Press release

Digital Banking Platform Market 2022 Industry Analysis, Size, Market Demand, Growth, and Comprehensive Research Study 2028

Digital Banking Platform Market Report contains key drivers and Restraints of the market with their information and market competition situation among the vendors and company profile. Product pictures, specifications, classifications, and categories are also mentioned. Comprehensively evaluates absolute scrutiny of the competitive landscape, covering value chain and key players.The report offers a complete company profiling of leading players competing in the global Digital Banking Platform industry with a high focus on the share, gross margin, net profit, sales, product portfolio, new applications, recent developments, and several other factors. It also throws light on the vendor landscape to help players become aware of future competitive changes in the global Digital Banking Platform industry.

Get a Sample Copy of this Premium Report: https://www.theinsightpartners.com/sample/TIPRE00006157/?utm_source=OpenPR&utm_medium=10749

In this report, our team offers a thorough investigation of the Digital Banking Platform Market, a SWOT examination of the most prominent players right now. Alongside an industrial chain, the full investigation offers market measurements regarding revenue, sales, value, capacity, regional market examination, section insightful information, and market forecast.

Key Benefits for Digital Banking Platform Market Reports

The analysis provides an exhaustive investigation of the global Post-Consumer Digital Banking Platform market together with future projections to assess the investment feasibility. Furthermore, the report includes both quantitative and qualitative analyses of the Post-Consumer Digital Banking Platform market throughout the forecast period. The report also comprehends business opportunities and the scope for expansion. Besides this, it provides insights into market threats or barriers and the impact of the regulatory framework to give an executive-level blueprint for the Post-Consumer Digital Banking Platform market. This is done to help companies in

Top Key Players:

• Appway AG

• CREALOGIX Holding AG

• EdgeVerve Systems Limited

• Fiserv, Inc.

• Oracle Corporation

• SAP SE

• Sopra Steria

• Tata Consultancy Services Limited

• Temenos Headquarters SA

• Worldline SA

Key Highlights of the Digital Banking Platform Market Report:

Digital Banking Platform Market Study Coverage: It incorporates key market sections, key makers secured, the extent of items offered in the years considered, the worldwide Digital Banking Platform market, and study goals. Moreover, it contacts the division study given in the report based on the sort of item and applications.

Digital Banking Platform Market Executive outline: This area stresses the key investigations, market development rate, serious scene, market drivers, patterns, and issues notwithstanding the naturally visible pointers.

Digital Banking Platform Market Production by Region: The report conveys information identified with import and fare, income, creation, and key players of every single local market contemplated are canvassed right now.

Digital Banking Platform Market Profile of Manufacturers: Analysis of each market player profiled is detailed in this section. This portion likewise provides a SWOT investigation, items, generation, worth, limit, and other indispensable elements of the individual player.

Digital Banking Platform Market Report Covers the Following Segments:

By Deployment

(Cloud and On-Premises)

By Type

(Corporate Banking and Retail Banking)

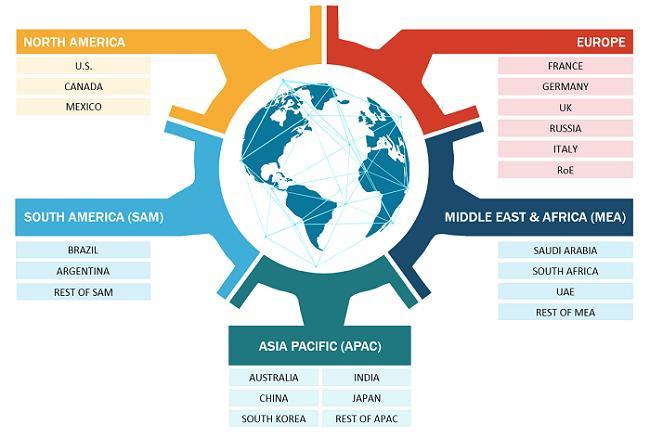

According to the Regional Segmentation, the Digital Banking Platform Market provides the Information covers following regions:

• North America

• South America

• Asia & Pacific

• Europe

• MEA (the Middle East and Africa)

The key countries in each region are taken into consideration as well, such as United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia, and New Zealand, etc.

Buy Now: https://www.theinsightpartners.com/buy/TIPRE00006157/?utm_source=OpenPR&utm_medium=10749

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Sameer Joshi

E-mail: sales@theinsightpartners.com

Phone: +1-646-491-9876

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Platform Market 2022 Industry Analysis, Size, Market Demand, Growth, and Comprehensive Research Study 2028 here

News-ID: 3059539 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…