Press release

Due to rising demand of contactless payments, along with shifting consumer preferences towards cashless mode of payments by advent of COVID-19 is fuelling the expansion of Credit Card Industry in India: Ken Research

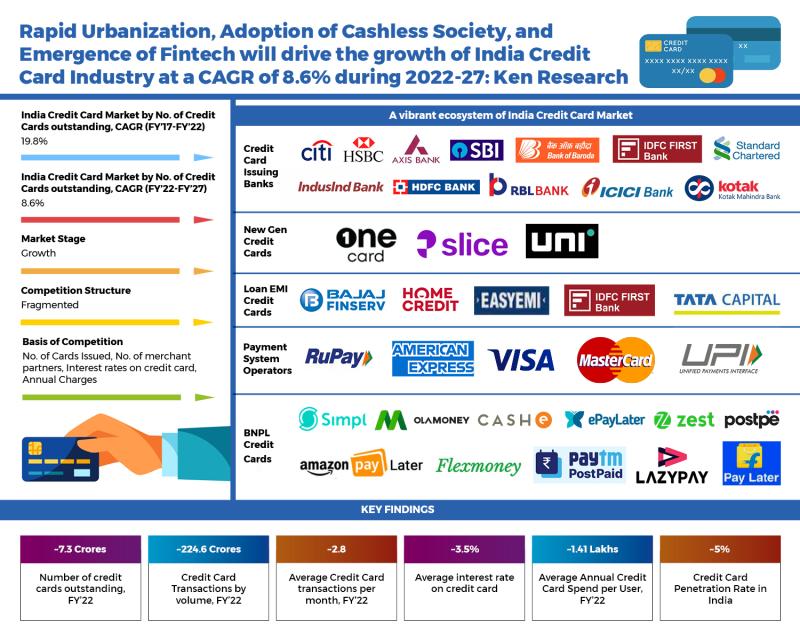

Credit Card Industry in India: The credit card industry in India is undergoing changes, with entry of players in the New-Generation cards as well as the Buy-Now-Pay-Later segment. Traditionally, the segment has been dominated by banks such as HDFC, SBI, ICICI and Axis. Newer business models such as New-Gen cards and BNPL are also making their way in India. The Indian payments industry has witnessed a dramatic shift in recent years in terms of the adoption of digitized technologies and innovations that process transactions within a matter of seconds. As we transition toward a more digital world, the role of credit cards is becoming even more important to facilitate online payments. The demand for online payments is ever growing and service providers are constantly innovating themselves to offer rewarding services to their users.Adoption of Contactless Payments: The need for contactless payments has seen a spike, especially due to the pandemic, giving rise to increased demand for contactless payments. This in turn has led to increased issuance of credit and debit cards in the country. Moreover, the increasing demand for payments through wearables is also driving the credit card industry.

Buy Now, Pay Later: Many fintech players are now offering the buy now, pay later solutions allowing consumers to split their purchase into multiple payments. Consumers can use a BNPL card to make interest-free installment payments on any purchase. This convenience in payment method also attracts them to choose credit options for their payments over other modes of payment.

Rewarding experience: Several consumers switch to using credit cards to avail the benefits that these cards offer in terms of rewards or cashbacks. Today, rewards come as a standard on many credit cards in the form of co-branded cards, giving cardholders a reason to use them in the long-term. With exciting rewards in store for users, while making payments, customers are increasingly inclined towards using credit cards for making payments relating to their daily needs, shopping, travel, etc. This has called for increased partnerships between banks and FinTechs in order to meet the growing demands of their customers and issue cards to them that offers exceptional consumer experiences.

Fintech disruption: In the last few years, the credit space has seen some of the most popular offerings globally by neobanks. New players are entering the credit space in India and have started providing credit cards and digital lending via BNPL, EMI and other services. FinTechs are also focusing on bringing out co-branded cards with features and rewards dedicated to a segment. Banks are also exploring partnerships with FinTech players to acquire new customers to their platforms. FinTechs have opened up new avenues for the credit industry to tap into the large customer base without credit history.

The publication titled "Indian Credit Card Industry Outlook to 2027: Driven by adoption of contactless payments, shifting consumer preferences towards cashless mode of payments, rising disposable income and digitalization" provides a comprehensive analysis of the credit card industry in India. The report covers various aspects including credit card industry market size on the basis of revenue, market overview, genesis of the market, India credit card industry Cycle, overview of credit card services/ Products, ecosystem of entities in the Indian credit card industry, consumption expenditure and borrowing trends, emerging business models- Loan against Credit Cards, value chain analysis of credit cards, growth drivers, restraints and challenges, major trends and developments, alternative assessment for NIP (no-income-proof) customers for credit card offerings, collection risks associated with credit card, key metrics of credit card issuers in India, government initiatives in the Indian credit card industry, Pradhan Mantri Jan Dhan Yojana (PMJDY), Pradhan Mantri Jan Dhan Awas Yojana (PMAY), collection risks associated with credit card, initiatives to promote access to data & innovation, regulatory sandbox, launch of India stack, recognising P2P lenders, increase in number of fintech start-ups, growth of digital lending, and evaluation of KYC norms. Insights on competitive landscape of credit card industry, company profile of major FinTechs players operating in the ecosystem on the basis of Company Overview, About the Company, Revenue Model, Funding and Investors, Key Features, Fee Structure, Product Offered, Strengths, Recent Developments, Key Takeaways and Financials- 2018,2019,2020 & 2021 and company profile of major Bank players operating in the ecosystem on the basis of Bank Overview, About the Company, Business Model, Product Offered, Key Features, Strengths, Recent Developments and Key Takeaways is also covered in the report. The report also covers Business Model Analysis of NewGen Cards, Business Model Analysis of BNPL Cards and Business Model Analysis of Loan EMI Cards. Further report also focuses on the Indian Credit Card Market Segmentation By Purpose of Usage, By Payment System Operator, By Type of Credit Card, By Average Ticket Size of Loan Disbursement . Indian Credit Card Market report concludes with projections for the future of the industry including forecasted industry size by revenue by 2027, and analysts' take on the future highlighting the major opportunities.

To learn more about this report Download a Free Sample Report: https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2Mzcw

Key Segments Covered in Indian Credit Card Industry

Indian Credit Card Market

By Purpose of Usage

Shopping/ Non-ATM Purpose

ATM Withdrawals

By Payment System Operator

Regular VISA

Peer to Peer Mastercard

Rupay

America Express

Others

By Type of Credit Card

Personal Credit Card

Commercial Credit Card

Visit this Link: - Request for custom report: https://www.kenresearch.com/ask-customization.php?Frmdetails=NTk2Mzcw

By Average Ticket Size of Loan Disbursement

Less than Rs. 25,000

Between Rs 25,000- Rs. 50,000

Between Rs. 50,000- Rs. 100,000

More than Rs. 100,000

Business Model Analysis of NewGen Cards

Business Model Analysis of BNPL Cards

Business Model Analysis of Loan EMI Cards

Overview of India Credit Card Industry

Comparison of Indian Credit Card Industry with Other Countries

Value Chain Analysis of Credit Cards

Scope for the Credit card in Semi-Urban and Rural India

Key Target Audience

Credit Card Issuing Banks

New Gen Credit Cards Players

Traders Loan EMI Credit Cards Players

Banking Institutions Payment System Operators

Regulatory Bodies BNPL Credit Cards Players

FinTechs

Various International Digital Lending Platforms and Players

New Entrants in Credit Card Space

Potential Credit Card Users

Request free 30 minutes analyst call: https://www.kenresearch.com/talk-to-expert.php?Frmdetails=NTk2Mzcw

Time Period Captured in the Report:

Historical Period: FY'2017-FY'2022

Forecast Period: FY'2022-FY'2027F

Indian Credit Card Industry Players/Ecosystem

Credit Card Issuing Banks

HDFC Bank

SBI

ICICI

Axis Bank

IDFC Bank

RBL

IndusInd Bank

Citibank

Bank of Baroda

Standard Chartered Bank

Kotak Bank

South Indian Bank

New Gen Credit Cards

Slice

OneCard

UniPay Card

Loan EMI Credit Cards

Bajaj Finserv

Tata Capital

HDFC EasyEMI

Home Credit India

Cards BNPL Credit Cards

Simpl

ZestMoney

LazyPay

CASHe

PostPe

Amazon Pay Later

Flipkart Pay Later

Ola Postpaid

Paytm Postpaid

Flexmoney

ICICI PayLater

Payment System Operators

Visa

Mastercard

American Express

Rupay

UPI

Key Topics Covered in the Report

Overview and Genesis of Indian Credit Card Market

India Credit Card Industry Cycle

Overview of Credit Card Services/ Products

Consumption Expenditure and Borrowing Trends

Emerging business models- Loan against Credit Cards

Socio-Demographic Outlook of India

Economic Outlook of India

Bank Loan Rates

Financing Options in India

Overview of India's Banking Industry

Digital Payment Growth v/s Cash Payment Growth

India Credit Card Industry Introduction

Comparison of Indian Credit Card Industry with Other Countries

Ecosystem of Entities in the Indian Credit Card Industry

Value Chain Analysis of Credit Cards

India Credit Card Market Sizing on the basis of number of credit cards outstanding, Number of Credit Cards Issued by Issuer Bank. Credit Card Transaction by Volume & Value and Annual Credit Card Spend and Monthly Transactions

India Credit Card Market Segmentation (By Purpose of Usage, By Payment System Operator, By Type of Credit Card, By Average Ticket Size of Loan Disbursement).

Business Model Analysis of NewGen Cards

Cross Comparison of Major Players in the NewGen Cards Segment

Business Model Analysis of BNPL Cards

Cross Comparison of Major Players in the BNPL Cards Segment

Business Model Analysis of Loan EMI Cards

Cross Comparison of Major Players in the Loan EMI Cards Segment

Trends and Developments

Growth Drivers of the Indian Credit Card Industry

Restraints and Challenges

Alternative Assessment for NIP (No-Income-Proof) Customers for Credit Card Offerings

Collection risks associated with credit card

Key Metrics of Credit Card Issuers in India

Government Initiatives in the Indian Credit Card Industry

Pradhan Mantri Jan Dhan Yojana (PMJDY)

Pradhan Mantri Jan Dhan Awas Yojana (PMAY)

Initiatives to Promote Access to Data & Innovation

Regulatory Sandbox

Launch of India Stack

Recognising P2P Lenders

Increase in number of Fintech start-ups

Growth of Digital Lending,

Credit Growth in Rural India

Evaluation of KYC Norms

Company profile of major Bank players operating in the ecosystem (Bank Overview, About the Company, Business Model, Product Offered, Key Features, Strengths, Recent Developments and Key Takeaways)

Company profile of major FinTechs players operating in the ecosystem (Company Overview, About the Company, Revenue Model, Funding and Investors, Key Features, Fee Structure, Product Offered, Strengths, Recent Developments, Key Takeaways and Financials)

Analyst Recommendations

Industry Speaks

For More Insights On Market Intelligence, Refer To The Link Below: -

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/indian-credit-card-industry/596370-93.html

Related Reports by ken Research: -

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/india-buy-now-pay-later-market-outlook-to-2026/515064-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/india-atm-managed-services-outlook-to-2026/472828-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/asia-credit-cards-market-outlook/289128-93.html

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a Market Research and Consulting Firm, based out of India, Indonesia and UAE. Since 2011, we have been assisting clients globally with our Syndicate and Bespoke Market Research and Advisory Services.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Due to rising demand of contactless payments, along with shifting consumer preferences towards cashless mode of payments by advent of COVID-19 is fuelling the expansion of Credit Card Industry in India: Ken Research here

News-ID: 3027242 • Views: …

More Releases from Ken Research Pvt .Ltd

UAE Taxi Market Surpasses USD 2,000 Billion Valuation - Latest Insights by Ken R …

Comprehensive market analysis maps fleet electrification mandates, tourism-led trip demand, competitive intensity, and strategic imperatives shaping the UAE's regulated and app-integrated taxi ecosystem.

Dubai, UAE - October 2025 - Ken Research released its strategic market analysis titled "UAE Taxi Market," revealing that the current market size is valued at USD 2,000 Billion, based on a five-year historical analysis. The detailed study outlines how the market is poised to expand, driven by…

Japan Hospitality Market - Ken Research Stated the Industry is Valued at ~USD 24 …

Comprehensive market analysis maps tourism recovery trajectory, investment opportunities, and strategic imperatives for industry leaders across Japan's rapidly evolving hospitality ecosystem.

Delhi, India - August 14, 2025 - Ken Research released its strategic market analysis titled "Japan Hospitality Market," revealing that the current market size is valued at USD 24 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised to expand, driven by the…

Ken Research Stated Global Fragrance and Perfume Market to Reach USD 56.6 Billio …

Comprehensive market analysis maps premiumization, digital acceleration, sustainability trends, and strategic imperatives for brands competing in the rapidly evolving global fragrance ecosystem.

Delhi, India - August 2025 - Ken Research released its strategic market analysis titled "Global Fragrance and Perfume Market," revealing that the current market size is valued at USD 56.6 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised to expand, driven…

Ken Research Stated Philippines Snacks Market to Reached USD 2.6 billion

Comprehensive market analysis maps accelerated consumption trends, portfolio innovation opportunities, and strategic imperatives for brands operating in the country's rapidly evolving packaged snacks ecosystem.

Delhi, India - February 24, 2026 - Ken Research released its strategic market analysis titled "Philippines Snacks Market Outlook to 2030," revealing that the current market size is valued at USD 2.6 billion, based on a five-year historical analysis. The detailed study outlines how the market is…

More Releases for Card

Gift Card and Incentive Card Market Set for Explosive Growth | National Gift Car …

A new business intelligence report released by AMA with title "Gift Card and Incentive Card Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Gift Card and Incentive Card Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through…

IC Card/Smart Card Market 2022 | Detailed Report

The IC Card/Smart Card research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the IC Card/Smart Card research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Download FREE Sample Report…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future.

A new report published by Allied Market Research, titled, Prepaid Card Market…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future

Prepaid Card Market is projected to grow at a CAGR of 22.7%…

Card Intelligent Lock Market Report 2018: Segmentation by Type (Magnetic card Lo …

Global Card Intelligent Lock market research report provides company profile for Tri-circle, Dessmann, Royalwand, Bangpai, ZKTeco, Schlage, KEYLOCK, Yale, Tenon, KAADAS, BE-TECH and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also…

Prepaid Card Market Report 2018: Segmentation by Card Type (Single-purpose prepa …

Global Prepaid Card market research report provides company profile for Green Dot Corporation, NetSpend Holdings, Inc., H&R Block Inc., American Express Company, JPMorgan Chase & Co., PayPal Holdings, Inc., BBVA Compass Bancshares, Inc. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…