Press release

Global Insurance Claims Software Market Valued at USD 41.2 Billion in 2022, Expected to Grow at a CAGR of 9.1% from 2023 to 2033

As per the study initiated by Evolve Business Intelligence, the global Insurance Claims Software market size accounted for USD 41.2 Billion in 2022, growing at a CAGR of 9.1% from 2023 to 2033. The insurance claims software market refers to the industry involved in the development and provision of software solutions specifically designed to streamline and automate the insurance claims process. Insurance claims software helps insurance companies and claims departments manage and process claims efficiently, improving customer service, reducing costs, and enhancing operational effectiveness. The market is driven by factors such as the increasing volume and complexity of insurance claims, the need for faster claims processing, improved customer experience, and the desire to reduce fraudulent activities. Additionally, regulatory requirements, advancements in technologies like AI and machine learning, and the growing emphasis on data analytics influence the development and adoption of insurance claims software.Request Free Sample Report or PDF Copy: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=019413

Key Highlights:

• The global Insurance Claims Software Market size was valued at USD 41.2 billion in 2022 growing at a CAGR of 9.1% from 2023 to 2033.

• North America dominated the market in 2022

• Asia Pacific is expected to fastest-growing at the highest CAGR from 2023 to 2033

Evolve Business Intelligence has published a new market research report on Global Insurance Claims Software Market focusing in various aspects including market size and forecast, market dynamics, competitors market share analysis, market size in terms of value and volume, SWOT analysis, product benchmarking, key players recent developments, and opportunities, among others. The market has also been analyzed based on 4 indicators in the market dynamic chapter which includes Drivers, Restraints, Key Trends, and Challenges. The overall sum of these sections will help to understand the best strategies to be adopted in order to prosper through this industry over short and long terms. The quantitative analysis includes our authentic findings out of this research study where we provided additional insight into what our readers can do to embrace new opportunities or plan against threats that might hinder the market.

In terms of COVID 19 impact, the Insurance Claims Software market report also includes the following data points:

• COVID19 Impact on Insurance Claims Software market size

• End-User/Industry/Application Trend, and Preferences

• Government Policies/Regulatory Framework

• Key Players Strategy to Tackle Negative Impact/Post-COVID Strategies

• Opportunity in Insurance Claims Software market

Buy Latest Copy of Report Now at Higher Discount: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=019413

Key Players

Some of the major Insurance Claims Software players holding high market share include Applied Epic, ClaimCenter, Snapsheet, and BriteCore. These players use partnership and collaboration as a key strategy to gain significant market share to compete with market leaders.

The key players profiled in the report are:

• Applied Epic

• ClaimCenter

• Snapsheet

• BriteCore

• ClaimXperience

• LexisNexis Carrier Discovery

• SIMS Claims

• Virtual Claims Adjuster

• A1 Tracker and ClaimZone Manager

• HIPAA Claim Master

• Riskmaster

• Filetrac.

Segmental Analysis

Market Segment By Type with focus on market share, consumption trend, and growth rate of Insurance Claims Software Market:

o On-Premise

o Cloud-Based

Market Segment By Application with focus on market share, consumption trend, and growth rate of Insurance Claims Software Market:

o Small Business

o Medium-Sized Business

o Large Business

Parameters Details

Market Size (2022) $ 41.2 Billion

CAGR (2023 to 2033) 9.1%

Market Segmentation Type, Application

Country Covered US, Canada, Mexico, UK, Germany, France, Italy, Spain, Nordic Countries, BeNeLux, Rest of Europe, China, India, Japan, South Korea, Indonesia, Malaysia, Australia, Rest of Asia Pacific, Middle East & Africa, and South America

For more information: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=019413

Global Insurance Claims Software Geographic Coverage:

• North America

o US

o Canada

o Mexico

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Nordic Countries

o Benelux

o Rest of Europe

• Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Australia

o Rest of Asia Pacific

• Middle East and Africa

o Saudi Arabia

o UAE

o Egypt

o South Africa

o Rest of MEA

• Latin America

o Mexico

o Brazil

o Argentina

o Rest of Latin America

Reasons to Buy this Report:

• Detail analysis of the impact of market drivers, restraints, and opportunities

• Competitive Intelligence provides an understanding of the ecosystem

• Details analysis of the Total Addressable Market (TAM) of your products

• Investment Pockets and New Business Opportunities

• Demand-supply gap analysis

• Strategy Planning

Address

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

Gujarat 396191

India

Email: sales@evolvebi.com

Website: https://evolvebi.com/

About EvolveBI

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing innovative solutions to challenging pain points of a business. Our market research reports include data useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate data through our in-house AI-modelled data analysis and forecast tool - EvolveBI. This tool tracks real-time data including, quarter performance, annual performance, and recent developments from fortune's global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Insurance Claims Software Market Valued at USD 41.2 Billion in 2022, Expected to Grow at a CAGR of 9.1% from 2023 to 2033 here

News-ID: 3062997 • Views: …

More Releases from Evolve Business Intelligence

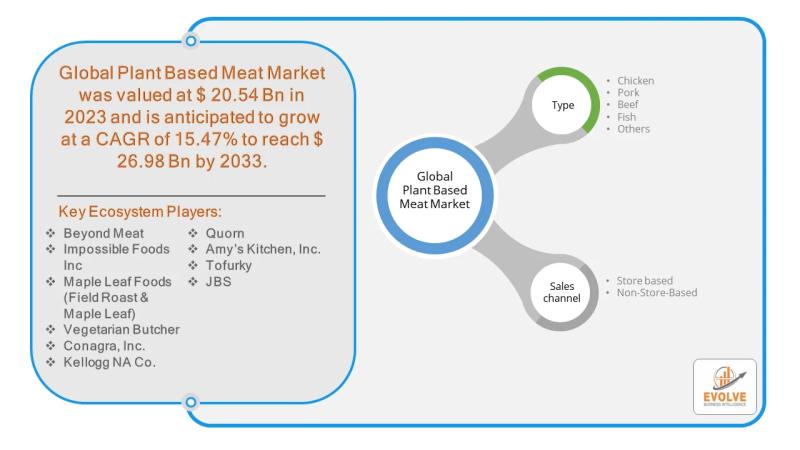

Plant-Based Meat Market Forecast to Reach USD 26.98 Billion by 2033

The plant-based meat market is at a pivotal point, marked by strong growth in the past decade but now facing headwinds. While traditional retail channels have seen recent slowdowns, the non-store-based segment, which includes direct-to-consumer (D2C) e-commerce, meal kits, and food service, presents a significant and largely untapped opportunity. This channel allows brands to bypass the challenges of traditional retail, such as intense competition for shelf space and high listing…

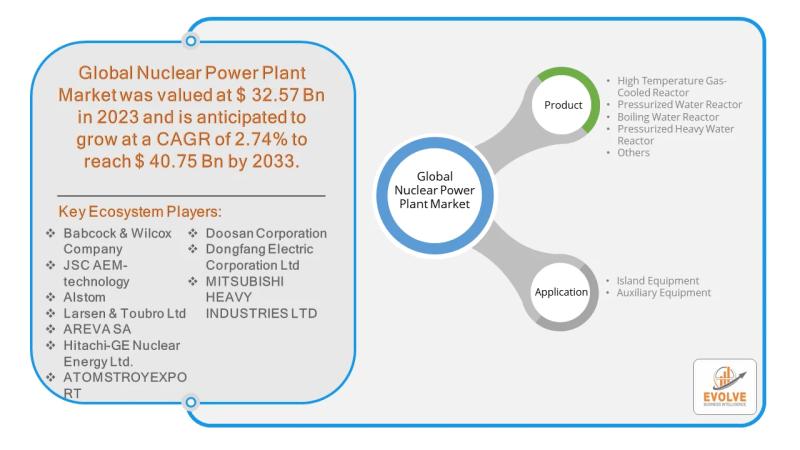

Nuclear Power Plant Market Forecast to Reach USD 40.75 Billion by 2033

As the world seeks a clean, reliable, and sustainable energy future, High Temperature Gas-Cooled Reactors (HTGRs) are emerging as a prime candidate to lead the next generation of nuclear power. This advanced reactor technology, which uses a graphite-moderated core and inert helium coolant, offers a unique blend of inherent safety and versatility that extends well beyond traditional electricity generation. While challenges remain, the opportunity for HTGRs to transform the nuclear…

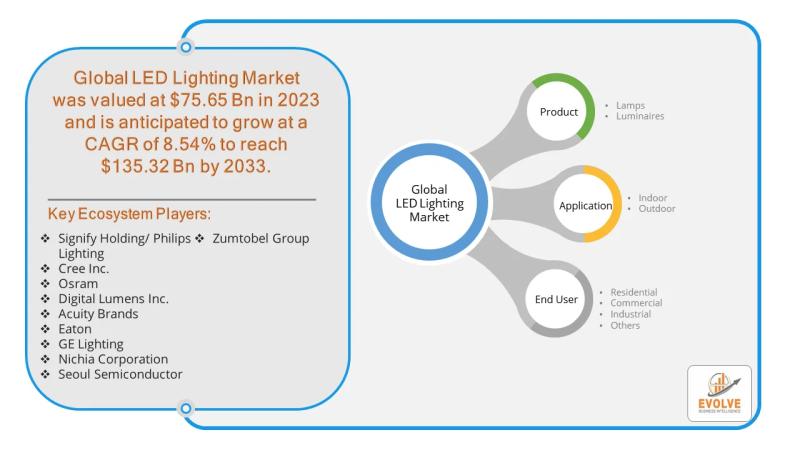

LED Lighting Market Forecast to Reach USD 255.92 Billion by 2035

The global LED lighting market is on a trajectory of significant expansion, fueled by the rising demand for energy-efficient and sustainable lighting solutions. While the market for LED lamps remains strong, luminaires-complete lighting fixtures with integrated LEDs-are emerging as the primary driver of future growth. Valued at an estimated USD 71.59 billion in 2023, the market is projected to surge to over USD 255.92 billion by 2035, with a compound…

Sensor Market Forecast to Reach USD 457.26 Billion by 2032

The global sensor market is at a pivotal point, poised for remarkable growth driven by the proliferation of smart devices, industrial automation, and the Internet of Things (IoT). The market, valued at an estimated USD 241.06 billion in 2024, is projected to expand significantly to approximately USD 457.26 billion by 2032, demonstrating a robust Compound Annual Growth Rate (CAGR) of about 8.5%. Within this dynamic landscape, a key player is…

More Releases for Claim

American Investment Trust Services: FINRA Claim

The White Law Group Files a Claim against American Trust Investment Services

The White Law Group announces the filing of a FINRA arbitration claim against American Trust Investment Services for investment losses involving high risk TIC/DST investments.

The firm submitted a claim to FINRA Dispute Resolution on behalf of a group of investors alleging claims for violation of common law fraud, breach of fiduciary duty, negligence, and…

OSP Labs Accelerates Claim Processing Workflow Through Claim Data Management Sol …

Medical claims processing is one amongst the three core elements of the value-added insurance chain. One primary avenue of fostering medical claims processing growth is by robust claims data management solutions. OSP Labs engineered a real-time medical claim data management solutions to enhance medical claim management by study and evaluate the claims data to judge its suitability for further processing.

"Paper-based manual claims data management is time-consuming and requires additional efforts.…

Claim Management in Mobility Projects

Quedlinburg (12.09.2012) - New mobility projects, like construction of subways, fully automatic driverless metro systems, mainline railways and suburban train projects, are on their way currently on their all over the world. The implementations of such projects involve complex technologies, the management of various interfacing systems and tight time schedules. Not surprisingly, those projects are therefore often harmed by obstructions and hindrances leading to claims between the projects participants. We…

Claim Management in Mobility Projects

New mobility projects, like construction of subways, fully automatic driverless metro systems, mainline railways and suburban train projects, are on their way currently on their all over the world. The implementations of such projects involve complex technologies, the management of various interfacing systems and tight time schedules. Not surprisingly, those projects are therefore often harmed by obstructions and hindrances leading to claims between the projects participants. We have talked to…

HDFC ERGO launches “Health Claim Services” - in-house health claim servicing …

HDFC ERGO General Insurance, 4th largest private sector general insurance company in India announced the launch of Health Claim Services (HCS) - its in-house health claim servicing department.. The main objective behind this initiative is to facilitate faster and transparent claim settlement process.

On the announcement, Mr. Mukesh Kumar, Head – Strategic Planning Group said “In today's era, customer expects to interact with company directly. There is more trust generated…

Jury Rules Against Princess’s Insurance Claim

By CHRISTIAN NOLAN

The Estate of Frederick Mali and Lucretia Mali v. Federal Insurance Co.: A federal jury decided that a Russian princess, whose Litchfield County barn burned to the ground six years ago, fabricated numbers when she told her insurance company that the building and all of the antiques inside it were worth nearly $3 million.

Because the jury ruled that the woman had misrepresented the value of the barn, which…