Press release

Robo Advisory Market Size, Scope, And Forecast 2027 | Fincite, Betterment, Charles Schwab & Co., Inc., Ellevest, Ginmon Vermögensverwaltung GmbH

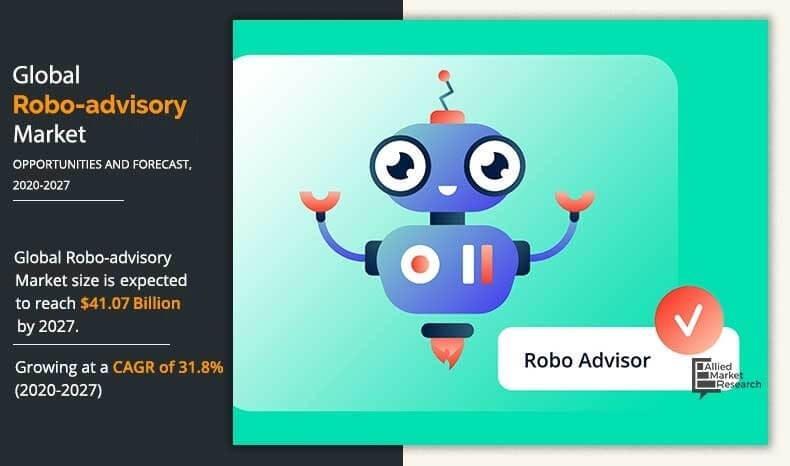

Robo Advisory Market By Business Model (Pure Robo Advisors and Hybrid Robo Advisors), Service Provider (FinTech Robo Advisors, Banks, Traditional Wealth Managers, and Others), Service Type (Direct Plan-Based/Goal-Based and Comprehensive Wealth Advisory), and End User (Retail Investor and High Net Worth Individuals [HNIs]): Global Opportunity Analysis and Industry Forecast, 2020-2027The global robo advisory market size was valued at $4.51 billion in 2019, and is projected to reach $41.07 billion by 2027, growing at a CAGR of 31.8% from 2020 to 2027.

Report Sample PDF : https://www.alliedmarketresearch.com/request-sample/2105

Competitive Analysis

The key players profiled in the robo advisory market report are Betterment, Blooom, Charles Schwab Corporation, FMR LLC, Personal Capital Corporation, SoFi, SIGFIG, The Vanguard Group Inc., Wealthfront Corporation, and WiseBanyan Inc. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the industry.

Based on component, the solution segment held the highest market share in 2020, holding more than two-thirds of the total market share, and is expected to continue its leadership status during the forecast period. Moreover, the service segment is estimated to register the highest CAGR of 33.3% from 2021 to 2030.

Interested to Procure the Data? Inquire here @ https://www.alliedmarketresearch.com/purchase-enquiry/2105

Key Benefits For Stakeholders

The study provides an in-depth analysis of the global robo advisory market forecast along with the current trends and future estimations to elucidate the imminent investment pockets.

Information about key drivers, restraints, and opportunities and their impact analysis on the global robo advisory market size is provided in the report.

Porter's five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

The quantitative analysis of the robo advisory market share from 2019 to 2027 is provided to determine the market potential.

Top Impacting Factors

Rapid Digitalization in Financial Services

Untapped Potential of Emerging Economies

Based on deployment mode, the on-premise segment held the largest market share in 2020, holding nearly three-fifths of the total market share, and is expected to continue its leadership status during the forecast period. Moreover, the cloud segment is projected to register the highest CAGR of 34.1% from 2021 to 2030.

Based on region, North America contributed to the highest share in terms of revenue in 2020, holding nearly two-fifths of the global RPA in financial services market, and is estimated to continue its dominant share by 2030. Moreover, Asia-Pacific region is projected to manifest the fastest CAGR of 34.6% during the forecast period. The report also includes LAMEA and Europe.

Connect Analyst

https://www.alliedmarketresearch.com/connect-to-analyst/2105

Robo Advisory Market Report Highlights

Aspects Details

By Business Model

Pure Robo Advisors

Hybrid Robo Advisors

By Provider

Fintech Robo advisors

Banks

Traditional wealth managers

Others

By Service Type

Direct Plan-Based/Goal-Based

Comprehensive Wealth Advisory

By End User

Retail Investor

High Net Worth Individuals (HNIs)

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Switzerland, Italy, Spain, REST OF Europe)

Asia-Pacific (China, India, Japan, Australia, Singapore, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Key Market Players Fincite, Betterment, Charles Schwab & Co., Inc., Ellevest, Ginmon Vermögensverwaltung GmbH, SigFig Wealth Management, Social Finance, Inc., Wealthfront Corporation, Wealthify Limited, THE VANGUARD GROUP,INC.

Want to Access the Statistical Data and Graphs, Key Players' Strategies@ https://www.alliedmarketresearch.com/robo-advisory-market/purchase-options

Related Reports in BFSI Industry:

Robotic Process Automation (RPA) in Financial Services Market

https://www.alliedmarketresearch.com/robotic-process-automation-rpa-in-financial-services-market-A06933

WealthTech Solutions Market

https://www.alliedmarketresearch.com/wealthtech-solutions-market-A31614

Asia-Pacific Wealth Management Market

https://www.alliedmarketresearch.com/asia-pacific-wealth-management-market-A15891

Wearable Payment Market

https://www.alliedmarketresearch.com/wearable-payment-market-A06001

United States

USA/Canada :

+1-800-792-5285

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms the utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Robo Advisory Market Size, Scope, And Forecast 2027 | Fincite, Betterment, Charles Schwab & Co., Inc., Ellevest, Ginmon Vermögensverwaltung GmbH here

News-ID: 2988558 • Views: …

More Releases from Allied Market Research

Winter Footwear Market 2026 : Expeditious Growth Expected in 2021 - 2031 | UGG, …

According to a new report published by Allied Market Research, titled, "Winter Footwear Market," The winter footwear market was valued at $8.6 billion in 2021, and is estimated to reach $13.6 billion by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

"Numerous varieties of winter footwear are expected to boost the market growth in the foreseeable future. Moreover, incorporation of customization, as well as innovative winter footwear is…

Ergonomic Chair Market Research Insights: Uncovering CAGR and USD Growth Drivers …

An ergonomic office chair is mostly utilized in different firms and other business areas where employees operate in a sitting position for extended hours. Adjustable seats, brackets and natural postures, which minimize back discomfort and stress in the lengthy seating time, are the ergonomic chairs. Currently, the offices are selecting ergonomic office chairs over the standard office chair to make the workplace healthier, happier, and to boost employer productivity. The…

Ethnic Wear Market Forecasting Essentials: Interpreting CAGR and USD Projections …

According to a new report published by Allied Market Research, titled, "Ethnic Wear Market," The ethnic wear market size was valued at $89.3 billion in 2021, and is estimated to reach $177.2 billion by 2031, growing at a CAGR of 7.2% from 2022 to 2031.

The market for ethnic wear is mostly driven by the rising number of fashion influencers across the globe. It is difficult to overlook the importance of…

$8.9+ Billion Commercial Janitorial Equipment Market Value by 2031 with a 4.6% C …

According to a new report published by Allied Market Research, titled, "Commercial Janitorial Equipment Market," The commercial janitorial equipment market size was valued at $5.7 billion in 2021, and is estimated to reach $8.9 billion by 2031, growing at a CAGR of 4.6% from 2022 to 2031. There has been a surge in the number of restaurants, hotels, and hospitals across the globe, which further contribute to the demand for…

More Releases for Robo

Robo Advisory Market is Rising

According to the latest research report published by Market Data Forecast, the global robo advisory market is expected to grow at a CAGR of 54.2% from 2024 to 2029, and the global market size is anticipated to be worth USD 154.6 billion by 2029 from USD 17.73 billion in 2024.

The robo advising market is expanding rapidly, fueled by technical developments and rising demand for automated financial solutions. These platforms use…

Global Robo-Advisory Market, Global Robo-Advisory Industry, Covid-19 Impact Glob …

The Robo-advisory market is expected to grow from USD X.X million in 2020 to USD X.X million by 2026, at a CAGR of X.X% during the forecast period. The Global Robo-Advisory Market report is a comprehensive research that focuses on the overall consumption structure, development trends, sales models and sales of top countries in the global Robo-advisory market. The report focuses on well-known providers in the global Robo-advisory industry, market…

Global Robo-Advisory Market (2015-2023)

Global robo-advisory market

Robo-advisors are independent financial planning services driven by algorithms and supported by a digital platform with no human intervention. They collect information from their customers at first through an online survey to understand their financial situations and ultimate goals. With this information they make portfolios of investments by calculating their risk and returns along with profits for long-term. The global robo-advisory market is expected to grow at an…

Global Robo-advisory Market (2015-2023)

Market Research Report Store offers a latest published report on Robo-advisory Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report. This report focuses on the key global Robo-advisory players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.To analyze the Robo-advisory with respect to individual growth trends, future…

Robo-Advisors: Mapping The Competitive Landscape

The wealth management industry has long been resilient to the digitization process observed in the wider financial services space. This has started to change, however, with interest in robo-advice platforms increasing in 2015. The automated investment management space is hence becoming ever-more competitive as new entrants launch propositions. Supported by software developers, traditional wealth managers have also started exploring the digital advice market. Competition will thus increase further, although robo-advisors…

Robo-Advisors: Mapping the Competitive Landscape

Summary

The wealth management industry has long been resilient to the digitization process observed in the wider financial services space. This has started to change, however, with interest in robo-advice platforms increasing in 2015. The automated investment management space is hence becoming ever-more competitive as new entrants launch propositions. Supported by software developers, traditional wealth managers have also started exploring the digital advice market. Competition will thus increase further, although robo-advisors…