Press release

High Frequency Trading Model Systems (Strategic) Market Outlook Growths, Top Companies, Research Method 2029| Virtu Financial, Citadel Securities, Two Sigma Securities

LOS ANGELES, United States: The research study offers powerful guidelines for market players to compete well against other participants operating in the global High Frequency Trading Model Systems (Strategic) market. It brings to light crucial market dynamics including drivers, challenges, restraints, trends, and opportunities. Readers are provided with detailed qualitative and quantitative analysis, PESTLE analysis, absolute dollar opportunity analysis, and Porter's Five Forces analysis that focus on various aspects of the global High Frequency Trading Model Systems (Strategic) market. The report includes regional growth analysis to show how the global High Frequency Trading Model Systems (Strategic) market is progressing in different parts of the world in terms of growth. Besides growth rate, the authors of the report provide market figures related to revenue, production, consumption, share, sales, and other vital factors.The competitive analysis offered in the report helps players to improve their business strategies or create new ones applicable to current or future market situations. The report provides powerful recommendations to help players to cement a strong position in the global High Frequency Trading Model Systems (Strategic) market. Its key findings can be used to prepare for any future challenges beforehand. Each segment is deeply analyzed on the basis of various factors such as market share, CAGR, and revenue growth. In addition, every regional market is comprehensively studied to help players identify key growth opportunities in different regions and countries.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) https://www.qyresearch.com/sample-form/form/5770752/Global-High-Frequency-Trading-Model-Systems-Strategic-Market-Report-History-and-Forecast-2018-2029-Breakdown-Data-by-Companies-Key-Regions-Types-and-Application

Key Players Mentioned in the Global High Frequency Trading Model Systems (Strategic) Market Research Report:

Virtu Financial

Citadel Securities

Two Sigma Securities

Tower Research Capital

Jump Trading

DRW

Hudson River Trading

Quantlab Financial

XTX Markets

Tradebot Systems

Flow Traders

IMC Financial

Optiver

XR Trading

HIGH-FLYER

The report includes company profiling of almost all important players of the global High Frequency Trading Model Systems (Strategic) market. The company profiling section offers valuable analysis on strengths and weaknesses, business developments, recent advancements, mergers and acquisitions, expansion plans, global footprint, market presence, and product portfolios of leading market players. This information can be used by players and other market participants to maximize their profitability and streamline their business strategies. Our competitive analysis also includes key information to help new entrants to identify market entry barriers and measure the level of competitiveness in the global High Frequency Trading Model Systems (Strategic) market.

Global High Frequency Trading Model Systems (Strategic) Market Segment by Type

Software Program

Trading Strategy

Hardware Deployment Classes

Others

Global High Frequency Trading Model Systems (Strategic) Market Segment by Application

Finance Industry

Scientific Research

Others

Our market analysts are experts in deeply segmenting the global High Frequency Trading Model Systems (Strategic) market and thoroughly evaluating the growth potential of each and every segment studied in the report. Right at the beginning of the research study, the segments are compared on the basis of consumption and growth rate for a review period of nine years. The segmentation study included in the report offers a brilliant analysis of the global High Frequency Trading Model Systems (Strategic) market, taking into consideration the market potential of different segments studied. It assists market participants to focus on high-growth areas of the global High Frequency Trading Model Systems (Strategic) market and plan powerful business tactics to secure a position of strength in the industry.

Table of Contents

Study Coverage: This is the first section of the report that includes three or more chapters, viz. Years Considered, Study Objectives, Global High Frequency Trading Model Systems (Strategic) Market Growth Rate by Product, Global High Frequency Trading Model Systems (Strategic) Market Growth Rate by Application, Key Manufacturers Covered, Key Market Segments, and Product Scope.

Executive Summary: In this section, the High Frequency Trading Model Systems (Strategic) report focuses on analysis of macroscopic indicators, market issues, drivers, and trends, competitive landscape, CAGR of the global market, and global production. Under the global production chapter, the authors of the report have included market pricing and trends, global capacity, global production, and global revenue forecasts.

Global Growth Trends: It includes capacity and production analysis where market pricing and trends, capacity, production, and production value are shed light upon. This section also includes industry trends and growth rate of key producers in the global High Frequency Trading Model Systems (Strategic) market.

Market Size by Manufacturer: Here, the High Frequency Trading Model Systems (Strategic) report concentrates on revenue and production shares of manufacturers for all the years of the forecast period. It also focuses on price by manufacturer and expansion plans and mergers and acquisitions of companies.

Market Size by Product: Here, the analysts provide breakdown data of the global High Frequency Trading Model Systems (Strategic) market by product and comprehensive analysis on global revenue by product and prices by product.

Market Size by Application: It includes breakdown data of the global High Frequency Trading Model Systems (Strategic) market by application, consumption by application, and consumption market share by application.

Upstream, Industry Chain, and Downstream Customers Analysis: In this section, the report analyzes customers, distributors, marketing and distribution in the global High Frequency Trading Model Systems (Strategic) market, the industry chain, and the upstream market.

Manufacturer Profiles: The report includes company profiling of leading players operating in the global High Frequency Trading Model Systems (Strategic) market. The players are analyzed with the help of SWOT analysis and considering their value, production, capacity, and other details.

Market Dynamics: Here, the report deals with the drivers, restraints, challenges, trends, and opportunities of the global High Frequency Trading Model Systems (Strategic) market. This section also includes the Porter's Five Forces analysis.

Research Findings and Conclusion: It gives powerful recommendations for new as well as established players for securing a position of strength in the global High Frequency Trading Model Systems (Strategic) market.

Appendix: It includes a disclaimer, author details, data sources, and research methodology. Under research methodology, this section explains data triangulation, market breakdown, market size estimation, and research design procedures.

Request for customization in Report: https://www.qyresearch.com/customize-request/form/5770752/Global-High-Frequency-Trading-Model-Systems-Strategic-Market-Report-History-and-Forecast-2018-2029-Breakdown-Data-by-Companies-Key-Regions-Types-and-Application

Table of Contents

1 Market Overview of High Frequency Trading Model Systems (Strategic)

1.1 High Frequency Trading Model Systems (Strategic) Market Overview

1.1.1 High Frequency Trading Model Systems (Strategic) Product Scope

1.1.2 High Frequency Trading Model Systems (Strategic) Market Status and Outlook

1.2 Global High Frequency Trading Model Systems (Strategic) Market Size Overview by Region 2018 VS 2022 VS 2029

1.3 Global High Frequency Trading Model Systems (Strategic) Market Size by Region (2018-2029)

1.4 Global High Frequency Trading Model Systems (Strategic) Historic Market Size by Region (2018-2023)

1.5 Global High Frequency Trading Model Systems (Strategic) Market Size Forecast by Region (2024-2029)

1.6 Key Regions, High Frequency Trading Model Systems (Strategic) Market Size (2018-2029)

1.6.1 North America High Frequency Trading Model Systems (Strategic) Market Size (2018-2029)

1.6.2 Europe High Frequency Trading Model Systems (Strategic) Market Size (2018-2029)

1.6.3 Asia-Pacific High Frequency Trading Model Systems (Strategic) Market Size (2018-2029)

1.6.4 Latin America High Frequency Trading Model Systems (Strategic) Market Size (2018-2029)

1.6.5 Middle East & Africa High Frequency Trading Model Systems (Strategic) Market Size (2018-2029)

2 High Frequency Trading Model Systems (Strategic) Market Overview by Type

2.1 Global High Frequency Trading Model Systems (Strategic) Market Size by Type: 2018 VS 2022 VS 2029

2.2 Global High Frequency Trading Model Systems (Strategic) Historic Market Size by Type (2018-2023)

2.3 Global High Frequency Trading Model Systems (Strategic) Forecasted Market Size by Type (2024-2029)

2.4 Software Program

2.5 Trading Strategy

2.6 Hardware Deployment Classes

2.7 Others

3 High Frequency Trading Model Systems (Strategic) Market Overview by Application

3.1 Global High Frequency Trading Model Systems (Strategic) Market Size by Application: 2018 VS 2022 VS 2029

3.2 Global High Frequency Trading Model Systems (Strategic) Historic Market Size by Application (2018-2023)

3.3 Global High Frequency Trading Model Systems (Strategic) Forecasted Market Size by Application (2024-2029)

3.4 Finance Industry

3.5 Scientific Research

3.6 Others

4 High Frequency Trading Model Systems (Strategic) Competition Analysis by Players

4.1 Global High Frequency Trading Model Systems (Strategic) Market Size by Players (2018-2023)

4.2 Global Top Players by Company Type (Tier 1, Tier 2 and Tier 3) & (based on the Revenue in High Frequency Trading Model Systems (Strategic) as of 2022)

4.3 Date of Key Players Enter into High Frequency Trading Model Systems (Strategic) Market

4.4 Global Top Players High Frequency Trading Model Systems (Strategic) Headquarters and Area Served

4.5 Key Players High Frequency Trading Model Systems (Strategic) Product Solution and Service

4.6 Competitive Status

4.6.1 High Frequency Trading Model Systems (Strategic) Market Concentration Rate

4.6.2 Mergers & Acquisitions, Expansion Plans

5 Company (Top Players) Profiles

5.1 Virtu Financial

5.1.1 Virtu Financial Profile

5.1.2 Virtu Financial Main Business

5.1.3 Virtu Financial High Frequency Trading Model Systems (Strategic) Products, Services and Solutions

5.1.4 Virtu Financial High Frequency Trading Model Systems (Strategic) Revenue (US$ Million) & (2018-2023)

5.1.5 Virtu Financial Recent Developments

5.2 Citadel Securities

5.2.1 Citadel Securities Profile

5.2.2 Citadel Securities Main Business

5.2.3 Citadel Securities High Frequency Trading Model Systems (Strategic) Products, Services and Solutions

5.2.4 Citadel Securities High Frequency Trading Model Systems (Strategic) Revenue (US$ Million) & (2018-2023)

5.2.5 Citadel Securities Recent Developments

5.3 Two Sigma Securities

5.3.1 Two Sigma Securities Profile

5.3.2 Two Sigma Securities Main Business

5.3.3 Two Sigma Securities High Frequency Trading Model Systems (Strategic) Products, Services and Solutions

5.3.4 Two Sigma Securities High Frequency Trading Model Systems (Strategic) Revenue (US$ Million) & (2018-2023)

5.3.5 Tower Research Capital Recent Developments

5.4 Tower Research Capital

5.4.1 Tower Research Capital Profile

5.4.2 Tower Research Capital Main Business

5.4.3 Tower Research Capital High Frequency Trading Model Systems (Strategic) Products, Services and Solutions

5.4.4 Tower Research Capital High Frequency Trading Model Systems (Strategic) Revenue (US$ Million) & (2018-2023)

5.4.5 Tower Research Capital Recent Developments

5.5 Jump Trading

5.5.1 Jump Trading Profile

5.5.2 Jump Trading Main Business

5.5.3 Jump Trading High Frequency Trading Model Systems (Strategic) Products, Services and Solutions

5.5.4 Jump Trading High Frequency Trading Model Systems (Strategic) Revenue (US$ Million) & (2018-2023)

5.5.5 Jump Trading Recent Developments

5.6 DRW

5.6.1 DRW Profile

5.6.2 DRW Main Business

5.6.3 DRW High Frequency Trading Model Systems (Strategic) Products, Services and Solutions

5.6.4 DRW High Frequency Trading Model Systems (Strategic) Revenue (US$ Million) & (2018-2023)

5.6.5 DRW Recent Developments

5.7 Hudson River Trading

5.7.1 Hudson River Trading Profile

5.7.2 Hudson River Trading Main Business

5.7.3 Hudson River Trading High Frequency Trading Model Systems (Strategic) Products, Services and Solutions

5.7.4 Hudson River Trading High Frequency Trading Model Systems (Strategic) Revenue (US$ Million) & (2018-2023)

5.7.5 Hudson River Trading Recent Developments

5.8 Quantlab Financial

5.8.1 Quantlab Financial Profile

5.8.2 Quantlab Financial Main Business

5.8.3 Quantlab Financial High Frequency Trading Model Systems (Strategic) Products, Services and Solutions

5.8.4 Quantlab Financial High Frequency Trading Model Systems (Strategic) Revenue (US$ Million) & (2018-2023)

5.8.5 Quantlab Financial Recent Developments

5.9 XTX Markets

5.9.1 XTX Markets Profile

5.9.2 XTX Markets Main Business

5.9.3 XTX Markets High Frequency Trading Model Systems (Strategic) Products, Services and Solutions

5.9.4 XTX Markets High Frequency Trading Model Systems (Strategic) Revenue (US$ Million) & (2018-2023)

5.9.5 XTX Markets Recent Developments

5.10 Tradebot Systems

5.10.1 Tradebot Systems Profile

5.10.2 Tradebot Systems Main Business

5.10.3 Tradebot Systems High Frequency Trading Model Systems (Strategic) Products, Services and Solutions

5.10.4 Tradebot Systems High Frequency Trading Model Systems (Strategic) Revenue (US$ Million) & (2018-2023)

5.10.5 Tradebot Systems Recent Developments

5.11 Flow Traders

5.11.1 Flow Traders Profile

5.11.2 Flow Traders Main Business

5.11.3 Flow Traders High Frequency Trading Model Systems (Strategic) Products, Services and Solutions

5.11.4 Flow Traders High Frequency Trading Model Systems (Strategic) Revenue (US$ Million) & (2018-2023)

5.11.5 Flow Traders Recent Developments

5.12 IMC Financial

5.12.1 IMC Financial Profile

5.12.2 IMC Financial Main Business

5.12.3 IMC Financial High Frequency Trading Model Systems (Strategic) Products, Services and Solutions

5.12.4 IMC Financial High Frequency Trading Model Systems (Strategic) Revenue (US$ Million) & (2018-2023)

5.12.5 IMC Financial Recent Developments

5.13 Optiver

5.13.1 Optiver Profile

5.13.2 Optiver Main Business

5.13.3 Optiver High Frequency Trading Model Systems (Strategic) Products, Services and Solutions

5.13.4 Optiver High Frequency Trading Model Systems (Strategic) Revenue (US$ Million) & (2018-2023)

5.13.5 Optiver Recent Developments

5.14 XR Trading

5.14.1 XR Trading Profile

5.14.2 XR Trading Main Business

5.14.3 XR Trading High Frequency Trading Model Systems (Strategic) Products, Services and Solutions

5.14.4 XR Trading High Frequency Trading Model Systems (Strategic) Revenue (US$ Million) & (2018-2023)

5.14.5 XR Trading Recent Developments

5.15 HIGH-FLYER

5.15.1 HIGH-FLYER Profile

5.15.2 HIGH-FLYER Main Business

5.15.3 HIGH-FLYER High Frequency Trading Model Systems (Strategic) Products, Services and Solutions

5.15.4 HIGH-FLYER High Frequency Trading Model Systems (Strategic) Revenue (US$ Million) & (2018-2023)

5.15.5 HIGH-FLYER Recent Developments

6 North America

6.1 North America High Frequency Trading Model Systems (Strategic) Market Size by Country (2018-2029)

6.2 United States

6.3 Canada

7 Europe

7.1 Europe High Frequency Trading Model Systems (Strategic) Market Size by Country (2018-2029)

7.2 Germany

7.3 France

7.4 U.K.

7.5 Italy

7.6 Russia

7.7 Nordic Countries

7.8 Rest of Europe

8 Asia-Pacific

8.1 Asia-Pacific High Frequency Trading Model Systems (Strategic) Market Size by Region (2018-2029)

8.2 China

8.3 Japan

8.4 South Korea

8.5 Southeast Asia

8.6 India

8.7 Australia

8.8 Rest of Asia-Pacific

9 Latin America

9.1 Latin America High Frequency Trading Model Systems (Strategic) Market Size by Country (2018-2029)

9.2 Mexico

9.3 Brazil

9.4 Rest of Latin America

10 Middle East & Africa

10.1 Middle East & Africa High Frequency Trading Model Systems (Strategic) Market Size by Country (2018-2029)

10.2 Turkey

10.3 Saudi Arabia

10.4 UAE

10.5 Rest of Middle East & Africa

11 High Frequency Trading Model Systems (Strategic) Market Dynamics

11.1 High Frequency Trading Model Systems (Strategic) Industry Trends

11.2 High Frequency Trading Model Systems (Strategic) Market Drivers

11.3 High Frequency Trading Model Systems (Strategic) Market Challenges

11.4 High Frequency Trading Model Systems (Strategic) Market Restraints

12 Research Finding /Conclusion

13 Methodology and Data Source

13.1 Methodology/Research Approach

13.1.1 Research Programs/Design

13.1.2 Market Size Estimation

13.1.3 Market Breakdown and Data Triangulation

13.2 Data Source

13.2.1 Secondary Sources

13.2.2 Primary Sources

13.3 Disclaimer

13.4 Author List

Contact US

QY RESEARCH, INC.

17890 CASTLETON STREET

SUITE 369, CITY OF INDUSTRY

CA - 91748, UNITED STATES OF AMERICA

+1 626 539 9760 / +91 8669986909

ankit@qyresearch.com / enquiry@qyresearch.com

About Us:

QY Research established in 2007, focus on custom research, management consulting, IPO consulting, industry chain research, data base and seminar services. The company owned a large basic data base (such as National Bureau of statistics database, Customs import and export database, Industry Association Database etc), expert's resources (included energy automotive chemical medical ICT consumer goods etc.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release High Frequency Trading Model Systems (Strategic) Market Outlook Growths, Top Companies, Research Method 2029| Virtu Financial, Citadel Securities, Two Sigma Securities here

News-ID: 2952511 • Views: …

More Releases from QY Research, Inc.

Global Semiconductor Silicon Wafer Market to Reach US$ 29.08 Billion by 2032, Dr …

Market Summary -

The global Semiconductor Silicon Wafer market was valued at US$ 17,020 million in 2025 and is projected to reach US$ 29,080 million by 2032, growing at a CAGR of 8.1% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Semiconductor Silicon Wafer Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" delivers a comprehensive, data-driven assessment of the global silicon wafer…

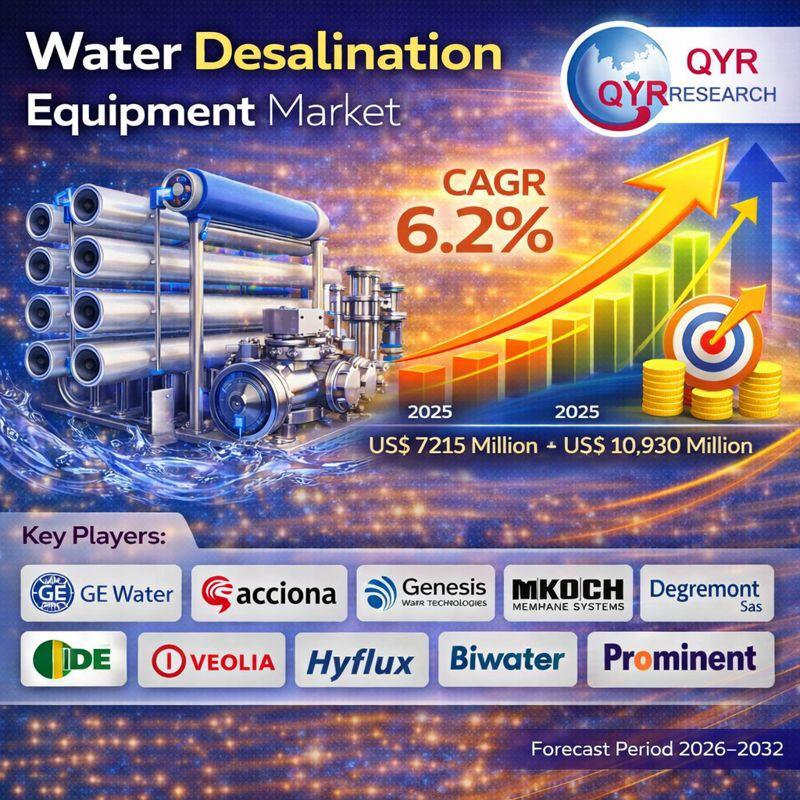

Global Water Desalination Equipment Market to Reach US$ 10.93 Billion by 2032, D …

Market Summary -

The global Water Desalination Equipment market was valued at US$ 7,215 million in 2025 and is projected to reach US$ 10,930 million by 2032, growing at a CAGR of 6.2% during the forecast period 2026-2032.

According to QY Research, the newly published report titled "Global Water Desalination Equipment Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global desalination equipment…

Global Syndiotactic Polystyrene Market to Reach US$ 162 Million by 2032, Driven …

Market Summary -

The global Syndiotactic Polystyrene (SPS) market was valued at US$ 111 million in 2025 and is projected to reach US$ 162 million by 2032, expanding at a CAGR of 5.6% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Syndiotactic Polystyrene Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven assessment of the global SPS market. The…

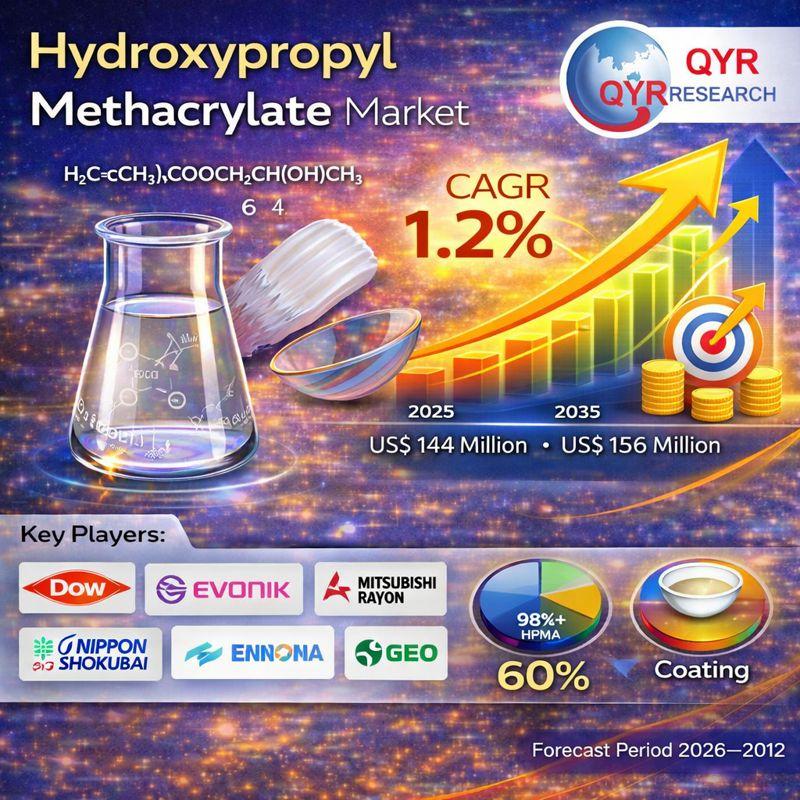

Global Hydroxypropyl Methacrylate Market to Reach US$ 156 Million by 2032, Suppo …

Market Summary -

The global Hydroxypropyl Methacrylate (HPMA) market was valued at US$ 144 million in 2025 and is projected to reach US$ 156 million by 2032, expanding at a CAGR of 1.2% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Hydroxypropyl Methacrylate Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global HPMA market.…

More Releases for Trading

Algorithmic Trading Market Showing Impressive Growth : Hudson River Trading, Jum …

The competitive landscape which incorporates the Algorithmic Trading Market ranking of the major players, along with new service/product launches, partnerships, business expansions and acquisitions in the past five years of companies profiled are also highlighted in the Algorithmic Trading Market report. Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major Algorithmic Trading Market players.

Top 10 key companies…

Increasing Awareness about Algorithmic Trading Market In Coming Years By Virtu F …

Global Algorithmic Trading Industry 2019 Research report provides information regarding market size, share, trends, growth, cost structure, capacity, revenue and forecast 2025. This report also includes the overall and comprehensive study of the Algorithmic Trading market with all its aspects influencing the growth of the market. This report is exhaustive quantitative analyses of the Algorithmic Trading industry and provides data for making Strategies to increase the market growth and effectiveness.

Algorithmic…

Algorithmic Trading Market 2024 SWOT Analysis by Key Players like Virtu Financia …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time. Algorithmic Trading are mainly used in investment banks, pension funds, mutual funds, hedge funds, etc.

Key trend which will predominantly effect the market in coming…

Automated Trading Market By Top Key Players- Citadel, KCG, Optiver, DRW Trading, …

The report "Automated Trading Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024", has been prepared based on an in-depth market analysis with inputs from industry experts.

An automated trading system, also referred to as mechanical trading system or algorithmic trading system, enables vendors to set up specific rules for money management, trade entries, and trade exits. Automated trading systems are generally programmed in a way…

Search4Research Announced Algorithmic Trading Market Forecast to 2024 - Virtu Fi …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time.

Algorithmic Trading Market provides a detail overview of latest technologies and in-depth analysis that reflect top vendor’s portfolios and technology; examines the strategic planning, challenges…

Algorithmic Trading Market 2019 | Flow Traders, Jump Trading, Spot Trading, DRW …

Global Algorithmic Trading market is also presented to the readers as a holistic snapshot of the competitive landscape within the given forecast period. The report also educates about the market strategies that are being adopted by your competitors and leading organizations. The report also focuses on all the recent industry trends. It presents a comparative detailed analysis of the all regional and player segments, offering readers a better knowledge of…