Press release

Intellectual Property Insurance market: Market Indicators Showing Positive Outlook | Aon, Ambridge, Allianz

"QY Research holds tons of experience in offering comprehensive and accurate analysis of global as well as regional markets. The report presented here is an industry-best compilation of detailed and quality research studies on the global Intellectual Property Insurance market. It provides SWOT, PESTLE, and other important types of analysis to give a real and complete picture of the current and future scenarios of the global Intellectual Property Insurance market. The analysts and researchers authoring the report have provided deeper competitive analysis of the global Intellectual Property Insurance market along with exhaustive company profiling of leading market players. Each market player is studied on the basis of market share, recent developments, future growth plans, and other significant factors. All of the statistics and data, including CAGR, market size, and market share, provided in the report are highly reliable and accurate. They have been verified and revalidated using in-house and external sources. The report comes out as a powerful tool that could enable market players to plan out effective strategies to improve their share of the global Intellectual Property Insurance market. Our result-oriented market experts provide research-based recommendations to help market players gain success in their targeted global and regional markets. On the whole, the report is just the right tool that market players can keep in their arsenal to increase their competitiveness.Final Intellectual Property Insurance Report will add the analysis of the impact of COVID-19 on this Market.

Intellectual Property Insurance Market competition by top manufacturers/Key players Profiled:

Aon

Ambridge

Allianz

Marsh

PICC

Ping An Insurance

China Pacific Insurance

The Hartford

CMI

CFC

Gallagher

Founder Shield

Request to Download PDF Sample Copy of Report: https://www.qyresearch.com/sample-form/form/6013128/Global-Intellectual-Property-Insurance-Market-Insights-Forecast-to-2029

Competitive Analysis:

Global Intellectual Property Insurance Market is highly fragmented and the major players have used various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market. The report includes market shares of Intellectual Property Insurance Market for Global, Europe, North America, Asia-Pacific, South America and Middle East & Africa.

Scope of the Report:

The all-encompassing research weighs up on various aspects including but not limited to important industry definition, product applications, and product types. The pro-active approach towards analysis of investment feasibility, significant return on investment, supply chain management, import and export status, consumption volume and end-use offers more value to the overall statistics on the Intellectual Property Insurance Market. All factors that help business owners identify the next leg for growth are presented through self-explanatory resources such as charts, tables, and graphic images.

The report offers in-depth assessment of the growth and other aspects of the Intellectual Property Insurance market in important countries (regions), including:

North America(United States, Canada and Mexico)

Europe (Germany, France, UK, Russia and Italy)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia and Australia)

South America (Brazil, Argentina, Colombia)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Our industry professionals are working reluctantly to understand, assemble and timely deliver assessment on impact of COVID-19 disaster on many corporations and their clients to help them in taking excellent business decisions. We acknowledge everyone who is doing their part in this financial and healthcare crisis.

Share Your Questions Here For More Details On this Report or Customization's As Per Your Need: https://www.qyresearch.com/customize-request/form/6013128/Global-Intellectual-Property-Insurance-Market-Insights-Forecast-to-2029

Table of Contents

Report Overview: It includes major players of the global Intellectual Property Insurance Market covered in the research study, research scope, and Market segments by type, market segments by application, years considered for the research study, and objectives of the report.

Global Growth Trends: This section focuses on industry trends where market drivers and top market trends are shed light upon. It also provides growth rates of key producers operating in the global Intellectual Property Insurance Market. Furthermore, it offers production and capacity analysis where marketing pricing trends, capacity, production, and production value of the global Intellectual Property Insurance Market are discussed.

Market Share by Manufacturers: Here, the report provides details about revenue by manufacturers, production and capacity by manufacturers, price by manufacturers, expansion plans, mergers and acquisitions, and products, market entry dates, distribution, and market areas of key manufacturers.

Market Size by Type: This section concentrates on product type segments where production value market share, price, and production market share by product type are discussed.

Market Size by Application: Besides an overview of the global Intellectual Property Insurance Market by application, it gives a study on the consumption in the global Intellectual Property Insurance Market by application.

Production by Region: Here, the production value growth rate, production growth rate, import and export, and key players of each regional market are provided.

Consumption by Region: This section provides information on the consumption in each regional market studied in the report. The consumption is discussed on the basis of country, application, and product type.

Company Profiles: Almost all leading players of the global Intellectual Property Insurance Market are profiled in this section. The analysts have provided information about their recent developments in the global Intellectual Property Insurance Market, products, revenue, production, business, and company.

Market Forecast by Production: The production and production value forecasts included in this section are for the global Intellectual Property Insurance Market as well as for key regional markets.

Market Forecast by Consumption: The consumption and consumption value forecasts included in this section are for the global Intellectual Property Insurance Market as well as for key regional markets.

Value Chain and Sales Analysis: It deeply analyzes customers, distributors, sales channels, and value chain of the global Intellectual Property Insurance Market.

Key Findings: This section gives a quick look at important findings of the research study.

About Us:

QY Research established in 2007, focus on custom research, management consulting, IPO consulting, industry chain research, data base and seminar services. The company owned a large basic data base (such as National Bureau of statistics database, Customs import and export database, Industry Association Database etc), expert's resources (included energy automotive chemical medical ICT consumer goods etc.

Table of Contents:

1 Report Overview

1.1 Study Scope

1.2 Market Analysis by Type

1.2.1 Global Intellectual Property Insurance Market Size Growth Rate by Type, 2018 VS 2022 VS 2029

1.2.2 Corporate Intellectual Property Insurance

1.2.3 Personal Intellectual Property Insurance

1.3 Market by Application

1.3.1 Global Intellectual Property Insurance Market Size Growth Rate by Application, 2018 VS 2022 VS 2029

1.3.2 Copyright

1.3.3 Patents

1.3.4 Trademarks

1.3.5 Design Rights

1.3.6 Trade Secrets

1.4 Assumptions and Limitations

1.5 Study Objectives

1.6 Years Considered

2 Global Growth Trends

2.1 Global Intellectual Property Insurance Market Perspective (2018-2029)

2.2 Global Intellectual Property Insurance Growth Trends by Region

2.2.1 Intellectual Property Insurance Market Size by Region: 2018 VS 2022 VS 2029

2.2.2 Intellectual Property Insurance Historic Market Size by Region (2018-2023)

2.2.3 Intellectual Property Insurance Forecasted Market Size by Region (2024-2029)

2.3 Intellectual Property Insurance Market Dynamics

2.3.1 Intellectual Property Insurance Industry Trends

2.3.2 Intellectual Property Insurance Market Drivers

2.3.3 Intellectual Property Insurance Market Challenges

2.3.4 Intellectual Property Insurance Market Restraints

3 Competition Landscape by Key Players

3.1 Global Revenue Intellectual Property Insurance by Players

3.1.1 Global Intellectual Property Insurance Revenue by Players (2018-2023)

3.1.2 Global Intellectual Property Insurance Revenue Market Share by Players (2018-2023)

3.2 Global Intellectual Property Insurance Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

3.3 Global Key Players of Intellectual Property Insurance, Ranking by Revenue, 2021 VS 2022 VS 2023

3.4 Global Intellectual Property Insurance Market Concentration Ratio

3.4.1 Global Intellectual Property Insurance Market Concentration Ratio (CR5 and HHI)

3.4.2 Global Top 10 and Top 5 Companies by Intellectual Property Insurance Revenue in 2022

3.5 Global Key Players of Intellectual Property Insurance Head office and Area Served

3.6 Global Key Players of Intellectual Property Insurance, Product and Application

3.7 Global Key Players of Intellectual Property Insurance, Date of Enter into This Industry

3.8 Mergers & Acquisitions, Expansion Plans

4 Intellectual Property Insurance Breakdown Data by Type

4.1 Global Intellectual Property Insurance Historic Market Size by Type (2018-2023)

4.2 Global Intellectual Property Insurance Forecasted Market Size by Type (2024-2029)

5 Intellectual Property Insurance Breakdown Data by Application

5.1 Global Intellectual Property Insurance Historic Market Size by Application (2018-2023)

5.2 Global Intellectual Property Insurance Forecasted Market Size by Application (2024-2029)

6 North America

6.1 North America Intellectual Property Insurance Market Size (2018-2029)

6.2 North America Intellectual Property Insurance Market Size by Type

6.2.1 North America Intellectual Property Insurance Market Size by Type (2018-2023)

6.2.2 North America Intellectual Property Insurance Market Size by Type (2024-2029)

6.2.3 North America Intellectual Property Insurance Market Share by Type (2018-2029)

6.3 North America Intellectual Property Insurance Market Size by Application

6.3.1 North America Intellectual Property Insurance Market Size by Application (2018-2023)

6.3.2 North America Intellectual Property Insurance Market Size by Application (2024-2029)

6.3.3 North America Intellectual Property Insurance Market Share by Application (2018-2029)

6.4 North America Intellectual Property Insurance Market Size by Country

6.4.1 North America Intellectual Property Insurance Market Size by Country: 2018 VS 2022 VS 2029

6.4.2 North America Intellectual Property Insurance Market Size by Country (2018-2023)

6.4.3 North America Intellectual Property Insurance Market Size by Country (2024-2029)

6.4.4 United States

6.4.5 Canada

7 Europe

7.1 Europe Intellectual Property Insurance Market Size (2018-2029)

7.2 Europe Intellectual Property Insurance Market Size by Type

7.2.1 Europe Intellectual Property Insurance Market Size by Type (2018-2023)

7.2.2 Europe Intellectual Property Insurance Market Size by Type (2024-2029)

7.2.3 Europe Intellectual Property Insurance Market Share by Type (2018-2029)

7.3 Europe Intellectual Property Insurance Market Size by Application

7.3.1 Europe Intellectual Property Insurance Market Size by Application (2018-2023)

7.3.2 Europe Intellectual Property Insurance Market Size by Application (2024-2029)

7.3.3 Europe Intellectual Property Insurance Market Share by Application (2018-2029)

7.4 Europe Intellectual Property Insurance Market Size by Country

7.4.1 Europe Intellectual Property Insurance Market Size by Country: 2018 VS 2022 VS 2029

7.4.2 Europe Intellectual Property Insurance Market Size by Country (2018-2023)

7.4.3 Europe Intellectual Property Insurance Market Size by Country (2024-2029)

7.4.3 Germany

7.4.4 France

7.4.5 U.K.

7.4.6 Italy

7.4.7 Russia

7.4.8 Nordic Countries

8 China

8.1 China Intellectual Property Insurance Market Size (2018-2029)

8.2 China Intellectual Property Insurance Market Size by Type

8.2.1 China Intellectual Property Insurance Market Size by Type (2018-2023)

8.2.2 China Intellectual Property Insurance Market Size by Type (2024-2029)

8.2.3 China Intellectual Property Insurance Market Share by Type (2018-2029)

8.3 China Intellectual Property Insurance Market Size by Application

8.3.1 China Intellectual Property Insurance Market Size by Application (2018-2023)

8.3.2 China Intellectual Property Insurance Market Size by Application (2024-2029)

8.3.3 China Intellectual Property Insurance Market Share by Application (2018-2029)

9 Asia (excluding China)

9.1 Asia Intellectual Property Insurance Market Size (2018-2029)

9.2 Asia Intellectual Property Insurance Market Size by Type

9.2.1 Asia Intellectual Property Insurance Market Size by Type (2018-2023)

9.2.2 Asia Intellectual Property Insurance Market Size by Type (2024-2029)

9.2.3 Asia Intellectual Property Insurance Market Share by Type (2018-2029)

9.3 Asia Intellectual Property Insurance Market Size by Application

9.3.1 Asia Intellectual Property Insurance Market Size by Application (2018-2023)

9.3.2 Asia Intellectual Property Insurance Market Size by Application (2024-2029)

9.3.3 Asia Intellectual Property Insurance Market Share by Application (2018-2029)

9.4 Asia Intellectual Property Insurance Market Size by Region

9.4.1 Asia Intellectual Property Insurance Market Size by Region: 2018 VS 2022 VS 2029

9.4.2 Asia Intellectual Property Insurance Market Size by Region (2018-2023)

9.4.3 Asia Intellectual Property Insurance Market Size by Region (2024-2029)

9.4.4 Japan

9.4.5 South Korea

9.4.6 China Taiwan

9.4.7 Southeast Asia

9.4.8 India

9.4.9 Australia

10 Middle East, Africa, and Latin America

10.1 Middle East, Africa, and Latin America Intellectual Property Insurance Market Size (2018-2029)

10.2 Middle East, Africa, and Latin America Intellectual Property Insurance Market Size by Type

10.2.1 Middle East, Africa, and Latin America Intellectual Property Insurance Market Size by Type (2018-2023)

10.2.2 Middle East, Africa, and Latin America Intellectual Property Insurance Market Size by Type (2024-2029)

10.2.3 Middle East, Africa, and Latin America Intellectual Property Insurance Market Share by Type (2018-2029)

10.3 Middle East, Africa, and Latin America Intellectual Property Insurance Market Size by Application

10.3.1 Middle East, Africa, and Latin America Intellectual Property Insurance Market Size by Application (2018-2023)

10.3.2 Middle East, Africa, and Latin America Intellectual Property Insurance Market Size by Application (2024-2029)

10.3.3 Middle East, Africa, and Latin America Intellectual Property Insurance Market Share by Application (2018-2029)

10.4 Middle East, Africa, and Latin America Intellectual Property Insurance Market Size by Country

10.4.1 Middle East, Africa, and Latin America Intellectual Property Insurance Market Size by Country: 2018 VS 2022 VS 2029

10.4.2 Middle East, Africa, and Latin America Intellectual Property Insurance Market Size by Country (2018-2023)

10.4.3 Middle East, Africa, and Latin America Intellectual Property Insurance Market Size by Country (2024-2029)

10.4.4 Brazil

10.4.5 Mexico

10.4.6 Turkey

10.4.7 Saudi Arabia

10.4.8 Israel

10.4.9 GCC Countries

11 Key Players Profiles

11.1 Aon

11.1.1 Aon Company Details

11.1.2 Aon Business Overview

11.1.3 Aon Intellectual Property Insurance Introduction

11.1.4 Aon Revenue in Intellectual Property Insurance Business (2018-2023)

11.1.5 Aon Recent Developments

11.2 Ambridge

11.2.1 Ambridge Company Details

11.2.2 Ambridge Business Overview

11.2.3 Ambridge Intellectual Property Insurance Introduction

11.2.4 Ambridge Revenue in Intellectual Property Insurance Business (2018-2023)

11.2.5 Ambridge Recent Developments

11.3 Allianz

11.3.1 Allianz Company Details

11.3.2 Allianz Business Overview

11.3.3 Allianz Intellectual Property Insurance Introduction

11.3.4 Allianz Revenue in Intellectual Property Insurance Business (2018-2023)

11.3.5 Allianz Recent Developments

11.4 Marsh

11.4.1 Marsh Company Details

11.4.2 Marsh Business Overview

11.4.3 Marsh Intellectual Property Insurance Introduction

11.4.4 Marsh Revenue in Intellectual Property Insurance Business (2018-2023)

11.4.5 Marsh Recent Developments

11.5 PICC

11.5.1 PICC Company Details

11.5.2 PICC Business Overview

11.5.3 PICC Intellectual Property Insurance Introduction

11.5.4 PICC Revenue in Intellectual Property Insurance Business (2018-2023)

11.5.5 PICC Recent Developments

11.6 Ping An Insurance

11.6.1 Ping An Insurance Company Details

11.6.2 Ping An Insurance Business Overview

11.6.3 Ping An Insurance Intellectual Property Insurance Introduction

11.6.4 Ping An Insurance Revenue in Intellectual Property Insurance Business (2018-2023)

11.6.5 Ping An Insurance Recent Developments

11.7 China Pacific Insurance

11.7.1 China Pacific Insurance Company Details

11.7.2 China Pacific Insurance Business Overview

11.7.3 China Pacific Insurance Intellectual Property Insurance Introduction

11.7.4 China Pacific Insurance Revenue in Intellectual Property Insurance Business (2018-2023)

11.7.5 China Pacific Insurance Recent Developments

11.8 The Hartford

11.8.1 The Hartford Company Details

11.8.2 The Hartford Business Overview

11.8.3 The Hartford Intellectual Property Insurance Introduction

11.8.4 The Hartford Revenue in Intellectual Property Insurance Business (2018-2023)

11.8.5 The Hartford Recent Developments

11.9 CMI

11.9.1 CMI Company Details

11.9.2 CMI Business Overview

11.9.3 CMI Intellectual Property Insurance Introduction

11.9.4 CMI Revenue in Intellectual Property Insurance Business (2018-2023)

11.9.5 CMI Recent Developments

11.10 CFC

11.10.1 CFC Company Details

11.10.2 CFC Business Overview

11.10.3 CFC Intellectual Property Insurance Introduction

11.10.4 CFC Revenue in Intellectual Property Insurance Business (2018-2023)

11.10.5 CFC Recent Developments

11.11 Gallagher

11.11.1 Gallagher Company Details

11.11.2 Gallagher Business Overview

11.11.3 Gallagher Intellectual Property Insurance Introduction

11.11.4 Gallagher Revenue in Intellectual Property Insurance Business (2018-2023)

11.11.5 Gallagher Recent Developments

11.12 Founder Shield

11.12.1 Founder Shield Company Details

11.12.2 Founder Shield Business Overview

11.12.3 Founder Shield Intellectual Property Insurance Introduction

11.12.4 Founder Shield Revenue in Intellectual Property Insurance Business (2018-2023)

11.12.5 Founder Shield Recent Developments

12 Analyst's Viewpoints/Conclusions

13 Appendix

13.1 Research Methodology

13.1.1 Methodology/Research Approach

13.1.2 Data Source

13.2 Disclaimer

13.3 Author Details

QY RESEARCH, INC.

17890 CASTLETON STREET

SUITE 369, CITY OF INDUSTRY

CA - 91748, UNITED STATES OF AMERICA

+1 626 539 9760 / +91 8669986909

hitesh@qyresearch.com / enquiry@qyresearch.com

About Us:

QY Research established in 2007, focus on custom research, management consulting, IPO consulting, industry chain research, data base and seminar services. The company owned a large basic data base (such as National Bureau of statistics database, Customs import and export database, Industry Association Database etc), expert's resources (included energy automotive chemical medical ICT consumer goods etc."

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Intellectual Property Insurance market: Market Indicators Showing Positive Outlook | Aon, Ambridge, Allianz here

News-ID: 3029790 • Views: …

More Releases from QYResearch, Inc.

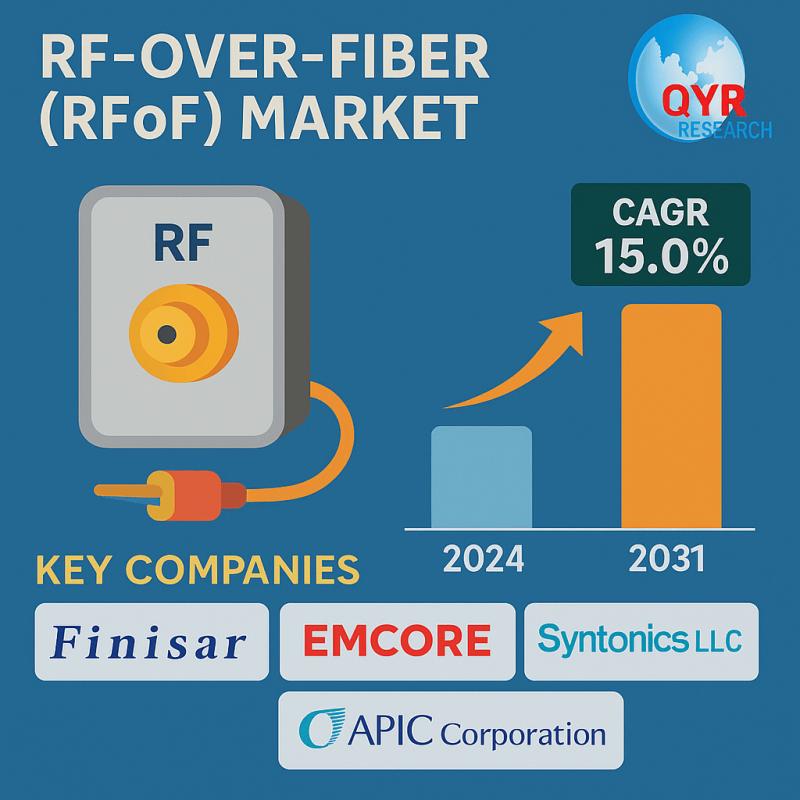

RF-over-Fiber (RFoF) Market Projected to Grow at a CAGR of 15.0% | Forecast 2025 …

Los Angeles, United State: The global RF-over-Fiber (RFoF) Market was valued at US$ 551 million in 2024 and is anticipated to reach US$ 1447 million by 2031, witnessing a CAGR of 15.0% during the forecast period 2025-2031. The research report targets specific customer segments to help companies effectively market their products and drive strong sales in the global RF-over-Fiber (RFoF) Market. It organizes valuable and relevant market insights to match…

Divinyl Sulfone Market 2024's Technological Tapestry: Advancements Shaping the M …

"The thorough study and analysis report is a fantastic and essential tool for worldwide market players to obtain a competitive advantage over their rivals. It contains accurate and validated projections for the global Divinyl Sulfone industry's size, CAGR, production, consumption, and sales. Additionally, it offers projections for industry revenue and volume until 2026. The report's readers may quickly learn about the major prospects, difficulties, and development drivers of the worldwide…

Divinyl Sulfone Market Balancing Acts: Gross Margins, Costs, and Revenue Predict …

"The thorough study and analysis report is a fantastic and essential tool for worldwide market players to obtain a competitive advantage over their rivals. It contains accurate and validated projections for the global Divinyl Sulfone industry's size, CAGR, production, consumption, and sales. Additionally, it offers projections for industry revenue and volume until 2026. The report's readers may quickly learn about the major prospects, difficulties, and development drivers of the worldwide…

Divinyl Sulfone Market Bright Horizons: Positive Market Indicators Revealed | Bo …

"The thorough study and analysis report is a fantastic and essential tool for worldwide market players to obtain a competitive advantage over their rivals. It contains accurate and validated projections for the global Divinyl Sulfone industry's size, CAGR, production, consumption, and sales. Additionally, it offers projections for industry revenue and volume until 2026. The report's readers may quickly learn about the major prospects, difficulties, and development drivers of the worldwide…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…