Press release

At 9.6% CAGR P&C Insurance Software Market to Garner $28.5 Bn, Globally, by 2031 with top players Fidel Technologies, Infosys Limited, Vuram, Opteamix, Automation Anywhere, Inc., Aspire Systems, Dynpro

Allied Market Research recently published a report, titled, "P&C Insurance Software Market by Component (Software, Service), by Deployment Model (On Premise, Cloud), by Application (Claims, Underwriting, Operations, Others): Global Opportunity Analysis and Industry Forecast, 2021-2031". As per the report, the global P&C insurance software industry accounted for $11.6 billion in 2021 and is expected to reach $28.5 billion by 2031, growing at a CAGR of 9.6% from 2022 to 2031. The report provides an in-depth analysis of changing market trends, key investment pockets, top segments, regional landscape, value chain, and competitive scenario.Download Free Sample Report :

https://www.alliedmarketresearch.com/request-sample/31774

The software segment dominated the market

By component, the software segment held the largest share in 2021, accounting for nearly three-fifths of the global P&C insurance software market, due to technological advancement and strategies such as cloud technology to provide the insurance services like sales, policy administration, and claims management. However, the service segment is estimated to register the highest CAGR of 10.9% during the forecast period, owing to rise in adoption of the insurer's needs to manage the entire claim lifecycle by reducing costs, increasing productivity, and by providing various P&C insurance software services.

The cloud segment to portray the highest CAGR through 2031

By deployment model, the cloud segment is projected to manifest the highest CAGR of 11.0% from 2022 to 2031, due to number of benefits, such as cost management, resource pooling, and quicker installation, cloud-based solutions are becoming more popular. However, the on-premise segment held the largest share in 2021, contributing to around three-fifths of the global P&C insurance software market, as it allows installation of the software and enables applications to run on existing systems on the premises of organizations, rather than at a distant facility such as server space or cloud.

Purchase Inquiry: https://www.alliedmarketresearch.com/purchase-enquiry/31774

The major determinants of the market growth in the global P&C (Property & Casualty) insurance software market are:

Digital Transformation: The rise in digital transformation across various industries has led to the growth of the P&C insurance software market. The adoption of digital technologies has helped insurers to improve their operational efficiency, reduce costs, and enhance customer experience.

Penetration of Internet & Mobile Devices: The increase in penetration of internet and mobile devices has enabled insurers to reach out to a larger audience, offer customized insurance products, and improve their distribution channels.

Need for Finance: The increasing need for finance among businesses and individuals to insure their property has also contributed to the growth of the market. The rising incidences of natural calamities and accidents have made it imperative for people to protect their property with insurance.

Regulatory Constraints: However, strict regulations imposed by banks and financial institutions for offering housing finance have hindered the growth of the market. These regulations make it difficult for people to get loans and mortgages, thereby limiting the demand for insurance.

Real Estate Prices: The increase in real estate prices in developing economies and the growth of metropolitan cities are expected to open new opportunities in the future. This would lead to an increase in demand for insurance products, especially for property and casualty insurance.

Key benefits for stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the RPA in insurance market forecast from 2022 to 2031 to identify the prevailing RPA in insurance market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the RPA in insurance market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global RPA in insurance market trends, key players, market segments, application areas, and market growth strategies.

Connect Analyst

https://www.alliedmarketresearch.com/connect-to-analyst/54024

RPA in Insurance Market Report Highlights

Aspects Details

Market Size By 2031 USD 1.2 billion

Growth Rate CAGR of 28.3%

Forecast period 2021 - 2031

Report Pages 418

Component

Solution

Service

Deployment Mode

On-Premise

Cloud

Enterprise Size

Large Enterprise

Small and Medium-sized Enterprises

Application

Claims Processing

Insurance Underwriting

Regulatory Compliance

Finance and Accounts

Others

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Key Market Players Fidel Technologies, Infosys Limited, Vuram, Opteamix, Automation Anywhere, Inc., Aspire Systems, Dynpro, Royal Cyber Inc., Pegasystems, Inc., UiPath

Related Reports:

Reinsurance Market

https://www.alliedmarketresearch.com/reinsurance-market-A06288

Insurtech Market

https://www.alliedmarketresearch.com/insurtech-market-A12373

B2B2C Insurance Market

https://www.alliedmarketresearch.com/B2B2C-insurance-market

IoT Insurance Market

https://www.alliedmarketresearch.com/iot-insurance-market-A09784

Takaful Insurance Market

https://www.alliedmarketresearch.com/takaful-insurance-market-A11835

United States

USA/Canada :

+1-800-792-5285

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release At 9.6% CAGR P&C Insurance Software Market to Garner $28.5 Bn, Globally, by 2031 with top players Fidel Technologies, Infosys Limited, Vuram, Opteamix, Automation Anywhere, Inc., Aspire Systems, Dynpro here

News-ID: 2972878 • Views: …

More Releases from Allied Market Research

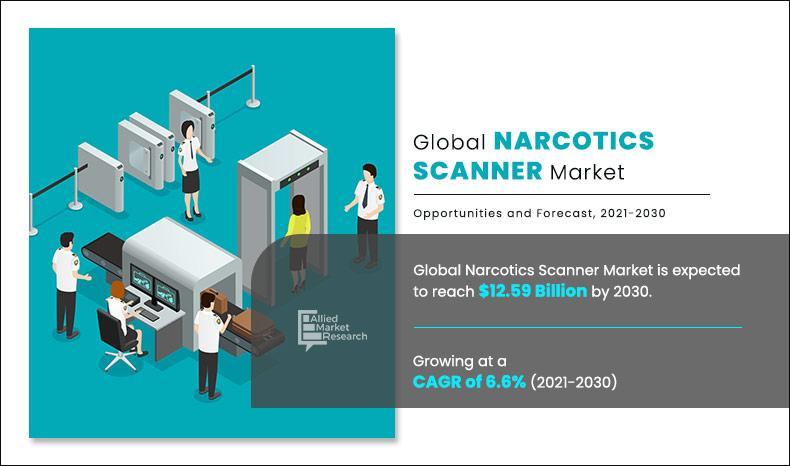

Narcotics Scanner Market Analysis and Forecast with a CAGR of 6.6% (2021-2030)

Narcotics scanner market size was valued at $6.89 billion in 2020, and is projected to reach $12.59 billion by 2030, registering with a CAGR of 6.6% from 2021 to 2030.

The growth of the global narcotics scanner market is driven by surge in consumption of drugs and related materials across the globe and modernization of the law enforcement agencies in developing countries. Growing requirement for improved security against the narcotics threats…

Herbal Die tary Supplement Market Size, Industry Analysis, Growth Drivers, Oppor …

The herbal die tary supplement market size was valued at $11 billion in 2022, and is estimated to reach $21.4 billion by 2032, growing at a CAGR of 7.1% from 2023 to 2032.

Herbal die tary supplements are natural items made from plants or plant extracts that are taken to supplement the diet and improve health and well-being. These supplements frequently contain a combination of vitamins, minerals, amino acids, and other…

Mobile Application Security Market Growing at 26.3% CAGR Reach USD 37.1 Billion …

Allied Market Research published a new report, titled, "Mobile Application Security Market Growing at 26.3% CAGR Reach USD 37.1 Billion by 2032." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

MarTech Market Witnessing CAGR of 18.5% Hit USD 1.7 Trillion by 2032

The global marketing technology market is experiencing growth due to several factors, including the increasing digital transformation, the surge in demand for personalized experience, and the proliferation of automation and efficiency. However, data privacy and compliance, and the high cost of implementation are expected to hamper market growth. Furthermore, the growing integration of AI and ML technologies and the increase in demand for real-time marketing are anticipated to provide lucrative…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…