Press release

Liquidity and Asset Liability Management Solutions Market 2022: Business Dynamics, Emerging Trends, Regional Analysis and Growth Strategies by 2028

Liquidity and Asset Liability Management Solutions Market Research Report efficiently gathers information about target markets or customers. It consists of qualitative including focus groups, in-depth interviews as well as quantitative techniques that include customer survey and analysis of secondary data. Market report aids in planning business by providing information about the market. Up-to-date marketing reports help companies to have in depth analysis of industry and future trends. In this Liquidity and Asset Liability Management Solutions market report, data collection modules with large sample sizes are used to collect data and perform base year analysis. The market drivers and restraints have been explained in the report using SWOT analysis.Get a Sample Copy of Report, Click Here: https://www.theinsightpartners.com/sample/TIPRE00017757/?utm_source=OpenPR&utm_medium=10183

Company Profiles:

• Experian Information Software, Inc.

• Fidelity National Information Services, Inc.

• Finastra International Limited

• IBM Corporation

• Infosys, Ltd.

• Intellect Design Arena Limited

• Moody's Corporation

• Oracle Corporation

• SAP SE

• Wolters Kluwer N.V

Based on component, the liquidity and asset liability management solutions market is segmented into solutions and services. The solutions segment is expected to be the fastest-growing segment, primarily promoted by the advent of AI-enabled solutions. The services segment is expected to grow at a moderate pace during the forecast period.

The report includes an inside and out valuation concerning the future progressions depending on the past information and current conditions of the market. It gives a comprehensive perspective on the worldwide Liquidity and Asset Liability Management Solutions market to settle on astute choices with respect to future changes. The examination group has researched administrators, central participants on the lookout, topographical fracture, item type, and its depiction, and market end-customer applications. It gives assessed deals income from every single section alongside every district. The report includes essential and optional information which is introduced as diagrams and pie graphs for better arrangement. The general report is introduced in a powerful way that includes a fundamental framework, arrangements, and certain realities according to reassurance and cognizance.

Key Offerings:

• Market Size & Forecast by Revenue | 2028

• Market Dynamics - Leading trends, growth drivers, restraints, and investment opportunities

• Market Segmentation - A detailed analysis by product, types, end-user, applications, segments, and geography

• Competitive Landscape - Top key vendors and other prominent vendors.

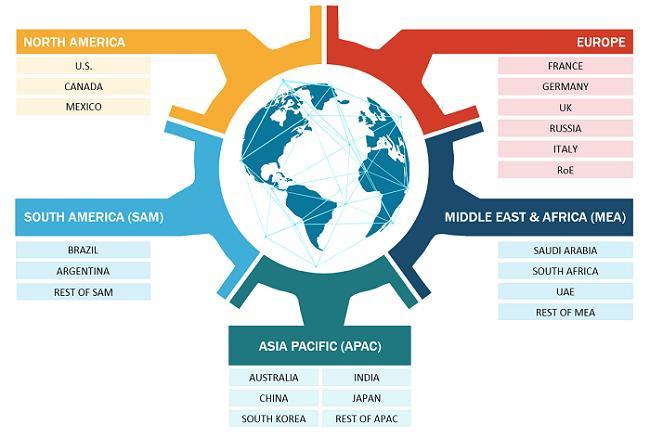

Liquidity and Asset Liability Management Solutions Market Regional and Country-wise Analysis:

• North America (U.S., Canada, Mexico)

• Europe (U.K., France, Germany, Spain, Italy, Central & Eastern Europe, CIS)

• Asia Pacific (China, Japan, South Korea, ASEAN, India, Rest of Asia Pacific)

• Latin America (Brazil, Rest of Latin America)

• The Middle East and Africa (Turkey, GCC, Rest of the Middle East and Africa)

Inquire before Buying Copy of Liquidity and Asset Liability Management Solutions Market: https://www.theinsightpartners.com/inquiry/TIPRE00017757/?utm_source=OpenPR&utm_medium=10183

Key Factors covered are:

1. To characterize, portray, and check the Liquidity and Asset Liability Management Solutions market based on product type, application, and region.

2. To estimate and inspect the size of the Liquidity and Asset Liability Management Solutions market (in terms of value) in six key regions, specifically, North and South America, Western Europe, Central & Eastern Europe, the Middle East, Africa, and the Asia-Pacific.

3. To estimate and inspect the Liquidity and Asset Liability Management Solutions markets at country-level in every region.

4. To strategically investigate every sub-market about personal development trends and its contribution to the Liquidity and Asset Liability Management Solutions market.

5. To look at possibilities in the Liquidity and Asset Liability Management Solutions market for shareholder by recognizing excessive-growth segments of the market.

Key Highlights & Touch Points of the Liquidity and Asset Liability Management Solutions Market Worldwide for the Forecast Year 2028

• Broad data on variables that will enhance the development of the Liquidity and Asset Liability Management Solutions market over the forthcoming years

• Precise assessment of the worldwide Liquidity and Asset Liability Management Solutions market size exact assessments of the forthcoming patterns and changes saw in the customer conduct

• Development of the worldwide Liquidity and Asset Liability Management Solutions market across the North and South America, Asia Pacific, EMEA, and Latin America

• Data about Liquidity and Asset Liability Management Solutions market development potential

• Top to bottom investigation of the business' serious scene and itemized data opposite on different merchants

• Outfitting of itemized data on the elements that will control the development of the Liquidity and Asset Liability Management Solutions markets

Purchase a copy of Liquidity and Asset Liability Management Solutions Market research report @ https://www.theinsightpartners.com/buy/TIPRE00017757/?utm_source=OpenPR&utm_medium=10183

Contact Us:

If you have any queries about this report or if you would like further information, please

Contact Person: Sameer Joshi

E-mail: sales@theinsightpartners.com

Phone: +1-646-491-9876

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Liquidity and Asset Liability Management Solutions Market 2022: Business Dynamics, Emerging Trends, Regional Analysis and Growth Strategies by 2028 here

News-ID: 2948308 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for Liquidity

Best altcoins analysis includes Pepenode liquidity strategy

This section frames our altcoin analysis around three forces shaping market moves: meme coins, crypto presales, and emerging utility tokens. Recent volatility in PEPE has pulled traders back into risky, fast-moving markets, while projects like Remittix show capital rotating toward functional platforms with listings and certified smart contracts.

We focus on the best altcoins by pairing technical cues with on-chain liquidity tactics. Expect discussion of price action signals-EMA placement, VWAP, RSI…

Best altcoins analysis includes Pepenode liquidity strategy

Assessing the best altcoins means marrying project fundamentals with market microstructure. Historical moves show how thin crypto liquidity and low sentiment create outsized returns: Solana traded below $15 and dipped under $10 in 2023, then surged past $294 in January 2025, illustrating how patient accumulation during quiet markets can yield large asymmetric gains.

That context matters for altcoin analysis and altcoin selection. Projects such as BMIC launched presales during tight liquidity…

Pepe Plus TO, vs Hyperliquid (HYPE) & Meme Liquidity Tokens: Structural Liquidit …

Liquidity-first meme tokens including Hyperliquid depend on short-term pool incentives and mining rewards attracting temporary capital seeking yield farming opportunities before rotating toward fresher alternatives.

Pepeto ($PEPETO) emerges through routed liquidity architecture permanently channeling volume into PEPETO demand, creating structural superiority over incentive-dependent models. Sustainable ecosystem at (https://pepeto.io/) implements PepetoSwap zero-fee exchanges, Pepeto Bridge cross-chain aggregation, and verified meme exchange routing all activity through PEPETO token.

Current presale pricing…

Best altcoins analysis includes Pepenode liquidity strategy

As markets reopen to speculative capital in 2025, smart altcoin analysis focuses on concrete on-chain signals and presale due diligence. The best altcoins era rewards projects that pair visible fundraising with durable liquidity controls. Maxi Doge's reported $4 million presale showed how headline raises can thrust a token into presale trackers and retail feeds, but observers must verify totals on Etherscan or BscScan before assuming lasting depth.

Pepenode's (https://pepenode.io/) meme coin…

Best altcoins commentary references Pepenode liquidity planning

A shift in market structure is steering capital toward the best altcoins, and Pepenode (https://pepenode.io/) liquidity planning sits at the center of that conversation. With Bitcoin exchange reserves falling and on-chain activity showing accumulation, traders are reallocating from blue-chip holdings into higher-beta opportunities. This article frames how presale mechanics and on-chain liquidity cues are reshaping altcoin trends and investor behavior.

Presale dynamics now matter more to larger allocators. Early detection of…

iZiSwap: Transforming DeFi Trading with Discretized Liquidity

The decentralized finance (DeFi) sector continues to evolve, with innovative platforms reshaping how traders and liquidity providers interact with blockchain markets. Among these, iZiSwap has emerged as a standout decentralized exchange (DEX), offering unique solutions to enhance trading efficiency and liquidity management.

Launched in 2023, iZiSwap https://iziswap.org/ introduces Discretized-Liquidity Automated Market Maker (DL-AMM) technology, a game-changing approach that optimizes capital efficiency while reducing trading risks.

What Sets iZiSwap Apart?

Traditional AMMs, such as…