Press release

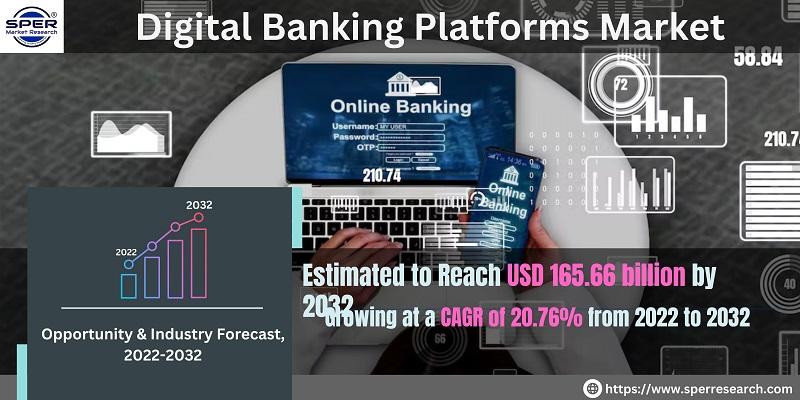

Digital Banking Platforms Market Growth, Revenue, CAGR Status, Emerging Trends, Opportunity and Forecast 2032: SPER Market Research

According to SPER Market Research, Market size for digital banking platforms is anticipated to grow in forecast period. Due to the expanding use of smartphones, computers, internet access, internet of things (IoT) devices, and artificial intelligence, there is an increasing demand for digital banking (AI). The paradigm shift of banks from conventional networks to digital and automated platforms has several benefits, including higher productivity, cost savings, and improved income possibilities. The importance of these technologies in the market for digital banking platforms has also expanded as a result of the recent expansion of cloud computing and storage.Request For Free Sample Report @ https://www.sperresearch.com/report-store/digital-banking-platforms-market.aspx?sample=1

Digital Banking Platforms Market Overview:

Forecast CAGR (2022-2032): 20.76%

Forecast Market Size (2032): 165.66 billion

The COVID-19 epidemic has increased online banking activity and forced organizations and individuals who had previously opposed internet banking to adopt digital banking as their new standard procedure. In addition, technological improvements and changing consumer preferences in developed and developing countries are largely to blame for the increased demand for consumer electronics devices like laptops, cell phones, and PCs. In the modern world, customers frequently use gadgets to access a variety of digital services. Nowadays, a sizable portion of users access their bank accounts using mobile browsers or apps.

Using quickly deployable and customized solutions to digital banking platforms, banks can transition to digital ecosystems. By improving customer service, interactive mobile banking websites and applications serve to increase client loyalty. The number of people using digital banking is predicted to rise, increasing the demand for digital banking platform solutions in the near future.

Digital Banking Platforms Market Key Players:

The market study provides market data by competitive landscape, revenue analysis, market segments and detailed analysis of key market players such as; Alkami Technology Inc., Apiture, Appway AG, Backbase, BNY Mellon, CR2, EdgeVerve, ebankIT, Finastra, Fiserv Inc., Intellect Design Arena, Mambu, MuleSoft, nCino, NETinfo, Oracle Corporation, Sopra Banking Software, TCS, Technisys, Temenos, Velmie, Worldline.

For More Information about this Report @ https://www.sperresearch.com/report-store/colorless-polyimide-films-market.aspx

Global Digital Banking Platforms Market Segmentation:

By Component: Based on the Component, Global Digital Banking Platforms Market is segmented as; Platform, Services (Managed Services, Professional Services).

By Deployment Type: Based on the Deployment Type, Global Digital Banking Platforms Market is segmented as; Cloud, On-premises.

By Banking Type: Based on the Banking Type, Global Digital Banking Platforms Market is segmented as; Corporate Banking, Investment Banking, Retail Banking.

By Banking Mode: Based on the Banking Mode, Global Digital Banking Platforms Market is segmented as; Online Banking, Mobile Banking.

By Region: North America has dominated the global market for digital banking platforms, and this is likely to continue throughout the projected period. The presence of significant competitors and the quick uptake of cutting-edge technologies are the main factors driving the market's growth in this region. However, due to the region's developing IT infrastructure and major investments from both private and public entities, Asia-Pacific is predicted to have significant growth rate during the projected period.

This study also encompasses various drivers and restraining factors of this market for the forecast period. Various growth opportunities are also discussed in the report.

Related Reports:

https://www.sperresearch.com/report-store/iot-in-banking-and-financial-services-market.aspx

https://www.sperresearch.com/report-store/banking-financial-services-and-insurance-security-market.aspx

Follow Us -

https://www.linkedin.com/company/sperresearch

https://www.instagram.com/sperresearch/

https://www.facebook.com/SPERresearch

https://twitter.com/SPERresearch

6 Sunflower Court,

Holtsville, NY 11742, USA

USA: +1-347-460-2899

SPER Market Research® is one of the world's most trusted market research, market intelligence, and consulting companies offering strategic research, custom research, market intelligence solutions, quantitative data collection, qualitative fieldwork, online research panel, and consumer research. Headquartered in India, the company has offices worldwide and provides strategic & consulting services.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Platforms Market Growth, Revenue, CAGR Status, Emerging Trends, Opportunity and Forecast 2032: SPER Market Research here

News-ID: 2923470 • Views: …

More Releases from SPER Market Research

Aircraft Micro Turbine Engines Market Trends 2023 - Global Industry Share, Reven …

Aircraft micro turbine engines are small air-breathing jet engines specifically designed for aircraft applications. They provide several benefits compared to traditional reciprocating engines, including higher power-to-weight ratios, improved fuel efficiency, and reduced emissions. These engines consist of key components such as an air inlet, compressor, combustion chamber, and turbine. The air is drawn into the engine through the inlet and compressed by the compressor. Fuel is then injected into the…

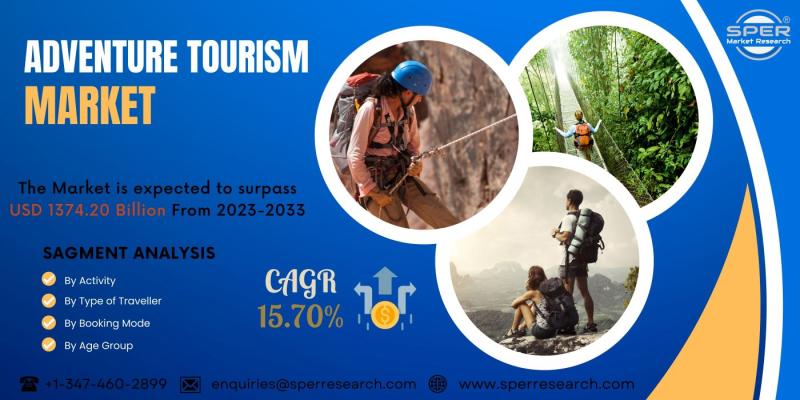

Adventure Tourism Market Growth 2023, Emerging Trends, Regional Insights, Growth …

Travelling to distant, unusual, and interesting locations with the intention of taking part in thrilling and adventurous activities is known as adventure tourism. It focuses on offering unusual and exhilarating experiences to tourists looking for thrills, challenges, and a change from typical tourist attractions. Adventure tourism encompasses travel and exploration activities where individuals embark on thrilling and adventurous experiences. It includes a diverse range of activities like trekking, climbing, scuba…

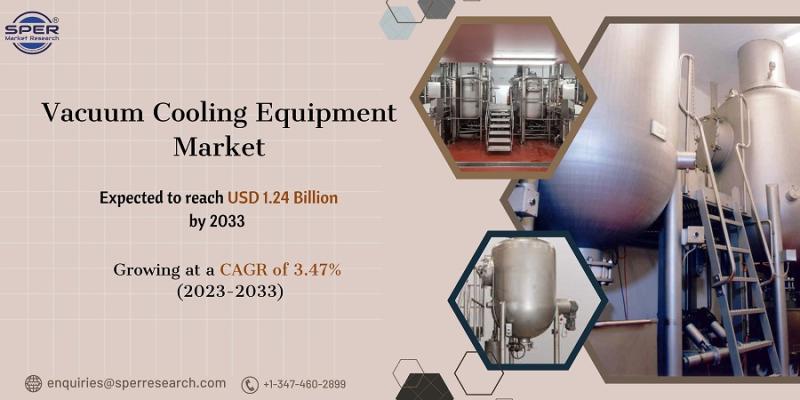

Vacuum Cooling Equipment Market Growth and Share, Emerging Trends, Challenges, K …

Vacuum cooling equipment is a high-efficiency approach for rapidly cooling a wide range of goods, particularly in the food business. It consists of a specially designed stainless steel chamber that is tightly sealed to create an airtight environment. To begin the cooling process, the air inside the chamber is removed using a vacuum pump. The pressure drops as the air exits, reducing the boiling point of water. This permits the…

Supply Chain Analytics Market Share 2023- By COVID-19 Impact on Industry Trends, …

The term "global supply chain analytics market" refers to the market for products and services that give businesses the ability to improve operations, get new insights, and make data-driven choices throughout their supply chains. Application of cutting-edge analytical tools and methodologies to a variety of data sources, including real-time data from sensors, business systems, and external data feeds, constitutes supply chain analytics. Supply chain analytics solutions offer a range of…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…