Press release

Voice Banking Market : Key Benefits for Stakeholders, Top Investment Pockets and Key Forces Shaping the Growth | U.S. Bank, Axis Bank, HSBC, Emirates NBD Bank, IndusInd Bank

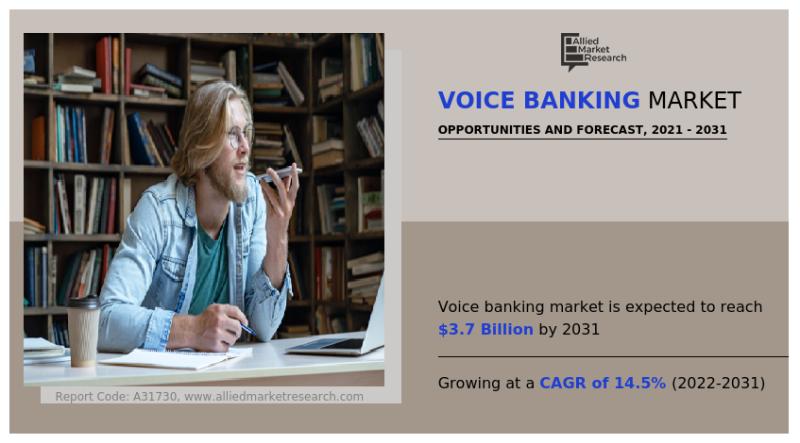

Allied Market Research, the global voice banking market study summarizes competitor analysis, business trends, and forthcoming market & technical analysis forecast. Moreover, the study exemplifies the value and major regional trends of the global voice banking market in terms of market size, revenue size, and growth opportunities. All data pertaining to the voice banking market are gathered from extremely trustworthy sources and carefully examined and verified by market experts.The global voice banking market was valued at $984.6 million in 2021, and is projected to reach $3.7 billion by 2031, growing at a CAGR of 14.5% from 2022 to 2031.

Report Sample PDF: https://www.alliedmarketresearch.com/request-sample/32180

Voice banking is a process that provides a person with voice management for all everyday banking operations. Voice banking is a process that allows a person to record a set list of phrases with their own voice, while they still have the ability to do so. This recording is then converted to create a personal synthetic voice.

Competitive Landscape-

The report analyzes the profiles of key players operating in the Voice banking market such as Acapela Group, Axis Bank, BankBuddy, Central 1 Credit Union, DBS Bank, Emirates NBD Bank, HSBC, IndusInd Bank, NatWest Group and U.S. Bank.

These players have adopted various strategies to increase their market penetration and strengthen their position in the voice banking market share.

Moreover, voice banking enables personalized and expert service at a distance and is a powerful component of a comprehensive digital customer service strategy. The major benefit is that voice banking allows banks to interact with customers digitally, in a secure and efficient yet still human way.

The report also covers their tactical developments, such as product launches, acquisitions & mergers, new collaborations, joint alliances, research & development, investments, and regional development of significant companies in the industry at a global and regional level.

Assessment of Strategic Partnerships-

The global Voice banking market is evaluated on the premise of product or service, industry vertical, application, and region. The market has included regions from North America (Mexico, Canada, and the United States), Europe (Italy, Germany, France, Spain, the United Kingdom, and the rest of the continent), Asia-Pacific (Japan, Australia, South Korea, China, India, and the rest of the Asia-Pacific), and LAMEA (Africa, Latin America, and the Middle East).

The expert specialists at Allied Market Research keep in-depth analyses of the market environment and accurately predict the necessary driving and restraining factors. The stakeholders can build their business plans on these factors.

Purchase Enquiry: https://www.alliedmarketresearch.com/purchase-enquiry/32180

Key Points from the Report-

• Top players operating in the voice banking market

• Major revenue-generating sectors with regional trends and opportunities

• Regulations and development inclinations

• Portfolios of companies, along with their financial information and investment strategies

• Venture Entrepreneurs

Key benefits for stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the voice banking market forecast from 2021 to 2031 to identify the prevailing voice banking market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the voice banking market outlook segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global voice banking market trends, key players, market segments, application areas, and market growth strategies.

Connect Analyst : https://www.alliedmarketresearch.com/connect-to-analyst/32180

Voice Banking Market Report Highlights

Application

Banks

NBFCs

Credit Unions

Others

Component

Solution

Services

Deployment Mode

On-Premise

Cloud

Technology

Machine Learning

Deep Learning

Natural Language Processing

Others

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Key Market Players

U.S. Bank, Axis Bank, HSBC, Emirates NBD Bank, IndusInd Bank, NatWest Group, BankBuddy, Central 1 Credit Union, DBS Bank, Acapela Group

More Reports:

Open Banking Market : https://www.alliedmarketresearch.com/open-banking-market

Corporate Banking Market : https://www.alliedmarketresearch.com/corporate-banking-market-A07536

Blockchain In Retail Banking Market : https://www.alliedmarketresearch.com/blockchain-in-retail-banking-market-A31695

RPA and Hyperautomation in Banking Market : https://www.alliedmarketresearch.com/rpa-and-hyperautomation-in-banking-market-A31697

Video Banking Service Market :

https://www.alliedmarketresearch.com/video-banking-service-market-A31651

Banking Encryption Software Market :

https://www.alliedmarketresearch.com/banking-encryption-software-market-A11824

Commercial Banking Market :

https://www.alliedmarketresearch.com/commercial-banking-market-A06184

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Voice Banking Market : Key Benefits for Stakeholders, Top Investment Pockets and Key Forces Shaping the Growth | U.S. Bank, Axis Bank, HSBC, Emirates NBD Bank, IndusInd Bank here

News-ID: 3020705 • Views: …

More Releases from www.alliedmarketresearch.com

Pet Insurance Market Soars: Projected to Hit $38.3 Billion by 2033 as Demand for …

According to a new report published by Allied Market Research, titled, "Pet Insurance Market, By Policy Coverage (Accident Only, Accident and Illness, and Others), By Animal Type (Dogs, Cats, and Others), and By Sales Channel (Agency, Broker, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". The pet insurance market was valued at $10.10 billion in 2023, and is estimated to reach $38.3 billion by 2033, growing at a CAGR…

Manual Spray Guns Market to Hit $2.6 Billion by 2032 | Key Growth Drivers & Oppo …

Prime determinants of growth

The demand for manual spray guns, which are mostly used for painting consumer durables, has increased because of this need, particularly in developing nations like India, China, and Vietnam. Additionally, there is a greater need for manual spray guns from car manufacturers due to the rising demand for automobiles around the world, particularly in industrialized nations like Europe and North America.

Download PDF Sample Report: www.alliedmarketresearch.com/request…ple/111362

Due to…

Hygienic Cladding Market Poised for Growth: Global Trends & Opportunities 2023-2 …

According to the report, the global hygienic cladding market generated $2.8 billion in 2022, and is anticipated to generate $6 billion by 2032, rising at a CAGR of 8.3% from 2023 to 2032.

Prime Determinants of Growth

The increased awareness & demand for health-related products, the increasing need for safe & healthy environments in healthcare facilities, and hygienic wall cladding's affordability & durability than traditional tiling methods are the factors expected to…

AI in Insurance Market Poised to Reach $45.74 Bn Globally by 2031, Soaring at a …

Global Opportunity Analysis and Industry Forecast, 2021-2031". According to the report, the global AI in insurance industry generated $2.74 billion in 2021, and is anticipated to generate $45.74 billion by 2031, witnessing a CAGR of 32.5% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11615

Higher deployment cost of AI, advanced machine learning, and lack of skilled labor hamper the market growth. On the contrary, surge in government initiatives…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…