Press release

At 15.2% CAGR U.S. Surplus Lines Insurance Market to Reach $125.92 Bn by 2027

Allied Market Research published a report, titled, "U.S. Surplus Lines Insurance Market by Coverage (General Business Liability Insurance, Allied Lines Insurance, Fire Insurance, Inland Marine Insurance, Commercial Multi-Peril Insurance, Commercial Auto Insurance, and Others), Distribution Model (Retail Agents, Wholesalers, and Others), and Application (Commercial and Personal): Country Opportunity Analysis and Industry Forecast, 2020-2027." According to the report, the U.S. surplus lines insurance market garnered $52.15 billion in 2019, and is expected to generate $125.92 billion by 2027, witnessing a CAGR of 15.2% from 2020 to 2027.In order to receive a free sample copy of this strategic report with top priority, (please use your corporate email ID.) : https://www.alliedmarketresearch.com/request-sample/6908

The U.S. Surplus Lines Insurance Market refers to a segment of the insurance industry that provides coverage for risks that are not covered by traditional insurance carriers. Surplus lines insurance companies are not licensed to do business in every state and typically operate under different regulations than traditional insurance carriers.

Surplus lines insurance is designed to provide coverage for unique or complex risks that are not covered by traditional insurance policies. These risks may include events like earthquakes, terrorism, or cyber attacks, or they may involve industries such as aviation, construction, or energy, where traditional insurers may not have the expertise to properly assess and underwrite risks.

Surplus lines insurers are typically required to be licensed in the state where the policy is written, and they are subject to regulation by state insurance departments. However, because they are not licensed in every state, they are not required to participate in state guaranty funds, which protect policyholders in the event of an insurer's insolvency.

Purchase Enquiry

https://www.alliedmarketresearch.com/purchase-enquiry/6908

Top impacting factors

Rapid growth of large corporates

Invest in developing unique customer & industry segment

Key Benefits for Stakeholders:

The study provides an in-depth analysis of the U.S. surplus lines insurance market share along with the current & future trends to elucidate the imminent investment pockets.

Information about key drivers, restrains, and opportunities and their impact analysis on the market size is provided in the report.

Porter's five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

An extensive analysis of the key segments of the industry helps to understand the U.S. surplus lines insurance market trends.

The quantitative analysis of the U.S. surplus lines insurance market from 2020 to 2027 is provided to determine the market potential.

U.S. Surplus Lines Insurance Market Report Highlights

Aspects Details

By Coverage

General Business Liability Insurance

Allied Lines Insurance

Fire Insurance

Inland Marine Insurance

Commercial Multi-Peril Insurance

Commercial Auto Insurance

Others

BY DISTRIBUTION MODEL

Retail Agents

Wholesalers

Others

By Application

Commercial

Personal

Connect Analyst

https://www.alliedmarketresearch.com/connect-to-analyst/6908

Key Market Players AXA, American International Group, Inc., Berkshire Hathaway Inc., Chubb, Lloyd's, Markel Corporation, Nationwide Group, ProSight Global, Inc., Swiss Re, Zurich American Insurance Company

Related Reports:

Takaful Insurance Market :

https://www.alliedmarketresearch.com/takaful-insurance-market-A11835

IoT Insurance Market :

https://www.alliedmarketresearch.com/iot-insurance-market-A09784

Usage-Based Insurance Market :

https://www.alliedmarketresearch.com/usage-based-insurance-market

Europe Travel Insurance Market :

https://www.alliedmarketresearch.com/europe-travel-insurance-market

Italy Travel Insurance Market:

https://www.alliedmarketresearch.com/italy-travel-insurance-market

United States

USA/Canada :

+1-800-792-5285

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release At 15.2% CAGR U.S. Surplus Lines Insurance Market to Reach $125.92 Bn by 2027 here

News-ID: 2985669 • Views: …

More Releases from Allied Market Research

Mortar Ammunition Market Demand, Growth Opportunities, Analysis by Top Key Playe …

Mortar ammunitions are stealth, robust and modern devices that can launch to a counter at short and low nearing activities. Modern-age mortars are light in weight and portable in nature. These ammunitions generally come in two types: fin-stabilized and spin-stabilized. Fin-Stabilized projectiles obtain stability through use of fins located at the aft of projectile. Spin-stabilized projectile technology has been used for aerodynamic stabilization. Glided path is auto-tracked and spinning creates…

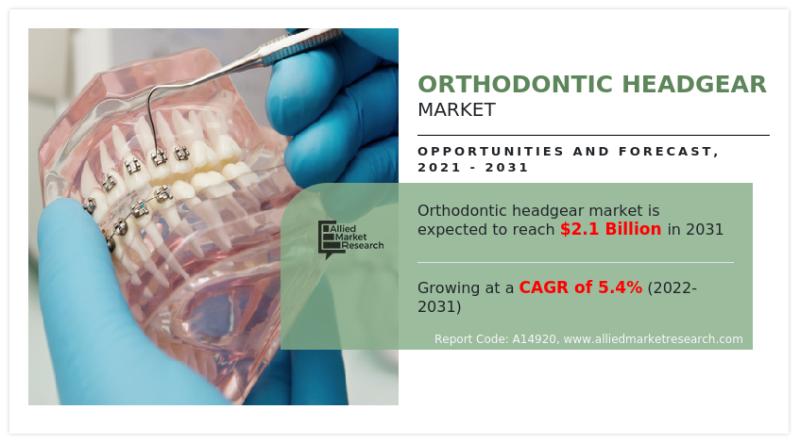

Orthodontic Headgear Market is Projected to Reach $2,094.00 Million by 2031, Gro …

The Orthodontic Headgear Market is a dynamic and integral segment of the orthodontic industry, playing a pivotal role in the correction of malocclusions and the alignment of teeth. Orthodontic headgear is a crucial orthodontic appliance used to address a wide range of dental and skeletal irregularities, such as overbites, underbites, and spacing issues. This market is witnessing substantial growth as orthodontic treatments become increasingly popular for both functional and cosmetic…

Olive Oil Market Analysis, Size, Growth, Trends, Segmentation, Opportunity and F …

The global olive oil industry was valued at $18,552.6 million in 2022, and is projected to reach $30,196.4 million by 2032, registering a CAGR of 5.2% from 2023 to 2032.

The olive oil market has experienced significant growth driven by several prime determinants. The increase in awareness and adoption of healthier lifestyles have led consumers to seek alternatives to traditional cooking oils, with olive oil being recognized for its numerous health…

Hotel Toiletries Market Revenue is expected to Surpass $50.5 billion by 2031

The hotel toiletries market was valued at $17.9 billion in 2021, and is estimated to reach $50.5 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/75060

There is a greater demand for hotel toiletries with the growth of the tourism industry and the rise in international travel. Improved transportation, economic growth, globalization, technology advancements, and other initiatives have…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…