Press release

Global Open Banking Market to Reach $123.7 Billion by 2032

According to a report published by Allied Market Research, the global open banking market generated $13.9 billion in revenue in 2020. It is projected to reach $123.7 billion by 2031, with a compound annual growth rate (CAGR) of 22.3% from 2022 to 2031. The report offers a comprehensive analysis of the industry's changing trends, key segments, value chain analysis, investment scenarios, regional landscape, and competitive landscape.Download Free Sample Report (Get Detailed Analysis in PDF - 228 Pages): https://www.alliedmarketresearch.com/request-sample/3840

It serves as a valuable source of information for major players, entrepreneurs, shareholders, and stakeholders, enabling them to develop new strategies and improve their market position. The report provides an in-depth quantitative analysis of the market from 2022 to 2031, assisting investors in making informed decisions regarding investments in this rapidly evolving industry.

Key participants in the global open banking market examined in the research include Banco Bilbao Vizcaya Argentaria, S.A., Crédit Agricole Group, Deposit Solutions, Finestra, Jack Henry & Associates, Inc., Nordigen Solutions, Revolut Ltd., Societe Generale S.A., Tink AB, and Yapily Ltd.

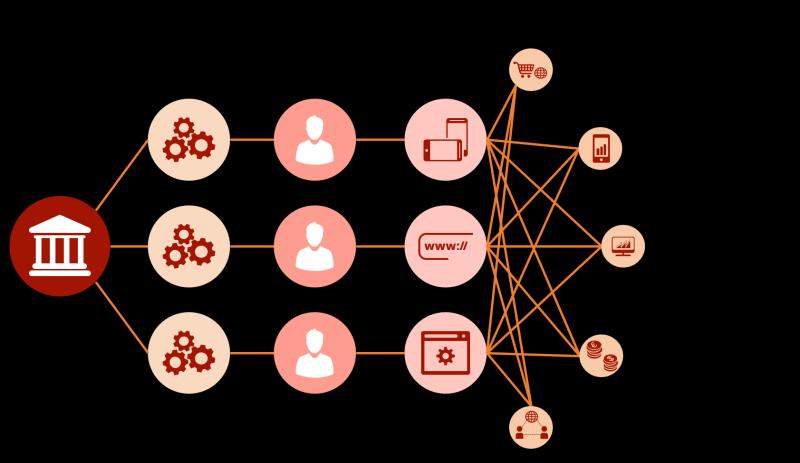

The report offers detailed segmentation of the global open banking market based on financial services, distribution channel, and region. It provides an in-depth analysis of every segment and sub-segment in tables and figures through which consumers can derive a conclusion about market trends and insights. The market report analysis aids organizations, investors, and entrepreneurs in understanding which sub-segments are to be tapped for achieving huge growth in the years ahead.

Inquire Before Buying

https://www.alliedmarketresearch.com/purchase-enquiry/3840

In terms of financial services, the banking & capital markets segment was the largest in 2020, accounting for nearly half of the overall share of the global open banking market. Moreover, the Payments segment is predicted to dominate the overall market growth in 2031. However, the value-added services segment is set to record the highest CAGR of 27.2% from 2022 to 2031. The report also analysis other segments including Digital Currencies.

On basis of the distribution channel, the app market segment held the largest share in 2020, contributing to two-fifths of the overall open banking market share. Moreover, this segment is predicted to account for the highest market share in 2031. Furthermore, the Distributors segment is also anticipated to record the fastest CAGR of 25.9% during the forecast timeframe. The report also includes bank channel and aggregators.

Based on region, Europe contributed toward the highest market share in 2020, accounting for more than two-fifths of the global open banking market share. Furthermore, the Asia-Pacific region is set to contribute majorly toward the global market share in 2031. In addition, the region is predicted to register the fastest CAGR of 27.0% during the forecast timespan. The research also analyzes regions including LAMEA and North America.

The report evaluates these major players in the global open banking industry. These players have executed a gamut of major business strategies such as the expansion of regional and customer bases, new product launches, strategic alliances, and joint ventures for expanding product lines across global markets. The market research report supports the performance monitoring of each segment, positioning of each product in respective segments, and the impact of new technology and product innovations on the overall market size.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the open banking market analysis from 2020 to 2031 to identify the prevailing open banking market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the open banking market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as open banking market trends, key players, market segments, application areas, and market growth strategies.

Request Customization

https://www.alliedmarketresearch.com/request-for-customization/3840

Key Market Segments

Financial Services

Banking & Capital Markets

Payments

Digital Currencies

Value Added Services

Distribution Channel

Bank Channel

App market

Distributors

Aggregators

By Region

North America (U.S., Canada)

Europe (United Kingdom, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin Amercia, Middle East, Africa)

More Reports:

Blockchain In Retail Banking Market: https://www.alliedmarketresearch.com/blockchain-in-retail-banking-market-A31695

RPA and Hyperautomation in Banking Market : https://www.alliedmarketresearch.com/rpa-and-hyperautomation-in-banking-market-A31697

Commercial Banking Market : https://www.alliedmarketresearch.com/commercial-banking-market-A06184

Core Banking Solutions Market : https://www.alliedmarketresearch.com/core-banking-solutions-market-A08726

Voice Banking Market : https://www.alliedmarketresearch.com/voice-banking-market-A31730

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Open Banking Market to Reach $123.7 Billion by 2032 here

News-ID: 3049278 • Views: …

More Releases from www.alliedmarketresearch.com

Pet Insurance Market Soars: Projected to Hit $38.3 Billion by 2033 as Demand for …

According to a new report published by Allied Market Research, titled, "Pet Insurance Market, By Policy Coverage (Accident Only, Accident and Illness, and Others), By Animal Type (Dogs, Cats, and Others), and By Sales Channel (Agency, Broker, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". The pet insurance market was valued at $10.10 billion in 2023, and is estimated to reach $38.3 billion by 2033, growing at a CAGR…

Manual Spray Guns Market to Hit $2.6 Billion by 2032 | Key Growth Drivers & Oppo …

Prime determinants of growth

The demand for manual spray guns, which are mostly used for painting consumer durables, has increased because of this need, particularly in developing nations like India, China, and Vietnam. Additionally, there is a greater need for manual spray guns from car manufacturers due to the rising demand for automobiles around the world, particularly in industrialized nations like Europe and North America.

Download PDF Sample Report: www.alliedmarketresearch.com/request…ple/111362

Due to…

Hygienic Cladding Market Poised for Growth: Global Trends & Opportunities 2023-2 …

According to the report, the global hygienic cladding market generated $2.8 billion in 2022, and is anticipated to generate $6 billion by 2032, rising at a CAGR of 8.3% from 2023 to 2032.

Prime Determinants of Growth

The increased awareness & demand for health-related products, the increasing need for safe & healthy environments in healthcare facilities, and hygienic wall cladding's affordability & durability than traditional tiling methods are the factors expected to…

AI in Insurance Market Poised to Reach $45.74 Bn Globally by 2031, Soaring at a …

Global Opportunity Analysis and Industry Forecast, 2021-2031". According to the report, the global AI in insurance industry generated $2.74 billion in 2021, and is anticipated to generate $45.74 billion by 2031, witnessing a CAGR of 32.5% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11615

Higher deployment cost of AI, advanced machine learning, and lack of skilled labor hamper the market growth. On the contrary, surge in government initiatives…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…