Press release

Neobanking Market is anticipated to grow up to USD 428.7 Billion by 2031 | Citigroup Inc., Dave, Inc., Deutsche Bank AG, Digibank, Equitable Bank

New York, Global Neobanking Market was valued at USD 42.2 Million in 2021 and it is anticipated to grow up to USD 428.7 Billion by 2031, at a CAGR of 26.1% during the forecast period.Global Neobanking Market report from Global Insight Services is the single authoritative source of intelligence on Neobanking Market. The report will provide you with analysis of impact of latest market disruptions such as Russia-Ukraine war and Covid-19 on the market. Report provides qualitative analysis of the market using various frameworks such as Porters' and PESTLE analysis. Report includes in-depth segmentation and market size data by categories, product types, applications, and geographies. Report also includes comprehensive analysis of key issues, trends and drivers, restraints and challenges, competitive landscape, as well as recent events such as M&A activities in the market.

Read more about Neobanking Market here: https://www.globalinsightservices.com/reports/neobanking-market/

Neobanking is a term used to describe financial institutions that offer digital-only banking services. These institutions are typically online-only and lack a physical branch presence. Neobanks typically offer a suite of services that are similar to those offered by traditional banks, such as checking and savings accounts, debit cards, personal loans, and investment products. However, neobanks often differ from traditional banks in terms of their business model, technology platform, and target market.

Request free sample copy of this research study: https://www.globalinsightservices.com/request-sample/GIS24355

Market Trends and Drivers

The market growth is attributed to the sophisticated digital advisory services offered by such banks. By 2021, neobanks were offering around ten features on average compared to only four functions provided by traditional banks. These four features, search, view balances, view transactions, and customize notifications, only provide basic insights for users, which has initiated a seismic consumer behavior change toward neobanking services.

Get Customized Report as Per Your Requirement: https://www.globalinsightservices.com/request-customization/GIS24355

Global Neobanking Market Segmentation

By Account Type

-Business Account

-Savings Account

By Service

-Mobile Banking

-Payments & Money Transfer

-Checking/Savings Account

-Loans

-Others

By Application

-Enterprise

-Personal

-Others

By Region

-North America

-The U.S.

-Canada

-Mexico

-Europe

-UK

-Germany

-France

-Spain

Rest of Europe

Major Players in the Global Neobanking Market

The neobanking market is analyzed to be highly competitive due to the presence of both multinational companies and fintech start-ups in the space. These market participants are mainly focusing on collaboration with banking institutes to gain revenue share. Prominent leaders operating in the market are placing an ever-growing emphasis on delivering advanced digital banking solutions that can cater to the dynamic requirements, especially during the rise of AI-enabled automation amid the ongoing pandemic.

The key players in the Neobanking market Atom Bank Plc, BBVA S.A., BMTX, Inc., Chime Financial, Inc., Citigroup Inc., Dave, Inc., Deutsche Bank AG, Digibank, Equitable Bank, and HSBC Holdings Plc., among others.

Purchase your copy now: https://www.globalinsightservices.com/checkout/single_user/GIS24355

With Global Insight Services, you receive:

• 10-year forecast to help you make strategic decisions

• In-depth segmentation which can be customized as per your requirements

• Free consultation with lead analyst of the report

• Excel data pack included with all report purchases

• Robust and transparent research methodology

Contact Us:

Global Insight Services LLC

16192, Coastal Highway, Lewes DE 19958

E-mail: info@globalinsightservices.com

Phone: +1-833-761-1700

Website: https://www.globalinsightservices.com/

About Global Insight Services:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neobanking Market is anticipated to grow up to USD 428.7 Billion by 2031 | Citigroup Inc., Dave, Inc., Deutsche Bank AG, Digibank, Equitable Bank here

News-ID: 3043384 • Views: …

More Releases from Global Insight Services

Liver Disease Treatment Market: Expansion Fueled by Increasing Incidence of NAFL …

The Liver Disease Treatment Market continues to expand rapidly as global awareness, early diagnosis, and advanced therapeutic approaches reshape patient care. With the market valued at $26.6 billion in 2024 and projected to reach $44.8 billion by 2034 at a steady 5.4% CAGR, demand for effective and accessible therapies is on the rise. The Liver Disease Treatment Market covers pharmaceuticals, biologics, vaccines, diagnostics, and liver transplant services designed to manage…

Healthcare Supply Chain BPO Market: Expansion Fueled by Increasing Outsourcing o …

The Healthcare Supply Chain BPO Market is rapidly evolving as healthcare providers worldwide seek smarter, leaner, and more resilient operations. With growing pressure to reduce costs, boost efficiency, and maintain uninterrupted patient care, outsourcing supply chain tasks has become a strategic necessity. The global Healthcare Supply Chain BPO Market is projected to grow from $3.05 billion in 2024 to $4.83 billion by 2034, reflecting a CAGR of 4.7%. This expansion…

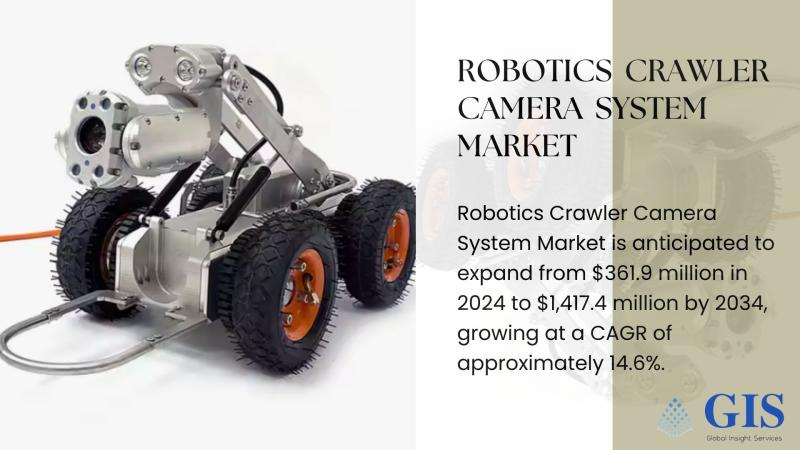

Robotics Crawler Camera System Market Rise by 2034 | Key Players: Inuktun Servic …

Market Overview

Robotics Crawler Camera System Market is witnessing a major transformation as industries shift toward advanced inspection technologies that improve safety, accuracy, and operational efficiency. These robotic crawlers, equipped with high-resolution cameras and strong maneuverability, enable real-time inspection across pipelines, sewers, industrial tanks, and hazardous environments where manual inspections pose risks. As automation becomes central to industrial maintenance, the Robotics Crawler Camera System Market continues to gain momentum, supported by…

Pet DNA Testing Market Growth to 2034 | Key Players: Wisdom Panel, Embark Veteri …

Market Overview

Pet DNA Testing Market is rapidly transforming the way pet owners understand the health, ancestry, and traits of their companion animals. As pets increasingly become family members, owners are demanding deeper insights into their pets' genetic makeup. The Pet DNA Testing Market offers services such as breed identification, disease risk assessments, trait analysis, and ancestry mapping. With advancements in genomics and the expansion of direct-to-consumer testing kits, the Pet…

More Releases for Neobanking

Neobanking Market Trends That Will Shape the Next Decade: Insights from Neobanki …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

How Large Will the Neobanking Market Size By 2025?

The scale of the neobanking market has seen remarkable expansion in the past few years. It is expected to surge from $176.05 billion in 2024 up to $261.4 billion in 2025, reflecting a compound annual growth rate (CAGR) of 48.5%.…

Primary Catalyst Driving Neobanking Market Evolution in 2025: Rapid Digitalizati …

How Are the key drivers contributing to the expansion of the neobanking market?

The burgeoning need for digital transformation in banking agencies worldwide is fuelling the neobanking market's expansion. Digital banking involves the complete digitization of banking operations, replacing the physical branches with a constant online presence, thereby eliminating the requirement for customers to visit a physical office. Traditional banking services are getting streamlined through digital means. With digital banking, bank…

Neobanking Market Size & Trends To 2030

The Neobanking Market 2024 Report makes available the current and forthcoming technical and financial details of the industry. It is one of the most comprehensive and important additions to the Prudent Markets archive of market research studies. It offers detailed research and analysis of key aspects of the global Neobanking market. This report explores all the key factors affecting the growth of the global Neobanking market, including demand-supply scenario, pricing…

Neobanking Market Potential and Growth Opportunities 2024-2031

The Neobanking Market is a rapidly evolving sector, driven by advancements in hardware, software, and digital infrastructure. It encompasses a wide range of services, including cloud computing, cybersecurity, data analytics, and artificial intelligence. The increasing demand for digital transformation across industries is fueling growth. Emerging technologies like 5G, blockchain, and IoT are further expanding its potential. With continuous innovation, the IT market is expected to see robust growth in the…

Neobanking Market Key Trends, Analysis, Forecast To 2033

"The Business Research Company has recently revised its global market reports, now incorporating the most current data for 2024 along with projections extending up to 2033.

Neobanking Global Market Report 2024 by The Business Research Company offers comprehensive market insights, empowering businesses with a competitive edge. It includes detailed estimates for numerous segments and sub-segments, providing valuable strategic guidance.

The Market Size Is Expected To Reach $836.11 billion In 2028 At A…

Neobanking Market Size, Share, Industry, Forecast to 2030

The Neobanking Market 2023 Report makes available the current and forthcoming technical and financial details of the industry. It is one of the most comprehensive and important additions to the Prudent Markets archive of market research studies. It offers detailed research and analysis of key aspects of the global Neobanking market. This report explores all the key factors affecting the growth of the global Neobanking market, including demand-supply scenario, pricing…