Press release

Global Cyber Insurance Market is expected to grow at a substantial CAGR of above 23% during 2023-2028, says RationalStat's Market Report

Helping cyber insurance carriers identify and promote organizational awareness about security controls, restricting extortion payments made by insurers to cyber-criminals, and preventing negligent companies from dodging the full cost of regulatory fines and class action settlements through cyber insurance coverage to skyrocket the sales on cyber insurance policies, says a report by RationalStatThe latest market research report on the Global Cyber Insurance Market by

RationalStat assesses the regional market based on cyber loss type, coverage type, enterprise size, insurance type, end user, and region. A detailed market analysis report provides an overall historical and future market size in terms of market value (US$ Million) and with a comprehensive market trend analysis (year-on-year growth). The market share analysis, growth of the insurance industry, competition overview, strategic imperatives, plans and strategies, key application, potential growth driver, recent R&D of cyber insurance across the globe, claims analysis, and competition analysis for the target players evaluated in the global cyber insurance market study.

Market Overview and Dynamics

The global cyber insurance market was valued at US$ 9.0 billion in 2022 and is expected to grow at a robust growth rate of around 23.4% during the forecast period 2022-2028. The major factors driving the growth of the global cyber insurance market are the increasing complexity of cyber-attacks and an upsurge in ransomware attacks ending up in a ransom payment of US$ 426 in 2020.

Market Drivers and Trends of the Global Cyber Insurance Market

In regions like Europe and North America, the presence of stringent government regulations is expected to fuel the demand for cyber insurance. Moreover, the regional companies have a strong technology adoption and are home to several hi-tech companies.

In addition, the Indian business sector is increasingly investing in cyber insurance coverage policies to shield itself against the adverse impact of pervasive cyber threats that include malware attacks, email comprises phishing, insider attacks, crypto-jacking, and (nation-state) sponsored cyber-attacks on critical infrastructure-driven businesses.

• The amount of yearly cyber insurance coverage companies usually buy ranges from US$ 1 million (small companies) to US$ 200 million (large IT service providers) and it is growing at a CAGR of 35 percent for the past three years.

In addition, the cyber insurance market is expanding swiftly as businesses roll out customized/ tailored cyber insurance policies to meet changing consumer preferences that cater to their specific needs.

In Asia Pacific, the insurance regulators and key players operating in the insurance sector should lay down rules that clarify and structure better in the terms of commercial cyber insurance coverage (what policies do and do not cover, and more importantly what policies should and should not cover) for policy buyers to an improved market density that directly has a positive impact on improved cyber-security in the region.

Segmental Analysis: Global Cyber Insurance Market

• On the basis of cyber loss type, the digital damage category is dominating the global market as it exposes the company's sensitive data and client information, the safety of which is of utter importance to an organization. However, physical damage is also gaining traction as cybercriminals are focusing on capturing access to a physical assets through digital hacking.

• Based on the insurance type, custom/tailored cyber insurance policies are expected to gain traction in the upcoming years as customized cyber insurance policies provide the end users with flexibility and chose options that cater to their needs.

Competition Analysis and Market Structure

The global cyber insurance market is fragmented in nature with the presence of various players operating in the region. Leading companies operating in the cyber insurance market are focusing on providing coverage for all kinds of liabilities that hamper routine activities of a firm after a cyberattack to provide to evolving consumer preferences.

Moreover, players and insurance companies operating in the cyber insurance market adopt various strategies to increase their market share and gain a competitive edge over other competitors in the market. Mergers and acquisitions, Partnerships, and collaborations are some of the strategies followed by industry players. Some of the key developments in the global cyber insurance market include,

• In Jan 2023, San Francisco-based At-Bay become a full-stack insurance carrier with the acquisition of At-Bay Specialty Insurance Company (At-Bay SIC) from XL Insurance America, Inc.

o At-Bay said the move to a full-stack carrier will allow the company to better serve its policyholders and accelerate planned product expansion into additional specialty lines, as well as give At-Bay more control over the entire insurance value chain while strengthening its commitment to the wholesale channel.

• In Jan 2023, Coalition's UK business began trading as an approved Lloyd's coverholder. Last year, Coalition launched an independent Bermuda-based Class 3B reinsurer, Ferian Re, that catered to provide capacity across Coalition's cyber programs.

Some of the key players operating in the global cyber insurance market include Traveler Indemnity Company, AXA AL, Chubb, American International Group, Inc, Beazley Group, AXIS Capital, BCS Financial Corporation, Zurich Insurance, CNA Financial Corporation, The Hanover Insurance Group, Bajaj Allianz, ICICI Lombard, Tata AIG, HDFC Ergo and Lloyds India among others.

RationalStat has segmented the global cyber insurance market on the basis of cyber loss type, coverage type, enterprise size, insurance type, end user, and region.

• Global Cyber Insurance Market Value (US$ Million), and Market Share (2019-2028) Analysis by Cyber Loss Type

o Digital Damage

IP Theft

Business Interruption

Digital Assets

o Physical Damage

• Global Cyber Insurance Market Value (US$ Million), and Market Share (2019-2028) Analysis by Coverage Type

o First-Party

o Liability Coverage

Forensics

Notification

Credit Monitoring

Public Relations

Reputational Risk

Legal Defense

Settlement Costs

Crisis Management

Recovery Costs

Regulatory Fines

• Global Cyber Insurance Market Value (US$ Million), and Market Share (2019-2028) Analysis by Enterprise Size

o Standalone

o Custom/Tailored

• Global Cyber Insurance Market Value (US$ Million), and Market Share (2019-2028) Analysis by Enterprise Size

o SMEs

o Large Enterprises

• Global Cyber Insurance Market Value (US$ Million), and Market Share (2019-2028) Analysis by End User

o Healthcare

o Retail

o BFSI

o Retail

o IT & Telecom

o Manufacturing

o Others (Government, Travel & Tourism, etc.)

• Global Cyber Insurance Market Value (US$ Million), and Market Share (2019-2028) Analysis by Region

o North America Cyber Insurance Market

US

Canada

o Latin America Cyber Insurance Market

Brazil

Mexico

Rest of Latin America

o Western Europe Cyber Insurance Market

Germany

UK

France

Spain

Italy

Benelux

Nordic

Rest of Western Europe

o Eastern Europe Cyber Insurance Market

Russia

Poland

Rest of Eastern Europe

o Asia Pacific Cyber Insurance Market

China

Japan

India

South Korea

Australia

ASEAN (Indonesia, Vietnam, Malaysia, etc.)

Rest of Asia Pacific

o Middle East & Africa Cyber Insurance Market

GCC

South Africa

Turkey

Rest of the Middle East & Africa

For more information about this report https://store.rationalstat.com/store/global-cyber-insurance-market-analysis-and-forecast-2019-2028/

Key Questions Answered in the Cyber Insurance Report:

• What will be the market value of the Global Cyber Insurance Market by 2028?

• What is the market size of the Global Cyber Insurance Market?

• What are the market drivers of the Global Cyber Insurance Market?

• How many Cyber Insurance are sold each year?

• What are the key trends in the Global Cyber Insurance Market?

• Which is the leading region in the Global Cyber Insurance Market?

• What are the major companies operating in the Global Cyber Insurance Market?

• What are the market shares by key segments in the Global Cyber Insurance Market?

RationalStat LLC

Kimberly Shaw, Content and Press Manager

sales@rationalstat.com

Phone: +1 302 803 5429

RationalStat is an end-to-end global market intelligence and consulting company that provides comprehensive market research reports along with customized strategy and consulting studies. The company has sales offices in India, Mexico, and the US to support global and diversified businesses. The company has over 80 consultants and industry experts, developing more than 850 market research and industry reports for its report store annually.

RationalStat has strategic partnerships with leading data analytics and consumer research companies to cater to the client's needs. Additional services offered by the company include consumer research, country reports, risk reports, valuations and advisory, financial research, due diligence, procurement and supply chain research, data analytics, and analytical dashboards.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Cyber Insurance Market is expected to grow at a substantial CAGR of above 23% during 2023-2028, says RationalStat's Market Report here

News-ID: 3001455 • Views: …

More Releases from RationalStat LLC

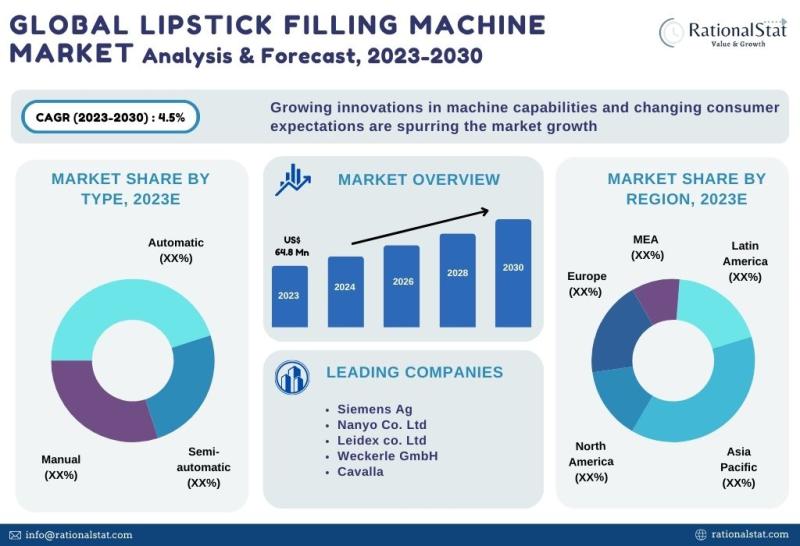

Latest Market Study | Global Lipstick Filling Machine Market Size, Share, & Fore …

The global lipstick filling machine market is expected to reach US$ 88.2 million by 2030, with an annual growth rate of more than 4.5%.

According to RationalStat's recent industry analysis, the Global Lipstick Filling Machine Market value is estimated at US$ 64.8 million in 2023 and is expected to rise at a strong CAGR of over 4.5% over the forecast period of 2023-2030.

Market Definition, Market Scope, and Report Overview

A lipstick…

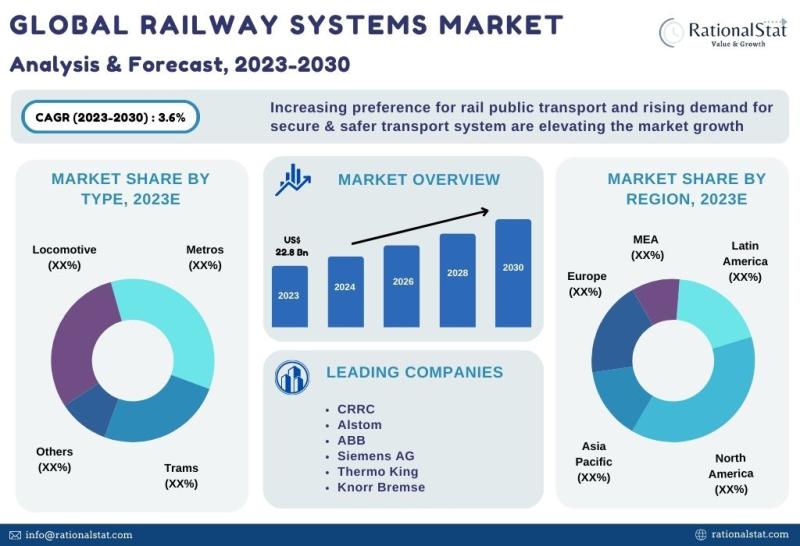

Published Market Report | Global Railway Systems Market Size, Share, & Forecast …

The global railway systems market is expected to reach US$ 29.2 billion by 2030, with an annual growth rate of more than 3.6%.

According to RationalStat's recent industry analysis, the Global Railway Systems Market value is estimated at US$ 22.8 billion in 2023 and is expected to rise at a strong CAGR of over 3.6% over the forecast period of 2023-2030.

Market Definition, Market Scope, and Report Overview

Railway systems, also known…

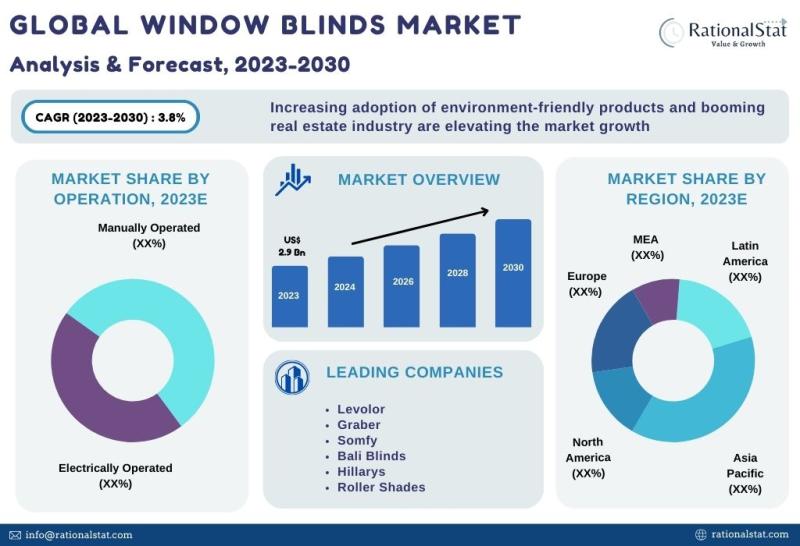

Published Market Report | Global Window Blinds Market Size, Share, & Forecast 20 …

The global window blinds market is expected to reach US$ 3.7 billion by 2030, with an annual growth rate of more than 3.8%.

According to RationalStat's most recent industry analysis, the Global Window Blinds Market value is estimated at US$ 2.9 billion in 2023 and is expected to rise at a strong CAGR of over 3.8% over the forecast period of 2023-2030.

Market Definition, Market Scope, and Report Overview

Window blinds are…

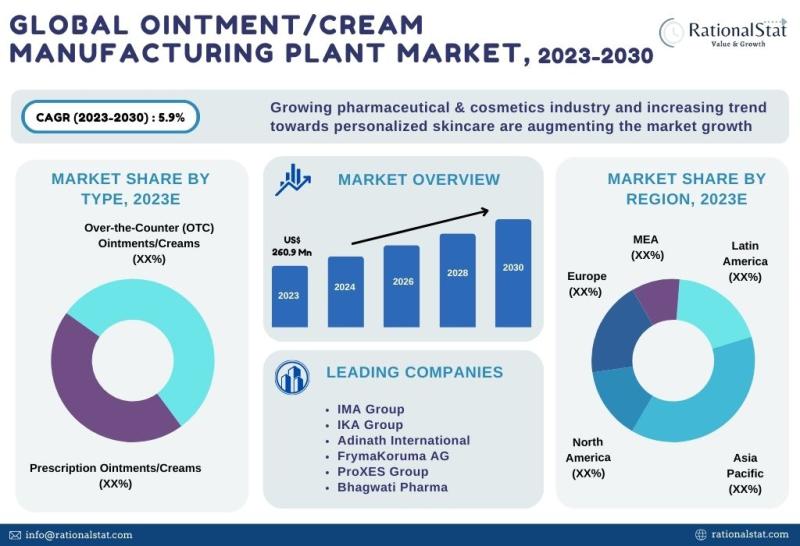

Ointment and Cream Manufacturing Plant Market Report 2023 | Ointment and Cream M …

The global ointment and cream manufacturing plant market is expected to approach US$ 388.7 million by 2030, with an annual growth rate of more than 5.9%

Global Ointment and Cream Manufacturing Plant Market is valued at US$ 260.9 million in 2023 and is expected to grow at a significant CAGR of over 5.9% over the forecast period of 2023-2030, according to the published market report by RationalStat

Market Definition, Market…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…