Press release

Digital Banking Platforms Market - Global Growth, Share, Trends, Demand and Analysis Report Forecast 2030

Global Digital Banking Platforms Market is valued at USD XX million in 2023 and is projected to reach USD XX million by the end of 2030, growing at a CAGR of XX% during the period 2023 to 2030.Global Digital Banking Platforms Market Growth Forecast:

The report is an extensively researched presentation of a highly detailed, comprehensive, and accurate study of the global digital banking platforms market. The report explores some of the important aspects of the global digital banking platforms market and uncovers how the various factors such as price, competition, market dynamics, regional expansion, gross margin, and consumption would be holding their influence over the performance of the market. The report includes a deep analysis of the competitive landscape and exhaustive company profiling of leading companies operating in the digital banking platforms market. It gives an overview of the accurate facts, and figures related to the market like production, revenue, market value, volume, market share, and growth rate.

Top Key Companies Profiled in the Global Digital Banking Platforms Market Report: Appway (Switzerland), Alkami (US), Apiture (US), Backbase (Netherlands), EdgeVerve (India), ebankIT (England), BNY Mellon (US), CR2 (Ireland), Finastra (UK), Mambu (Germany), MuleSoft (US), Fiserv (US), Intellect Design Arena (India), nCino (US), Oracle (US), SAP (Germany), NCR (US), NETinfo (Cyprus), Sopra Banking Software (France), Temenos (Switzerland), Velmie (US), Worldline (France) TCS (India), and Technisys (US).

Get a Sample Copy/TOC of this Research Study at: https://www.fairfieldmarketresearch.com/report/digital-banking-platforms-market/request-toc/

Global Digital Banking Platforms Market Segmentation

The segmentation chapters allow a reader to understand the chief aspects of the market such as its products, applications, and available technologies. The segmentation chapters of the report intend to reveal the projected development pattern of each of the market segments in the course of the period of forecast. They also offer valued information about the prominent trends likely to be influencing the performance of market segments.

Global Digital Banking Platforms Market : Regional Segmentation

For deeper understanding of the global digital banking platforms market, the report covers an in-depth geographical segmentation that serves to evaluate the market outlook in each region, as well as country. Such a detailed assessment gives an accurate analysis of the regional-wise growth of the global digital banking platforms market.

North America (the United States, Mexico, and Canada)

South America (Brazil etc.)

Europe (Turkey, Germany, Russia UK, Italy, France, etc.)

Asia-Pacific (Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia)

The Middle East and Africa (GCC Countries and Egypt)

Key Questions Answered in the Report:

What will be the size of the global digital banking platforms market by 2030?

What are the drivers in the market?

How will the companies transform threats into opportunities?

What are the potential mergers and acquisitions likely to happen during the forecast period?

Which is the leading segment in the global digital banking platforms market?

Which region will emerge as the leading one?

Do You Have Any Query or Specific Requirement? Request for Custom Research: https://www.fairfieldmarketresearch.com/report/digital-banking-platforms-market/request-customization/

Strategic Points Covered in TOC:

Chapter 1: Introduction, market driving force product scope, market risk, market overview, and market opportunities of the global digital banking platforms market

Chapter 2: Evaluating the leading manufacturers of the global digital banking platforms market which consists of its revenue, sales, and price of the products

Chapter 3: Displaying the competitive nature among key manufacturers, with market share, revenue, and sales

Chapter 4: Presenting global digital banking platforms market by regions, market share and with revenue and sales for the projected period

Chapter 5, 6, 7, 8 and 9: To evaluate the market by segments, by countries and by manufacturers with revenue share and sales by key countries in these various regions

For More Information Visit: https://www.fairfieldmarketresearch.com/report/digital-banking-platforms-market/

Contact

Fairfield Market Research

London, UK

UK +44 (0)20 30025888

USA +1 (844) 3829746 (Toll-free)

Email: sales@fairfieldmarketresearch.com

Web: https://www.fairfieldmarketresearch.com/

Follow Us: https://bit.ly/3voYIm9

About Us :-

Fairfield Market Research is a UK-based market research provider. Fairfield offers a wide spectrum of services, ranging from customized reports to consulting solutions. With a strong European footprint, Fairfield operates globally and helps businesses navigate through business cycles, with quick responses and multi-pronged approaches. The company values and eye for insightful take on global matters, ably backed by a team of exceptionally experienced researchers. With a strong repository of syndicated market research reports that are continuously published & updated to ensure the ever-changing needs of customers are met with absolute promptness.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Platforms Market - Global Growth, Share, Trends, Demand and Analysis Report Forecast 2030 here

News-ID: 2944787 • Views: …

More Releases from Fairfield Market Research

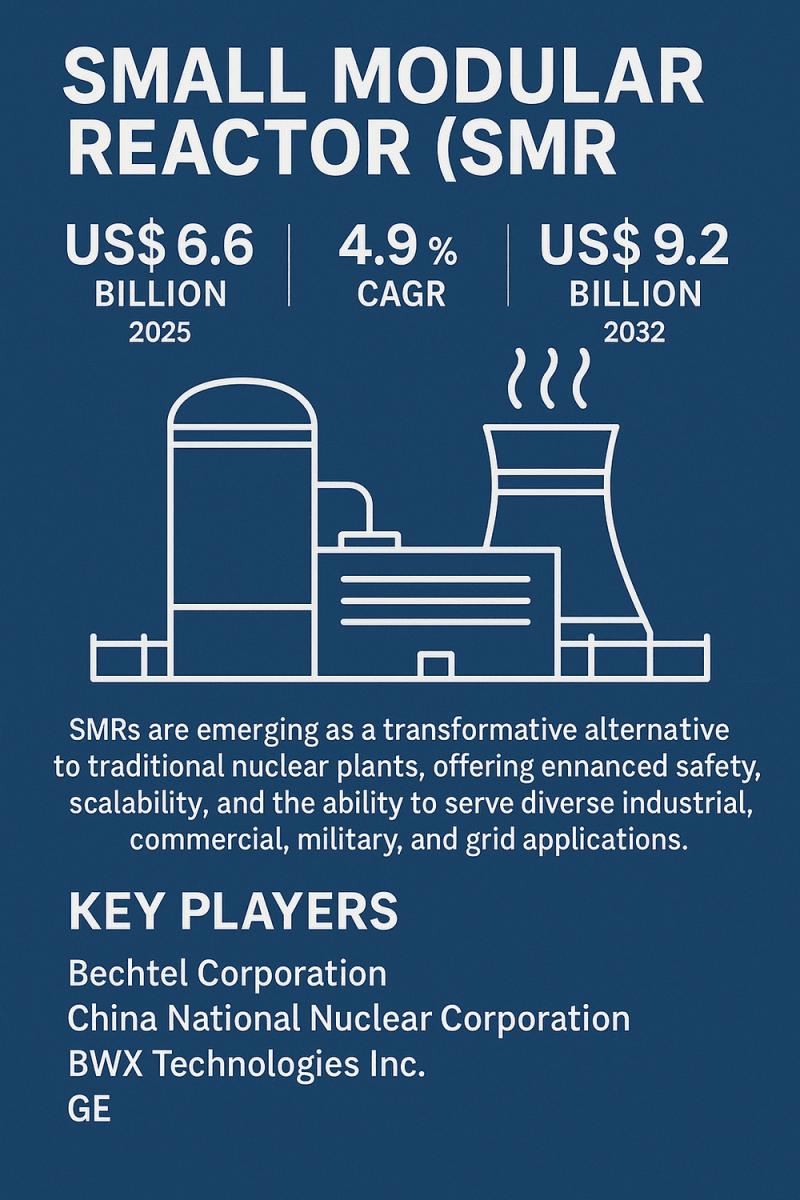

Small Modular Reactor (SMR) Market Set to Climb from $6.6 Bn in 2025 to $9.2 Bn …

The Small Modular Reactor (SMR) industry is entering a crucial phase of global development as nations accelerate the transition toward low-carbon energy systems and resilient power infrastructure. With the market estimated at US$ 6.6 billion in 2025 and projected to reach US$ 9.2 billion by 2032, the sector is expanding at a 4.9% CAGR during the forecast period. SMRs are emerging as a transformative alternative to traditional nuclear plants, offering…

Antimony-free Films Market Set for Sustainable Expansion Through 2032

The global Antimony-free Films Market is entering a defining phase of strategic expansion as sustainability, regulatory shifts, and consumer safety expectations reshape the packaging and materials landscape. With rising concerns surrounding antimony-based catalysts in polyester films, end-use industries are accelerating the transition toward safer, more compliant, and environmentally responsible alternatives. According to industry estimates, the market is valued at US$ 238.6 million in 2025 and is projected to reach US$…

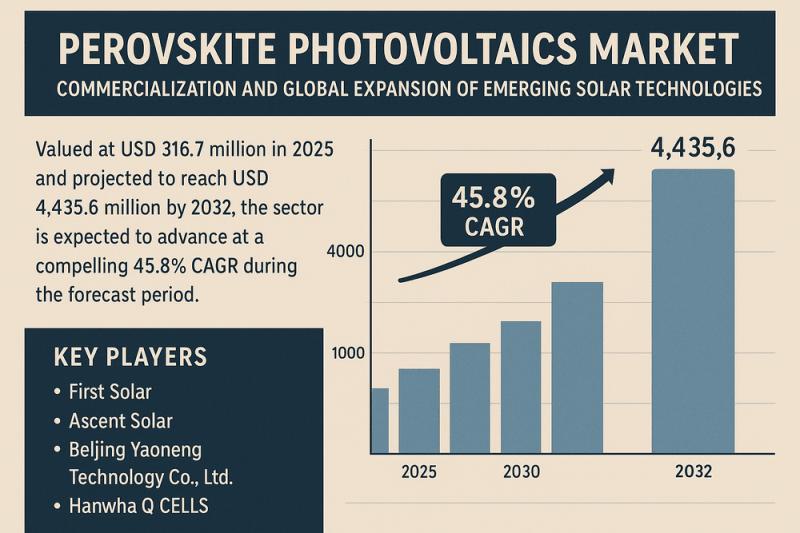

Perovskite Photovoltaics Market Set for Transformational Growth Through 2032

The Perovskite Photovoltaics Market is entering a pivotal phase of commercialization and global expansion as emerging solar technologies gain momentum across residential, commercial, and utility-scale applications. Valued at USD 316.7 million in 2025 and projected to reach USD 4,435.6 million by 2032, the sector is expected to advance at a compelling 45.8% CAGR during the forecast period. This remarkable growth trajectory reflects rising demand for low-cost, high-efficiency solar modules, continued…

Micro EV Market Accelerates Toward a Sustainable Urban Mobility Future Through 2 …

The Micro Electric Vehicle (Micro EV) Market is entering a new phase of accelerated growth, supported by global sustainability targets, rapid urbanization, and policy-driven adoption of small-format electric mobility solutions. Valued at USD 12.1 billion in 2025 and projected to reach USD 26.8 billion by 2032, the industry expands at a 12.0% CAGR, reflecting strong market confidence in compact, zero-emission vehicles. These vehicles-ranging from two-seater microcars to lightweight quadricycles-are increasingly…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…