Press release

Evolving Private Networks: A Comprehensive Analysis of Trends and Innovations

Evolving Private Networks: TRENDS AND ANALYSISThe shift toward digitalization and enterprise mobility driven by the explosive growth in data is creating the need for a private LTE/5G network. Private networks are networks specifically built for individual enterprises. Currently, every organization is moving towards implementing automation technologies with big data analytics to transform operations and increase operational efficiency. Wireless networking technologies such as LTE/5G enable organizations to execute their digital transformation program securely and efficiently.

Private networks enable the organization to allot the bandwidth dedicatedly for low-latency and ultra-reliable use cases such as smart manufacturing and robotics. The organizations also have complete control over data, security, and networks. Manufacturing and mission-critical applications such as utility, oil and gas, and mining are leading the deployment of private LTE/5G networks where traditional Wi-Fi networks lack frequency, power, and signal coverage. Other industries such as transportation, logistics, and healthcare are expected to witness the increasing deployment of private networks as a result of emerging technologies such as AI/ML, IoT sensors, machine vision, robotics, etc.

Private LTE/5G networks are primarily used for industrial equipment connectivity use cases, followed by mobile broadband (MBB). The rising implementation of edge computing, cloud computing, robotics, and supply chain connectivity is leading to the deployment of private networks for asset tracking and AGV applications.

So, what are the key shifts which are and will drive the deployment of private/5G networks, well, let's have a look at different industries and use cases:

Manufacturing:

The shift toward Industry 4.0, IoT, AI/ML, AR/MR, Digital Twin, Blockchain, Edge computing, and Robotics to implement process automation, remote monitoring of production assets, and real-time data analysis will be the key for the deployment of Wi-Fi and cellular (4G/5G) for smart manufacturing operations.

5G IoT is a key enabler for this shift, offering manufacturing companies and their supply chain partners improved visibility over their whole ecosystem and setting the foundation for technologies such as AI and machine vision to create new use cases and improved commercial outcomes.

The key use cases of 5G include Connected Asset Monitoring, Predictive Maintenance, Logistics & Fleet Management, Quality Management, Connected Warehouse, etc.

Healthcare:

During COVID-19, everybody witnessed the potential of 5G in the healthcare sector when Huawei built a private 5G network at Huoshenshan Hospital in Wuhan, which played a crucial role in treating COVID-19 patients in 2020. 5G-powered robots were used for providing medical services such as body temperature tests, cleaning and drug delivery, remote care, and spraying disinfectants.

In the wake of the pandemic, healthcare providers realized that combining 5G with other leading-edge technologies such as AI/ML, AR/VR, IoT, wearables, and robotics can create the opportunity to transform several aspects of patient care. As a result, we are witnessing a rapid shift toward digitization across the healthcare ecosystem. Healthcare ecosystem partners are carefully assessing key emerging technologies as a part of their digital transformation strategy to continue building and scaling them over time.

Transporation & Logistics:

The global shortages in everything from raw materials to electronic chips to consumer goods are directly linked with disruption in the supply chain. This necessitates the implementation of systems and solutions that can connect manufacturing, transportation, and logistics to ensure goods and products are delivered on time.

The shift towards a connected supply chain is driving the deployment of emerging technologies AI/ML, IoT, and 5G. These technologies will be key enablers in facilitating data-driven analytics and decision-making in the transportation and logistics sectors. It is estimated that by 2035, 5G use cases in transportation and logistics will contribute more than USD 250 billion to the global GDP.

5G technology is unleashing new and emerging use cases in the transportation and logistics sector, such as asset tracking, fleet management optimization, last-mile delivery, real-time service, breakdown alerts, and real-time analytics leveraging edge computing. Several market players across the supply chain are investing in 5G technology.

Agriculture:

The agriculture sector demands massive efforts and effective planning during the crop production lifecycle. Therefore, this sector is observing the rising deployment of emerging technologies such as AI, IoT, Drones, Smart Sensors, etc. These smart farming technologies leverage fast, high-capacity private and public 5G networks that enable farmers to water and electricity usage, livestock movements, equipment maintenance, and soil moisture monitoring. For instance, drones are deployed in the agriculture sector for automatically capture and transmit HD videos and images, including thermal and topographical images, track and identify objects like livestock, weeds, and pests using AI for effectively analyzing field conditions, distribute seeds and sprays, and manage crops and livestock in real-time. This is made possible with the use of 5G technology that offers high-speed and ultra-reliable connectivity for on-field drones.

Mission Critical Sectors:

Utilities, oil & gas, mining, public safety, airports, and military sectors usually comprise private network deployments. Currently, many investments are happening in deploying private 5G networks, which are expected to replace private mobile radio (PMR), TETRA, and microwave fixed links in the coming years. There has been a growing interest in using private 5G to create neutral host networks in-building. It is estimated that by 2035, 5G use cases in mission-critical sectors will contribute more than USD 350 billion to the global GDP. We expect that the focus on deploying digital technologies in these mission-critical industries will accelerate the shift towards AI/ML, IoT, smart sensors, AGVs, AR/VR, and so forth, pushing the ecosystem players to deploy 5G private networks. Also, we expect this development to accelerate further when the most useful private 5G features arrive when Release 16/17 versions are commercialized in the next few years.

Related research projects/Topics:

5G Enterprise Market: https://www.marketsandmarkets.com/Market-Reports/5g-enterprise-market-128223246.html

Private LTE Market: https://www.marketsandmarkets.com/Market-Reports/private-lte-market-64117901.html

5G Fixed Wireless Access Market: https://www.marketsandmarkets.com/Market-Reports/5g-fixed-wireless-access-market-41266711.html

5G Infrastructure Market: https://www.marketsandmarkets.com/Market-Reports/5g-technology-market-202955795.html

5G Chipset Market: https://www.marketsandmarkets.com/Market-Reports/5g-chipset-market-150390562.html

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA : 1-888-600-6441

sales@marketsandmarkets.com

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Evolving Private Networks: A Comprehensive Analysis of Trends and Innovations here

News-ID: 2953927 • Views: …

More Releases from MarketsandMarkets

Top Ultrasound Market Trends Driving Growth in 2025 and Beyond | Philips Healthc …

The global ultrasound market is entering a transformative phase in 2025. Once primarily associated with pregnancy scans and basic imaging, ultrasound has now evolved into a powerful, multipurpose diagnostic tool with applications across cardiology, oncology, musculoskeletal care, emergency medicine, and beyond.

As healthcare systems worldwide shift towards non-invasive, affordable, and portable imaging solutions, ultrasound is becoming central to modern diagnostics. According to market insights, the ultrasound industry is poised for steady…

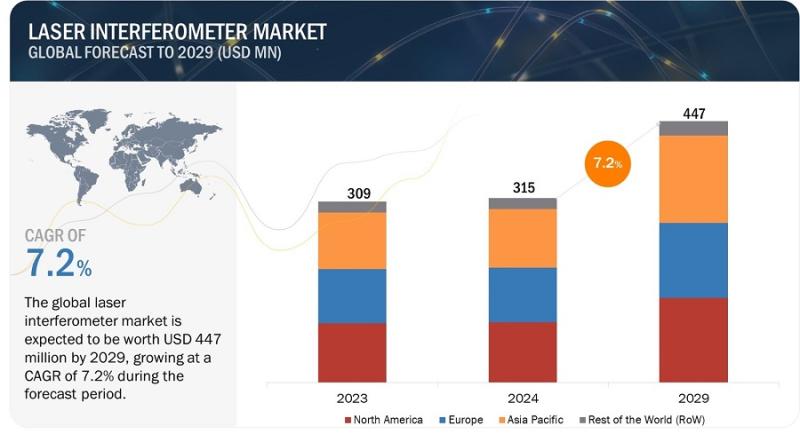

Laser Interferometer Market Set to Grow at the Fastest Rate- Time to Grow your R …

The global laser interferometer market is expected to be valued at 315 million in 2024 and is projected to reach USD 447 million by 2029, at a CAGR of 7.2% from 2024 to 2029. Emerging applications in industries push the market's growth due to the growing demand for precision in the manufacturing sector. However, challenges such as higher initial investments and maintenance costs cause problems. Despite these, opportunities arise for…

With 19.6% CAGR, Battery Testing, Inspection, and Certification Market Growth to …

The battery testing, inspection, and certification market is projected to reach USD 36.7 billion by 2029 from USD 14.9 billion in 2024 at a CAGR of 19.6% during the forecast period. Increasing adoption of EVs and energy storage systems, rising enforcement of stringent standards to ensure battery safety, thriving portable electronics industry, and rapid advances in battery technology are the major factors contributing to the market growth.

Download PDF Brochure @…

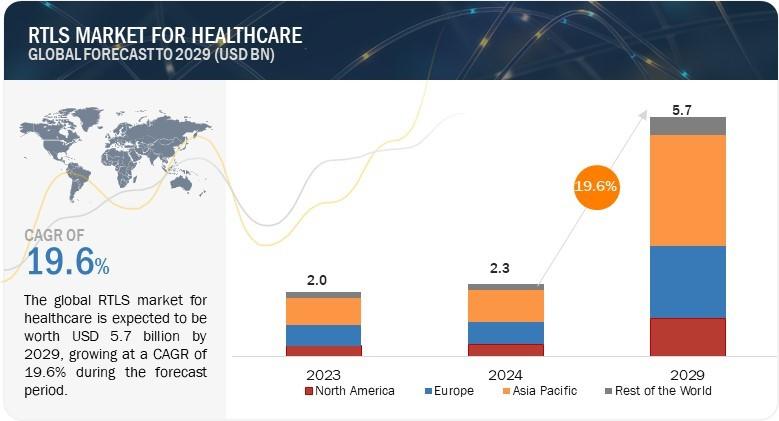

Real-Time Location Systems Revolutionize Healthcare: Insights from MarketsandMar …

The global RTLS market for healthcare is projected to grow from USD 2.3 billion in 2024 to USD 5.7 billion by 2029, at a compound annual growth rate of 19.6% from 2024 to 2029. As it attracts more and more players who enter this market with innovative RTLS features for customers, the market for RTLS technology is rapidly increasing. Top companies in this market focus on healthcare, retail, and manufacturing…

More Releases for Private

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private asset management,private wealth management firms,middle market private e …

Private asset management is the management of assets on behalf of private individuals, families, or institutions. It involves the creation of a customized investment strategy to achieve specific financial goals, such as wealth preservation, growth, income generation, or a combination of these objectives. The assets managed can include cash and cash equivalents, stocks, bonds, real estate, private equity, and alternative investments.

https://tendawholesale.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private asset management is typically provided by…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Financing Consulting, China Private Equity Investment Corpo …

Pandacu China is a venture capital firm that focuses on early-stage investments in technology companies based in China. The firm was founded in 2015 by a group of experienced venture capitalists and entrepreneurs who have a deep understanding of the Chinese market and a strong network of contacts in the tech industry.

http://pandacuads.com/

China Private Equity Financing Consulting

Email:nolan@pandacuads.com

Pandacu China's mission is to help innovative and ambitious entrepreneurs turn their ideas into successful…