Press release

Cyber Security Insurance Market value is expected to grow at a CAGR of 18.93% between 2023-2030 to hit USD 42.22 Bn

Cyber Security Insurance Market Overview:The research investigates the industry's global market share, development potential, and choices. It is critical to acquire an impartial assessment of market performance since market participants rely on this data to maintain and expand their market position. The study also examines the short- and long-term effects of macro variables, drivers, and restraints on the regional and global Cyber Security Insurance Market.

The research report looks into the global business plans of prominent market participants. The entire forecast, trends, and dollar values for the global target market are provided. A solid research technique was used to generate the thorough study of the worldwide Cyber Security Insurance Market, which aids in examining vital insights and also examines the industry's potential possibilities.

"As per the SNS Insider Research, the Cyber Security Insurance Market was valued at US$ 10.54 Bn in 2022, and is projected to reach US$ 42.22 Bn by 2030, with healthy growing CAGR of 18.93% over the Forecast Period 2023-2030."

Get a Free Sample Report of Cyber Security Insurance Market @ https://www.snsinsider.com/sample-request/2273

Major Key Players Included are:

• Tata Consultancy Services Limited

• Guy Carpenter and Company

• At-Bay

• Lloyds Bank PLC

• AXA SA

• Cisco Systems

• Chubb Limited

• Apple Inc

• American International Group

• Zurich Insurance Group

Market Segmentation Analysis:

When adopting a thorough and iterative research technique to eliminate variation, the most precise predictions and projections are achievable. For segmenting and calculating the quantitative components of the Cyber Security Insurance Market, the organization employs a combination of bottom-up and top-down methodologies.

Market Segmentation & Sub-segmentation included are:

On The Basis of Deployment Model:

• Cloud-based

• On-premise

On The Basis of Service Type:

• Wireless security

• Application security

• Network security

• Endpoint security

• Others

On The Basis of Organization:

• SMB

• Large Enterprise

On The Basis of Application:

• BFSI

• Healthcare

• IT & Telecom

• Retail

• Others

COVID-19 Pandemic Impact Analysis:

The Cyber Security Insurance Market component of the analysis assessed the overall situation of the COVID-19 scenario. The industry's revenues have dropped dramatically. Similarly, the temporary closure of manufacturing/processing facilities harmed the Customized Premixes industry. Analysts have also focused on the critical efforts that companies are taking to withstand the storm.

Regional Outlook:

The research report is prepared to assist the readers in understanding the market in terms of definition, segmentation, market potential, pertinent trends, and the issues that the sector deals with in various key areas. The Cyber Security Insurance Market report is a compilation of first-hand experience, qualitative and quantitative analysis by industry analysts, and opinions from field specialists and value chain players.

Enquire about the Report @ https://www.snsinsider.com/enquiry/2273

Competitive Analysis:

The report was produced following thorough research and analysis. This study will provide readers with a comprehensive understanding of the market. Important manufacturers and suppliers are focusing on business expansion and product innovation to strengthen their worldwide market position. Product innovation and strategic mergers and acquisitions have an impact on the competitiveness of the Cyber Security Insurance Market.

Key Questions Answered in the Cyber Security Insurance Market Report:

• Which regions will have the most appealing regional marketplaces in the future for market participants?

• What strategies might developed-region players employ in order to gain a competitive advantage in the global market?

Conclusion:

We intend to give readers with a detailed and relevant report. Professionals in the business have painstakingly studied and built the Cyber Security Insurance Market, which will provide the crucial information required by market stakeholders.

Get complete report details @ https://www.snsinsider.com/reports/cyber-security-insurance-market-2273

Table of Contents - Major Key Points:

1. Introduction

2. Research Methodology

3. Market Dynamics

4. Impact Analysis

5. Value Chain Analysis

6. Porter's 5 Forces Model

7. PEST Analysis

8. Cyber Security Insurance Market Segmentation, By Deployment Model

9. Cyber Security Insurance Market Segmentation, By Service Type

10. Cyber Security Insurance Market Segmentation, By Organization

11. Cyber Security Insurance Market Segmentation, By Application

12. Regional Analysis

13. Company Profiles

14. Competitive Landscape

15. Conclusion

Buy Single User PDF of Cyber Security Insurance Market Report @ https://www.snsinsider.com/checkout/2273

Contact Us:

Akash Anand

Head of Business Development & Strategy

info@snsinsider.com

Office No.305-B, Arissa Avenue, Fountain Road, Kharadi, Pune, Maharashtra 411014

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Our staff is dedicated to giving our clients reliable information, and with expertise working in the majority of industrial sectors, we're proud to be recognized as one of the world's top market research firms. We can quickly design and implement pertinent research programs, including surveys and focus groups, and we have the resources and competence to deal with clients in practically any company sector.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cyber Security Insurance Market value is expected to grow at a CAGR of 18.93% between 2023-2030 to hit USD 42.22 Bn here

News-ID: 3013524 • Views: …

More Releases from SNS Insider

Private Cloud Services Market Forecast Predicts Promising Growth Ahead

Private Cloud Services Market Scope and Overview

The Private Cloud Services Market has witnessed significant growth in recent years, fueled by the increasing adoption of cloud computing technologies across various industries. Private clouds offer enhanced security, control, and customization compared to public cloud services, making them a preferred choice for enterprises seeking to leverage cloud capabilities while maintaining data sovereignty and compliance. This report delves into the competitive landscape, market segmentation,…

Video Surveillance Market Analysis Unveils Insights for Growth and Development

Video Surveillance Market Scope and Overview

The Video Surveillance Market has seen significant growth over the past few decades, driven by advancements in technology and an increasing need for security across various sectors. Video surveillance systems, once primarily used for security purposes, have now expanded their applications to include monitoring, analysis, and even preventive measures in various industries. This report provides a comprehensive analysis of the video surveillance market, covering its…

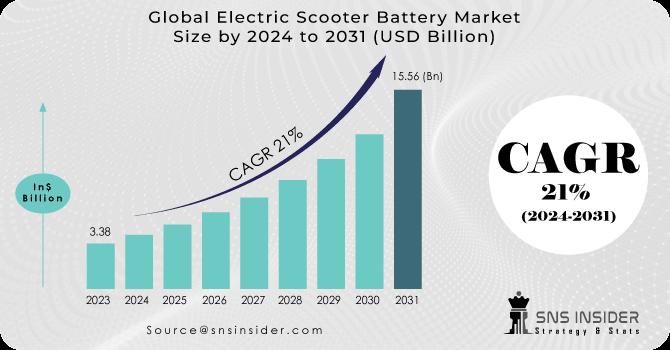

Electric Scooter Battery Market Charges Ahead, Propelling Sustainable Urban Mobi …

The Global Electric Scooter Battery Market is experiencing a remarkable surge, fueled by the rising demand for eco-friendly and convenient transportation solutions in urban environments. As cities around the world grapple with traffic congestion, air pollution, and the need for sustainable mobility, the electric scooter battery market is poised to play a pivotal role in shaping the future of urban transportation. According to a comprehensive market research report, the electric…

Solar-Powered Vehicle Market Accelerates Towards a Sustainable Future, Projected …

The Global Solar-Powered Vehicle Market is rapidly gaining momentum, driven by the urgent need to combat climate change and reduce greenhouse gas emissions. As the world transitions towards a greener and more sustainable future, the adoption of solar-powered vehicles is emerging as a game-changer in the automotive industry. According to a comprehensive market research report, the solar-powered vehicle market, valued at $1.27 billion in 2023, is expected to reach a…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…