Press release

Future Outlook of Indian Credit Card Industry: Ken Research

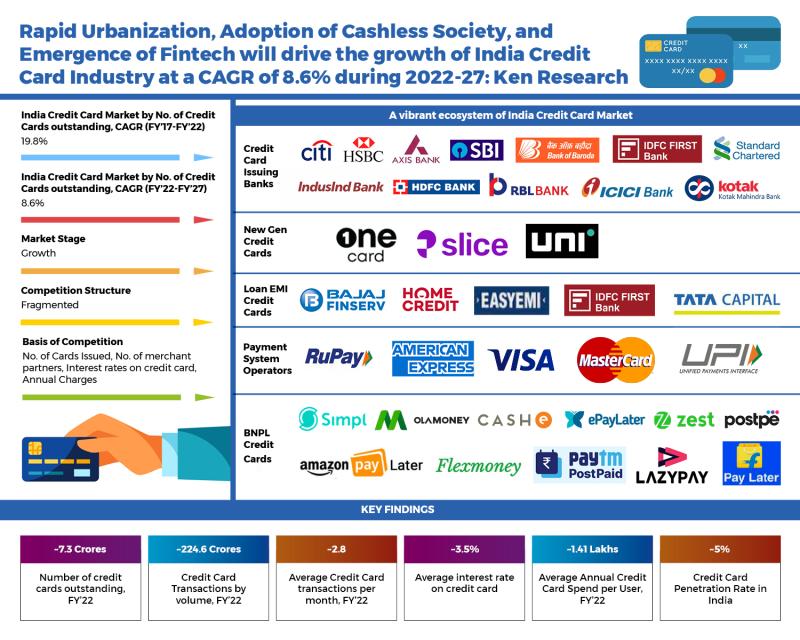

Overview of Indian Credit Card Industry and Market SizeIndian Credit Card Industry was valued at ~XX INR Crore in FY'22, expanding at a CAGR of XX% in between FY'17 and FY'22 on the basis of revenue generated with massive expansion in the adoption of credit card as the mode of payment due to rising industry valuation, trend of contactless payments and the emergence of credit card lending startups going beyond the typical credit card issuance model. The primary factors driving the market growth is the emergence of instant payment anytime and anywhere, rising internet penetration in the country, growing awareness among the users, controlled, secured and efficient transactions with convenience of use and a highly rewarding experience provided by the market players to their users. The volume of digital payments in India grew by 33% during the financial year 2021-2022. These payments are assisted by advanced technology and are, therefore, quick, simple and convenient. When these payments are assisted by credit products, they boost the purchasing power of people. Digital lenders like LazyPay have made these payment facilities widely accessible to all kinds of Indian residents in all major tier-I and tier-II cities. On the other hand, consumers too are increasingly being drawn to digital payments due surging adoption of contactless payments post COVID-19 which is also contributing in the growth of credit card market by increasing their userbase. The smartphone penetration rate in India is projected to increase from 54% in 2020 to 96% in 2040. As more and more people across India, including people in rural areas, use smartphones, they get increasingly exposed to digital payment modes. Gen-Zs and millennials are already comfortable with using them as they grew up with technology. Merchants are linking themselves to new-age online payment gateways to allow more and more consumers to access and shop for their products easily. Thus, as digital payment modes are forming the bridge between multiple consumers and merchants, they're undergoing exponential growth. For instance, virtual cards like LazyCard by LazyPay are receiving 99.5% acceptance all over India. Besides the apps of digital lenders like LazyPay can be downloaded on both Android and iOS devices. The best part of digital payments is that they can be carried out instantly anytime anywhere and even on the move. However, especially when people are travelling, it often becomes a hassle to follow the OTP and remember the PIN. Thankfully, new-age digital payments have removed these hassles to speed up the process further. For instance, LazyPay's Buy Now Pay Later facility allows people to shop at 250+ partner merchants in a flash by skipping PINs and OTPs.

To learn more about this report Download a Free Sample Report: https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2Mzcw

Overview of Indian Credit Card Industry and Market Size

In the wake of the pandemic, the National Payments Corporation of India (NPCI) encouraged customers and providers of emergency services to adopt digital payment systems, ensuring the safety of contactless transactions. As a result, transactions increased to some extent. However, reduced international travel due to restrictions imposed during the 2020 - 2021 period negatively impacted credit card usage during that time. Revenue levers are likely to be hard to pull as several customers are unwilling to use credit cards frequently. Therefore, various cost management strategies need to be adopted by issuers to attract customers and attain a competitive and robust future for the credit cards market.

For More Insights On Market Intelligence, Refer To The Link Below: -

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/indian-credit-card-industry/596370-93.html

Indian Credit Card Industry Segmentation, 2022

By Purpose of Usage: Credit Card market in India can be segmented on the basis of Purpose of Usage: ATM Withdrawals and non- ATM Purposes where number of credit cards issued for non-ATM purposes accounted for the highest market share of XX% as compared to the ATM withdrawals on the basis of revenue generated in the year 2022. Attributed to the fact that after Covid-19, there is an increase in online shopping rather than going to the stores which in turn increased the credit card usage.

By Type of Credit Card: Credit Card market in India can be segmented on the basis of Type of Credit Card: Personal Credit Card and Commercial Credit Card where Personal Credit card are dominating the Indian credit card industry with market share of XX% when compared to the commercial credit card on the basis of revenue contribution in 2022. This is due to the fact that Credit card companies often offer 0% APR on purchases and/or balance transfers for a limited period of time with better promotional incentives in case of personal cards.

By Payment System Operator: Credit Card market in India can also be segmented on the basis of Payment System Operator: VISA, Mastercard, Rupay, American Express, etc. where VISA is dominating the market with a share of XX% since 2017 whereas market share of Mastercard has declined in 2022 as RBI had barred Mastercard in 2021 from enrolling new customers for not storing their data in India.

Average Ticket Size of Loan Disbursement: Credit Card market in India can also be segmented on the basis of Average Ticket Size of Loan Disbursement: 1,00,000. Ticket size between Rs 50,000 to Rs 1,00,000 captures the major market share pf XX% in 2022 on the basis of revenue contribution. This is attributed to the rise in disposable income of consumers and better living standards.

Business Model Analysis of Newgen Cards

The business model of New Generation Credit Card players particularly revolved around being able to provide an extension of credit to individuals with no prior notable history of having used credit through organized sources, hence lacking a bureau-recorded credit score

Business Model Analysis Of BNPL Cards

The business model of BNPL players revolves around revenues earned from sellers and revenues earned from customers. Typically, there is a transaction fee which a vendor has to burden as part of offering BNPL as an alternative payment method to regular credit and debit cards, along with wallets and COD.

Business Model Analysis Of Loan EMI Cards

The Bajaj Finserv EMI card lets a person pay for a purchase in affordable EMI. As per research conducted, this card is mainly used for high ticket purchases such as electronics. Customers can visit any store of their choice which is affiliated with Bajaj Finserv, select a repayment tenor as per their choice, share the EMI network card details and complete the purchase process by submitting an OTP which is sent to the customer's mobile.

Government Initiatives in the Indian Credit Card Industry

With India on its path towards becoming digitally enhanced country which is majorly fueled by various initiative taken by Government of India in the recent years such as launch of Digi locker as a part of Digital India Initiative and PMJDY scheme among others. Government of India is focusing on complete digitalization of financial services in the country which helps in keeping the track of each activity happened at ease hence encouraging citizens to opt for these online services and is continuously promoting them.

There are several steps/initiatives taken by government to facilitate the Credit card issuance.

Visit this Link: - Request for custom report: https://www.kenresearch.com/ask-customization.php?Frmdetails=NTk2Mzcw

Key Segments Covered in Indian Credit Card Industry

Indian Credit Card Market

By Purpose of Usage

Shopping/ Non-ATM Purpose

ATM Withdrawals

By Payment System Operator

Regular VISA

Peer to Peer Mastercard

Rupay

America Express

Others

By Type of Credit Card

Personal Credit Card

Commercial Credit Card

By Average Ticket Size of Loan Disbursement

Less than Rs. 25,000

Between Rs 25,000- Rs. 50,000

Between Rs. 50,000- Rs. 100,000

More than Rs. 100,000

Business Model Analysis of NewGen Cards

Business Model Analysis of BNPL Cards

Business Model Analysis of Loan EMI Cards

Overview of India Credit Card Industry

Comparison of Indian Credit Card Industry with Other Countries

Value Chain Analysis of Credit Cards

Scope for the Credit card in Semi-Urban and Rural India

Key Target Audience

Credit Card Issuing Banks

New Gen Credit Cards Players

Traders Loan EMI Credit Cards Players

Banking Institutions Payment System Operators

Regulatory Bodies BNPL Credit Cards Players

FinTechs

Various International Digital Lending Platforms and Players

New Entrants in Credit Card Space

Potential Credit Card Users

Request free 30 minutes analyst call: https://www.kenresearch.com/talk-to-expert.php?Frmdetails=NTk2Mzcw

Time Period Captured in the Report:

Historical Period: FY'2017-FY'2022

Forecast Period: FY'2022-FY'2027F

Indian Credit Card Industry Players/Ecosystem

Credit Card Issuing Banks

HDFC Bank

SBI

ICICI

Axis Bank

IDFC Bank

RBL

IndusInd Bank

Citibank

Bank of Baroda

Standard Chartered Bank

Kotak Bank

South Indian Bank

New Gen Credit Cards

Slice

OneCard

UniPay Card

Loan EMI Credit Cards

Bajaj Finserv

Tata Capital

HDFC EasyEMI

Home Credit India

Cards BNPL Credit Cards

Simpl

ZestMoney

LazyPay

CASHe

PostPe

Amazon Pay Later

Flipkart Pay Later

Ola Postpaid

Paytm Postpaid

Flexmoney

ICICI PayLater

Payment System Operators

Visa

Mastercard

American Express

Rupay

UPI

Key Topics Covered in the Report

Overview and Genesis of Indian Credit Card Market

India Credit Card Industry Cycle

Overview of Credit Card Services/ Products

Consumption Expenditure and Borrowing Trends

Emerging business models- Loan against Credit Cards

Socio-Demographic Outlook of India

Economic Outlook of India

Bank Loan Rates

Financing Options in India

Overview of India's Banking Industry

Digital Payment Growth v/s Cash Payment Growth

India Credit Card Industry Introduction

Comparison of Indian Credit Card Industry with Other Countries

Ecosystem of Entities in the Indian Credit Card Industry

Value Chain Analysis of Credit Cards

India Credit Card Market Sizing on the basis of number of credit cards outstanding, Number of Credit Cards Issued by Issuer Bank. Credit Card Transaction by Volume & Value and Annual Credit Card Spend and Monthly Transactions

India Credit Card Market Segmentation (By Purpose of Usage, By Payment System Operator, By Type of Credit Card, By Average Ticket Size of Loan Disbursement).

Business Model Analysis of NewGen Cards

Cross Comparison of Major Players in the NewGen Cards Segment

Business Model Analysis of BNPL Cards

Cross Comparison of Major Players in the BNPL Cards Segment

Business Model Analysis of Loan EMI Cards

Cross Comparison of Major Players in the Loan EMI Cards Segment

Trends and Developments

Growth Drivers of the Indian Credit Card Industry

Restraints and Challenges

Alternative Assessment for NIP (No-Income-Proof) Customers for Credit Card Offerings

Collection risks associated with credit card

Key Metrics of Credit Card Issuers in India

Government Initiatives in the Indian Credit Card Industry

Pradhan Mantri Jan Dhan Yojana (PMJDY)

Pradhan Mantri Jan Dhan Awas Yojana (PMAY)

Initiatives to Promote Access to Data & Innovation

Regulatory Sandbox

Launch of India Stack

Recognising P2P Lenders

Increase in number of Fintech start-ups

Growth of Digital Lending,

Credit Growth in Rural India

Evaluation of KYC Norms

Company profile of major Bank players operating in the ecosystem (Bank Overview, About the Company, Business Model, Product Offered, Key Features, Strengths, Recent Developments and Key Takeaways)

Company profile of major FinTechs players operating in the ecosystem (Company Overview, About the Company, Revenue Model, Funding and Investors, Key Features, Fee Structure, Product Offered, Strengths, Recent Developments, Key Takeaways and Financials)

Analyst Recommendations

Industry Speaks

For More Insights On Market Intelligence, Refer To The Link Below: -

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/indian-credit-card-industry/596370-93.html

Related Reports by ken Research: -

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/india-buy-now-pay-later-market-outlook-to-2026/515064-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/asia-credit-cards-market-outlook/289128-93.html

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a Market Research and Consulting Firm, based out of India, Indonesia and UAE. Since 2011, we have been assisting clients globally with our Syndicate and Bespoke Market Research and Advisory Services.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Future Outlook of Indian Credit Card Industry: Ken Research here

News-ID: 3036810 • Views: …

More Releases from Ken Research Pvt .Ltd

Ken Research Stated Saudi Arabia's Food and Beverage Market to Reached USD 23.5 …

Comprehensive market analysis maps consumption evolution, investment opportunities, and strategic imperatives for industry leaders in the Kingdom's rapidly transforming F&B ecosystem.

Delhi, India - February 16, 2026 - Ken Research released its strategic market analysis titled "Saudi Arabia Food and Beverage Market," revealing that the current market size is valued at USD 23.5 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised to expand,…

Saudi Arabia Facility Management Services Market Surpasses USD 26 Billion Milest …

Comprehensive market analysis maps sustained infrastructure expansion, outsourcing momentum, and strategic imperatives for operators and investors in the Kingdom's rapidly professionalizing facility management ecosystem.

Delhi, India - September 16, 2025 - Ken Research released its strategic market analysis titled "Saudi Arabia Facility Management Services Market," revealing that the current market size is valued at USD 26 Billion, based on a five-year historical analysis. The detailed study outlines how the market is…

Ken Research Stated Chile Sports Equipment and Fitness Retail Market to Reached …

Comprehensive market analysis maps growth trajectory, consumer demand shifts, and strategic imperatives for retailers and brands operating in Chile's rapidly evolving sports and fitness ecosystem.

Delhi, India - February 16, 2026 - Ken Research released its strategic market analysis titled "Chile Sports Equipment and Fitness Retail Market," revealing that the current market size is valued at USD 1.2 Billion, based on a five-year historical analysis. The detailed study outlines how the…

Saudi Arabia Life Insurance Market - Ken Research Stated the Sector Valued at ~U …

Comprehensive market analysis maps strong growth trajectory, investment opportunities, and strategic imperatives for insurers operating in the Kingdom's rapidly evolving life insurance ecosystem.

Delhi, India - February 16, 2026 - Ken Research released its strategic market analysis titled "Saudi Arabia Life Insurance Market Outlook to 2030," revealing that the current market size is valued at USD 8 billion, based on a five-year historical analysis. The detailed study outlines how the market…

More Releases for Card

Gift Card and Incentive Card Market Set for Explosive Growth | National Gift Car …

A new business intelligence report released by AMA with title "Gift Card and Incentive Card Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Gift Card and Incentive Card Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through…

IC Card/Smart Card Market 2022 | Detailed Report

The IC Card/Smart Card research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the IC Card/Smart Card research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Download FREE Sample Report…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future.

A new report published by Allied Market Research, titled, Prepaid Card Market…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future

Prepaid Card Market is projected to grow at a CAGR of 22.7%…

Card Intelligent Lock Market Report 2018: Segmentation by Type (Magnetic card Lo …

Global Card Intelligent Lock market research report provides company profile for Tri-circle, Dessmann, Royalwand, Bangpai, ZKTeco, Schlage, KEYLOCK, Yale, Tenon, KAADAS, BE-TECH and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also…

Prepaid Card Market Report 2018: Segmentation by Card Type (Single-purpose prepa …

Global Prepaid Card market research report provides company profile for Green Dot Corporation, NetSpend Holdings, Inc., H&R Block Inc., American Express Company, JPMorgan Chase & Co., PayPal Holdings, Inc., BBVA Compass Bancshares, Inc. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…