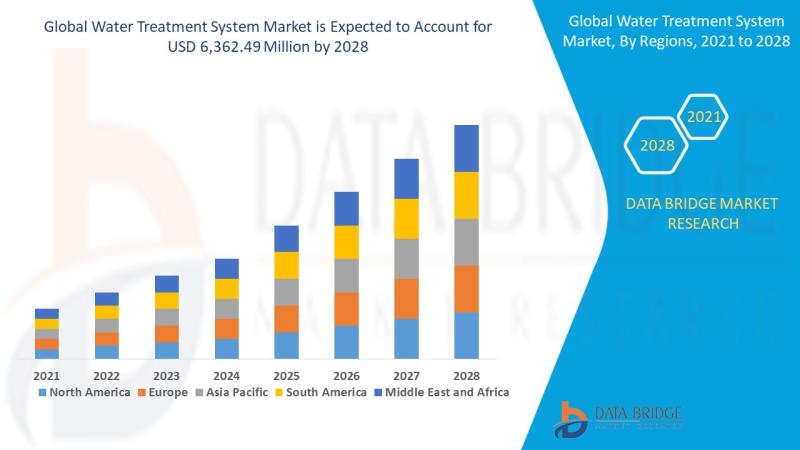

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…