Press release

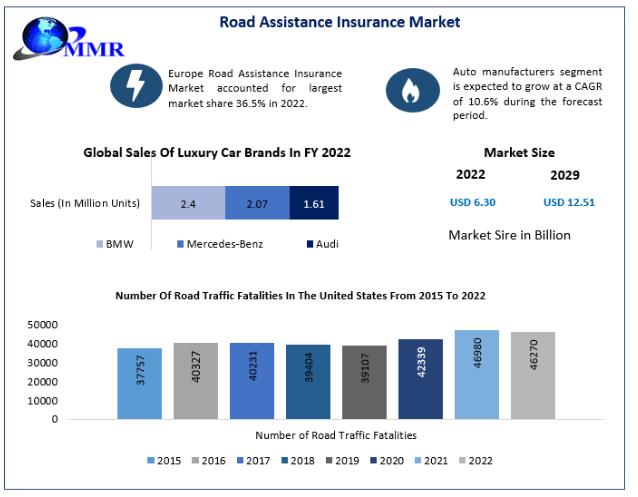

Road Assistance Insurance Market witnessed substantial growth in 2022, with a market value of USD 6.30 billion. A recent market analysis projects a steady compound annual growth rate (CAGR) of 10.3% from 2023 to 2029, resulting in the market size reaching

Road Assistance Insurance Market Report Scope and Research MethodologyThe Road Assistance Insurance Market Report provides a comprehensive analysis of the road assistance insurance industry, including key trends, market dynamics, competitive landscape, and future growth prospects. The report aims to offer valuable insights into the market, enabling stakeholders to make informed decisions and devise effective strategies.

Get to Know More About This Market Study:https://www.maximizemarketresearch.com/market-report/road-assistance-insurance-market/183096/

To gather the necessary data, a robust research methodology was employed. Primary research was conducted by interviewing industry experts, including executives, managers, and key personnel from leading road assistance insurance companies. These interviews provided qualitative insights into market trends, challenges, and opportunities.

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/183096

What are Road Assistance Insurance Market Dynamics:

The Road Assistance Insurance Market dynamics are characterized by various factors that influence the growth and development of the industry. These dynamics include market drivers, restraints, opportunities, and challenges that shape the road assistance insurance market landscape.

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/183096

One of the significant drivers for the road assistance insurance market is the increasing number of vehicles on the road. As the global population grows and economies expand, the demand for personal and commercial vehicles has been on the rise. This surge in vehicle ownership has resulted in a higher likelihood of breakdowns, accidents, and other road incidents, creating a greater need for road assistance services and insurance coverage.

Request For Free Sample Report:https://www.maximizemarketresearch.com/request-sample/183096

Road Assistance Insurance Market Market Regional Insights:

North America: The North American region, comprising the United States and Canada, holds a significant share in the road assistance insurance market. The presence of a large number of vehicles and a well-developed automotive industry contributes to the demand for road assistance insurance. Additionally, the increasing emphasis on safety and convenience services in the region further drives the market growth.

Europe: Europe is another prominent market for road assistance insurance. Countries such as Germany, France, and the United Kingdom have a high concentration of automobile manufacturers and a strong infrastructure for road assistance services. The market in Europe is driven by factors such as strict regulations regarding vehicle safety, rising consumer awareness, and the need for comprehensive coverage.

What is Road Assistance Insurance Market Segmentation:

by Vehicle Type

• Passenger Vehicle

• Commercial Vehicle

by Coverage

• Towing

• Jump Start/Pull Start

• Lockout/Replacement Key Service

• Flat Tire

• Fuel Delivery

• Others

Distribution Channel

• Independent Agents/Brokers

• Auto Manufacturer

• Motor Insurance providers

• Independent Warranty

• Automotive Club

• Others (Direct Response, Banks)

Purchase Report : https://www.maximizemarketresearch.com/market-report/road-assistance-insurance-market/183096/

Who are Road Assistance Insurance Market Key Players:

• Good Sam Enterprise LLC. (Illinois, United States)

• Auto Vantage (Connecticut, United States)

• Best Roadside Service (Texas, United States)

• Falck A/S (Denmark, Europe)

• Roadside Transportation LLC. (Florida, United States)

• DBA, Agero, Inc. (The Cross Country Group) (Florida, United States)

• Allstate Insurance Company (San Francisco, United States)

• Agero, Inc., (Massachusetts, United States)

• American Express Company (New York, United States)

• Erie Indemnity Co. (Pennsylvania, United States)

• GEICO, USAA (Maryland, United States)

• IFFCO-Tokio General Insurance Company Limited (India)

• Progressive Casualty Insurance Company (Ohio, Unites States)

• Nationwide Mutual Insurance Company (Ohio, Unites States)

• Viking Assistance Group (Norway, Europe)

• Access Roadside Assistance (Canada)

• Paragom Motorclub (Texas, United States)

• Roadside Masters (Florida, United States)

• ARC Europe SA, (Belgium, Europe)

• Agero, Inc., (Massachusetts, United States)

• Allianz Global Assistance (Germany, Europe)

• ASSURANT, INC. (New York, United States)

• GM Motor Club (Michigan, United States)

• National Motor Club (Texas, United States)

• SO S International A / S (London, United Kingdom)

Table of content for the Road Assistance Insurance Market includes:

1. Global Road Assistance Insurance Market: Research Methodology

1. Global Road Assistance Insurance Market: Executive Summary

• Market Overview and Definitions

• Introduction to the Global Market

• Summary

• Key Findings

• Recommendations for Investors

• Recommendations for Market Leaders

• Recommendations for New Market Entry

3. Global Road Assistance Insurance Market: Competitive Analysis

• MMR Competition Matrix

• Market Structure by region

• Competitive Benchmarking of Key Players

• Consolidation in the Market

• M&A by region

• Key Developments by Companies

• Market Drivers

• Market Restraints

• Market Opportunities

• Market Challenges

• Market Dynamics

• PORTERS Five Forces Analysis

• PESTLE

• Regulatory Landscape by region

• North America

• Europe

• Asia Pacific

• Middle East and Africa

• South America

• COVID-19 Impact

4. Global Road Assistance Insurance Market Market Segmentation

• Global Market, by Vehicle Type (2021-2029)

• Global Market, by Coverage (2021-2029)

• Global Market, Distribution Channel (2021-2029)

5. Regional Road Assistance Insurance Market Market (2021-2029)

• Regional Market, by Vehicle Type (2021-2029)

• Regional Market, by Coverage (2021-2029)

• Regional Market, Distribution Channel (2021-2029)

• Regional Market, by Country (2021-2029)

6. Company Profile: Key players

• Company Overview

• Financial Overview

• Global Presence

• Capacity Portfolio

• Business Strategy

• Recent Developments

Key Offerings:

• Past Market Size and Competitive Landscape (2018 to 2021)

• Past Pricing and price curve by region (2018 to 2021)

• Market Size, Share, Size & Forecast by different segment | 2022-2029

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Market Segmentation - A detailed analysis by Product

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

• Competitive landscape - Market Leaders, Market Followers, Regional player

• Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

Luxury Car Rental market https://www.maximizemarketresearch.com/market-report/luxury-car-rental-market/186978/

Container Handling Equipment Market https://www.maximizemarketresearch.com/market-report/container-handling-equipment-market/187000/

Low Voltage Power Cable Market https://www.maximizemarketresearch.com/market-report/low-voltage-power-cable-market/187007/

Rubber Market https://www.maximizemarketresearch.com/market-report/rubber-market/187279/

Cattle Healthcare Market https://www.maximizemarketresearch.com/market-report/cattle-healthcare-market/187285/

Tracksuits Market https://www.maximizemarketresearch.com/market-report/tracksuits-market/187293/

Sesame Oil Market https://www.maximizemarketresearch.com/market-report/sesame-oil-market/187303/

Next Generation Anode Materials Market https://www.maximizemarketresearch.com/market-report/next-generation-anode-materials-market/187309/

Chronic Kidney Disease Market https://www.maximizemarketresearch.com/market-report/chronic-kidney-disease-market/187290/

Corn Starch Market https://www.maximizemarketresearch.com/market-report/corn-starch-market/187298/

Carpets and Rugs Market https://www.maximizemarketresearch.com/market-report/carpets-and-rugs-market/187345/

Mother Child Healthcare Market https://www.maximizemarketresearch.com/market-report/mother-child-healthcare-market/187324/

Almond Market https://www.maximizemarketresearch.com/market-report/almond-market/187333/

Millet Flour Market https://www.maximizemarketresearch.com/market-report/millet-flour-market/187340/

Neoprene Fabric Market https://www.maximizemarketresearch.com/market-report/neoprene-fabric-market/187312/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Road Assistance Insurance Market witnessed substantial growth in 2022, with a market value of USD 6.30 billion. A recent market analysis projects a steady compound annual growth rate (CAGR) of 10.3% from 2023 to 2029, resulting in the market size reaching here

News-ID: 3065319 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

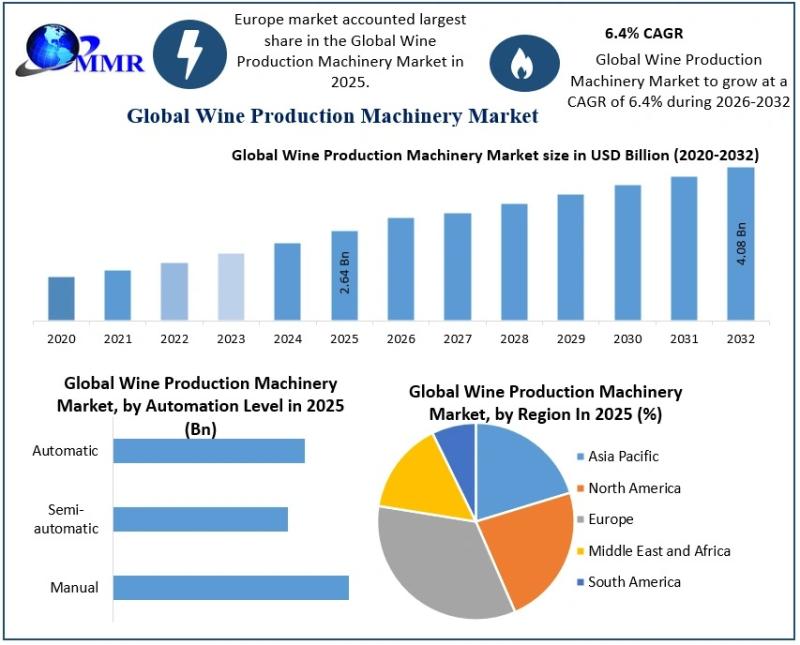

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

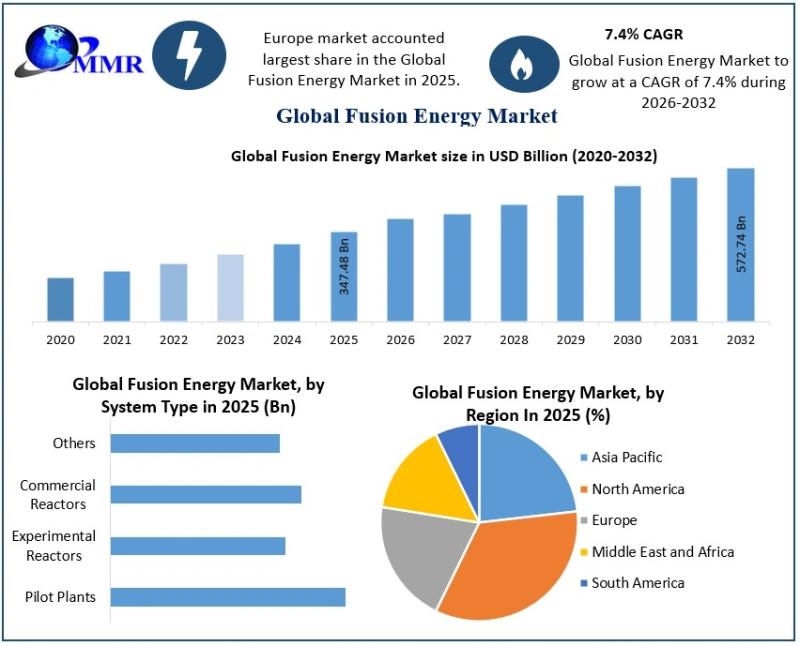

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…