Press release

Financial Cards and Payments Market Latest Trends, Regional Insights and Global Industry Dynamics By 2033

Financial Cards and Payments Market 2033New Study Reports " Financial Cards and Payments Market : Global Key Players, Trends, Share, Industry Size, Segmentation, Opportunities, Forecast To 2033″ has been Added on PMR.

Report Overview

The report on the Financial Cards and Payments Market provided based on the recent developments and data that has been collated from the previous year's looks to provide a thorough understanding. The market overview provided in the initial section looks to provide the reader with adequate information regarding the product and services. It focuses on the market definition along with the product applications and end-user industries. Competitive analysis and prominent industry trends have been included in the in-depth study provided in the main section of the report.

Electronic payment through financial cards and payment systems is on the rise across the world. On account of the convenience and higher availability offered, financial cards and payment systems have witnessed higher penetration in numerous economies across the world. Traditional payment systems such as cash payments, demand drafts and other payment certificates have become obsolete due to technological advancements in financial cards and payment systems.

Request for Free Sample Report of "Financial Cards and Payments" Market @ https://www.persistencemarketresearch.com/samples/10882

Through financial cards and payment systems, numerous financial transactions can be executed between entities located anywhere in the world. Financial cards including debit cards, credit cards, charge cards, ATM cards, fleet cards and stored value cards are widely used for different types of financial transactions. Other types of financial cards including Scrip, gift cards and electronic purse have gained popularity and serve to a very niche market. Financial cards are deployed using numerous technologies such as embossing, magnetic stripe cards, smart cards, proximity cards and re-programmable magnetic stripe cards.

Key Players:

The report has profiled some of the Important players prevalent in the global like - MasterCard, Amazon Payments, Apple Pay, Visa, PayPal,and RuPay and more.

This report covers the sales volume, price, revenue, gross margin, manufacturers, suppliers, distributors, intermediaries, customers, historical growth and future perspectives in the Financial Cards and Payments.

Magnetic stripe were highly adopted in the global credit and debit cards due to inefficiencies in the embossing technology. However, due to factors such as magnetic interference and possibility of damage to the magnetic stripe, the magnetic stripe cards were replaced by other technologies such as smart cards and proximity cards.

The smart card technology uses an integrated circuit chip (ICC) which can process financial transactions with higher efficiency as compared to magnetic stripe cards. Proximity cards are contactless integrated circuit devices which make use of Radio Frequency Identification (RFID) technology and are powered by resonant energy transfer.

Proximity cards are gaining immense popularity in private payment systems and public transit payments. Financial payment systems include various types of payment methods such as bank transfers, E-wallets, direct debit and other mobile payment solutions. Users across the world make use of such payment systems to electronically transfer cash directly to merchant's account. Unlike financial cards where the payments takes place through point of sale (PoS) systems, payment systems enable users to authenticate and execute financial transactions over the internet.

One of the major factors driving the growth of financial cards and payments market is the rise of ecommerce. Increasing penetration of online stores for numerous products and services has offered higher accessibility and availability of market places to consumers. Such factors have driven the growth of financial cards and payments systems across the world.

Moreover, benefits such as convenience, security and privacy have further driven the growth of financial cards and payments market. In addition, ongoing collaboration between numerous payment industry participants including merchants' banks, card issuers and card association network providers has led to development of comprehensive financial payment and transfer solutions.

Increasing penetration of ecommerce and mobile phones across the world has made the financial cards and payment systems lucrative in recent years. Numerous players in these markets seek to reap maximum profits in the developing economies especially in countries such as Brazil, Russia, India and China (BRIC).

Free analysis

The electronic payment from financial cards and payment systems is gaining popularity across the globe owing to high convenience. Different types of financial cards gaining rapid traction in the market are debit cards, fleet cards, ATM cards, and credit cards. Various highly demanded technologies in the market are magnetic stripe cards, re-programmable magnetic stripe cards, and proximity cards.

Presence of different payment methods in the market that include bank transfers, mobile payments, and e-wallets are propelling the growth of the market ahead. Growing penetration of e-commerce acts as a major growth lever in the market, creating new growth prospects for the service providers.

The increase in the numerous offers provided by the online stores has enhanced the accessibility and availability of various market places which is drawing the consumers towards it. Attributes such as security and privacy are further boosting the market growth rate.

View Table of Contents, Figures, and Tables @ https://www.persistencemarketresearch.com/toc/10882

Region Coverage (Regional Production, Demand & Forecast by Countries etc.):

North America (U.S., Canada, Mexico)

Europe (Germany, U.K., France, Italy, Russia, Spain etc.)

Asia-Pacific (China, India, Japan, Southeast Asia etc.)

South America (Brazil, Argentina etc.)

Middle East & Africa (Saudi Araia, South Africa etc.)

Key Stakeholders

Financial Cards and Payments Market Manufacturers

Financial Cards and Payments Market Distributors/Traders/Wholesalers

Financial Cards and Payments Market Subcomponent Manufacturers

Industry Association

Downstream Vendors

If you have any special requirements, please let us know and we will offer you the report as you want.

Major Highlights of the Financial Cards and Payments Market Report:

• The Financial Cards and Payments Market analysis report offers an in-depth study of the potential market growth opportunities and challenges.

• The report dives deeper into the market and explains the dynamic factors bolstering market growth.

• The report deeply assesses the current, historical market size, market share, and revenue growth rates to offer accurate market projections for the forecast period.

• The report analyzes the Financial Cards and Payments Market presence across major regions of the world.

• It determines the production & consumption capacities and demand & supply dynamics of each regional market.

• The report further illustrates the intense competition among the key market players and highlights their effective business expansion plans and strategies.

• It provides company overview and SWOT analysis of each of the market players.

Key Questions Answered in This Report.

• What will the Market growth rate in Future?

• What are the key factors driving the global Market?

• Who are the key manufacturers in Market space?

• What are the opportunities and threats faced by the vendors in the global industry?

• What are sales, revenue, and price analysis by regions of industry?

If you have any special requirements, please let us know and we will offer you the report as you want and also We Provide you Table of Content.

Click Here to Buy/Pre-Book this Report @ https://www.persistencemarketresearch.com/checkout/10882

Contact Us:

Persistence Market Research

Address - 305 Broadway, 7th Floor, New York City, NY 10007 United States

U.S. Ph. - +1-646-568-7751

USA-Canada Toll-free - +1 800-961-0353

Sales - sales@persistencemarketresearch.com

Website - https://www.persistencemarketresearch.com

Expert analysis, actionable insights, and strategic recommendations - the Electronics, Semiconductor, and ICT team at Persistence Market Research helps clients from all over the globe with their unique business intelligence needs. With a repository of over 500 reports on electronics, semiconductors, and ICT, of which, 100+ reports are specific for ICT, the team provides end-to-end research and analysis on regional trends, drivers for market growth, and research development efforts in the electronics, semiconductor, and ICT industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Cards and Payments Market Latest Trends, Regional Insights and Global Industry Dynamics By 2033 here

News-ID: 2937515 • Views: …

More Releases from Persistence Market Research

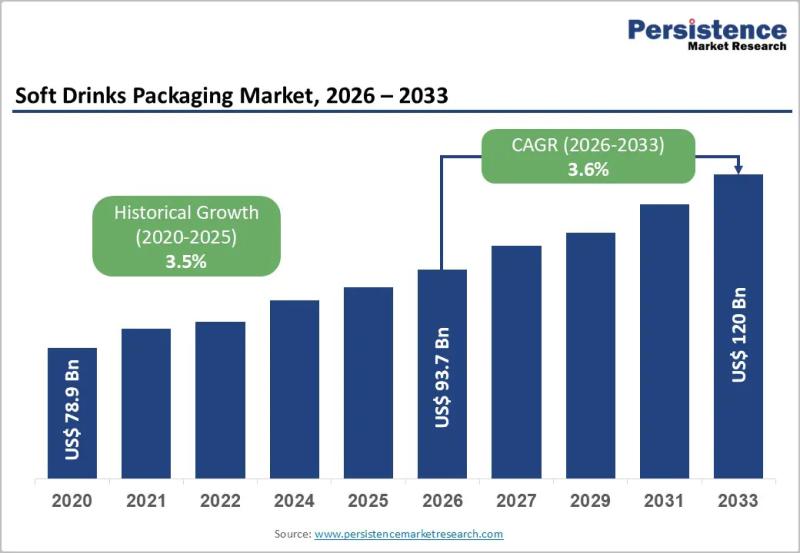

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

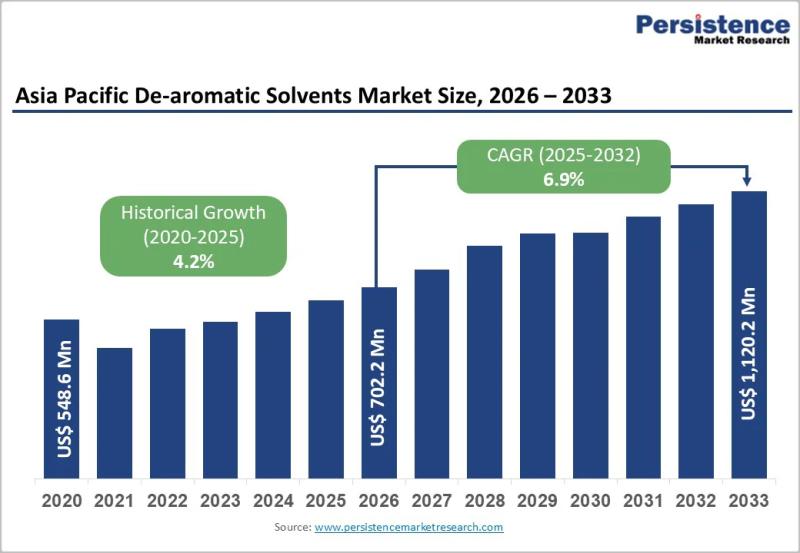

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…