Press release

Cyber Insurance Market Size, Growth, Share, Trends, Outlook and Analysis 2023-2028

According to the latest report by IMARC Group "Cyber Insurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028", The global cyber insurance market size reached US$ 9.8 Billion in 2022. Looking forward, IMARC Group expects the market to reach US$ 31.7 Billion by 2028, exhibiting a growth rate (CAGR) of 22.39% during 2023-2028. This report can serve as an excellent guide for investors, researchers, consultants, marketing strategists and all those who are planning to foray into the market in any form.Cyber insurance is designed to protect businesses against digital threats such as malicious hacks, malware, ransomware, data breaches, and distributed denial-of-service (DDoS). They cover financial protection for sensitive customer information, such as social security numbers, health records, account numbers, driver's licenses, and credit card numbers. In addition, they notify customers of cybersecurity incidents, restore their identities, recover compromised data, and repair damaged computer systems. Consequently, organizations are widely embracing cyber insurance to cover physical damage to hardware and income loss. Moreover, it is widely adopted in banking, financial services and insurance, information and technology, retail, telecom, and healthcare sectors across the globe.

Get a PDF Sample for more detailed market insights: https://www.imarcgroup.com/cyber-insurance-market/requestsample

Cyber Insurance Market Trends and Drivers:

The market is primarily driven by the increasing incidences of cyber-attacks and data breaches. In addition, the rising digitization and the recent onset of the coronavirus (COVID-19) pandemic resulted in increasing remote working conditions contributing to the market growth. Moreover, various governments and law enforcement agencies are taking several initiatives to strengthen data security and protection. For instance, a United States assembly introduced bills to make cybersecurity insurance mandatory to protect the personal information of citizens. Besides this, numerous data privacy laws, including personally identifiable information (PII) and the United States health insurance portability and accountability act (HIPPA), are accelerating the product adoption rate. Furthermore, the growing awareness regarding business interruption (BI) cyber risks and the advancements in artificial intelligence (AI) and blockchain technology are also creating a positive market outlook.

Competitive Landscape:

The competitive landscape of the market has been studied in the report with the detailed profiles of the key players operating in the market.

Some of the key players operating in the market are:

Allianz SE

American International Group Inc.

AON Plc

AXA XL

Berkshire Hathaway Inc.

Chubb Limited (ACE Limited)

Lockton Companie

Munich Re

Society of Lloyd's

Zurich Insurance Group.

For more information about this report visit: https://www.imarcgroup.com/cyber-insurance-market

The report has segmented the market on the basis of Product Type, Distribution Channel, and Region.

Breakup by Component:

Solution

Services

Breakup by Insurance Type:

Packaged

Stand-alone

Breakup by Organization Size:

Small and Medium Enterprises

Large Enterprises

Breakup by End Use Industry:

BFSI

Healthcare

IT and Telecom

Retail

Others

Market Breakup by Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Other Trending Reports By IMARC Group

Europe Bancassurance Market: https://www.imarcgroup.com/europe-bancassurance-market

United States Bancassurance Market: https://www.imarcgroup.com/united-states-bancassurance-market

India Health Insurance Market: https://www.imarcgroup.com/india-health-insurance-market

Usage-based Insurance Market: https://www.imarcgroup.com/usage-based-insurance-market

Contact US

IMARC Group

Email: sales@imarcgroup.com

USA: +1-631-791-1145 | Asia: +91-120-433-0800

Address: 134 N 4th St. Brooklyn, NY 11249, USA

Follow us on Twitter: @imarcglobal

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cyber Insurance Market Size, Growth, Share, Trends, Outlook and Analysis 2023-2028 here

News-ID: 2998864 • Views: …

More Releases from IMARC Group

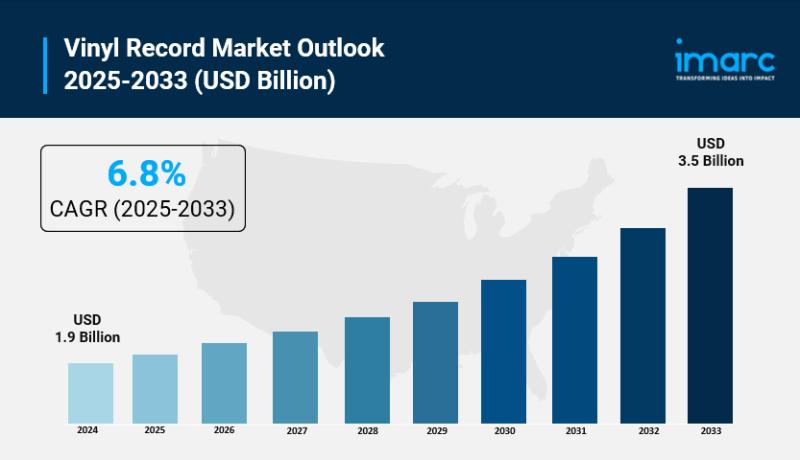

Vinyl Record Market Size to Reach USD 3.5 Billion by 2033 | With a 6.8% CAGR

Market Overview:

According to IMARC Group's latest research publication, "Vinyl Record Market Report by Product (LP/EP Vinyl Records, Single Vinyl Records), Feature (Colored, Gatefold, Picture), Gender (Men, Women), Age Group (13-17, 18-25, 26-35, 36-50, Above 50), Application (Private, Commercial), Distribution Channel (Supermarkets and Hypermarkets, Independent Retailers, Online Stores, and Others), and Region 2025-2033", The global vinyl record market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the…

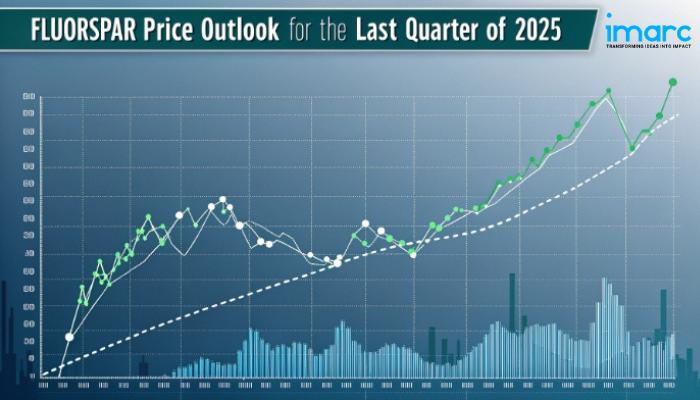

North America Fluorspar Prices Rise in Q4 2025: USA at USD 484/MT, Canada Peaks …

North America Fluorspar Prices Movement Q4 2025:

Fluorspar Prices in USA:

In Q4 2025, fluorspar prices in the USA averaged USD 484 per metric ton. Stable demand from aluminum production and chemical manufacturing supported price levels. Domestic mining operations maintained consistent output, while transportation and energy costs influenced overall supply. Moderate industrial activity and inventory management helped prevent significant price fluctuations across the regional market.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/fluorspar-pricing-report/requestsample

Note: The analysis…

Brazil Hybrid Electric Vehicle Market: Growth Dynamics, Consumer Shifts, and Com …

The Brazil hybrid electric vehicle market size was 348.75 Thousand Units in 2025 and is forecasted to reach 2,551.74 Thousand Units by 2034, reflecting a CAGR of 24.75% during 2026-2034. This robust expansion is fueled by increasing environmental awareness, rising fuel costs, and government policies aimed at emission reduction. Advances in battery technology and flex-fuel hybrid variants leveraging Brazil's ethanol resources also contribute to market growth.

Sample Request Link: https://www.imarcgroup.com/brazil-hybrid-electric-vehicle-market/requestsample

Study Assumption…

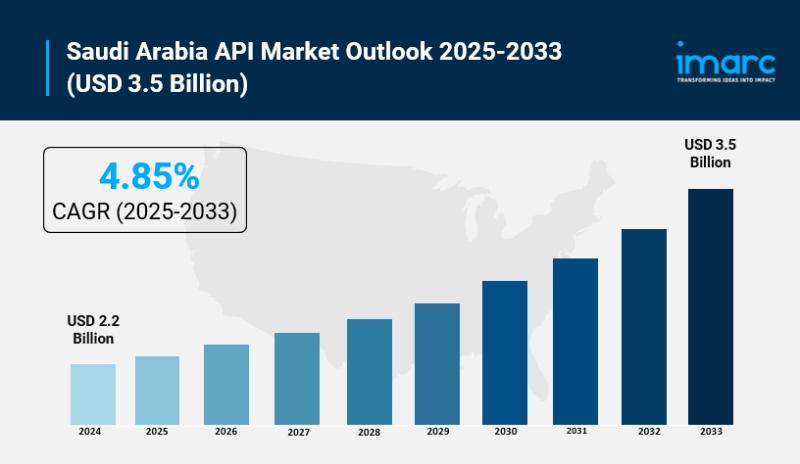

Saudi Arabia API Market Size to Expand USD 3.5 Billion by 2033 at a CAGR of 4.85 …

Saudi Arabia API Market Overview

Market Size in 2024: USD 2.2 Billion

Market Forecast in 2033: USD 3.5 Billion

Market Growth Rate 2025-2033: 4.85%

According to IMARC Group's latest research publication, "Saudi Arabia API Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia API market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2033, exhibiting a growth rate…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…