Press release

Open Banking Market Size, Growing CAGR of 27.45% Growth Strategy, Business Challenges, Opportunities and Forecast 2032: SPER Market Research

According to SPER Market Research, the Open Banking Market is A financial service called "open banking" allows for the electronic sharing of financial data. Additionally, open banking services use application programming interfaces (APIs) to perform a secure financial data transfer. Banks and outside service providers also communicate financial data back and forth. Customers' transaction histories and patterns, which are collected by third-party service providers, are secured by an open API, making it simple to access publicly available data, such as a bank's product offerings. In order to improve the user experience related to the usage of financial services, innovative applications are developed using the financial information obtained for a customer. One of the key elements supporting the development of the open banking sector is a rise in the adoption of new wave applications and services. The open banking sector also needs to expand in order to be supported by an increase in customer engagement and active banking clients. All parties participating in the financial services sector, including banks, enterprises, FinTech, and innovators, can gain from an open banking platform's many benefits.Request For Free Sample Report @ https://www.sperresearch.com/report-store/open-banking-market.aspx?sample=1

Due to the increase in usage and adoption of application programming interfaces (APIs) by consumers to carry out payment procedures, the COVID-19 pandemic has a substantial impact on the open banking sector. Thanks to market-wide technical developments, open banking is expanding rapidly. Additionally, to support the open banking platforms, banks and the fintech sector are offering their clients capabilities in APIs that are acceptable and beneficial. In turn, during the current global health crisis, this has turned into one of the main development causes for the open banking sector.

Open Banking Market Overview:

Forecast CAGR (2022-2032): 27.45%.

Forecast Market Size (2032): 226.96 billion

Impact of COVID-19 on the Global Open Banking Market:

Due to the increase in usage and adoption of application programming interfaces (APIs) by consumers to carry out payment procedures, the COVID-19 pandemic has a substantial impact on the open banking sector. Thanks to market-wide technical developments, open banking is expanding rapidly. Additionally, to support the open banking platforms, banks and the fintech sector are offering their clients capabilities in APIs that are acceptable and beneficial. In turn, during the current global health crisis, this has turned into one of the main development causes for the open banking sector. Over the course of the projection period, the COVID-19 pandemic outbreak is anticipated to have a significant impact on the market's growth. The epidemic raised the need for contactless payments, which led to an increase in the need for open banking on a global scale. To deliver cutting-edge digital solutions and spur industry growth, numerous fintech startups partnered with significant market participants.

Get More Info @ https://www.sperresearch.com/report-store/open-banking-market.aspx

Open Banking Market Key Segments Covered

The SPER Market Research report seeks to give market dynamics, demand, and supply forecasts for the years up to 2032. This report contains statistics on product type segment growth estimates and forecasts.

By Services:

Banking & Capital Markets

Payments

Digital Currencies

Value Added Services

By Deployment:

Cloud

On-premise

By Distribution Channel:

Bank Channels

App Markets

Distributors

Aggregators

By Region:

Asia-Pacific

Europe

Middle East

Africa

North America

Latin America

The global open banking market report covers Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the United Kingdom, and the United States.

Open Banking Market Key Players:

The market study provides market data by competitive landscape, revenue analysis, market segments and detailed analysis of key market players such as; Banco Bilbao Vizcaya Argentaria, S.A., Crédit Agricole, DemystData, Ltd., Finleap connect, Finastra, FormFree Holdings Corporation, Jack Henry & Associates, Inc., Mambu., Mineral Tree, Inc., NCR Corporation.

Related Reports:

https://www.sperresearch.com/report-store/digital-banking-platforms-market.aspx

https://www.sperresearch.com/report-store/banking-financial-services-and-insurance-security-market.aspx

Follow Us -

https://www.linkedin.com/company/sperresearch/

https://twitter.com/SPERresearch

https://www.facebook.com/SPERresearch

https://www.instagram.com/sperresearch/

Contact Us:

Sara Lopes, Business Consultant - USA

SPER Market Research

enquiries@sperresearch.com

+1-347-460-2899

6 Sunflower Court,

Holtsville, NY 11742, USA

USA : +1-347-460-2899

SPER Market Research is amongst the top market research companies where we have been serving over 20 industries, with core offerings in Pharmaceutical/Healthcare, Food & Beverages, Chemical and Materials, Consumer Retail, ICT, Semiconductor, Automotive, Power and Energy and other industries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Open Banking Market Size, Growing CAGR of 27.45% Growth Strategy, Business Challenges, Opportunities and Forecast 2032: SPER Market Research here

News-ID: 2952563 • Views: …

More Releases from SPER Market Research

Aircraft Micro Turbine Engines Market Trends 2023 - Global Industry Share, Reven …

Aircraft micro turbine engines are small air-breathing jet engines specifically designed for aircraft applications. They provide several benefits compared to traditional reciprocating engines, including higher power-to-weight ratios, improved fuel efficiency, and reduced emissions. These engines consist of key components such as an air inlet, compressor, combustion chamber, and turbine. The air is drawn into the engine through the inlet and compressed by the compressor. Fuel is then injected into the…

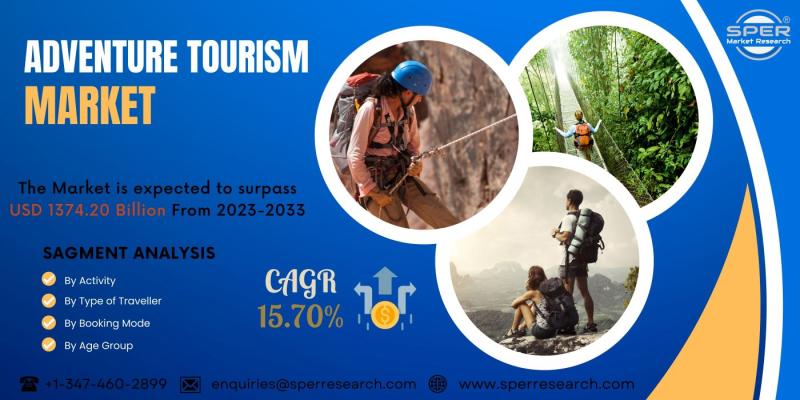

Adventure Tourism Market Growth 2023, Emerging Trends, Regional Insights, Growth …

Travelling to distant, unusual, and interesting locations with the intention of taking part in thrilling and adventurous activities is known as adventure tourism. It focuses on offering unusual and exhilarating experiences to tourists looking for thrills, challenges, and a change from typical tourist attractions. Adventure tourism encompasses travel and exploration activities where individuals embark on thrilling and adventurous experiences. It includes a diverse range of activities like trekking, climbing, scuba…

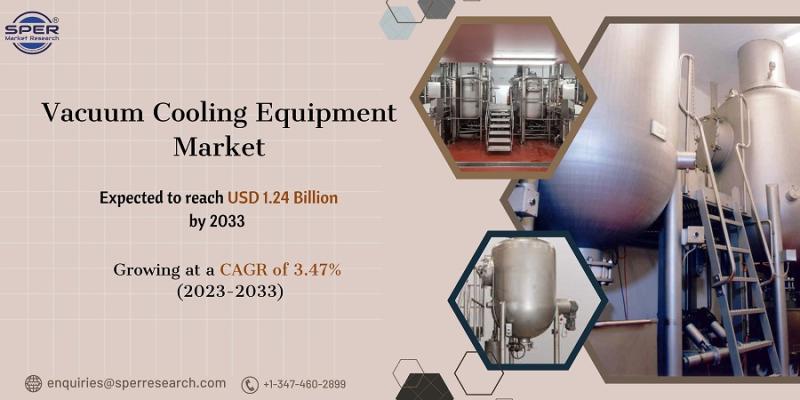

Vacuum Cooling Equipment Market Growth and Share, Emerging Trends, Challenges, K …

Vacuum cooling equipment is a high-efficiency approach for rapidly cooling a wide range of goods, particularly in the food business. It consists of a specially designed stainless steel chamber that is tightly sealed to create an airtight environment. To begin the cooling process, the air inside the chamber is removed using a vacuum pump. The pressure drops as the air exits, reducing the boiling point of water. This permits the…

Supply Chain Analytics Market Share 2023- By COVID-19 Impact on Industry Trends, …

The term "global supply chain analytics market" refers to the market for products and services that give businesses the ability to improve operations, get new insights, and make data-driven choices throughout their supply chains. Application of cutting-edge analytical tools and methodologies to a variety of data sources, including real-time data from sensors, business systems, and external data feeds, constitutes supply chain analytics. Supply chain analytics solutions offer a range of…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…