Press release

Fraud Detection and Prevention Market Size 2021 At More Than 23.4% CAGR By 2030 | Acumen Research and Consulting

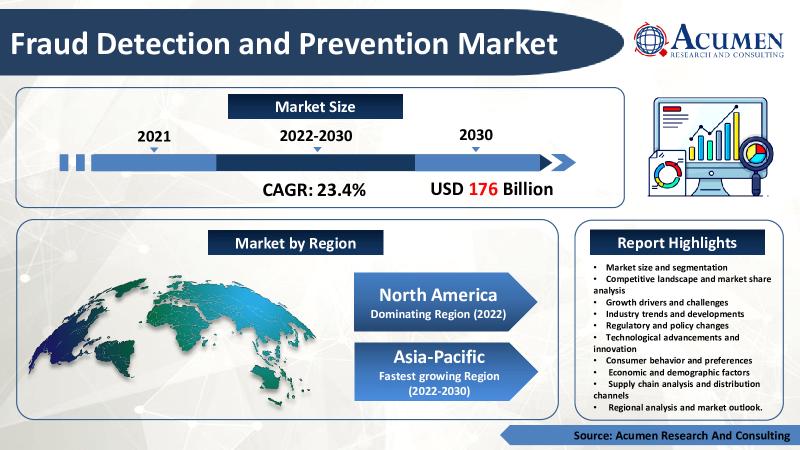

Fraud Detection and Prevention Market Size in 2021 was USD 27 Billion, Market Value set to reach USD 176 Billion at 23.4% CAGR by 2030Fraud Detection and Prevention Market Overview

The Fraud Detection and Prevention Market is a rapidly growing industry that offers a range of solutions designed to protect organizations against a wide range of financial and identity fraud threats. This market is driven by the increasing need for organizations to secure sensitive data and financial transactions in the face of growing cybercrime, data breaches, and other forms of fraud.

Fraud detection and prevention solutions use a combination of advanced technologies, such as artificial intelligence, machine learning, big data analytics, and cloud computing, to identify and prevent fraudulent activities. These solutions are available in a variety of forms, including software, hardware, and services, and can be customized to meet the specific needs of different organizations and industries.

The market for fraud detection and prevention is highly competitive, with a large number of players offering a range of solutions to organizations of all sizes, across a wide range of industries and regions. Some of the key applications of fraud detection and prevention solutions include banking, financial services, insurance, retail, healthcare, government, and other critical infrastructure sectors.

With the continued growth of the fraud detection and prevention market, organizations can expect to see a wide range of benefits, including improved security, reduced costs, increased operational efficiency, and enhanced customer experience. As cybercrime and other forms of fraud continue to evolve and become more sophisticated, organizations will need to invest in the latest fraud detection and prevention solutions to stay ahead of the curve and protect against the growing threat of fraud.

Download Sample Report Copy Of This Report From Here: https://www.acumenresearchandconsulting.com/request-sample/3048

Fraud Detection and Prevention Market Research Report Highlights and Statistics

● The global Fraud Detection and Prevention market size in 2021 stood at USD 27 Billion and is set to reach USD 176 Billion by 2030, growing at a CAGR of 23.4%

● The fraud detection and prevention market has grown rapidly in recent years, driven by the increasing need for organizations to protect against a growing number of financial and identity fraud threats

● North America is the largest market for fraud detection and prevention, followed by Europe, Asia-Pacific, and the rest of the world.

● Some of the key players in the market for fraud detection and prevention include Experian, FICO, ACI Worldwide, LexisNexis Risk Solutions, TransUnion, SAS Institute, BAE Systems, IBM Corporation, FIS, and NICE Systems.

● The market for fraud detection and prevention includes a range of solutions, including analytics and investigation, authentication and fraud detection, and security and fraud prevention.

● Some of the key technologies used in fraud detection and prevention include artificial intelligence, machine learning, big data analytics, and cloud computing.

Trends in the Fraud Detection and Prevention Market

● Multichannel Fraud Detection: With fraudsters becoming increasingly sophisticated, organizations are looking for multichannel fraud detection solutions that can identify and prevent fraud across multiple channels, including online, mobile, and in-person transactions.

● Real-Time Fraud Detection: Real-time fraud detection is becoming increasingly important, as organizations look to prevent fraud as soon as it occurs, rather than after the fact.

● Behavioral Analytics: Behavioral analytics is becoming a key trend in the market, as organizations look to identify fraudulent activities by analyzing the behavior of users and transactions.

● Advanced Authentication: Advanced authentication methods, such as biometrics and multi-factor authentication, are becoming increasingly popular in the fraud detection and prevention market, as organizations look to improve the security of their systems and prevent fraud.

● Mobile Fraud Detection: Mobile fraud detection is becoming increasingly important, as organizations look to prevent fraud on mobile devices, including smartphones and tablets.

● Fraud Management Solutions: Fraud management solutions are becoming increasingly popular, as organizations look for integrated and comprehensive fraud prevention strategies that address all aspects of fraud, from detection to resolution.

Fraud Detection and Prevention Market Dynamics

● Increased adoption of digital technologies: The increased adoption of digital technologies, such as online banking, e-commerce, and mobile payments, is driving the growth of the fraud detection and prevention market, as organizations look to prevent fraud on these platforms.

● Rise in online fraud: The rise in online fraud is driving the growth of the fraud detection and prevention market, as organizations look to prevent fraudsters from taking advantage of digital technologies.

● Growing complexity of fraud: The growing complexity of fraud is driving the growth of the fraud detection and prevention market, as organizations look for more sophisticated solutions to prevent fraud.

● Increased Focus on Cybersecurity: The growing importance of cybersecurity is a key trend in the fraud detection and prevention market, as organizations look to prevent cyberattacks and other forms of digital fraud.

● Regulatory Compliance: The need for regulatory compliance is becoming increasingly important in the fraud detection and prevention market, as organizations look to meet regulatory requirements and prevent fines and other penalties.

Growth Hampering Factors in the market for Fraud Detection and Prevention

● High cost of implementation: The high cost of implementing fraud detection and prevention solutions can be a major barrier to the growth of the market, as organizations may be unwilling to invest significant resources into these solutions.

● Privacy concerns: Privacy concerns can be a hindrance to the growth of the fraud detection and prevention market, as individuals and organizations may be concerned about the use of personal data for fraud detection purposes.

● Inadequate data infrastructure: The lack of adequate data infrastructure in many regions can be a hindrance to the growth of the fraud detection and prevention market, as organizations may be unable to process the large amounts of data required for effective fraud detection.

● Competition from traditional security solutions: Competition from traditional security solutions, such as firewalls and intrusion detection systems, can be a hindrance to the growth of the fraud detection and prevention market, as organizations may be hesitant to adopt new technologies.

● Technical challenges: Technical challenges, such as the integration of fraud detection and prevention solutions with existing systems, can be a hindrance to the growth of the market, as organizations may struggle to implement these solutions effectively.

Market Segmentation

● By Component

○ Services

■ Managed Services

■ Professional Services

○ Solutions

■ Authentication

■ Fraud Analytics

■ Government, Risk and Compliance (GRC)

● Fraud Type

○ Payment Fraud

○ Internet/Online Fraud

○ Identity Fraud

○ Insurance Fraud

○ Check fraud

○ Others

● By Deployment Model

○ Cloud

○ On-Premise

● By Organization Size

○ SMEs

○ Large Enterprise

● By Industry Vertical

○ Government & Defense

○ BFSI

○ Industrial & Manufacturing

○ IT& Telecom

○ Healthcare

○ Retail & E-commerce

○ Others

Fraud Detection and Prevention Market Key Players

The Fraud Detection and Prevention Market is highly competitive and features a large number of players, including Experian, FICO, TransUnion, RSA Security, BAE Systems, Capgemini, CGI Group, Deloitte, EY, IBM, Infosys, KPMG, Mastercard, Microsoft, NTT Data, PwC, Tata Consultancy Services, Wipro, and Zscaler. These players offer a wide range of fraud detection and prevention solutions, including anti-money laundering (AML) solutions, identity and access management (IAM) solutions, and risk management solutions, among others. Each of these players has its own unique strengths and offerings, and the market is highly competitive, with players constantly innovating and evolving their offerings to stay ahead of the competition.

Fraud Detection and Prevention Market Overview by Region

● North America's Fraud Detection and Prevention market share is the highest globally. The market is dominated by established players such as Experian, FICO, and TransUnion, who offer a range of fraud detection and prevention solutions for various industries, including banking and financial services, insurance, and retail.

● The Asia-Pacific region's Fraud Detection and Prevention Market share is also huge and is growing at the fastest rate. The market is dominated by a mix of local and international players, many of which offer fraud detection and prevention solutions tailored to the specific needs of the region's diverse market. For example, in China, there is a high demand for fraud detection and prevention solutions for mobile payment and e-commerce, while in India, the banking and financial services sector is the primary driver of growth in the market.

● Europe is another key market for Fraud Detection and Prevention. The market is characterized by a large number of smaller, niche players, many of which specialize in fraud detection and prevention solutions for specific industries, such as online payment and e-commerce. The region is also home to a number of innovative start-ups, such as Ravelin and AI-based solution providers, who are quickly gaining market share.

● The South American and MEA regions have a smaller Fraud Detection and Prevention market share, however it is expected to grow at a steady pace. The regions are characterized by a large number of smaller, local players, many of which offer innovative solutions for the specific needs of the market.

Get TOC's From Here@ https://www.acumenresearchandconsulting.com/table-of-content/fraud-detection-and-prevention-market

Ask Query Here: Richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/3048

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fraud Detection and Prevention Market Size 2021 At More Than 23.4% CAGR By 2030 | Acumen Research and Consulting here

News-ID: 2982454 • Views: …

More Releases from Acumen Research and Consulting

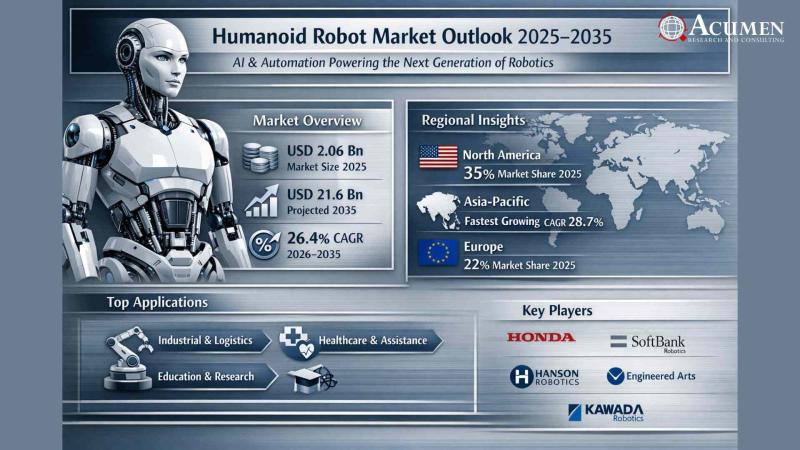

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

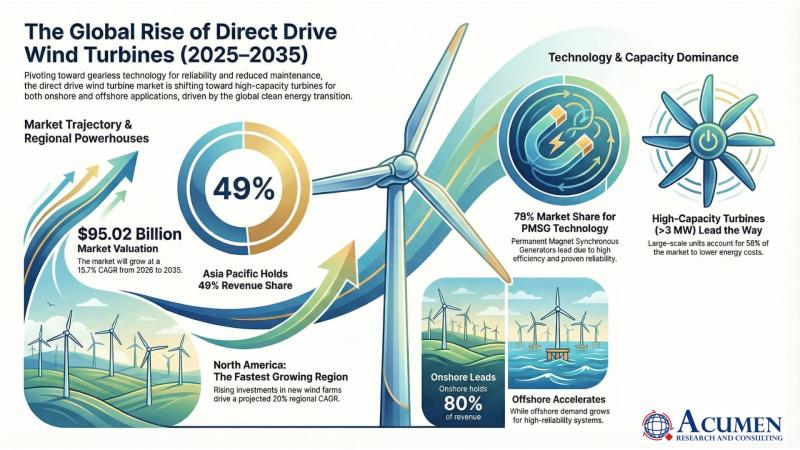

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

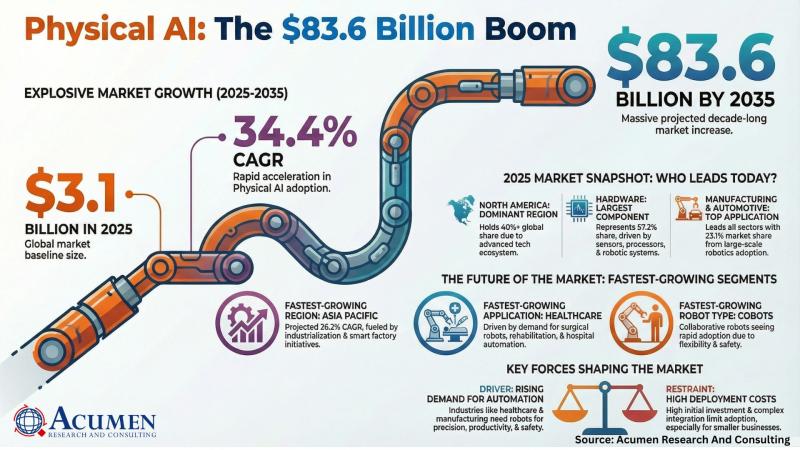

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…